🌎 Inside Cloverleaf Infrastructure’s power play #206

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

Plus, spotlight on Austin Whitman, CEO of Climate Neutral

Happy Memorial Day Monday!

Thanks for making our newsletter part of your weekend, below is a picture of the pure joy of a dog in a bandana on a beach. Grateful you’re here with us relaxing and rebooting!

This week we dive deep into carbon offsets - first debriefing Stripe’s announcement of its 4 first emissions reductions projects and then spotlighting the CEO of Climate Neutral, the ever-thoughtful Austin Whitman.

Of course, we round things out with fresh deals (a surprising amount of African and ag fundraising this week!) and pop-ups including the launch of Third Derivative incubator from RMI.

Not a subscriber yet?

Last year, Stripe announced its carbon negative emissions commitment to spend at least $1M per year on carbon sequestration technologies. This week, after evaluating 24 applications, Stripe announced its first purchases across 4 projects:

What does this mean?

Why does this matter?

What is likely to happen?

💸 Aspiration, a Los Angeles-based socially- and environmentally-conscious fintech startup, raised $135m in Series C funding from Alpha Edison, UBS O’Connor, DNS Capital, Radicle Impact, Sutter Rock, and Social Impact Finance. A certified B Corp, the company focuses on conscious consumerism through services such as a debit card that offsets the carbon emissions of every mile driven. TechCrunch has more here.

🍎 Imperfect Foods, a San Francisco-based online food marketplace focused on reducing food waste, raised $72m in Series C funding from Insight Partners and Norwest Venture Partners. The funding will be used to expand delivery of “ugly” food which would have otherwise been thrown away. More here.

🧬 Checkerspot, a Berkeley, CA-based high-performance materials company that designs materials at a molecular level raised $32.9m from Breakout Ventures, Illumina, and KdT Ventures. The company optimizes microbes to biomanufacture sustainable polyurethanes and textiles coatings which improve the performance of consumer products.

🔋 Nanotech Energy, a Los Angeles-based supplier of graphene batteries, raised $27.5m in Series C funding. The company has produced non-flammable batteries with higher performance levels and is working on developing a battery for Daimler Mercedes hybrid and electric automobiles. More here.

🌾 Sound Agriculture, an Emeryville, CA-based developer of innovative plant-breeding solutions, raised $22m in Series C funding led by S2GVentures, Cultivian Sandbox, Fall Line Capital, Cavallo Ventures and Syngenta Ventures. The company’s first commercial product Source™ helps growers improve crop yields without requiring more fertilizer. More here.

🐜 NextProtein, a Paris-based insect protein producer, raised $11m in Series A funding from Blue Oceans Partners, Telos Impact, and RAISE Impact. The company produces insect-based animal feed and fertilizer which require less land and capital than the widely-used alternative, soy protein.

🌾 Apollo Agriculture, a Kenya-based creator of a mobile-based product suite for farmers, raised $6m in Series A funding from Anthemis, Leaps by Bayer, Accion Venture Lab, and Flourish Ventures. The platform provides Kenyan smallholder farmers with working capital, data analysis for higher crop yields, and options to purchase key inputs and equipment. TechCrunch has more here.

🍅 Tomato Jos, a Nigeria-based agro-processing venture focused on the local production of high-quality tomato paste for the African market, raised $4.2m in Series A funding from Goodwell Investments, Acumen Capital Partners and VestedWorld. Roughly 45% of Nigeria’s harvested tomatoes go to waste, requiring Africa’s second largest producer to import half of its tomatoes. More here.

🌾 MicroGen Biotech, an Ireland-based ag-tech developer focused on reducing heavy metals in food and increasing soil health, raised $3.8m in Series A funding from Fulcrum Global Capital and The Yield Lab Europe. More here.

❄️ InspiraFarms, a London-based developer of off-grid solar-powered food refrigeration, raised Series B funding from KawiSafi Ventures and Untapped, joining repeat investors Energy Access Ventures and PYMWYMIC (Put Your Money Where Your Meaning Is Community). The startup provides energy-efficient cold rooms to agribusinesses in Africa, helping to reduce energy costs and post-harvest waste. More here.

This past week we interviewed Austin Whitman, founding CEO of Climate Neutral, an independent non-profit organization working to accelerate the transition to a low-carbon world. The Climate Neutral Certified label is a clear symbol that a company has measured and offset its carbon footprint, and implemented plans to drive carbon emissions out of its supply chain. Our chat has been edited lightly for length and clarity, so check out our website for the full interview.

Alright, let’s take it from the top. How did Climate Neutral come up?

It started with two successful entrepreneurs who wanted to do more about climate change. The founders of Peak Design and BioLite each had a nagging feeling that despite baking positive climate impact into the core of their operations since inception, they could still be doing more about climate change. They were missing a playbook for how to take operationally achievable, yet environmentally meaningful action that they could then communicate to their customers.

I came into the conversation after basically being out of the carbon market for 10 years; I worked at a clean tech software company (FirstFuel Software) and prior to that was deep in the sustainable investing world (Cambridge Associates, Climate Change Capital). After riding the hype rollercoaster of the first wave of carbon offsets, it was intriguing to me that these entrepreneurs were now thinking about offsets as a mechanism for attacking the consumer market. I was excited to build something and, in the fall of 2018, decided to set up a nonprofit to help companies through their carbon offsetting journeys.

How do you get the flywheel of carbon offsets investment turning? What comes first?

I think the basic thing that has been left out of the equation is a simple, clear, and hopeful message that consumers can grab onto. This is increasingly important when 2/3rds of Americans think the government should be doing more about climate change, 3/4ths of Americans think climate change is a real problem, and yet 0 have a meaningful climate policy they benefit from.

We think there’s an opportunity to engage consumers in a clearer way and mobilize a significant chunk of the US economy to direct it towards companies and brands that are measuring and doing something about their carbon footprint. So, consumers come first in this equation.

Once the consumers want the label, what comes next?

We’ve benefited from early adopters who were willing to jump into this before anyone knew what Climate Neutral was. We now have 105 certified companies.

To get to the next level, we have to jump to the second step; the companies have to want it. Many companies want to do something about climate change abstractly but they don't have the resources to do it comprehensively. We come to them with a clear process of outlined steps, time expectations, and an approachable budget. We’ve built a piece of software designed to accurately and quickly get companies some basic fluency in carbon emissions and pin down their carbon footprint.

Tell us more about the criteria that Climate Neutral uses during assessment?

We take this seriously and actually have two advisory committees that guide our assessment standards. Even though the voluntary market is tiny in overall demand today, we want to be an arbiter of what should and shouldn’t be done with carbon credits in the future marketplace when this inevitably scales. Recognizing that the market today isn’t perfect, we’re working to improve quality through buying credits with the following 6 characteristics:

Carbon offsets vary widely in price. What price are you paying? How does this compare to Stripe’s recent announcement?

We target $5 / ton which is reflective of where most of the market is to date. We stay away from credits priced at $.60 to $0.70 / ton which have been on the shelf for a while from the UN Clean Development Mechanism. Many argue that carbon should have a higher price per ton. There’s a tradeoff between public policy price and market price – public policy often takes a much narrower approach to coverage. So, a company could pay $4 or $5 / ton using our broad boundaries, but that may be equivalent to paying $60 to $70 / ton using the narrow boundaries that a policy considers a company to be subjected to.

First off, I commend Stripe for thinking about creative ways to deal with climate change. We tell our companies to expect to spend 0.3% to 0.4% of revenues to offset their entire carbon footprint. By that measure, the companies that we are working with are doing 10x what Stripe has done with that million dollar commitment. We try to impress upon companies that this is an incredibly affordable undertaking. And even in difficult economic times, companies have said that the benefits far outweigh the costs.

What’s the plan for growth?

We are raising, which as a nonprofit means that we’re looking for foundation funding. We’re kicking off a fellowship with the Mulago Foundation, and have also been talking to large financial institutions which see a lot of synergy between our work and their belief in market-based solutions.

Another interesting lever is the venture capital community’s ability to push footprinting and offsetting across their portfolio. We‘ve talked to some folks in Europe (Leaders for Climate Action) who have started to rethink the basic contract between VCs and their portfolio companies. These folks have written into their term sheets a requirement that companies fully disclose climate impacts each year (or quarter). We hope that we can be a resource to venture firms who have portfolio companies that are looking to operationalize carbon offsetting – one dream scenario would be that an investor’s entire portfolio gets Climate Neutral certified.

If folks are interested in learning more, how can they reach out?

We actively respond to all inquiries to our general contact and encourage interested companies to get in the certification queue through the join us form on our website.

Our core success metric is volume of offset carbon. We’ve had a great group of startups, and are also expanding with larger footprint companies. Companies that are thinking about how this can become a core part of their brand and are excited to engage with their customers about this are especially interesting to us.

Continue reading the full interview here.

Third Derivative: A unique new climate tech accelerator program called Third Derivative launched last week. A joint venture of the world's leading clean energy think-and-do tank Rocky Mountain Institute and the global entrepreneur support organization New Energy Nexus, D3 was built to "accelerate the rate of climate innovation" by combining a next-generation accelerator, committed venture capital, and a curated ecosystem of global corporations. The goal? To find, fund, hone, and scale the most-promising technologies to achieve larger, faster reductions in global carbon emissions. They’re currently seeking startups doing promising work in the areas of hard science, hardware, software, and business model innovation to apply before June 30th for their virtual 16-month-long program.

Yale: Tune in for what should be a lively and informative discussion with Jigar Shah and fellow climate tech investors on our favorite topic: “the unique challenges and opportunities of investing in nascent climate technologies that could critically reduce emissions.” See you there, this Wednesday @4pm ET!

Stanford: The plans to design a school focused on climate and sustainability include a “sustainability neighborhood”, which would serve as a living lab accelerating scalable sustainability solutions through external partnerships with government, industry, and NGOs.

Beam Project: Want to help cleantech startups build faster? Beam Project collects donations to give grants to startups with transformative climate solutions. Round up and donate your Amazon purchases to this nonprofit using their Chrome extension.

NYTimes: With coronavirus stressing our inability to protect against pandemics while continuing to eat meat regularly, is a rise in vegetarianism inevitable?

Axios: A new study shows that hungry bees bite plants to spur faster flowering and fruiting. We tried nibbling our refrigerator, but no verifiable repeat results to report on yet…

Front-End Developer, UX/UI Developer @CarbonCure

Business Development Lead @Salient Predictions

Operations Manager @Commonwealth Fusion Systems

Senior Accountant @Clean Capital

Strategic Partnerships Manager @Kiva

Finance Lead @Ethic

Software Engineer @Pachama

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

England's new election ushers in a new test of clean energy and climate tech

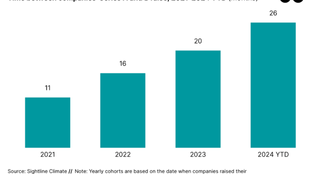

H1'24 funding totaled $11.3 billion, down 20% from H1 2023.