Despite much effort and funding poured into innovative solar technologies over the past two decades, financing mechanisms have been critical to driving down the cost of deployment as much if not more than the technology innovations did themselves.

As carbon capture and sequestration (CCS) technologies mature, the production of carbon offsets will require similar creativity in the arrangement and deployment of capital.

Key renewables financing takeaways:

- Varied investment structures incentive varying returns: To stimulate investment in renewable energy generation projects, the federal government developed a series of support structures to reduce taxes for investors – namely, the investment tax credit, the production tax credit, and accelerated depreciation.

- Advanced financial structures work because they allocate risk and reward: The nature of these tax incentives often requires an outside investor and a complex financial arrangement to allocate risk and reward among multiple parties.

- Access to debt is key: Financial structures that include project debt generally yield a lower cost of energy compared to those that rely purely on equity capital. Realistically, raising project debt is tricky, especially for newer, smaller developers.

What’s similar about the carbon offset and solar markets?

Both require outsized complex technologies, scale, and sale of commoditized end products (e.g. electricity, carbon offsets) for which there are myriad cost complexities. Both struggle with deployment, and both reduce the cost of technology on a predictable curve. However, to date, there has been less innovation on how to price the return of carbon offsets partially due to a lack of financial innovation.

What needs to be true for CCS technologies to scale?

- Carbon offset markets need to mature: Today, the market is small ($300m voluntary market), shallow in terms of projects and participants, and pricing lacks transparency and stability.

- Carbon offset products need to peg to an inelastic need (or regulation): Stable, significant commitments to purchase large volumes of carbon offsets at a set price over a concrete timeframe will allow project developers to raise debt capital. Unlike electricity, carbon offsets remain a privilege and not a need – were companies allowed to operate only if they reduce carbon (or drive it negative) it would create a futures market for longterm sequestration.

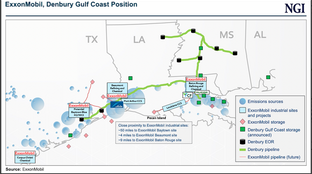

- Carbon sequestration requires more players: Lots of legacy investors, with varied ESG stripes, enabled the financial innovation required to de-risk and drop the cost curve of solar. Currently, the players financing CCS are limited to deeptech venture capitalists and strategic corporate players; the field lacks the institutional or governmental support to deliver an asset mix at scale

Interested in more content like this? Subscribe to our weekly newsletter on Climate Tech below!