🌍 EU CBAM’s €8bn price tag #282

We did the EU carbon math

Happy Tuesday!

We’re back after a quick summer break and easing into the post-Labor Day season with a look at what’s quietly working in clean firm power. Next-gen geo gets the hype, but an older plant just inked a major 25-year PPA, offering a preview of the future of power markets.

In deals, $863m for fusion energy, $50m for energy storage development, and $28m for battery-equipped home appliances.

In other news, offshore wind takes another political hit, carbon storage goes live in the North Sea, and KoBold Metals gets the green light to dig deeper in Congo.

Plus, NY Climate Week is right around the corner, and our event tracker is live. Hosting a meetup or panel? Send it our way.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

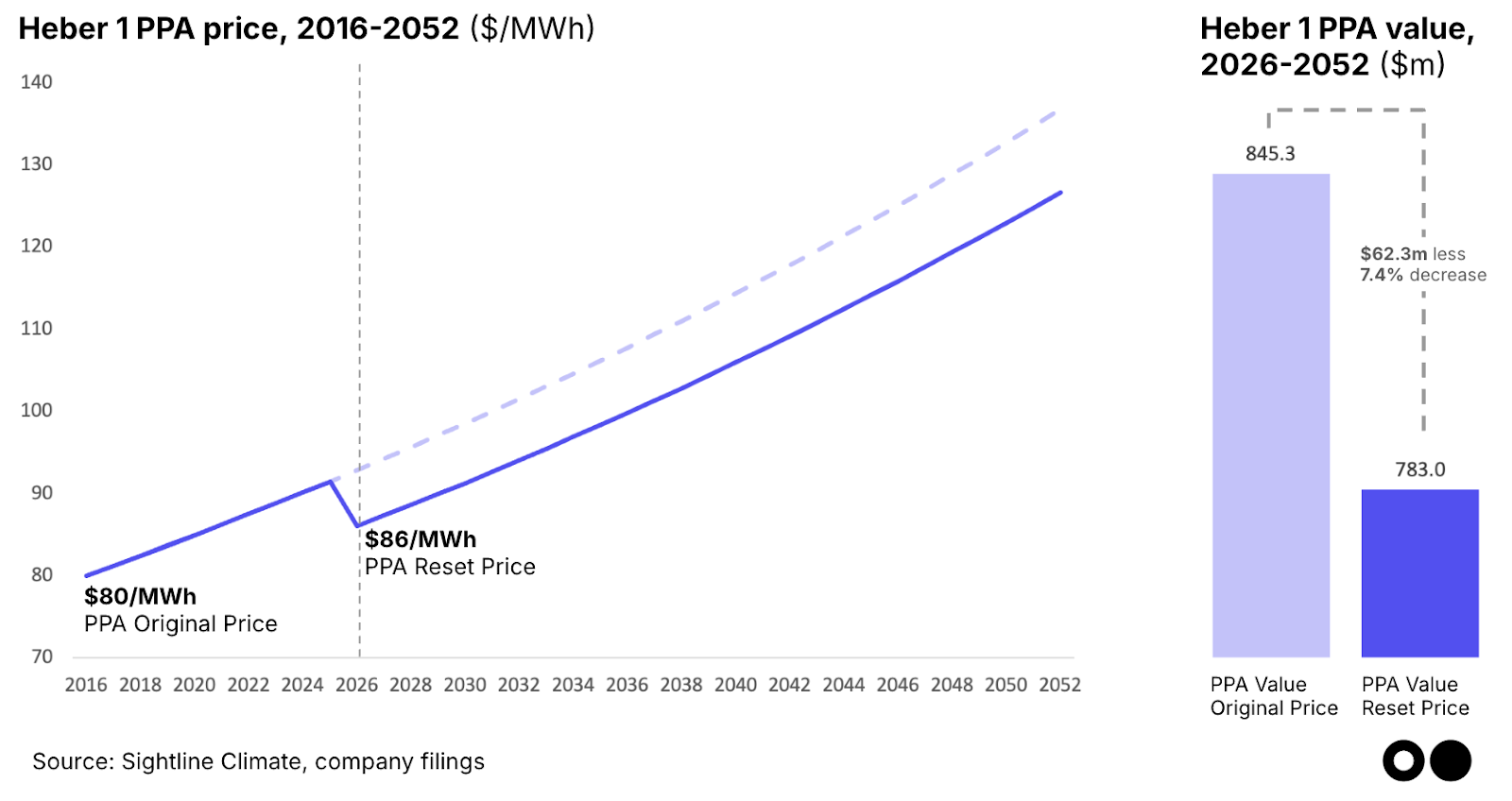

Last week, renewable energy developer Ormat Technologies announced it had signed a 52MW, 25-year extension of a power purchase agreement (PPA) for its Heber 1 geothermal project in southeast California. At a time when utilities are scrambling for clean firm power and headlines are dominated by next-gen geothermal breakthroughs, this agreement to give an old conventional geo plant a new lease — at a freshly negotiated price — is a slow-burn success now, but one that could shape how clean firm power gets built tomorrow.

Ormat, which develops vertically integrated geothermal projects, just scored a long-term, early renewal of its Heber 1 contract — notable for:

The result: LADWP and IID lock in target-compliant, clean firm capacity at a time when every marginal megawatt is increasingly expensive and contested. And Ormat gets a guaranteed long-term return on a depreciated asset that now runs on mostly opex.

Conventional geothermal like Heber 1’s is reliable, mature, and often overlooked in favor of exciting EGS and closed-loop innovations. But it’s also already operating today. And at a moment when US electricity demand is climbing for the first time in decades, in a market where new capacity takes years to build, all while affordability pressures are mounting, that matters. See the chart below for the math:

It’s a win-win: Ormat locks in 25 years of cash flow from a fully operating plant, with operating costs likely to be well below the new PPA price. Meanwhile, LADWP and IID secure long-term clean firm power at a lower-than-market rate. Compare that to Fervo’s Corsac Station PPA with NV Energy, which is $107/MWh for 15 years.

That’s not to discount next-gen geothermal. The tech is quickly becoming a favorite for meeting surging demand from data centers and other large loads, and leader Fervo is posting blockbuster results left and right, proving out the potential of enhanced geothermal. But in today’s power markets, greenfield challenges persist: long development timelines, financing gaps, and clogged interconnection queues. Which is why the near-term opportunity may lie in getting “back to the future” — deploying next-gen techniques at existing geothermal fields. By re-drilling, applying novel EGS stimulation, or even using AI to re-map known resources, developers can unlock stranded capacity at lower risk, shorter timelines, and cheaper cost.

Take startup Zanskar, which acquired the underperforming Lightning Dock in New Mexico in 2024. Zanskar’s AI platform GeoCore identified a hotter, higher-permeability zone near the original wells. By re-drilling directionally from the existing pad — avoiding costly new surface work — the team slashed development costs by 75%. Within 12 months, Lightning Dock jumped from 4–7MW to its full 15MW capacity, what Zanskar says is the most productive pumped geothermal well in the US.

Meanwhile, geothermal developer Greenfire Energy is working with power generator Calpine at the geothermal site, The Geysers in California, to apply closed-loop retrofits, while Ormat also announced a partnership with Sage Geosystems to pilot stimulation tech at existing wells last week. (Meta already tagged Sage for geothermal for its data centers last year.)

⚡ Commonwealth Fusion Systems (CFS), a Devens, MA-based fusion energy technology developer, raised $863m in Series B funding from Mitsubishi Corporation, Mitsui & Co., Brevan Howard, FFA Private Bank, Morgan Stanley, NVIDIA, and other investors.

♻️ everwave, an Aachen, Germany-based river waste cleanup provider, raised an undisclosed amount in Growth funding from KSK-Wagniskapital, NRW BANK, SistaAct, The European Social Innovation and Impact Fund (ESIIF), and other investors.

⚡ Copper, a Berkeley, MI-based battery-equipped home appliances manufacturer, raised $28m in Series A funding from Prelude Ventures, Building Ventures, Climactic VC, Climate Capital, Collaborative Fund, and other investors.

💨 Terraton, a San Francisco, CA-based full-stack biochar carbon removal platform, raised $12m in Seed funding from Gigascale Capital, Lowercarbon Capital, ANA Holdings, and East Japan Railway.

🏠 Koolboks, a Rosny-sous-Bois, France-based sustainable refrigeration solutions developer, raised $11m in Series A funding from Aruwa Capital, KawiSafi Ventures, All On, Beyond the Grid, Bpifrance, and other investors.

ChemFinity Technologies, a Brooklyn, NY-based critical minerals refining platform, raised $7m in Seed funding from At One Ventures, Overture Ventures, Closed Loop Ventures Group, Pace Ventures, WovenEarth Ventures, and other investors.

🧪 EnsiliTech, a Bristol, England-based biologics stabilization technology developer, raised $6m in Seed funding from Eos Advisory, Calculus Capital, Empirical Ventures, Fink Family Office, HERmesa, and other investors.

💨 Therm Solutions, a Lake Forest, IL-based Food supply chain decarbonization platform, raised $4m in Series A from undisclosed investors

📦 Blitz Electric Mobility, a Kota Administrasi Jakarta Utara, Indonesia-based electric vehicle-based logistics service provider, raised an undisclosed amount in Seed funding from Vynn Capital, ADB Ventures, BonBillo, FiveFortyAlpha(540 Alpha), Iterative, and other investors.

🔋 Pacific Green Technologies, a London, England-based energy storage developer, raised $50m in PF Debt funding from Australian Philanthropic Services Foundation (APS Foundation) and Longreach Credit Investors.

⚡ SWITCH Maritime, a Jackson, WY-based hydrogen and electric ferries manufacturer, raised $2m in Grant funding from the New York State Energy Research and Development Authority (NYSERDA).

⚡ Ace Power, a Manly, Australia-based renewable energy project developer, was acquired by TagEnergy for an undisclosed amount.

This is a sample of the deals available for Sightline Climate clients. Can’t get enough deals?

Last week, the Trump administration canceled $679m in federal funding for 12 offshore wind port and terminal projects, including major developments in California, New York, and Virginia. The move is part of a broader rollback of support for wind power, which includes halting construction at Revolution Wind and revoking approvals for other projects. This escalates uncertainty for offshore wind in the US, potentially delaying its role in the energy transition and prompting developers to shift investments abroad.

The Northern Lights project has begun injecting CO2 under the North Sea, marking the operational launch of the world’s first open-access, cross-border CO2 transport and storage network. Developed by Equinor, Shell, and TotalEnergies as part of Norway’s Longship initiative, Northern Lights enables industrial emitters across Europe to ship captured CO2 to a central terminal at Øygarden, where it is piped and stored 2,600 meters beneath the seabed. This milestone advances CCS as a critical pillar for decarbonizing hard-to-abate sectors and lays the foundation for a pan-European carbon infrastructure.

KoBold Metals scored permits to explore lithium, manganese, tin, and tantalum in southeastern Democratic Republic of Congo, including at the Manono site, one of the world’s largest hard-rock lithium deposits. The AI-driven exploration startup must still resolve a legal dispute with AVZ Minerals over project rights. Its entry signals growing US efforts to loosen China’s grip on critical mineral supply chains and reshape global EV battery sourcing.

NV Energy has asked FERC for permission to let renewable developers withdraw from its interconnection queue without penalty, citing a wave of uncertainty after the July 4 rollback of clean energy tax credits and a Department of the Interior memo tightening oversight of federal land use. Nearly 80% of NV Energy’s queue consists of solar and wind projects, many of which may no longer be viable under the new policy constraints. If approved, the waiver could accelerate the cleanup of interconnection queues across the West, unclogging access for better-positioned clean energy projects to move forward.

Africa’s solar market takes off as solar panel imports from China surge.

Sneezing iguanas and staring orcas: The Ocean Photographer finalists were just revealed.

How did electricity get so expensive? Heatmap explains.

Shocking the system: Kent’s all-electric community powers its homes and gives back to the grid.

NYC garages aren’t just for cars — a startup turns them into underground heaters.

Bad apple? A German court calls out Apple’s carbon-neutral claim: forests only offset emissions temporarily.

A breath of fresh air: Brazil secures allies for a massive global fund to protect the Amazon — and maybe even your oxygen.

Frontier dives deeper with Planetary, shelling out for the first-ever wave of verified ocean-based CO2 removals through 2030.

📅 SOSV’s VC-Founder Climate Tech Matchup: Join 1,000 startups and 1,000 investors for 1:1 meetings online, taking place online from Monday, September 8 to Friday, September 12. Register as an investor or a startup for free!

💡 The Earthshot Prize 2026: The prize finds, supports and celebrates those who turn bold ideas into real solutions to repair our planet. Submit your ambitious climate solution addressing one of five goals by October 31.

💡 EarthScale: A new UK-wide 12-month programme supporting climate tech startups and spinouts scale to commercialization. Apply by September 7 to join a connected, long-term ecosystem for scaling the UK’s most promising climate tech ventures.

📅 Berlin Sunday Brunch Social: Join Women and Climate Berlin for a brunch and an opportunity to talk climate with professionals identifying as women or non-binary on Sunday, September 7, 11:30AM.

📅 Decarb TechInvest North America 2025: Join us September 9–10 in Boston, MA. Connect with Series B+ founders, VCs, private equity, and industrial leaders to scale hardtech solutions for industrial decarbonization. A two-day event focused on matching capital with high-impact tech for hard-to-abate sectors.

📅 SightLive 2025: Back for its second year, SightLive is where sharp analysis meets real-world playbooks. On September 22, this full-day, invite-only gathering convenes top decision-makers across energy, finance, technology, and policy, combining the best of Sightline and CTVC. Through analyst deep-dives, curated discussions, and real-world case studies, the event will shape the narrative around the new age of power and the evolving global landscape for innovation. Sessions will cover clean firm power, data centers, gridtech, and more, anchored by research, data-driven insights, and community. Come for the signal. Leave with strategy. Approved registrants only. Interested in volunteering? Apply by September 15 to join and support with check-in, speaker management, and more at the event.

Senior Software Engineer @Sightline Climate

Senior Product Designer @Sightline Climate

Business Development Lead @Barnwell Bio

Senior Associate @Energize Capital

Commercial Account Manager @OVO Energy

Senior Machine Learning Engineer @OVO Energy

Analyst @TerraForm Power

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

We did the EU carbon math

With long duration energy procurement surging, new rankings reveal who's pulling ahead

A tale of two public debuts