🌎 Taxing times for CCUS #254

OBBB blows tailwinds through CCUS, but takeoff stalls

The US debt ceiling deal trades relaxed environmental review for fast-tracked clean energy approvals

Happy Monday!

The US avoided a debt ceiling crisis and the legislation Biden signed on Saturday has some implications for the floor of climate action. The compromise bill included updates to permitting and conspicuously lacked action to address transmission issues.

In other news, State Farm stops offering insurance to California homeowners, reforestation hits a sapling supply snag, and oil giant investors vote down every single climate-related shareholder proposal.

This week in deals, $93M for real estate emissions reporting, $86M for energy-efficient appliances, and $62M for EV charging.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter at [email protected].

💼 Find or share roles on our job board here.

The legislation that came out of the US debt ceiling negotiations is a mixed bag for clean energy advocates.

The final version, signed into law on Saturday, is less aggressive in curtailing renewable energy incentives than House Republicans initially proposed—it leaves IRA provisions in place, but does make changes to permitting processes.

The ongoing discussions about federal “permitting reform”—from the National Environmental Policy Act (NEPA) process to transmission and interconnection—are a jumble of opposing and overlapping priorities. Broadly, Republicans want to relax environmental reviews and Democrats want to streamline the process to get new clean energy onto the grid.

NEPA reforms in the debt ceiling legislation would do four things:

These reforms are meant to shorten timelines on the permitting process, getting projects underway more quickly—for both clean energy and fossil fuels. The legislation also adds energy storage to projects that can be fast-tracked through the permitting process.

One of the biggest challenges facing clean energy deployment is the need for constructing new transmission capacity, but by opting for more research rather than action on transmission construction, this debt ceiling compromise only kicked the can down the road.

The bill calls for the North American Electric Reliability Corporation (NERC), which is responsible for the reliability of the nation’s grid, along with regional transmission organizations (RTOS), Independent System Operators (ISOs), and utilities to conduct studies of transfer capacity between regions.

But similar studies have already shown the costs and benefits associated with investing in expanding and stabilizing the transmission systems in the US. Republicans reportedly weren’t interested in transmission updates, and a lack of bipartisan support for the issue in these talks means a longer wait to clear up backlogged interconnection queues.

The debt ceiling bill’s permitting reforms are the most substantial changes to NEPA since the 1970s and could expedite the approval process. But this compromise of environmental review relaxation for new capacity streamlining certainly doesn’t mark the end of the issue. Without resolutions for many areas of permitting reform in this legislation, expect to keep hearing the topic come up in Congressional talks.

🌱 Measurabl, a San Diego, CA-based ESG and emissions reporting platform for real estate, raised $93M in Series D funding from Sway Ventures, Energy Impact Partners, WVV Capital, Suffolk Construction, Salesforce Ventures, RET Ventures, Moderne Ventures, Lincoln Property Company, Constellation Technology Ventures, Concrete Ventures, Colliers, Chamber Creek, Building Ventures, and Broadscale.

🏠 Atomberg Technology, a Mumbai, India-based smart and energy-efficient appliances company, raised $86M in Series C funding from Inflexor Ventures, Jungle Ventures, Steadview Capital, Temasek Holdings, and Trifecta Capital Advisors.

⚡ Weev, a Belfast, United Kingdom-based EV charging provider, raised $62M from Octopus Investments.

✈️ CleanJoule, a Salt Lake City, UT-based sustainable aviation fuel (SAF) producer, raised $50M from Cleanhill Partners, Frontier Airlines, GenZero, Indigo Partners, Volaris, and Wizz Air.

🛰️ Pixxel, a Bengaluru, India-based hyperspectral earth imaging company, raised $36M in Series B funding from Sparta Group, Radical Ventures, Lightspeed Venture Partners, Google, Blume Ventures, and Athera Venture Partners.

📦 Debut, a San Diego, CA-based platform developing sustainable active ingredients for cosmetics, raised $34M in Series B funding from ACVC Partners, Business Opportunities for L'Oréal Development, Cavallo Ventures, Cultivian Sandbox Ventures, Fine Structure Ventures, GS Futures, and Material Impact.

⚒️ Ceibo, an Antofagasta, Chile-based sustainable mining technology company, raised $30M in Series B funding from Energy Impact Partners, Khosla Ventures, Aurus, Orion Resource Partners, Audley Institute, CoTec, Pincus Green, and Unearth Capital.

💨 Equatic, a Los Angeles, CA-based company combining carbon removal and carbon-negative hydrogen generation, raised $30M from Chan Zuckerberg Initiative, Pritzker Family Foundation, Grantham Foundation, National Science Foundation, , Temasek Foundation, PUB: Singapore's National Water Agency, U.S. Department of Energy’s FECM, and ARPA-E.

☀️ Beem Energy, a Nantes, France-based residential solar kit company, raised $14M in Series A funding from Cathay Innovation.

⚡ Realta Fusion, a Madison, WI-based developer of fusion energy targeting industrial heat and energy, raised $9M in Seed funding from Khosla Ventures and Wisconsin Alumni Research Foundation and Grant funding from ARPA-E.

🌱 Qflow, a London, UK-based decarbonization software platform for construction, raised $9M in Series A funding from Ascension Ventures, Bridge Investment Group, Gravel Road Ventures, GreenSoil Investments, Grosvenor Group, MMC Ventures, Suffolk Technologies, and SYSTEMIQ.

⚡ Proxima Fusion, a Munich, Germany-based developer of fusion power plants using stellarators, raised $7M in Pre-Seed funding from Plural, UVC Partners, High-Tech Grunderfonds, and Wilbe Group.

💨 CUR8, a London, UK-based carbon removal purchasing platform, raised $7M in Pre-Seed funding from CapitalT and Google Ventures.

⚡ Jolt, a Tarragona, Spain-based provider of electrodes coating treatments, raised $6M in Series A funding from Axon Partners Group, Climentum Capital, and Ship2B Ventures.

⚡ Newtrace, a Bengaluru, India-based hydrogen electrolyzers manufacturer, raised $6M in Seed funding from Sequoia Capital India, Aavishkaar Capital, IKP Knowledge Park, Micelio Fund, and Speciale Invest.

📦 Cocoli, a Berlin, Germany-based sustainable furniture marketplace, raised $3M in Seed funding from Adevinta Ventures, Ship2B Ventures, and IBB Ventures.

🚢 Zparq, a Älta, Sweden-based developer of ultracompact electric marine motors, raised $3M in Seed funding from Santander, Almi Invest GreenTech, and EIT InnoEnergy.

📦 Uncaged Innovations, a Troy, NY-based sustainable leather alternatives platform, raised $2M in Pre-Seed funding from InMotion Ventures, VegInvest, Stray Dog Capital, Alwyn Capital, Hack Capital, and GlassWalls Syndicate.

📦 Earthodic, a Brisbane, Australia-based producer of bio-based coatings for paper packaging, raised $2M in Pre-Seed funding from Closed Loop Partners, Investible, Tenacious Ventures, and Twynam Agricultural Group.

💨 Riverse, a Lyon, France-based carbon measurement, reporting, and verification (MRV) platform for carbon credits, raised $2M in Seed funding from Techstars and angels.

🔋 i-TES, a Turin, Italy-based developer of thermal storage batteries using phase change materials (PCMs) and thermochemical materials, raised $1M in Seed funding from Eureka Venture and Tech4Planet.

💨 Carbogenics, an Edinburgh, United Kingdom-based developer of bio-additives stabilizing anaerobic digestion plant performance, raised $1M in Seed funding from Green Angel Ventures, Scottish Enterprise, and Old College Capital.

💨 Global Thermostat, a Commerce City, CO-based direct air capture company, raised an undisclosed amount from Presidio Ventures.

🛵 LAND, a Cleveland, OH-based producer of an electric two-wheeler, raised an undisclosed amount in Series A funding from Ancora.

🔋 Lyten, a San Jose, CA-based developer of lithium-sulfur batteries, raised an undisclosed amount from Stellantis Ventures.

⚡ Braya Renewable Fuels, a Dallas, TX-based renewable fuels developer, raised $86M in federal funding from the Government of Canada for a biorefinery.

♻️ Carbios, a Clermont-ferrand, France-based enzymatic technologies for PET, raised $58M in Grant funding from the French Government.

⚡ Brookfield Asset Management has acquired a controlling stake in CleanMax, a Mumbai, India-based renewable energy developer and operator, for $360M.

🥩 Current Foods, a San Francisco, CA-based plant-based seafood company, was acquired by Wicked Foods for an undisclosed amount.

NGP, an Irving, TX-based investment firm, held a final close of $700M for their fund that provides growth capital for renewable energy companies.

Talis Capital, a London, UK-based investment firm, held a first close of $100M out of the $175M early-stage fund focused on tech infrastructure, climate tech and consumer internet.

Big Idea Ventures, a New York, NY-based investment firm, held a first close for its $75M New Protein Fund II.

Share new deals and announcements with us at [email protected]

French energy company TotalEnergies closed the sale of most of its climate venture capital arm, TotalEnergies Ventures, to French VC firm Aster.

State Farm, the largest homeowner insurance company in California, announced it would stop selling coverage to homeowners everywhere in the state, following a similar move by AIG, another home insurer, last year. Insurance companies across the US are raising rates, restricting coverage or pulling out of entire regions due to financial loss and climate risk.

The US Department of Energy announced $46M in funding to eight companies advancing research and development for fusion power plants.

Germany’s draft climate bill, which aims to ensure that newly installed heating systems run on at least 65% renewable energy starting in 2024, continues to face hurdles as tensions continue between the current three-party government. The lack of agreement has led to doubts on whether Germany will meet commitments to Europe’s climate goals.

The national seedling shortage is a major bottleneck in reforestation. The Bipartisan Policy Center's latest report makes the case for investing in nursery infrastructure, soil quality, and sapling survival rates. Mast Reforestation (formerly DroneSeed) moved to secure its supply earlier this year, purchasing a nursery in California.

Arizona announced that the state will no longer grant approval for new developments within the capital city of Phoenix, as groundwater rapidly disappears due to overuse and climate change-driven drought. It is the latest instance of climate change impacts on housing development, water laws, and regional politics.

SBTN (Science Based Targets Network) released the first draft of corporate science-based targets for nature. In support of this, the Land & Carbon lab created a baseline map for companies’ no-conversion targets.

A UN climate panel sparked concern in the carbon removal industry after it cast doubt on whether it would be counted as a carbon offset.

Exxon and Chevron investors voted down every climate-related shareholder proposal. These results are in sharp contrast to the past two years when shareholders supported some resolutions put forward by environmental activists.

The Soros Fund wrestles with Scope 3 reporting conundrum as they pursue cutting emissions from their portfolio holdings given that just 5% of US companies report emissions from supply chains and customers.

“Climate finance” dollars flow to chocolate stores, a coal plant, and a movie.

Deep sea mining hotspots are home to thousands of previously undiscovered species like Carnivorous Sponges and the Gummy Squirrel!

Sargassum shakeup. A seaweed menace might be a carbon storage savior in a stinky disguise.

Dropping water levels means rising arsenic risk in drinking wells.

Bankrupt O&G Co. reinvents itself as a booming Carbon Cowboy, thanks to carbon-capture tax credits.

Should battery recycling be required in the US to meet future demand?

Climate paradox: lower levels of emissions and pollutants actually make the earth hotter in the short term.

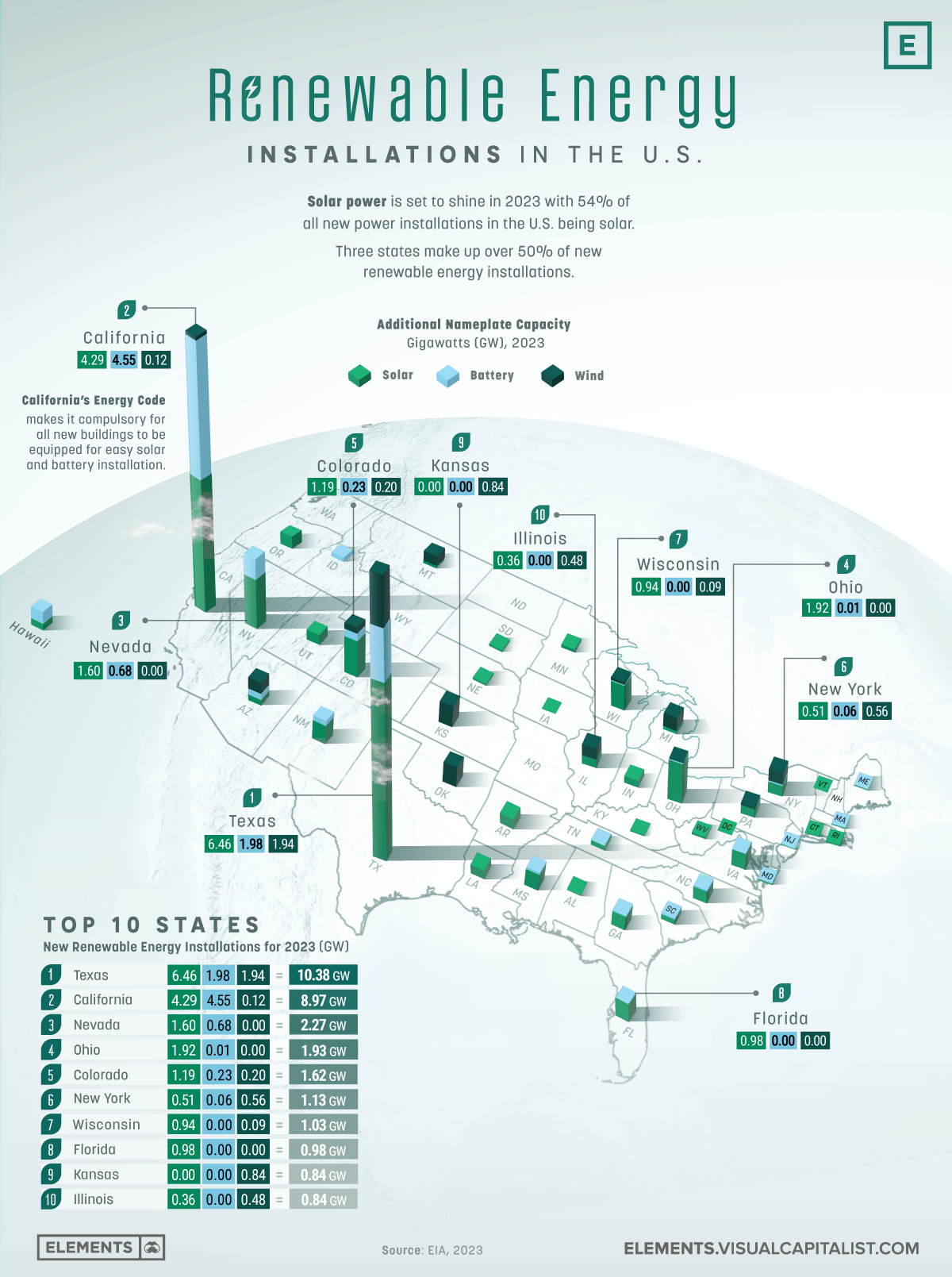

We love a good map—this visualization of EIA data of planned new renewable energy and battery installations very much included.

You can’t manage what you can’t measure, including on fuel-guzzling maritime fleets.

After its come up on solar and wind tax credits, NextEra, the most valuable US power co, makes a huge bet on hydrogen tax credits.

Geothermal’s 10,000 meter-deep moonshot in China.

Young people don’t want to work for oil and gas companies, but they want to work in the mining industry even less.

🗓️ Watershed 2023 Summit: Tune in on June 7th to Watershed’s virtual conference with speakers including Nat Bullard and Laurene Powell Jobs.

🗓️ Sylvera Carbon Markets Summit: Tune in on June 8th to Sylvera’s half day of programming on the state of voluntary carbon markets, with speakers including Diego from Pachama, Peter from Charm, and Sophie from, well, this!

💡 Climate Resiliency Challenge: Apply by July 10th to OpenIDEO’s innovation challenge for a chance to win funding for tech supporting prevention, preparedness, and recovery for frontline communities.

🗓️ Climate Tech Summit: Join in on June 13th as part of London Tech Week.

💡 LACI Incubation: Apply by June 23rd to this two-year program for LA-based cleantech cos to drive impact, market & investment readiness, and pilots.

Business Development - C&I Renewable Energy @InRange Energy

MBA Finance & Strategy Intern @InRange Energy

Founder In Residence, Zero Emission Steel @Deep Science Ventures

Vice President, Clean Energy (Solar Manufacturing) @Boundary Stone

Principal, Carbon Markets @RMI

Executive Assistant to the Chief Investment Officer @The Nature Conservancy

Investment Operations Manager @The Nature Conservancy

Investment Analyst @The Nature Conservancy

Vice President / Senior Associate @Carbon Drawdown Collective

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

OBBB blows tailwinds through CCUS, but takeoff stalls

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook