🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Happy Monday!

The anticipated red wave from the #Midterms2022 did not come crashing down in response to Biden’s aggressive action against climate change. In fact, the Republican climate backlash was barely felt at all - parting the seas to fully implement IRA with lots of steel in the ground and clean electrons in sockets.

Talking of waves, a continued flood of deal activity this week with $76m for photocatalytic reactors, $70m for residential geothermal, and $50m for carbon markets. Just a week after publishing, our climate dry powder analysis is outdated, with 7 new funds announced this week!

COP negotiations continued over the weekend as the event venue itself was dismantled. Global countries agreed to create a new Loss and Damage fund for vulnerable developing countries, meanwhile cultured meat gets the greenlight from the FDA and the new Prius steps into the spotlight.

No Friday feature from us this week while we prep and then recover from a low-carbon spread.

Thankful for y’all!

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter here.

💼 Find or share roles on our job board here.

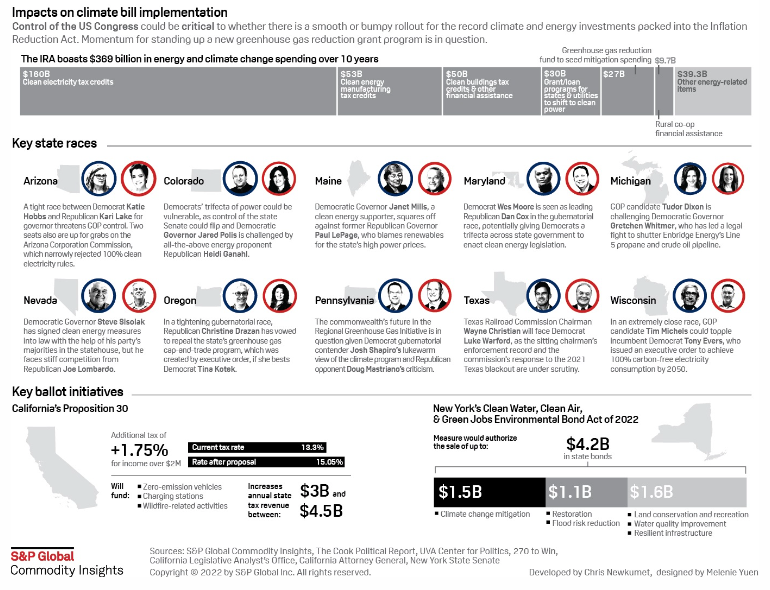

The “red wave” predicted by US congressional midterm pundits never made it to shore. Democrats’ surprisingly strong showing in the midterm elections now all but ensure the transformational implementation of the Inflation Reduction Act.

Every action has an equal and opposite reaction. Except when the action is a win-win across the aisle. In response to Biden’s historic push against climate change, Republicans… mostly shrugged. Ultimately, there was little to no political blowback for major climate action.

🌊 Democrats overcame the historical trend of a midterm backlash and kept Senate control by flipping Pennsylvania and holding on to seats in Arizona and Nevada. Republicans won a shockingly narrow majority in the House with 218 seats.

At the federal level, the House is unlikely to engage in new climate legislation under new House Speaker-elect McCarthy, though the narrow majority leaves little margin for error. Meanwhile, the Senate has the ability to confirm judicial nominees to circuit courts – leading to more supportive clean energy rulings.

At the state level, legislature flips in Michigan and Minnesota as well as a new Democratic Arizona governor create expansive climate progress possibilities. Climate Cabinet Action, a nonprofit supporting climate campaigns, saw 85% of their priority candidates win. Climate measures were also on the midterm ballot. Several, particularly around climate resiliency, passed:

✅ New York: overwhelmingly passed $4.2B for environmental improvement projects – including $1.5B for pollution cleanup, wetland protection, clean energy projects, and electric school bus fleets, $1B in coastal shoreline restoration, and the remaining for sewage infrastructure and land and fishery conservation

✅ Rhode Island: two-thirds support for $50M Environment and Recreation Bond Measure endorsing climate municipal resiliency, small business energy loans, land restoration and remediation

❌ California: rejected Proposition 30 that would use a tax for the rich (+1.75%) to fund zero-emission vehicle subsidies and production, charging infrastructure, and wildfire prevention

⚡ Syzygy Plasmonics, a Houston, TX-based company developing photocatalytic reactors, raised $76m in Series C funding from Carbon Direct, Toyota Ventures, The Engine, Sumitomo Corporation, Aramco Ventures, Lotte Group, Horizons Ventures, GOOSE Capital, Evok Innovations, Equinor Ventures, Pan American Energy, and Chevron Technology Ventures.

⚡ Dandelion Energy, a New York, NY-based residential geothermal company, raised $70m in Series B funding from LenX, NGP Energy Capital Management, New Enterprise Associates, GV, Collaborative Fund, Building Ventures, and Breakthrough Energy Ventures.

💨 BeZero Carbon, a UK-based company conducting carbon ratings and risk analysis, raised $50m in Series B funding from Quantum Energy Partners, Molten Ventures, Norrsken VC, Illuminate Financial, Qima, Contrarian Ventures, EDF Pulse Ventures, Hitachi Ventures, and Intercontinental Exchange.

🥩 Vow, an Australian-based cultured meat company, raised $49m in Series A funding from Blackbird, Prosperity7 Ventures, Toyota Ventures, Square Peg Capital, Grok Ventures, Cavallo Ventures, Peakbridge, Tenacious Ventures, HostPlus Super, NGS Super and Pavilion Capital.

🚗 WeaveGrid, a San Francisco, CA-based company developing data software for optimizing EV energy usage on the grid, raised $35m in Series B funding from Salesforce Ventures, Activate Capital, Emerson Collective, Collaborative Fund, MCJ Collective, Coatue, Breakthrough Energy Ventures, Grok Ventures and The Westly Group. [Read our interview with WeaveGrid here]

💨 Impulse, a San Francisco, CA-based home appliances company reducing carbon emissions, raised $20m in Series A funding from Lux Capital, Fifth Wall, Lachy Groom, and Construct Capital.

♻️ RoadRunner Recycling, a Pittsburgh, PA-based waste management company raised $20m in Series D funding from Fifth Wall.

🏠 Service 1st Financial, a Bethesda, MD-based company facilitating individual households’ access to sustainable HVAC systems, raised $20m in Series B funding from S2G Ventures.

🌱 Freight Farms, a Boston, MA-based company providing container farms to support farming in any climate, raised $17.5m in Series B funding from Aliaxis SA, Ospraie Ag Sciences, Spark Capital, Stage 1 Ventures, and Alkaline Partners.

⚡ Upstart Power, a Southborough, MA-based manufacturer of solid oxide fuel cell power systems, raised $17m in Series C funding from Itochu Corp, Enphase Energy, Sunnova, Rodgers Capital, H+ Partners, and Cricetus Flex Ventures.

⛓️ Circularise, a Netherlands-based supply chain traceability platform for emissions-intensive industries, raised $11m in Series A funding from Brightlands Venture Partners, Neste, Asahi Kasei, and 4impact.

🛵 Corrit Electric, a India-based electric bike manufacturer, raised $9m in Series A funding from Sphiticap.

🔋 Evyon, a Norway-based provider of second-life C&I storage systems, raised $8.3m in Seed funding from Sandwater, Wiski Capital, Skagerak Energi, and Antler.

🔋 ChargeUp, a India-based battery swapping network, raised $7m in Seed funding from Capital A Partners, and Anicut Capital.

💨 Carbon Engineering, a Canada-based direct air capture company, raised $6.8m in funding from Air Canada and Airbus.

🚌 BasiGo, a Kenya-based provider of electric buses, raised $6.6m in Seed funding from Truck.vc, SIG, OnCapital, Novastar Ventures, MCJ Collective, Moxxie Ventures, Mobility 54, and Keiki Capital.

🌍 SparkNano, a Netherlands-based spatial atomic layer deposition developer, raised $5.5m in Seed funding from Air Liquide ALIAD, TNO, Somerset Capital, Invest-NL, Innovation Industries, and Brabant Development.

♻️ ULUU, a Australia-based company developing plastic alternatives from seaweed, raised $5.3m in Seed funding from Main Sequence, Albert Impact Ventures, Mistletoe, and Possible Ventures.

🛰️ Overstory, a Netherlands-based satellite company providing vegetation intelligence, raised $5.2m in Seed funding from Convective Capital, Toba Capital, Semapa Next, Pale Blue Dot, Moxxie Ventures, Climate Capital, CapitalT, Bentley iTwin Ventures, and B Capital Group.

🌎 Fennel, a Greenwich, CT-based ESG investing platform, raised $5m in Seed funding from angel investors.

⚡ Anode Labs, a Houston, TX-based decentralized Web3 platform connecting energy storage assets, raised $4.2m in funding from Lerer Hippeau, Lattice, VaynerFund, CoinShares, and Digital Currency Group.

🚚 The Eight Notch, an Alamo, CA-based company providing last-mile logistics, raised $3.5m in funding from Ecosystem Integrity Fund.

♻️ Impacked, a New York, NY-based B2B marketplace for sustainable packaging, raised $2.5m in Seed funding from TenOneTen Ventures.

💨 Thallo, a U.K.-based Web3 carbon credits platform, raised $2.5m in Seed funding from Arcan, Friendly Trading Group 2, Ripple, Allegory, Cerulean Ventures, and Flori Ventures.

🚗 Zeti, a UK-based EV fleet financing platform, raised $2.5m in Seed funding from Toyota Ventures, Powerhouse Ventures,

🔋 Sinergy Flow, an Italy-based company developing redox flow batteries for energy storage, raised $1.9m in Seed funding from 360 Capital, PoliHub and CDP Venture Capital.

🌾 Peptyde Bio, a St Louis, MO-based company developing AMPs for agriculture use, raised $1.2m in Pre-seed funding from Danforth Technology Company, St. Louis Arch Angels, BioGenerator Ventures, and QRM Capital.

🌎 PulsESG, a San Francisco, CA-based cloud platform helping institutions improve their ESG performance, raised funding from Workday Ventures.

♻️ Queen of Raw, a New York, NY-based excess inventory management platform, raised funding from Future Planet Capital and True Wealth Ventures.

💨 AirCarbon Exchange, a Singapore-based carbon trading exchange, raised funding from Mubadala.

🌎 NEXT Renewable Fuels, a Portland, OR-based company developing biofuel as alternatives for petroleum-based diesel, raised up to $37.5m from United Airlines Ventures for its biorefinery.

⚡ Simply Blue Group, a Ireland-based blue economy project developer in offshore wind and wave energy, raised $28.5m in funding from Octopus Energy Generation.

Climate Adaptive Infrastructure raised over $1B ($825m equity, $200m for co-investments) to invest in low-carbon real assets in clean energy, water, and urban infrastructure.

Closed Loop Partners and Brookfield Renewable announced Circular Services, a developer of circular economy and recycling infrastructure, with Brookfield committing $700m.

SE Ventures, backed by Schneider Electric, raised $520m for its Fund II to invest in startups building tools for climate technology, predictive maintenance, and the internet-of-things.

Energy Impact Partners raised $485m for its Frontier Fund focused on revolutionary climate technologies that have achieved early technical validation but not yet reached full maturity.

Alcazar Energy Partners raised $337m for its second fund to invest in clean energy infrastructure across emerging markets.

MassMutual Ventures launched a $100m Climate Tech Fund to invest in 15 to 20 companies addressing sources of climate change.

Sopoong raised $8m to invest in Korean companies targeting environmental impact.

Planetly, a German-based carbon management software company, closed and laid off all 200 staff.

COP27 went overtime negotiating until 4 a.m. on Sunday morning about the most significant outcomes from the two-week bonanza. Parties agreed to create a new breakthrough “loss and damage” fund to help vulnerable developing countries bear the costs of climate-fueled events, with the US signing on in the final hours. The finer details of who pays and how the fund operates were punted to COP28. On a more sour note, nations including China and Saudi Arabia blocked a key proposal to phase out all fossil fuels, not just coal.

Following Indonesia and South Africa’s lead, Vietnam creates an $11B climate financing package to shift its economy from coal to renewables. While coal makes up ~50% of Vietnam’s energy supply, its 2,000 miles of coastline are ideal for wind power.

The Biden Administration is requiring federal contractors to disclose their GHG emissions and set emissions reduction targets. Suppliers with $50m+ in annual federal procurement contracts would also be required to disclose Scope 3 emissions.

The DOE announced a $350m funding opportunity for emerging Long-Duration Energy Storage demonstration projects delivering 10-24+ hours of energy and $74m for 10 projects advancing domestic battery recycling and reuse.

National governments are uniting against seabed mining, claiming more scientific research is needed to understand environmental impacts before mining EV battery inputs from the ocean floor.

The FDA approved cultivated meat from Upside Foods, breaking expectations for approval timelines and rivaling Singapore’s lead.

HBD to the world’s 8,000,000,000th person.

Elon’s Twitter takeover has spiked climate denialism and blue-check verified disinformation during COP.

Oysters, potatoes, and leftovers are on the low-carbon Thanksgiving menu.

Sue Biniaz is “The Closer” behind climate negotiations’ legalese.

Got soup? Meet the mastermind behind the controversial protests, that are conversely decreasing public support for climate action.

Got faith? Interfaith groups smash the 10 “climate commandments” at Mount Sinai, in a symbolic protest.

Frontier published a smorgasbord of 100+ CDR gaps for founders, technical leaders, and philanthropists to feast upon.

The environmental hero who’s ever-in touch with his people, King Charles III notes that “My old Aston Martin, which I’ve had for 51 years, runs on—can you believe this—surplus English white wine and whey from the cheese process.”

Kids feel betrayed by other generations. Here, kids give kids advice on climate change.

Laid off in the tech crunch? Climate startups want to put you to work!

A watched pot never boils. Except when it’s on an Impulse induction stove equipped with a lithium-ion battery.

💡 Unreasonable Fellowship: Reach out by Nov 30 for nominations to the Unreasonable fellowship focused on kick ass and scaling European climate tech ventures (typically Series A+) for their upcoming spring Unreasonable Impact UK & Europe program.

🗓️ Zero Carbon Capture: Join ZERO on Nov 24 in London for a set of talks around carbon capture featuring Seabound, Mission Zero, Carbon Engineering, and Inherit.

🗓️ Ask a VC: Register for lunch and a panel discussion on Nov 30 at the Stanford Graduate School of Business to discuss what’s getting funded in climate tech with BCV’s Sarah Hinkfuss, Voyager’s Sierra Peterson, Lowercarbon’s Mia Diawara, and BEV’s Matt Eggers.

🗓️ Urban-X Night on Climate Innovation: Join Urban-X on Dec 2 at Newlab in NYC to celebrate climate entrepreneurship with behavioral scientist Dr. Sweta Chakraborty.

Director of Capital Markets @Pachama

Operations & Compliance Manager @Clean Growth Fund

Legislative Affairs Specialist @US Department of Energy

Head of Carbon Solutions @Living Carbon

Winter Ventures Intern @Closed Loop Partners

Customer Success Lead (Remote) @Yard Stick PBC

Chemical Engineer (Level II/III/Staff) @Found Energy

R&D Scientist (Level II/III/Staff) @Found Energy

Senior Full-Stack Software Engineer @Arch

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project