🌏 The bits and bytes of grid tech

(Bonus edition) Part III: The software “middleware” layer for grid operators / utilities

Baseload energy is hot these days. Between climate-induced energy crises, war-induced energy shortages, and IRA, the importance of 24/7 clean power has never been greater. Amid the usual trickle of fusion and renewables + storage investments, investors are also starting to turn to a once-unloved resource: geothermal energy.

Last month, two geothermal startups raised fresh venture capital. Fervo Energy, a Houston-based geothermal developer, raised a $138M Series C led by DCVC, on the heels of deals with Google and East Bay Community Energy. Zanskar,* a Salt Lake City-based geothermal exploration company, raised a $12M Series A led by Union Square Ventures. Earlier this year, Quaise Energy, a Cambridge, MA-based geothermal drilling company, raised a $52M Series A.

Public funding is also following suit with newfound geothermal interest. Earlier this month, the US Department of Energy launched a new Enhanced Geothermal Shot, “a department-wide effort to dramatically reduce the cost of Enhanced Geothermal Systems (EGS) —by 90%, to $45 per megawatt hour by 2035.”

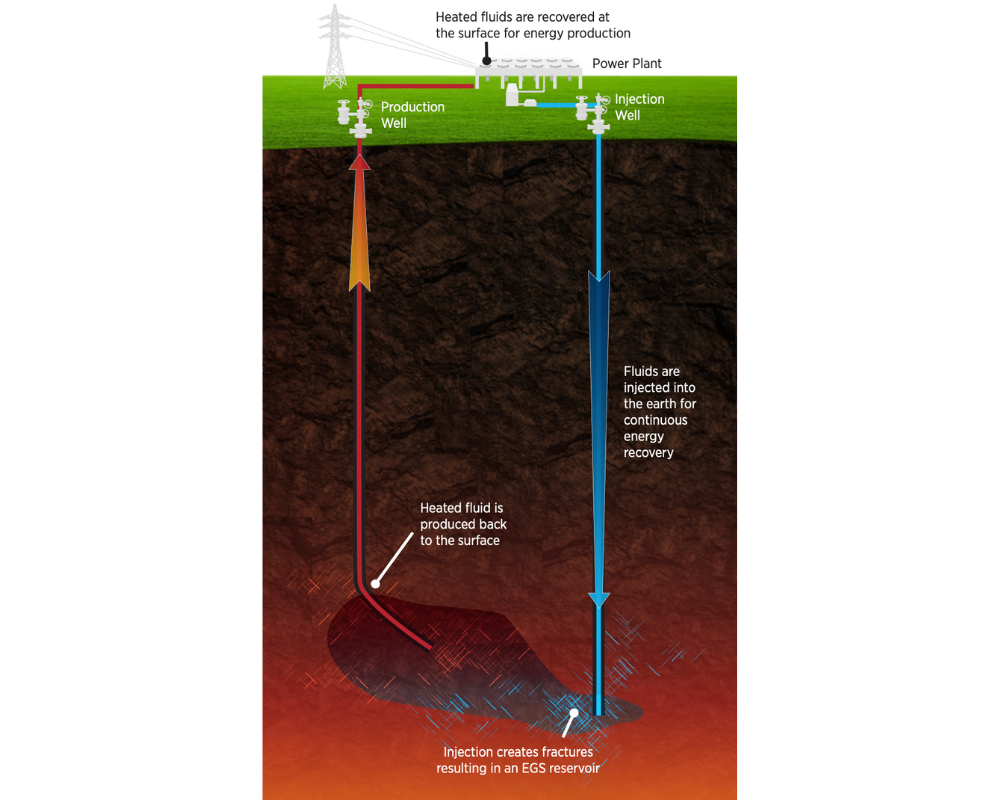

There’s heat beneath our feet. Geothermal energy systems harness the Earth’s naturally occurring heat below the surface to serve useful functions, like producing electricity, or heating or cooling spaces.

Any geothermal system contains three ingredients:

🔥 Heat: an energy source (10 to +300ºC)

💧 Fluid: an energy carrier (typically water)

🔀 Permeability: paths for fluid to flow underground while collecting heat (i.e., a heat exchanger)

In order to harness it, you need to find resources, drill wells, and manage reservoirs. (Sound like any other industry you know of…? We’ll come back to this later.)

There are three-ish types of geothermal systems:

Caveats: This is more a spectrum than discrete buckets – resources can have elements of several categories.

And there are two things you can do with the heat:

Caveats: There are other downstream things you can do with geothermal resources, like provide grid services, draw down carbon, produce lithium, or even 🐟 dry fish.

Let’s say you’re a benevolent dictator in charge of providing abundant carbon-free energy to all of Planet Earth. You see lots of solar, wind, and battery capacity coming online, which is great, but you also see energy crises happening in high-solar and wind areas. You see energy crunches in areas dependent on foreign oil and gas. You see the power of hydro, but you also see that climate change is turning hydro into a more and more variable resource. You see fusion as the potential miracle that it is, but you’ve already placed your bets on it; we’ll see how they play out. You like that nuclear fission is a baseload resource, but your subjects seem mixed (remember: benevolent dictator). You’re left thinking about one option: geothermal. What are we working with?

Today, we have about 15 GW of geothermal power plants on the planet. Compare that to the 168 GW of solar and 94 GW of wind installed in 2021 alone, and we’re not talking about a needle-moving amount of zero-carbon power.

So far, we’ve been picking the low-hanging fruit. Today, most geothermal power comes from “Ring of Fire” countries, where plate tectonics have created hot zones near the surface of the Earth’s crust. According to Ren21, the top producers are The United States (2.6 GW), Indonesia (2.3 GW), the Philippines (2 GW), Turkey (1.7 GW), and New Zealand (1.1 GW). Just a bit further down this list is Iceland, which derives about 65% of primary energy (electricity + heat) from geothermal resources. It’s good to be a volcanic island.

But it’s early, and the resource is massive: a key study estimated that deep EGS is a nearly 16,000 GW resource waiting to be tapped. Zooming out further: According to AltaRock Energy, “Just 0.1% of the heat content of Earth could supply humanity’s total energy needs for 2 million years.” In addition to being a baseload resource, it requires little land, few minerals, and can mobilize one of the world’s greatest assets: the oil and gas industry. The prize is bigger than oil, gas, and coal combined. Geothermal’s clean baseload volume capabilities can also be ramped up and down, stable clean electrons which the grid will pay top dollar for - call it “beyond baseload”.

There are four things holding geothermal back:

⛏️ Exploration risk: The risk that a given project fails to produce enough energy to be viable.

💸 Resource development costs: The time and expense needed to develop a project.

📅 Regulatory timelines: It’s harder to drill geothermal wells than oil and gas wells.

🧠 Talent: There are more good ideas than people working on them.

The first two issues collide when it comes time to drill wells.

Before drilling, it’s hard to know what’s underground in great detail. But drilling costs millions of dollars, and any one well runs the risk of failure. So because of this chicken-and-egg problem, geothermal has high capital requirements and high cost of capital. Upfront project risk is high and cumulative costs for drilling, construction, and maintenance stack up. This makes it harder to get the innovation flywheel going.

Adding to the risk and cost is red tape. Since geothermal is so similar to oil and gas, and we have millions of oil and gas wells around the world, you might think that it’s straightforward to get wells drilled and power plants built. In the US, you’d be wrong:

If the US government put the same priority on geothermal as it does oil and gas development, we would have a ton more geothermal. This disparity between renewables and oil and gas in permitting treatment has persisted for a long, long time.

— Tim Latimer (@TimMLatimer) April 19, 2022

Caveat: Some countries, like Kenya, do a great job of this.

In short, permitting is slow, and the National Environmental Policy Act (NEPA) turns a 4-5 year process into a 7-10 year process.

There is good news on the policy front: the Inflation Reduction Act (see CTVC’s Master IRA tracker) included a production tax credit of up to 1.5 ¢/kWh for geothermal electricity, and a 30% tax credit for home geothermal systems.

That was the bad news. The good news is that geothermal represents an enormous whitespace for innovation. There are tons of good ideas to work on – across technology, policy, finance, and talent – and people are starting to take notice. Here’s a selection:

Innovators: Quaise Energy (drill into our interview with CEO Carlos), GA Drilling

Innovators: Fervo Energy, Sage Geosystems, Bedrock Energy, Eavor, GreenFire Energy, Icarus Energy, GeoX

Innovators: Fervo Energy, Hephae Energy Technologies

Innovators: TerraCOH

Innovators: Zanskar, Viridly, Optic Earth

Innovators: Fervo Energy, Sage Geosystems, Transitional Energy

Innovators: Quaise Energy

There are tons of good ideas, but not enough people to try them. This is fixable: the oil and gas industry is about 1,000x larger than the geothermal industry. Repurposing 1% of O&G human capital would 10x the geothermal industry.

Michael Campos is a climate tech venture capitalist, Strategic Advisor to Project InnerSpace, and author of Adapting, a newsletter about technologies we’ll need to thrive on a changing planet. Previously, he has worked at Azolla Ventures, Prime Impact Fund, and ARPA-E. *Disclosure: Prime Impact Fund led Zanskar’s Seed round.

Special shoutout to Tim Latimer for his hot takes. For folks looking to drill in deeper, Fervo is hiring!

(Bonus edition) Part III: The software “middleware” layer for grid operators / utilities

Part II: How grid tech is the rails of the energy transition

The Goldilocks effect in geothermal HVAC systems