🌎 The SMR shake-up #284

Small reactors, big power rankings

Happy Monday!

Maritime decarbonization is facing rocky waters as a last-minute vote on Friday night delayed adoption of the sector's (and the world’s) first major industrial carbon tax. We’re diving into the ripple effects.

In deals, $5bn for hydrogen, $1.6bn for grid transmission, and $105m for precision farming.

In other news, the DOE’s first loan under Trump, plus its dealings with the Esmerelda solar project, and Singapore’s levy for sustainable aviation fuels.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

CTVC is powered by Sightline, the tactical market intelligence platform for energy and investment decision-makers.

Last Friday, members of the International Maritime Organization (IMO) voted on whether or not to adopt its Net-Zero Framework, the world’s first global shipping carbon pricing scheme set to reshape global fuels, fleets, and financing. But after a Saudi-led motion — and US pressure — the motion sank, leaving $13bn in carbon pricing revenue on hold and the shipping sector adrift without clear climate rules.

First approved in April (when we originally wrote about it), the IMO’s Net-Zero Framework would’ve required ships over 5,000 tons to cut their greenhouse gas fuel intensity each year from a 2008 baseline. That would’ve made international shipping — the backbone of global trade — subject to its first binding climate rules.

It would have started with a 4% reduction by 2028 and ramping up to 30% (base compliance) or 43% (direct compliance) by 2035. Ships that missed the mark would’ve paid emissions penalties priced at $100/tCO2e (direct) or $380/tCO2e (base), while overperformers could bank and trade surplus credits. The expected revenue, $11–13bn annually, was earmarked for clean fuel incentives, vulnerable states, and the IMO’s broader decarbonization strategy.

Instead, at the meeting last week, a Saudi-led motion to defer the Framework passed 57–49. Key countries that previously backed the plan — including China, Greece, Cyprus, Japan, and South Korea — flipped to “delay.” The vote will be revisited in 2026, but with the 2028 implementation timeline now shaky, the IMO will likely need to renegotiate core elements of the policy.

Notably, the US bailed early and spent months urging others to jump ship. Washington withdrew from Framework talks in April, slamming the plan as a “global carbon tax on Americans.” Ahead of the vote, the Trump administration threatened visa bans, trade restrictions, and port fees for supporters. Trump personally urged members to vote no on what he called a “Green New Scam Bureaucracy.”

The global economy runs on ships, but their climate impact has mostly stayed below deck. Maritime moves ~90% of global trade and emits nearly 3% of annual CO2, with few rules and even fewer alternatives. The IMO’s Framework was meant to change that, historically marking the first global carbon pricing scheme for any major industry. It wasn’t as sweeping as the EU ETS, but a real financial signal and a model for others.

Still, even before the delay, the Framework’s impact was front-loaded with promises and back-loaded with action. Emissions were on track to drop just 10% by 2030 — well short of the IMO’s own 30% target — meaning that operators already faced little pressure to move fast.

Now they have even less. The deferral buys time, reshapes incentives, and creates new winners and losers in the maritime decarbonization race:

🟢 Winners

🔴 Losers

🟡 Toss-ups

🌾 ecoRobotix, a Yverdon-les-Bains, Switzerland-based precision farming solutions, raised $105m in Series D funding from Highland Europe, ECBF, and McWin Capital Partners.

🛵 Segway-Ninebot, a Beijing, China-based smart electric mobility and robotics developer, raised $100m in Series C funding from China Mobile Fund, SDIC Fund, Sequoia Capital, Shunwei Capital, and Xiaomi.

📦 Starship Technologies, a San Francisco, CA-based autonomous delivery robot manufacturer, raised $50m in Series C funding from Plural, Coefficient Capital, Karma Ventures, Latitude, Skaala, and other investors.

⚡ enspired, a Vienna, Austria-based AI-based power asset optimization platform, raised $47m in Series B funding from 360 Capital, Banpu NEXT, EnBW New Ventures, Future Energy Ventures, PUSH Ventures, and other investors.

☔ Stand, a San Francisco, CA-based climate insurance provider, raised $35m in Series B funding from Eclipse, Equal Ventures, Inspired Capital, and Lowercarbon Capital.

⚡ Prisma Photonics, a Tel Aviv, Israel-based grid monitoring platform, raised $30m in Growth funding from Protego Ventures, Adara Ventures, Insight Partners, Schneider Electric Ventures and other investors.

⚡ Arevo, an Umeå, Sweden-based biofertilizer developer, raised $9m in Growth funding from Fort Knox, Industrifonden, Navigare Ventures, and Stora Enso.

🏭 Stegra, a Stockholm, Sweden-based decarbonized steel manufacturer, raised an undisclosed amount in Growth funding.

🌾 Wild Bioscience, an Oxford, England-based crop resilience biotech developer, raised $60m in Series A funding from The Ellison Institute of Technology, Braavos Investment Advisers, Oxford Science Enterprises, and University of Oxford.

🏭 HyImpulse, a Neuenstadt am Kocher, Germany-based hybrid orbital rocket developer, raised $52m in Series A funding from Campus Founders and European investors.

⚡ Energy Robotics, a Darmstadt, Germany-based AI and robotics platform for infrastructure inspection, raised $13m in Series A funding from Future Energy Ventures, EnBW New Ventures, btov Partners, and Qualcomm Ventures.

🥩 Tender Food, a Boston, MA-based alternative protien developer, raised $7m in Series A funding from Rhapsody Venture Partners, Claridge Venture Partners, and Safar Partners.

🏭 Lasso, a Boston, MA-based clean ingredient tech developer, raised $7m in Seed funding from Rhapsody Venture Partners.

🔋 SirenOpt, an Oakland, CA-based manufacturing inspection platform, raised $7m in strategic funding from Hitachi Ventures,InMotion Ventures,Voyager Ventures and Visionaries Tomorrow.

⚡ Chara Technologies, a Bengaluru, India-based rare-earth-free motors developer, raised $6m in Series A funding from Arkam Ventures.

⚡ Bees & Bears, a Berlin, Germany-based clean tech finance platform, raised $6m in Seed funding from Contrarian Ventures and Extantia.

🥩 Celleste Bio, a Tel Aviv, Israel-based biotech cocoa producer, raised $6m in Seed funding from Barrel Ventures, Mondelēz, Supply Change Capital, and Trendlines.

🌡 Titan4, a Rome, Italy-based satellite infrastructure monitoring platform, raised $5m in Series A funding from CDP Venture Capital and Vertis.

🌾 Fragaria, a Chennai, India-based indoor vertical berry farmer, raised $2m in Seed funding from Rainmatter Capital, WEH Ventures, Spiral Ventures, Perpetual Capital, and other investors.

🔋 Allye, a London, England-based energy storage developer, raised $3m in Seed funding from Elbow Beach Capital and Alpha Future Funds.

🌬 GEVI, a Pontedera, Italy-based AI-powered vertical wind turbine manufacturer, raised $3m in Seed funding from 360 Capital, CDP Venture Capital, and NextSTEP.

🏠 Conry Tech, a Melbourne, Australia-based building operations and efficiency software, raised $3m in Seed funding from Audacy Ventures.

⚡ Tobe Energy, a Tulsa, OK-based hydrogen electrolyzer developer, raised an undisclosed amount in Seed funding from Hurricane Ventures and University of Tulsa.

⚡ Bloom Energy, a Sunnyvale, CA-based hydrogen fuel cells producer, raised $5bn in PF Equity funding from Brookfield.

⚡ American Electric Power, a Columbus, OH-based clean energy and electricity distributor, raised $1.6bn in PF Debt funding from US DOE’s Loan Programs Office.

🚗 Aptera Motors, a Carlsbad, CA-based solar mobility developer, raised $75m in Post-IPO Equity funding from New Circle Capital.

✈️ Lilium, a Weßling, Germany-based electric regional airplane developer, raised $21m in Asset Sale funding from Archer.

🏭 GreenIron, a Stockholm, Sweden-based fossil-free mining service provider, raised $11m in Convertible Note funding from FAM AB.

☀️ ClearVue, a West Perth, Australia-based solar glass company, raised $3m in Post-IPO Equity funding.

🏠 Aligned Data Centers, a Plano, TX-based data center developer, was acquired by BlackRock, Microsoft, NVIDIA, and xAI for a valuation of $40bn.

🛵 Kleta, a Barcelona, Spain-based urban bike subscription provider, was acquired by Cooltra for an undisclosed amount.

💰 Ardian, a Paris, France‑based private equity and infrastructure investor, raised $20 bn for its next‑generation European infrastructure fund Ardian Infrastructure Fund VI (AIF VI), targeting energy, transport and digital connectivity.

💰 Climate Fund Managers, a The Hague, Netherlands-based blended-finance firm, raised $1.06bn for Climate Investor Two from public and private investors including a €205m EU guarantee, focusing on water, sanitation, oceans, and climate-resilient infrastructure in emerging markets.

💰 Ultra Capital, a Philadelphia, PA-based growth and infrastructure investor, raised $130m for its Energy Transition Fund III to invest in solar, battery storage, distributed generation, EV charging, and fleet electrification.

This is a sample of the deals available for Sightline clients. See full listings and deal analytics on Sightline Climate

The DOE finalized a $1.6bn loan guarantee to reconductor 5,000 miles of transmission lines to enhancing grid reliability across the Midwest – one of the first DOE loans under Trump that could help meet load growth. This comes as US utilities are poised to invest a record $1.1tr between 2025 and 2029 in grid modernization efforts. However, the DOE simultaneously canceled over $8bn in funding for other major grid projects, including a $464m grant for a transmission line connecting renewable energy sources to the central US.

Meanwhile, the US Department of the Interior canceled the broad environmental review for the 6.2GW Esmeralda 7 solar project in Nevada, opting to assess each of its seven component projects individually (although previous reports indicated the entire project would be canceled). follows a broader trend under the Trump administration of stalling renewable energy on public lands (this covers roughly 62,300 acres). Developers now face uncertainty in approval timelines, which were previously estimated at 18 to 36 months per project, with delays for gigawatt-scale clean energy deployment.

Singapore is introducing a green aviation levy on departing flights to reduce emissions and promote the use of sustainable aviation fuel. The levy will be paid to the Civil Aviation Authority of Singapore, which will procure and manage SAF on behalf of airlines. While Singapore has a relatively small number of flights, it hosts the world’s largest SAF production facility, so diverting fuel for domestic use could affect global supply.

Stegra, Europe’s flagship green steel start-up, is facing a severe funding crunch. Despite raising $7.5bn from major investors, cost overruns, construction delays, and higher operational requirements have pushed its funding gap to as much as $1.75bn, threatening near-term solvency. It reflects broader trends in energy infrastructure where ambitious, high-capital projects (like Northvolt’s) require enormous investment and face both technical and financial hurdles.

In nuclear news, the US military plans to deploy a commercial microreactor on a domestic base by 2028. The initiative will help nuclear companies prove their commercial viability and loosen permit restrictions, with startups like Radiant Nuclear already preparing mass-production factories for military microreactors. Additionally, Westinghouse Electric is reorienting its microreactor strategy away from commercial deployment, but remains committed to developing the microreactor for military and space applications, as the defense sector emerges as a proving ground for next-gen nuclear tech.

In the UK, household energy bills are set to rise by 20% over the next four years due to increasing non-commodity costs, even if wholesale prices fall. Levies funding network upgrades and low-carbon power projects now add hundreds of pounds annually to bills, with network costs alone rising over $188 in four years to $531 per household. US electricity bills also surged this summer, imposing a significant financial burden on at least 20% of households, particularly those earning under $30,000 annually. The average residential electric bill in July was $204, or 4% of the median monthly household income.

Two steps forward, one step back: California fast-tracks geothermal, but not too quickly.

Polar bears chill at abandoned research stations.

US utilities supercharge $1.3tr in grid spending - and they’re not unplugging anytime soon.

Waymo steers (autonomously) towards London.

Philippines’ DOE may let generators build their own transmission lines.

China has tightened rare earth exports while reshaping renewables…

But only after the helium balloon popped.

Article on how AI water worries add up to a splash in the bucket compared to golf, jeans, and your morning cup of coffee.

Bigger details on Amazon’s planned small modular reactors … while China completes cold functional testing of its SMRs.

Micro nukes go macro-market as Terra Innovatum becomes the first publicly traded reactor startup.

📅 Decarb Connect Canada: Join us in Toronto from Oct 28th-29th for the only Pan-Canadian conference on industrial decarbonization and climate tech. CTVC subscribers can access 30% off tickets with code CTVC30.

📅 Carbon Unbound Europe: Join 400+ leaders in London on October 21-22 for Europe's premier summit on carbon dioxide removal. Engage in high-level discussions, intimate panels, and networking sessions covering topics like BECCS, DAC, biochar, offtake strategies, and policy frameworks.

📅 VERGE at Trellis Impact 25: Join us October 28-30, in San Jose for three events at the intersection of climate and technology. Connect with 5,000+ professionals and 500+ speakers advancing decarbonization strategies and climate tech. Register by October 3rd to save $300 and use our partner code TI25SL for 10% off.

📅 SOSV Climate Tech Summit: Join us from November 3-7 in San Francisco for a week of panels, breakout sessions, and networking with founders, investors, and industry leaders exploring AI, carbon removal, first-of-a-kind scaling, and other breakthrough climate innovations.

Senior DevOps Engineer @Sightline Climate

Senior Product Designer @Sightline Climate

Senior Software Engineer @Sightline Climate

Communications Officer @Ocean Visions

Carbon Project Analyst @Revalue Nature

CEO, Battery Manufacturing @Marble

CTO, Protein Engineering @Marble

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

Small reactors, big power rankings

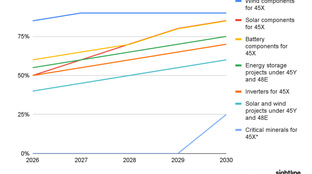

Stricter foreign sourcing rules reshape clean energy tax credit eligibility

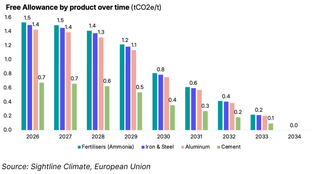

We did the EU carbon math