🌎 Taxing times for CCUS #254

OBBB blows tailwinds through CCUS, but takeoff stalls

Happy Monday! In this week’s issue, we limp into the week after an all too happening NY Climate Week with a dive into Salesforce’s net zero marketplace. While it leans towards offsets, it accounts for some ~90 projects that spread familiarity and availability of carbon credits towards broader audiences which in sum should generate more positive liquidity.

In fundings this week, $250m Series D for insect-based proteins in France, as well as a smattering of fundings for solar energy systems manufacturing and two-sided solar installation platforms.

In the news, our hearts go out to those impacted by Hurricane Fiona - climate isn’t getting nicer, and its costs will continue to compound. The US (finally) joins the Kigali amendment to ramp down HFCs, Uber helps corporates account for their carbon, and Amtrak pledges net zero emissions by 2045 (pending customary delays, we’re sure).

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter here.

💼 Find or share roles on our job board here.

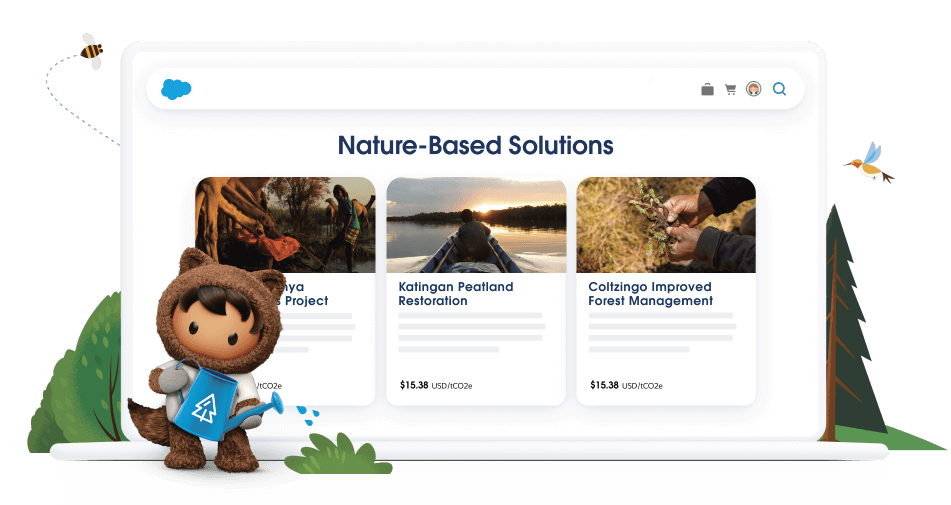

While the hum of Climate Week engulfed the Big Apple last week, over on the West Coast Salesforce announced the ‘Net Zero Marketplace’ during Dreamforce.

Salesforce joins the corporate carbon offsetting fray with a new carbon credit marketplace - set to go live with ~90 projects across 11 countries. For now, projects seem to lean toward offsets as opposed to removals (forget the difference? here’s our carbon markets refresher). The new platform creates a one-stop shop for carbon, linking players across the value chain - from project developers (Climate Impact Partners, South Pole, Respira, and Native), carbon credit rating providers (Calyx, Sylvera), data providers (Pachama), to API marketplaces (Cloverly, Lune).

Beyond its robust rolodex of partners, Salesforce’s carbon credit marketplace is a starting point to unravel some of the voluntary carbon market’s key hurdles. Nat Bullard outlines the VCM’s rate-limiting steps: (1) availability of scalable carbon projects (2) liquidity for companies to easily buy and sell credits (3) familiarity among non-specialists and (4) quality of credits generated by current and future projects.

Of the manifold challenges with the voluntary carbon markets, are marketplaces the most influential lever to pull? Perhaps in this case. With 150K+ customers, ranging from the Fortune 500 to credit-unaware SMEs, Salesforce is best positioned to unlock liquidity and familiarity. Companies without dedicated carbon management resources can easily plug into Salesforce’s one-stop shop for all their CRM and carbon offsetting needs. If Salesforce can successfully pull on those two threads, the whole knot might start to unravel. Liquidity and familiarity act as “an effective form of disinfectant” to clean up quality.

What happens now to all of the other offset marketplaces? Specialization could still win, for now, particularly for removals-focused players (where availability is short) and for strong vetting and verification players (where quality is a concern).

What’s Salesforce’s next climate move? TIME (which Benioff owns) launched CO2.com in parallel. The same week, Arcadia and Salesforce teamed up to expand access to actual energy emissions data. But we’d expect to see Salesforce roll out more carbon accounting and verification services to its customer base. We’re excited for the hype to settle (and valuations to come back to Earth) in the carbon marketplace and accounting spaces, and for the stage of the cycle in which Salesforce and the Big Four make carbon accounting “boring” because of its commonplaceness.

🐛 Innovafeed, a France-based company developing insect-based protein for animal and plant nutrition, raised $250m in Series D funding from Qatar Investment Authority, ADM, Cargill, Future French Champions, ABC Impact, IDIA Capital Investissement, Grow Forward, Creadev and Temasek.

⚡ Mainspring Energy, a Menlo Park, CA-based developer of linear generators, raised an additional $140m in Series E funding from Lightrock, CPP Investments, Shell Ventures, Hanwha Power Systems, Khosla Ventures, Bill Gates, Fine Structure Ventures, and Princeville Capital.

☀️ Ojjo, a San Rafael, CA-based company manufacturing solar energy foundation systems, raised $40m in Series C funding from NGP Energy Capital Management and Ajax Strategies.

🛰️ 4M Analytics, an Israel-based subsurface infrastructure mapping startup, raised an additional $30m in Series A funding from Insight Partners, ITI Venture Capital, Viola Ventures and F2 Venture Capital.

♻️ Ioniqa Technologies, a Netherlands-based company upcycling plastics raised $29m in funding from Koch Separation Solutions.

🔥 Pano AI, a San Francisco, CA-based wildfire detection startup, raised $20m in Series A funding from Initialized Capital, Congruent Ventures, Convective Capital, DCVC, January Ventures, and Quiet Capital.

📏 Yard Stick, a Cambridge, MA-based soil carbon measurement provider, raised $18m in grant funding from the USDA'a Partnerships for Climate-Smart Commodities initiative.

🌍 Datamaran, an England-based ESG risk management software firm, raised $12.7m in Series B funding from Fortive and American Electric Power.

☀️ Enact Systems, a Pleasanton, CA-based two-sided solar installation platform, raised $11.5m in Series A funding, from Energy Growth Momentum, Olympus Capital Holdings Asia, NB Ventures, Arka Venture Labs, and Alumni Ventures.

🏢 CIM, an Ireland-based property operations decarbonization platform, raised $6.5m in Series A funding from Five V Capital.

🐛 Trapview, a Slovenia-based pest monitoring and forecasting company raised $9.7m in Series B funding from European Circular Bioeconomy Fund, Pymwymic, and Demeter.

☀️ Exasun, a Netherlands-based solar roof manufacturer, raised $8.7m in funding from Wienerberger Ag, No Such Ventures, Invest-NL, ENERGIIQ, Dockpoint, and ABN AMRO Fund.

🔋 Sylvatex, an Alameda, CA-based company commercializing a battery cathode production technology, raised $8.4m in Series AQ funding from Catalus Capital, Amplify Capital, and How Women Invest.

⚡ Sweetch Energy, a France-based provider of osmotic energy from saltwater, raised $5.8m in Seed funding from EDF Renewable Energy, Compagnie Nationale du Rhône, Go Capital, Future Positive Capital, and Demeter.

💳 Future, a Silver Spring, MD-based debit-card company providing cash incentives for carbon footprint reductions, raised $5.3m in Seed funding from Urban Impact Ventures, Techstars Ventures, Climate Capital, Active Impact Investments, and Accomplice.

💨 Transaera, a Somerville, MA-based company developing energy-efficient AC systems, raised $4.5m in Seed funding from Energy Impact Partners, Saint-Goblin, Massachusetts Clean Energy Center, and Carrier Ventures.

🏗️ AICrete, a Richmond, CA-based concrete decarbonization software platform, raised $4m in Seed funding from CLEAR Ventures and VoLo Earth Ventures.

⚡Flyscan, a Quebec, Canada-based energy infrastructure remote sensing platform, raised $3.5m in Seed funding from Hatch, BDC Capital, and Enbridge.

⚡ ExerGo, a Switzerland-based district heating and cooling startup using captured CO2, raised $3.2m in Seed funding from Baker Hughes, EREN Groupe, and existing investors.

💨 RenewCO2, a Cranford, NJ-based CO2 to chemicals startup, raised $2m in Seed funding from Energy Transition Ventures.

🏭 EcoLocked, a Germany-based startup using biochar to produce sustainable construction materials, raised $1.7m in Seed funding from Counteract, SFO, and Better Ventures.

🔋Esmito, an India-based battery swapping company, raised $1.2m in Seed funding from Unicorn India Ventures.

🔋Lithion Recycling, a Montreal, CA-based battery recycling technology provider, raised an undisclosed amount in Series A funding from GM Ventures.

AXA launched their $484m Natural Capital strategy, focused on investments including strategic equity, carbon solutions, and project financing in sustainable forest management.

Extantia Capital launched a $290m climate tech innovation platform, including Extantia Flagship, a $145m fund to invest in decarbonization companies, Extantia AllStars, a $145m climate tech fund of funds, and Extantia Ignite, a climate innovation information hub.

SER Capital Partners raised $475m for its debut middle-market private equity fund to support businesses leading decarbonization.

Vence, a San Diego, CA-based company developing virtual fencing for livestock management, was acquired by Merck Animal Health, a Kenilworth, NJ-based pharmaceutical company.

BreezoMeter, an Israel-based air quality monitoring startup, was acquired by Google for $200m.

Long overdue. The US joined 137 nations ratifying the 2016 Kigali Amendment, agreeing to reduce production of HFCs (chemicals with 1,000x the heat-trapping strength of CO2). Worth noting – the EPA’s AIM Act of 2021 already brought the US in line with Kigali, phasing down national use of HFCs by 85% by 2035.

California moves to ban natural gas furnaces and heaters by 2030, the first statewide initiative after cities like NYC and Boston declared the same goal earlier this year.

Amtrak pledged net-zero GHG emissions by 2045. That is, if they can get their rolling stock back on track.

Meanwhile in more heavy transport decarb headlines, Amazon announced an agreement to use Infinium’s low-carbon electrofuels in its middle mile fleet and JetBlue and Virgin Atlantic are purchasing 1B gallons of Air Company’s (not vodka) CO2-based sustainable aviation fuel.

Uber’s new carbon accounting tool will help 170,000 corporate clients clean up their transportation carbon footprint by providing data on total rides and emissions, changing an estimate-driven process to bottoms up reporting.

The DOE announced a new Industrial Heat Shot aimed at reducing emissions from industrial heating processes by 85% by 2035 by electrifying heating operations and integrating low-emissions heat sources.

The world’s largest sovereign wealth fund pledged to net zero. Norway's $1.2T wealth fund will decarbonize by prioritizing shareholder engagement rather than divestment.

Drama on the world stage. World Bank Chief refuses to resign after pressure to quit over climate change denial. Former Vice President Al Gore called David Malpass a “climate denier” after Malpass repeatedly avoided answering whether he accepted the reality of human-driven climate change during a Climate Week panel.

After failing to adequately protect its north coast islanders from climate change, the UN called Australia out on human rights violations – creating a ‘pathway’ for climate victims to hold national governments accountable for ineffective adaptation measures. Denmark also becomes the first UN member to pay for ‘loss and damage’ from climate change.

You’re up. Climate Draft publicly launched this week as a bridge for talent from tech to climate.

Frontier presents their framework and a new Verification Confidence Level (VCL) metric for quantifying delivered carbon removal. TLDR; Expect challenges quantifying removal based on technology type, and use diligence, dollars, and milestones to drive down quantification uncertainty.

A can’t miss from the Frontier x Carbonplan collab? This CDR Quantification tool mapping VCLs by CDR pathway.

SME Climate Hub launched their US initiative to help small businesses pledge to climate action and track emissions.

Explore the 34 new climate tech companies part of Tech Nation's Net Zero 3.0 cohort.

NYC Chef Justin Lee is magnetic in an induction cooking demonstration at Climate Week.

Add hydrogen to your whiskey tasting notes with Suntory’s new electrolyzer-powered distillery.

King Arthur’s birthplace is at risk of coastal erosion.

Nonprofits launch “first-of-its-kind” open source public database of global fossil fuel reserves, production and emissions.

Getting straight As on green. New Jersey officially rolls out a climate curriculum, along with lesson plans.

Retweet. Climate Week singles event? "So… are you more of a personal accountability type or a systems change kinda person?"

Saildrone footage from inside Hurricane Fiona.

Climate change might be making lakes less blue.

NYT details Canada’s push into lithium mining.

There are approximately 20 quadrillion ants on earth. Read here for the ant hill we want to die on this week – a deep dive into how climate changes will impact ants and ecosystems.

🗓️ Axios Pro & DOE LPO: Register (and submit questions!) for a conversation with LPO Director Jigar Shah on long-term capital formation in climate tech, taking place on Sept 27.

🗓️ JetBlue Sustainability in Travel Tech Summit: Register for this event taking place in San Francisco on Sept 28 for a day full of panels and fireside chats discussing sustainability in travel.

🗓 Climatetech Founder Showcase: Join Canadian Women's Network on October 27th featuring Canadian-based climate female founders.

Associate @DBL Partners

Analyst @CleanCapital

Vice President @Aligned Climate Capital

Chief of Staff @Odyssey Energy Solutions

Chief of Staff @Elephant Energy

Senior Strategy Analyst @Rumin8

VP Product @WasteX

Chief Engineer @Ohmium Int

Data Scientist @Habitat Energy

GM/VP Mineral Processing @Impossible Mining

Director of Finance and Administration @Carbon180

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

OBBB blows tailwinds through CCUS, but takeoff stalls

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook