🌎 Lithium-ion is the benchmark in new LDES leaderboards #281

With long duration energy procurement surging, new rankings reveal who's pulling ahead

Inside the plans to expand the British emissions cap-and-trade scheme

Happy Monday!

This week, we’re peeking under the cap of the UK’s newly expanded carbon market — and what it means for carbon pricing, removals, and market expansion.

In deals, $1.6bn for nuclear fusion, $218m for carbon removal services across two deals, and $187m for solar across two deals.

In other news, the Palisades nuclear plant inches closer to restarting, Google’s makes a new LDES bet on Energy Dome, and the Trump admin cancels an LPO loan to the biggest planned US transmission project.

Plus, we’re starting to build out our CTVC x NYCW 2025 Events Schedule — your go-to guide for the most relevant, nerdy, and can’t-miss happenings across climate tech. Hosting a panel, meetup, happy hour, or any type of activation? We want to include it. 👉 Submit your event here.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

The UK is charting a new course for its emissions trading scheme (ETS) — by land, sea, and air. With the release of its latest roadmap, the UK ETS is set to include emissions from waste, maritime, and in a global first, carbon removals.

Since 2021, the UK’s Emissions Trading Scheme (ETS) has been a cap-and-trade program that limits emissions from energy-intensive sectors, specifically aviation, power, and heavy industry. Now, following consultations launched last year, the government is moving to expand the scheme’s scope.

Last week, the UK ETS Authority released its responses to three consultations — covering greenhouse gas removals (GGRs), maritime emissions, and waste incineration. The proposed updates include:

Since leaving the EU — and with it, the world’s largest carbon market — the UK has faced mounting pressure to build a credible alternative. Without access to the EU ETS, UK firms trading with their biggest partner risked exposure to higher carbon prices and border adjustment taxes (especially amid the threats of more trade wars). At the same time, the UK still has a binding net-zero target for 2050, so building a strong domestic carbon pricing system was both strategic and legally required.

Standing up that system has taken time, but since launching in 2021, the UK ETS has already capped emissions from the power sector, aviation, and heavy industry (a quarter of the country’s total emissions). And just last month, the UK inked a deal to link its ETS with the EU’s, expected to save British businesses up to £800m ($1.1bn) annually in avoided carbon border taxes. The linkage also lays the groundwork for a more liquid carbon market and enables smoother cross-border trade in low-carbon goods and services.

This expansion also marks a big step in the UK’s ambitions: including waste incineration, domestic shipping, and engineered carbon removals is critical for full economy-wide coverage. The waste and maritime sectors are fast-growing sources of emissions that, until now, have escaped direct carbon pricing.

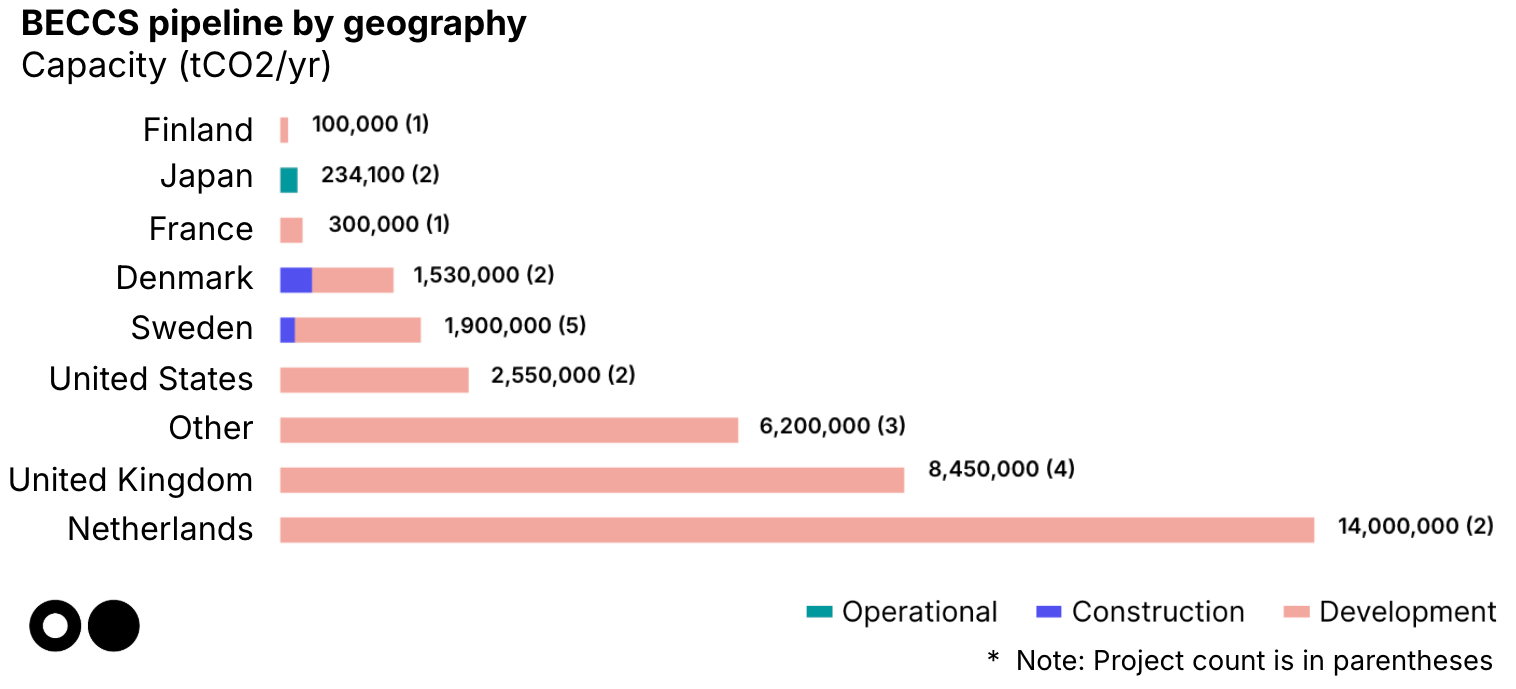

The GGR component is especially noteworthy. If implemented as proposed, the UK would become the first country in the world to formally integrate engineered carbon removals into a national cap-and-trade system. While the EU has debated similar moves, it has yet to act. The UK’s proposal now sets a high bar for integrity and opens a window for carbon removal developers, especially those in the BECCS space. UK energy company Drax, the owner of a controversial biomass-based power plant in northern England that generates about 5% of the country’s electricity, could leverage the new system to help offset the costs of capturing its CO2. (Drax planned to use carbon capture on this plant to become one of the world's largest carbon removal facilities.)

🌱 Makersite, a Stuttgart, Germany-based intelligent supply chain data platform, raised $71m in Series B funding from Lightrock, Partech, Hitachi Ventures, KOMPAS, Planet A Ventures, and other investors.

🚗 Transvolt Mobility, a Mumbai, India-based shared electric mobility services provider, raised $20m in Growth funding from International Finance Corporation (IFC).

⚡ Sunsave, a London, England-based residential solar and storage provider, raised $152m in Series A funding from IPGL, Norrsken VC, and Clearance Capital.

🔋 Estes Energy, a San Francisco, CA-based durable high voltage battery systems developer, raised $11m in Seed funding from BMW i Ventures, Fortescue, DCVC, and New System Ventures.

🧪 Provectus Algae, a Noosaville, Australia-based algae-driven photosynthetic bioproducts producer, raised $10m in Series A funding from At One Ventures, Hitachi Ventures, Methane Mitigation Ventures, and Mort & Co.

🚚 Nevoya, a San Francisco, CA-based zero-emissions freight transport operator, raised $9m in Seed funding from Lowercarbon Capital, Floating Point, LMNT Ventures, Never Lift, Stepchange VC, and other investors.

🌾 NetZeroNitrogen, a Nottingham, England-based synthetic nitrogen fertilizer alternative producer, raised $7m in Seed funding from Azolla Ventures, World Fund, Ananke, Innovate UK, Kibo Invest, and other investors.

🚗 Glīd Technologies, a Fresno County, CA-based autonomous road-to-rail developer, raised $3m in Pre-seed funding from Outlander VC, Antler, Draper University Ventures, M1C, and The Veteran Fund.

🧪 Brightplus, an Espoo, Finland-based bio-based textile coating developer, raised $2m in Seed funding from Butterfly Ventures and Collateral Good.

⚡ China Fusion Energy, a Beijing, China-based nuclear fusion R&D company, raised $1.6bn in PE Expansion funding from China National Nuclear Corporation (CNNC), Kunlun Capital, Shanghai Future Fusion Energy Technology Co., Ltd, Sichuan Heavy Industry Fusion Energy Technology Co., Ltd., and other investors.

💨 Chestnut Carbon, a New York City, NY-based nature-based carbon removal service provider, raised $210m in PF Debt funding from JPMorgan, Bank of Montreal, CoBank, and East West Bank.

🌊 CorPower Ocean, a Stockholm, Sweden-based wave energy conversion technology developer, raised $47m in Grant funding from EU Innovation Fund (EIF).

💨 Calix, a Pymble, Australia-based industrial decarbonization solutions service provider, raised $45m in Grant funding from Australian Renewable Energy Agency (ARENA).

🧪 AmphiStar, a Gent, Belgium-based biosurfactant manufacturer, raised $15m in Grant funding from European Innovation Council.

⚡ Avalanche Energy, a Seattle, WA-based compact electrostatic fusion reactor developer, raised $10m in Grant funding from Washington State Department of Commerce.

💨 Mission Zero, a London, England-based direct air capture technology developer, raised $8m in Grant funding from UK Department for Transport (DfT).

🏭 Innovatium, an East Kilbride, Scotland-based liquid air energy storage developer, raised $4m in Corporate Strategic funding from Hitachi Industrial Equipment Systems (HIES) and Scottish National Investment Bank.

🧪 Provectus Algae, a Noosaville, Australia-based algae-driven photosynthetic bioproducts producer, raised $3m in Grant funding from Australian Government - Department of Industry, Science and Resources.

🥩 Äio, a Tallinn, Estonia-based biotech oil and fat producer, raised $1m in Grant funding from Estonian Business and Innovation Agency.

🌱 Arete Zero Carbon, a Liverpool, England-based carbon management consultancy, was acquired by PNZ Group for an undisclosed amount.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate.

The Palisades nuclear plant in Michigan secured approval from the Nuclear Regulatory Commission to restart, becoming the first permanently closed US nuclear plant to reopen. With over $1.5bn in federal loans, the plant’s revival reflects rare bipartisan alignment to revive aging nuclear infrastructure. If successful, it could chart a path for extending zero-carbon baseload power assets amid the energy transition.

Google has partnered with Energy Dome to scale its novel CO2 Battery, a long-duration energy storage (LDES) technology capable of delivering 8–24 hours of clean power. The technology addresses the critical challenge of storing intermittent renewable energy and has already shown commercial viability in Italy, with planned deployments in the US and India. This move accelerates the commercialization of LDES, boosting grid flexibility and resilience as part of Google's push toward 24/7 carbon-free energy amid rising data center power demand.

The Trump administration canceled a $4.9bn federal loan guarantee for the Grain Belt Express, the largest planned US transmission project linking Midwest renewables to the East. The move signals a broader rollback of clean energy support and risks worsening grid bottlenecks. Invenergy plans to proceed with private financing, but the loss of federal backing threatens progress on grid decarbonization.

The Trump administration canceled a $4.9bn federal loan guarantee for the Grain Belt Express, the nation’s largest planned transmission project linking Midwest renewables to eastern markets. The move, driven by political pressure, threatens a project expected to cut $52bn in energy costs and ease grid congestion. Developer Invenergy says it will proceed with private financing, but the decision signals renewed federal headwinds for clean energy infrastructure.

The world’s top court, the International Court of Justice, has declared that governments can be held legally responsible for climate inaction, even if they aren’t party to the Paris Agreement. In a landmark opinion, it ruled that failing to regulate emissions, subsidizing fossil fuels, or delaying action may constitute a breach of international law—with potential reparations owed to affected countries. While nonbinding, the decision sets a powerful precedent and opens the door for a wave of climate accountability lawsuits worldwide.

The IPCC’s Sixth Assessment Report issued its starkest warning yet, declaring the impacts of climate change “unequivocal” and already driving irreversible harm to people and ecosystems. With the world on track for 2.7–3.1°C of warming, billions of people face deadly heat, food and water insecurity, and rising extinction risks. The report urges immediate global action, warning that the window for a livable, sustainable future is rapidly closing.

Chestnut Carbon secured a first-of-its-kind $210m credit facility, led by J.P. Morgan and backed by a long-term carbon removal deal with Microsoft, to scale its US afforestation efforts. This marks the first time a nature-based carbon project in the voluntary market has attracted traditional bank financing, signaling growing institutional confidence in the asset class, and potentially creating a replicable financial model that could unlock broader capital access for the sector to scale high-integrity carbon credits.

SAF gets $63m lift off with UK grant funding.

F1 hits the brakes on emissions, cutting 26% off its carbon lap time.

From lag to leap: Berkeley Lab explores how regulatory sandboxes supercharge grid tech adoption in new report.

Manmade clouds take center reef as scientists trial weather tweaks to save the Great Barrier.

A surprising collab: Tesla x Sunrun.

Rice University scientists turn bacterial teamwork into a plastic-smashing, metal-mimicking material marvel.

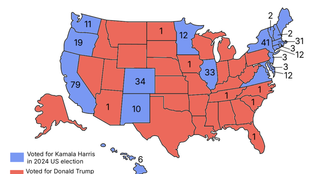

New report says Republican districts lose the most as clean energy cancellations surge past $22bn+.

📅 The Future of Buildings: Join Heatmap on Thursday, August 7 at Mintz in Boston, MA for the opportunity to explore the intersection of housing abundance and decarbonization with leaders like Senator Ed Markey, industry innovators, and city officials.

💡 EarthScale: Apply by September 7 to participate in a transformative 12-month UK-wide program supporting IP-rich climate tech ventures. Designed to help startups scale, navigate manufacturing, and raise Series A funding. Join Q&A webinars on July 29 and August 7 to learn more.

📅 Designing for Impact — AI, User Behavior, and the Climate Cost of Design Choices: Join Climate Conscious on Wednesday, August 6 at 3:00 PM ET virtually for an engaging session exploring how design choices in digital products shape user behavior and emissions impact, featuring live AI case studies and actionable strategies for climate-conscious design.

Senior Account Executive @Sightline Climate

Investment Analyst @38 Degrees North

Sr. Analyst/Associate - Corporate Development @Aspen Power

Process Engineer @Huminly, Inc.

Analyst @Hitachi Ventures

Analytics Manager (Credit Risk) @Octopus Energy

Carbon Data Expert @Ecovadis

Donor Relations Manager @The Nature Conservancy

Senior Director, Laser Fusion Program @Xcimer Energy

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

With long duration energy procurement surging, new rankings reveal who's pulling ahead

A tale of two public debuts

US courts roll back Trump-era actions on offshore wind and DOE grant cancellations