🌏 High-flying fuels

The runway for sustainable aviation fuels

In the throes of the pandemic, air travel took the hardest hit as we all hunkered down in our Zoom bubbles. Now that we can see the light at the end of the tunnel, the aviation industry has been busy not only adapting to a post-COVID world but also a

In the throes of the pandemic, air travel took the hardest hit as we all hunkered down in our Zoom bubbles. Now that we can see the light at the end of the tunnel, the aviation industry has been busy not only adapting to a post-COVID world but also a climate change-impacted one. In the past few months, airlines, aerospace manufacturers, airports, and aviation startups alike are catching the decarbonization hype that has pervaded their transport peers on the ground.

A few weeks ago, Europe’s aviation sector revealed its ambitious plan, “Destination 2050” to reach net zero by 2050. Other major airlines like oneworld’s 13 member airlines (which includes American Airlines, British Airways, and Japan Airlines) have also committed to a 2050 target. United Airlines has even gone a step further by committing to meet its 2050 goal exclusively through direct air capture and SAFs (sustainable aviation fuels) and without any carbon offsets. Meanwhile, major aircraft manufacturers Boeing and Airbus have taken contrasting pathways to decarbonization with Boeing pledging that all its aircraft will run on SAFs by 2030 and Airbus releasing three zero-emission hydrogen aircraft designs which could enter service by 2035.

What’s even more exciting (and what we’ve been tracking) is the new crop of startups emerging to pursue electric or hydrogen flight. Within the last few months, the electric aviation sector has been taking off with SPACs, fundings, and acquisitions. While these sci-fi looking aircraft seem far away, many of these startups are targeting commercial operation in the next few years. TBD on whether their visions all come to pass, but we could all be taking some form of zero-carbon flight by the end of the decade.

SPACs

Archer Aviation and Joby Aviation, both startups developing eVTOLs (electric vertical takeoff and landing) which hold 1-6 people and look like helicopters from a sci-fi movie, announced they’re SPACing at $3.8B and $6.6B respectively. United Airlines invested in Archer’s SPAC in addition to purchasing a future fleet of electric aircraft. Lilium, another eVTOL startup, is also reportedly on the verge of going public through a SPAC at a $2B valuation.

Fundings

ZeroAvia, which is pursuing the hydrogen-electric pathway, announced a $21.4M funding round including Breakthrough Energy Ventures, Shell Ventures, and the Amazon Climate Pledge Fund. The company is aiming to have hydrogen-electric 20-seater flights operating in 2023 and larger aircraft operating by 2027. Volocopter, (yet another) eVTOL company, raised $241M in a Series D round from BlackRock, Avala Capital, and others.

Acquisitions

Ampaire, a hybrid aviation startup, will be acquired by Surf Air, a subscription-based air travel provider, with plans for the integrated company to go public later this year (another SPAC..?). Ampaire has focused on shortening the time frame for electrification by retrofitting 9- and 19-seater aircraft for short island hops, with its largest developments in Hawaii.

Cuberg, a battery startup targeting aviation applications with an energy-dense lithium metal chemistry, will be acquired by NorthVolt, a Swedish battery manufacturer. Cuberg already counts several aviation companies among its publicly announced customers, including Boeing, BETA Technologies, Ampaire, and VoltAero.

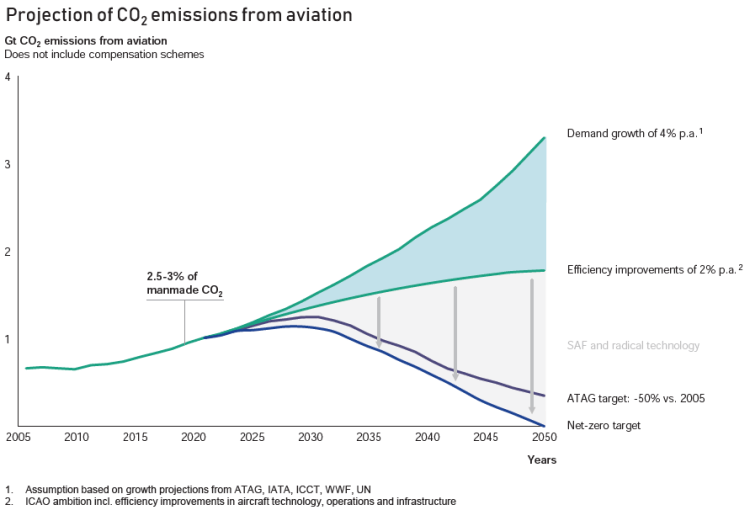

The decarbonization challenge of aviation is massive and far from being solved. Air travel accounts for 2-3% of global CO2 emissions and 12% of transportation-specific emissions – but even as other sources of emissions are on track to plateau or decline, aviation emissions are forecasted to grow dramatically as air travel demand is expected to triple by 2050. Planes also release NOx emissions and particulate matter that create contrails, both of which may more than double the warming impact of aviation emissions.

Achieving decarbonization for the aviation industry will be much more challenging compared to ground transport. The industry has primarily focused on efficiency and operations improvements and offset purchases over radical technology changes. But reductions from efficiency improvements would be more than negated by growth in demand for air travel (see chart below). To reach net-zero, SAFs and “radical technology” adoption will be necessary to drive down the remaining emissions.

Projection of CO2 emissions from aviation (credit: European Commission)

Aviation is already a feat of engineering and a delicate balancing game between power and weight. While ground vehicles can experiment with a range of weights and sizes, the physics of aviation put narrow constraints on feasible craft. Replacing jet fuel combustion will require a major leap in propulsion technology or a breakthrough in low to net-zero carbon replacement fuels.

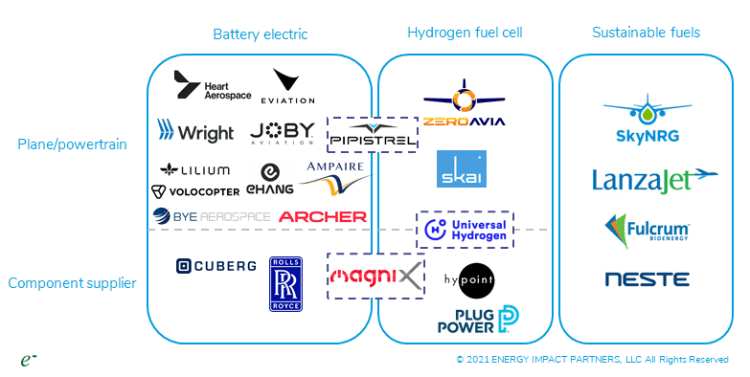

Startups are currently making significant progress in battery electric and hydrogen fuel cell planes that seat 20 or fewer passengers and could take off in the next decade to service short routes. Larger aircraft may pursue hydrogen combustion down the line, but in the immediate future most large commercial operators will likely seek out SAFs to address emissions. Because designing a new aircraft can take decades, existing aircraft can stay in service for nearly half a century, and certification of new commercial craft is a long and arduous process given the safety implications. Getting aviation to true net zero by mid-century will require turbocharging radical technology breakthroughs,

Breakdown of aviation decarbonization pathways (credit: Energy Impact Partners / Madison Freeman)

Battery Electric: As electric vehicles have become the assumed transition pathway for all light-duty vehicles, with major automakers like Volvo and GM planning to only produce electric vehicles by 2030 and 2035, many have looked to mobilize the lessons learned from EVs into making electric planes.

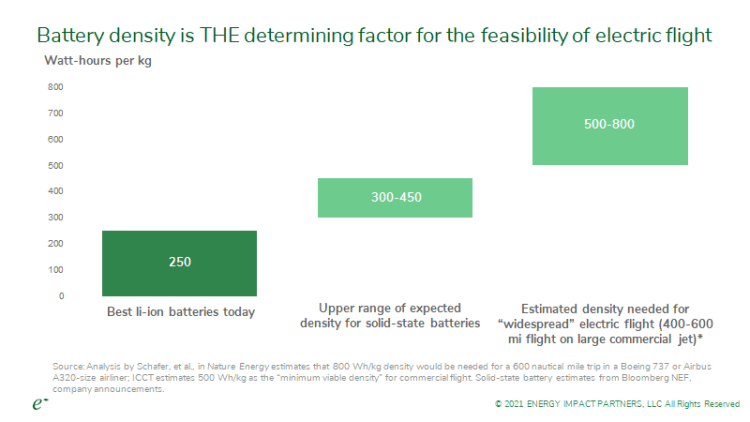

The biggest challenge for electric aviation is in battery weight (or more accurately, gravimetric density). The batteries we have today work well for most passenger vehicles on the road, but for aircraft, each pound of battery means more work is needed to get off the ground and stay in the air. Though estimates of necessary battery density vary widely based on the type of plane evaluated and the length of route, most analyses agree that it’s unlikely (if not physically impossible) to achieve the density needed for widespread long-distance flight from lithium-ion batteries.

Impact of battery density on electric flight range (credit: Energy Impact Partners, Nature Energy, ICCT)

Today’s batteries may work well for short flights in smaller planes, but a longer trip (say, Los Angeles to NYC) will almost certainly require a breakthrough in battery chemistry, like those promised by solid-state battery makers like Quantumscape or lithium metal batteries like Cuberg.

However, some countries are leaning into the electric transition. Norway in particular is moving quickly, with a goal for all flights within the country to be electric by 2040 and for the first electric flights to begin in 2030. Norway’s state-owned airport operator Avinor and its largest airline Widerøe are both on board, and the country’s geography, which includes many small remote towns that are challenging to reach except by flight, lends itself well to the operation of short and small flights enabled by current battery technology. Just as strong policy support led Norway to become the global leader in electric vehicles, this coordinated push may result in Norway breaking the electric aviation barrier.

Innovators: Heart Aerospace, Eviation, Wright Electric, Ampaire, Bye Aerospace, Joby Aviation, Lilium, Volocopter, EHang, Archer Aviation, Cuberg, Magnix

Hydrogen: Using hydrogen as fuel solves two key problems for aviation, as it produces only water vapor when combusted and is extremely lightweight. Hydrogen aviation startups today are pursuing hydrogen fuel cell applications for smaller planes, but larger efforts like the aircraft Airbus has floated could be powered by direct hydrogen combustion.

The biggest challenges facing hydrogen aviation are fueling infrastructure at airports and managing the volume of hydrogen in an aircraft. Though electric aviation would necessitate that airports install charging infrastructure and possibly make upgrades to grid infrastructure, hydrogen aviation presents a further challenge in sourcing hydrogen and managing refueling. Airports will need to either bring in hydrogen by pipeline or truck or generate it onsite, and then manage storage at the airport and fueling at the gate.

Though hydrogen is far more gravimetrically dense (lighter weight) than batteries, it faces a different density problem in its volume. Tanks of gaseous hydrogen start to displace space inside the plane, and larger craft will need to shift to liquid fuel (which presents additional fueling challenges), start directly combusting the hydrogen instead of using fuel cells, and/or lengthen the body of the aircraft. As hydrogen combustion isn’t currently feasible at a certain size of long-range craft, hydrogen’s sweet spot will likely be in small regional to mid-size aircraft.

Innovators: ZeroAvia, Universal Hydrogen, Hypoint, Skai

Sustainable Aviation Fuels (SAFs): SAFs promise a drop-in substitute for regular jet fuel that has significant emissions reductions but require no retrofit or redesign of existing aircraft. Their ability to be used immediately means that they could help tackle emissions as alternative propulsion technologies are being scaled up. SAFs have been embraced by airlines as the primary decarbonization pathway, and will likely be the only solution for long-distance flight in the foreseeable future.

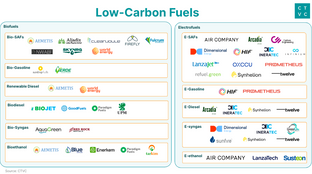

SAFs can be biofuels (made from organic matter like corn) or synfuels (produced from CO2 and hydrogen using electricity). The climate impact of SAFs varies fairly widely based on how they are created, and SAFs generally can offer somewhere between 30-80% CO2 emissions reductions over jet fuel. The major hurdle for SAFs is securing reliably low-cost and environmentally sound sources. SAFs have been around for more than a decade, but remain far more expensive than comparable jet fuel (estimates suggest 2-3x the cost of jet fuel). Some of this will be mitigated as production scales, but they will likely always face some price penalty. Biofuels are cheaper than synfuels but present problems with sustainable sourcing, since the supply can compete with food production (corn) or be linked to deforestation (palm oil). Synfuels from CO2 would promise to solve that, but are still very early in development.

So far, SAFs are the only technologically feasible route to decarbonize long-distance flight and it will require big subsidies or policy support to help bridge the initial cost differential and make this economically feasible.

Innovators: SkyNRG, Lanzajet, Fulcrum Bioenergy

Readers who have followed the activity mentioned above may have noticed that the majority of the aircraft startups are pursuing very small planes, most below 19 seats – a far cry from the planes flown on major routes. These smaller planes make up a very small part of the global aircraft fleet (~4%) and contribute less than 1% of aviation emissions. Clearly, electrifying them will not even begin to budge the needle on decarbonizing air travel. However, they are an important entry point for proving decarbonized flight, and many of these startups plan to expand the number of small aircraft and displace the use of larger craft in the air through innovative business models:

eVTOL (2-6 seats): eVTOL (electric vertical takeoff and landing) startups are seeking to build an entirely new business around “air taxis,” replacing ground vehicles on congested routes less than 50 miles. Though these applications could present some opportunities to ease short-distance travel, startups will need to surmount significant regulatory and local policy hurdles to operate in urban airspaces. But eVTOLs have other pathways to commercialization – they could replace small cargo aircraft on existing routes, which may encounter less regulatory friction, and may be deployed in military missions (the U.S. Air Force is particularly interested).

Small regional aircraft (9-40 seats): Most decarbonized aviation startup activity has focused on smaller aircraft because a 2018 rule change by the FAA opened a certification pathway for new propulsion under 19 seats. While many short routes today are served by large aircraft, several operators have argued that they would prefer to use smaller planes to run these routes more frequently – but because existing smaller aircraft are incredibly inefficient, they feel forced to operate large aircraft to make the cost per seat mile work. Several regional airlines like Cape Air have signed LOIs to purchase electric or hydrogen aircraft.

Single and double aisle aircraft (100+ seats): There are many traditional manufacturers of small to medium aircraft, but above 100 seats, the field narrows and is dominated by Boeing and Airbus. Because the vast majority of emissions come from the large commercial craft they produce and that operate on most routes, large-scale decarbonization mainly rests on the two manufacturers. Boeing has made investments in several startups mentioned above through its VC arm, and Airbus has developed several decarbonized craft of its own. Airbus was working on a large commercial battery hybrid aircraft with Rolls Royce (which was cancelled in the wake of COVID-19), but has recently turned its focus more towards hydrogen, releasing some concept craft and pushing for support for hydrogen aircraft development in EU stimulus packages.

The runway for sustainable aviation fuels

Well-to-wake pathways to cleaner shipping

The cost and complexity challenges of creating drop-in alternative fuels