🌍 Your 2026 prediction bets are in

We asked, you answered, and experts weighed in on 2026

We all know the joke: Fusion is indefinitely 30 years away. And the joke especially works today — despite the billions pouring in, companies are still running into roadblocks. In the last month, General Fusion laid off a quarter of its team, citing financial strain. The Google-backed Project Blixt shuttered after its frozen-fiber Z-pinch concept failed to sustain a plasma. Meanwhile, some startups are still promising commercial fusion just three years from now and even hitting major milestones: Astral Systems said at a fusion conference just last week that its multi-state fusion reactors successfully bred tritium, the fuel vital for the future of fusion-based power, for the first time.

It’s hard to tell whether we’re nearing ignition, or if we’re still stuck in park. So, are we there yet? We’re unpacking the state of fusion in 2025 — who’s building, who’s bluffing, and what the data really shows.

Whether you’re tracking fusion as an energy play, a strategic asset, or a signal for wider climate-tech trends, this is your once-in-a-while chance to peek behind the paywall. If you’re interested in speaking to our team and getting more behind-the-scenes on Sightline webinars, find a time to chat with us here.

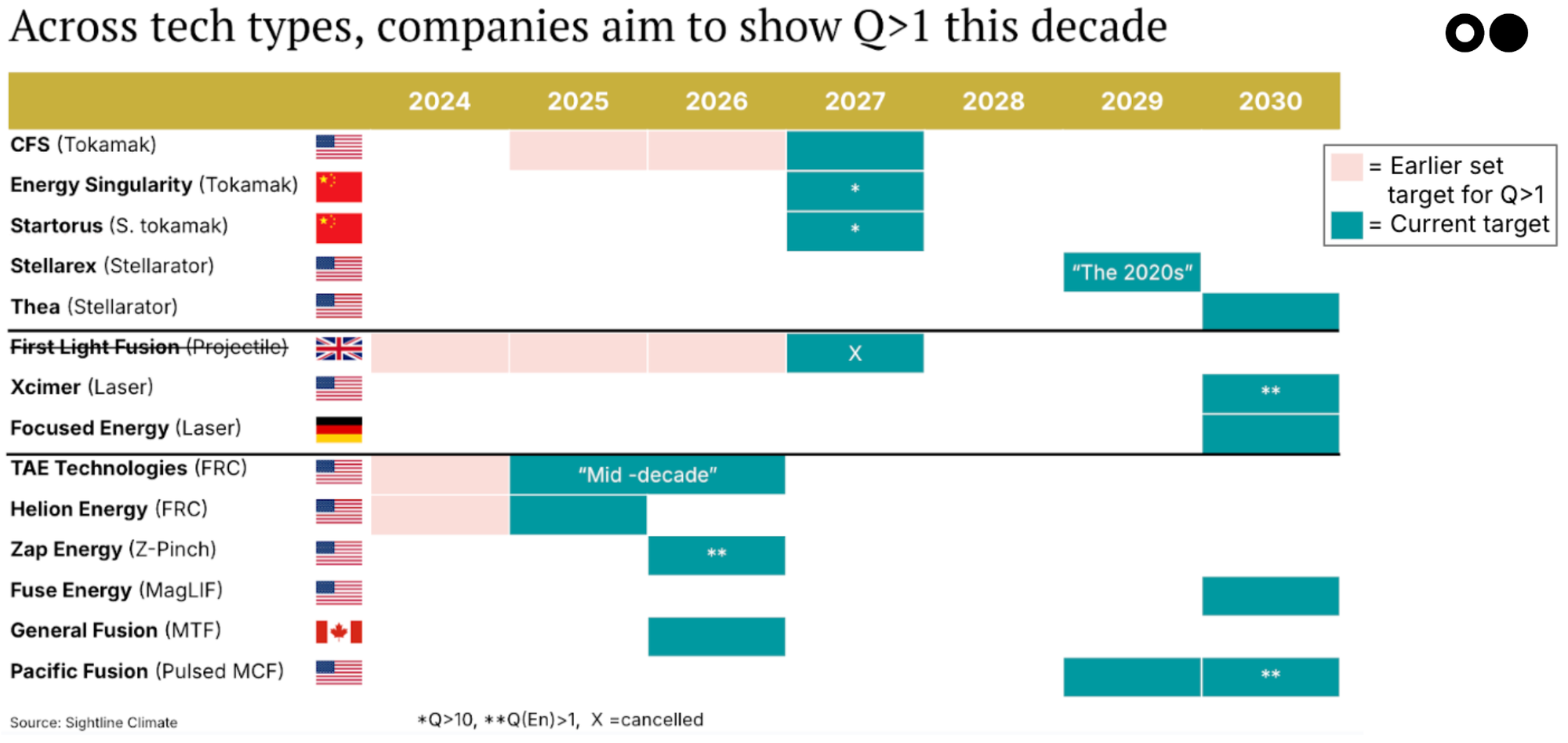

Fusion isn’t one big bet — it’s a cluster of competing (and sometimes contradictory) technical approaches. Each is chasing the same target: a commercially competitive power plant, where the first milestone is achieving what’s known as Q > 1, or getting more energy out than you put in. To achieve fusion conditions, a given fuel has to be hot and dense enough for long enough (“confinement time”). This is measured by the “triple product.”

Only ICF at NIF (Livermore) has demonstrated this, but commercial viability is still far off.

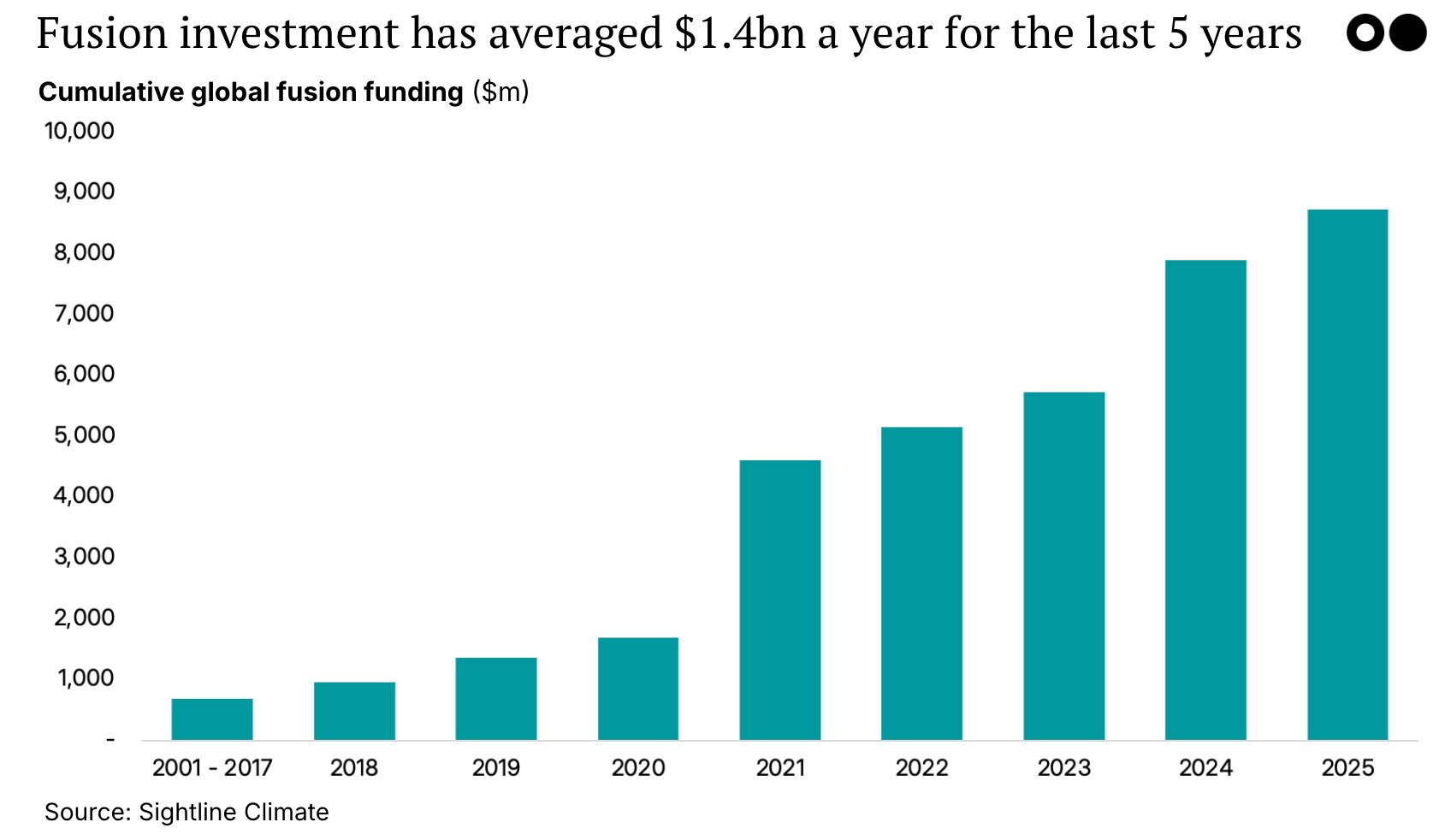

Meanwhile, the fusion space is full of big investor bets. It has raised $9bn+ globally, with a surge of $7bn in just the last five years. The significant majority have come from the USA and China. Europe, particularly the UK, France, and Germany, also plays a role, while Canada leads the rest of the world.

But most of that is concentrated in a few mega-rounds:

But the boom isn’t evenly distributed. Investment clusters around a few favored tech stacks: tokamaks (MCF), known for their technical maturity, while FRCs (a MIF subtype) attract bets on breakthrough potential.

Still, funding ≠ readiness. First-of-a-kind (FOAK) fusion plants will cost $1–$5bn, according to the companies themselves — so we expect the real costs to be multiples higher. And no company has demonstrated Q > 1, closed the tritium loop, or proved long-term material durability.

Fusion may be a scientific moonshot, but it's also a geopolitical asset, a regulatory wildcard, and a deployment challenge all rolled into one.

Regulators are still deciding what fusion is. Most developers are lobbying for rules akin to particle accelerators — less stringent than nuclear fission — which could enable faster builds and smoother site approvals. But globally, that light-touch regime is far from guaranteed.

Meanwhile, fusion’s wide-reaching supply chain is already a pressure point. Key ingredients like lithium-6 — critical for breeding tritium — are primarily sourced from China, raising long-term questions about energy sovereignty and material risk.

China isn’t just a supplier in the fusion race, but also an ambitious tech actor. One of the most headline-grabbing projects is a fusion-fission hybrid plant, designed to use fusion-generated neutrons to burn nuclear waste. If it works, it could transform spent fuel from a liability into a new energy source, blurring the definition of what a “fusion power plant” would even be.

China has a nuanced fusion landscape: Many companies report massive raises, both private and public. It’s clear that fusion is a strategic priority for the Chinese government, and it’s not only China. The race to breakeven is heating up around the world, with governments favoring their own strategic players, possibly for industrial policy and energy sovereignty. In Japan, Kyoto Fusioneering functions as a semi-state entity; in the UK, Tokamak Energy has deep public ties.

On paper, fusion companies are bullish on the 2030s. At least ten first-of-a-kind (FOAK) power plants aim to be built by 2030–2035.

But the core technical blockers they face could stop them in their tracks. None have achieved Q > 1, and few are even actively building a fully integrated fuel cycle, not to mention mastering the materials science to operate systems in the most extreme temperature differential in the solar system (as the plasma is much hotter than the sun).

And even if fusion hits the grid by the early 2030s, early plants may have to run at low capacity factors (thanks to frequent maintenance), depend on scarce, externally sourced tritium, and operate at a loss, at least initially. The road from plasma physics to profitable power is longer — and more politically entangled — than many forecasts suggest.

But investors aren’t going to wait around for returns until the mid-2030s and beyond. Luckily, there are nearer-term opportunities: monetizing the tech stack they’re developing along the way.

🧪 Medical isotopes: Companies like Shine Technologies are already generating revenue by using fusion to produce medical isotopes used in cancer diagnostics and treatment. These isotopes are in chronic short supply globally, and fusion’s ability to do high neutron flux is uniquely suited for solving that bottleneck.

🧲 High-temperature superconductors (HTS): Developing magnets powerful enough to confine fusion plasma has spurred advances in HTS tape, a critical enabler for grid upgrades, high-speed rail, electric aircraft, and space systems. Tokamak Energy has spun off TE Magnets to sell its high temperature superconducting (HTS) magnet technology, for instance.

♻️ Nuclear waste recycling: Fusion’s high-energy neutrons have potential uses in reprocessing spent nuclear fuel, breaking down long-lived isotopes into shorter-lived or usable forms. It’s still early—but the concept could redefine nuclear waste from liability to input, with applications in both existing fission fleets and next-gen reactors.

🛡️ Advanced shielding and materials: Materials developed to survive fusion’s extreme conditions are driving innovations in radiation shielding, thermal protection, and quantum-safe environments. These advances are catching the attention of the defense and aerospace industries.

Overall, you don’t have to believe in fusion’s 2035 grid debut to believe in the breakthroughs it’s generating now.

Want to dive deeper? Reach out to learn more about how Sightline can help you evaluate energy and industrial innovation.

We asked, you answered, and experts weighed in on 2026

My visit to China's cleantech factories, labs, and HQs

Get the data, insights, and case studies behind the next wave of climate tech