🌍 Your 2026 prediction bets are in

We asked, you answered, and experts weighed in on 2026

And that’s a wrap! We’ve made it to the end of New York Climate Week, the calendar-breaking, climate-convening marathon where everyone runs on fumes, hors d’oeuvres, and ambition.

Fifteen years in, NYCW has evolved from a United Nations General Assembly sideshow into a full-on city-wide circus: part conference, part demo day, part protest, part party. We were running, subwaying, and Citi Biking from panels to coffees to happy hours, zig-zagging the length of the city and back.

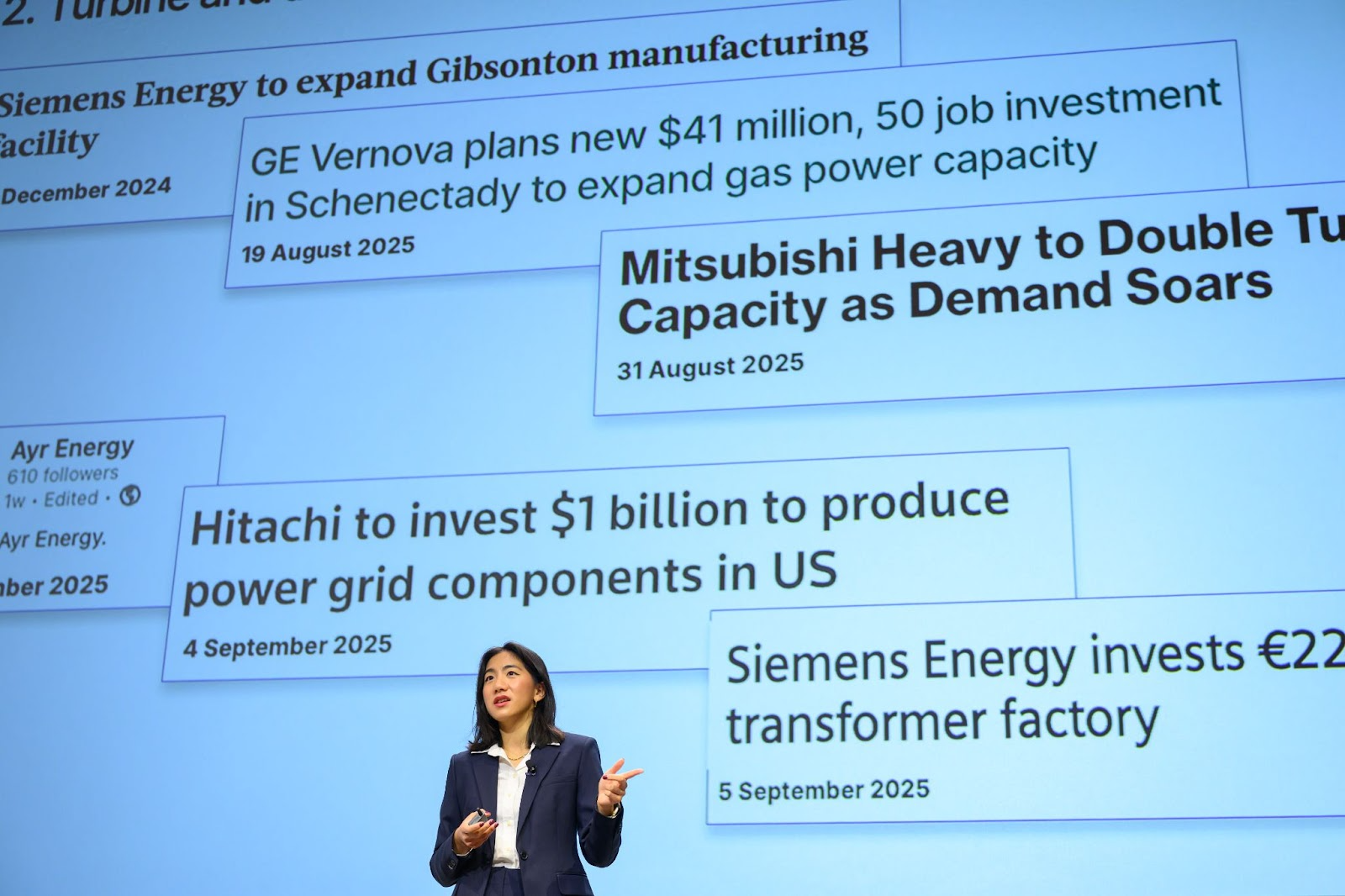

The usual suspects were there — the people adding zeros to checks and putting steel in the ground — but the tone of the week felt different. No more of the lofty corporate commitments and decarbonization pledges, but actual conversions about what’s going on: load growth, strained grids, and the economical solutions that might actually fix them. Less “climate” this week, more of “Energy AI” week, with adjacencies like security, affordability, resiliency, and efficiency also taking the spotlight.

Meanwhile, in the background and down the street at the UN, the US president was calling climate change a hoax. It made it clear that climate tech and climate change policy have never been further apart. It seemed like it could have just been a coincidence that NYCW happened at the same time as UNGA, given how little overlap there is anymore in conversation or expectation for global cooperation on climate change. But the community’s mood wasn’t defeatist – there was a recognition and there was an urgency around the challenges and opportunities ahead. The same forces that look like headwinds, the rising power demand, stressed grids, higher capital costs, are also tailwinds, accelerating the push for clean firm power, storage, and grid innovation. And all that is on a note of pragmatic optimism, that the solutions that succeed will be the ones with the best business models and economics that can succeed in the wake of policy or subsidies.

Read on for our five top takeaways and photos from the week below. Still, it was apparently the biggest NYCW yet, and we couldn’t catch everything. If your takeaways looked different, we’d love to hear them at [email protected].

This year crystallized a shift that’s been building for the past few conference cycles, the final move from lofty pledges to pragmatic energy realism. ESG as it once was is dead. Now, those with the power are the ones producing power, or buying it, or making it so we can get more of it, as fast as possible.

That’s the paradox: the headwinds threatening the sector are also its strongest tailwinds. Data center and electrification power demand could be the forcing function for rapid deployment of clean firm power, storage, and grid innovation.

Demand is rising fast — and so is the cost of doing nothing. 2024 marked the warmest year on record, at about 1.55°C above pre-industrial levels. Climate risks are rising, bringing new urgency for mitigation, adaptation, and removals solutions. The scale of demand for solutions is still uncertain — it’s not clear how much demand is actually rising. Plus, utilities are slow planners with regulatory hurdles and long timelines, while trying to assuage affordability concerns for consumers. More gas, still billed as a “transition fuel,” is set to come online, even as pressure grows for efficiency, flexibility, and resilience alongside decarbonization. The real investable opportunity is at this intersection, the consumption surge of this New Energy Era and the risk mitigation imperative of the New Climate Reality. Unlike the last wave of green premium-dependent or efficiency-first business models, today’s customers are paying up for energy security and downside protection.

To no one’s surprise, AI and data centers dominated the conversation again this year. But the vibe was different: less hand-wringing, more acceptance — even a little excitement. Forecasts suggest AI could consume 11–12% of U.S. electricity by 2030. Some say that’s conservative; others call it overblown. Either way, the load is coming.

The challenges are familiar: chronic underinvestment in transmission, just-in-time generation that leaves systems vulnerable, and hyperscaler interconnection queues that look more like parking lots than lists.

At the same time, data centers are spreading into new geographies (Appalachia, old industrial hubs), pulled by power availability rather than fiber. That shift could open new markets, revive regional economies, and diversify grid demand. In fact, we saw some hardtech that a few years ago might have touted its climate benefits is now focusing on speed to power for data centers.

And while the sector’s power appetite is daunting, it’s also fueling innovation. AI isn’t just driving the load; it’s accelerating climate solutions too — from smarter grid management to faster weather forecasting to materials discovery. What felt like an existential threat last year is starting to look more like a generational opportunity.

Yes, demand spikes are making life harder — for utilities scrambling to keep up and for startups navigating their long sales cycles and grid delays. But those same challenges are creating urgency. Clean firm power, storage, flexibility, and grid innovation aren’t aspirational anymore, they’re being piloted today.

Rising load is also forcing everyone to do more with what we already have. That means squeezing efficiency gains, deploying distributed resources where possible, and leaning on solar-plus-storage as the clean mature solution that’s ready the quickest. There was renewed interest in tools that help get projects built: permitting APIs, interconnection modeling, and workforce logistics.

And the US is still a place where things can get built. The scale of so many industries here, particularly the power sector and oil and gas, mean that if a tech can deliver lower costs, whether that's for power, industrial heat, or AI, it can still find a market. Regional governments aren't slowing down: While federal support was a big blow, states with big economies like New York, California, and Texas can still drive new industries forward. With New York State planning 1GW of advanced nuclear and new grid enhancing technologies pilots, and Texas still being the state of choice for deploying large scale renewables paired with data centers, progress, like power, is getting more distributed.

Even in a tough macro environment, founders are raising, and funders are writing checks. We saw venture and project deals closing. Even in a Trump 2.0 NYCW, the forward momentum is still there. Founders brought their science fair energy to demo days and showcases, where VCs looked for their next play. The spirit is alive.

At the end of the day it’s a realistic take – everything had to work without government subsidies amid the pullback. Philanthropic capital continues to play a catalytic role, especially for first capital and FOAK projects. And across conversations, it was clear that PE and infra shops are actively circling, not just watching from the sidelines. From transmission to carbon pipelines, everyone’s talking infrastructure.

Conversations about AI weren’t just about compute and power demand — they stretched from the organizational level to full system planning. And with that shift comes sharper scrutiny on the data itself.

From MRV tools to biodiversity monitoring, from grid efficiency to permitting APIs, the refrain was the same: data has to be “investor grade.” Trust, transparency, and usability are the new moats. If the last decade was about building tech, this one is about proving it works — with verifiable numbers that regulators, utilities, and financiers can actually underwrite.

The applications were everywhere. Startups pitched platforms that identify endangered birds near wind turbines, streamline siting and permitting, monitor methane leaks in real time, or deliver investor-ready nature data. Even permitting is getting reimagined as a data problem. On the adaptation side, AI is enabling the discovery of new materials (like heat-mitigating fabrics or cooling technologies) that address climate resilience at the consumer and building level.

It did feel like people were allergic to the word climate. Mostly unspoken, but obvious. Conversations still orbited the same themes, just reframed. Security, resiliency, affordability, efficiency, and circularity all got as much airtime as “climate” itself. (And notably, the voluntary carbon market barely came up at all. And bless the folks starting new DAC companies!)

Still, fewer shiny “climate” verticals on stage doesn’t mean a smaller opportunity. If anything, the scale is bigger than ever. The adjacencies are expanding — from satellites and space tech riding the Starship launch to new layers of security and resilience infrastructure — opening crossover opportunities well beyond the traditional climate tent. Resilience and adaptation got their long-overdue turn in the spotlight, especially for solutions in wildfire prediction, flood modeling, and critical infrastructure hardening.

We asked, you answered, and experts weighed in on 2026

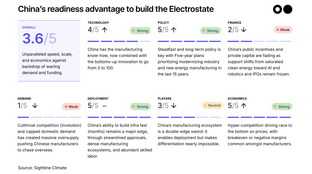

My visit to China's cleantech factories, labs, and HQs

Get the data, insights, and case studies behind the next wave of climate tech