🌎 Inside Cloverleaf Infrastructure’s power play #206

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

Plus, US renewables production eclipses coal for first time ever

Happy Monday!

This week, renewables leave coal in the dust, we compare solar and CCS financing, and share some exciting bike, battery, and farm yield investments.

Thanks for reading!

Not a subscriber yet?

This isn’t an energy newsletter, but the rhythm of the energy industry often moves the climate conversation. For the first time ever in the US, renewables are on track to beat out coal in electricity production this year.

That’s despite coal making up over half of our annual energy production less than a decade ago, and despite Trump’s recent 3-year crusade to prop up the sector. This is a story of continuous innovation in renewables at the same time that coal has been dying by a thousand cuts. Now, the coronavirus pandemic is potentially delivering the final lethal blow.

What does this mean?

Why does this matter?

What is likely to happen?

🚗 IRP Systems, an Israel-based leading provider of innovative electric powertrain products for e-mobility, raised $17m in Series B funding from Chinese VC Fosun RZ Capital among others including Champion Motors (Israeli distributor of Volkswagen Group). The company provides products like controllers, motors, and battery management systems for the electric vehicle market. More here.

🚲 VanMoof, an Amsterdam-based e-bike startup raised $13.5m from London VC Balderton Capital and SINBON Electronics. The funding will be used for international expansion as cities gradually emerging from lockdown discourage public transport in favor of safer (and greener!) options such as cycling and walking (see the news section for more on the UK’s £2bn travel alternatives package). TechCrunch has more here.

🚗 Wallbox, a Barcelona-based smart EV charging startup closed a $13m second tranche of Series A funding in early March from Seaya Ventures, Endeavor Catalyst, and Iberdrola (Spanish electric utility). The company designs smart charging systems which enable real-time charging control through its smartphone app and the ability to transfer energy from your car to your home or electric grid. More here.

⚡ Span, San Francisco-based maker of smart electrical panels, raised $10.2m in funding from ArcTern Ventures, Capricorn Investment Group, Incite Ventures, Congruent Ventures, and other existing ventures. Span’s panel replaces the standard electrical panel, enabling digital monitoring, control, and automation of home energy through a smartphone interface. TechCrunch has more here.

🌾 The Yield, a Sydney-based IoT agricultural technology startup, raised $7m in funding from Yamaha Motor Ventures and Bosch Group. The IoT platform ingests variables such as rain, light, and soil moisture to better predict crop yield as farmers face a risky future with climate change and more unpredictable weather events. More here.

🌱 Ecoinno, a Hong Kong-based company developing sustainable alternatives to single-use plastics, raised $6m in Series A funding from Alibaba. The funding will be used to scale the company’s production of its Green Composite Material™, which is based on 100% natural plant fibres. More here.

🌾 Intello Labs, an India-based software startup that uses computer vision and AI to grade food quality, raised $5.9m in Series A funding from Saama Capital, Omnivore, and Nexus Venture Partners. Food quality assessment tools like Intello Labs’ can bring efficiency to the food supply chain and reduce food waste. LiveMint has more here.

🌾 Andes, an Emeryville, CA.-based regenerative agriculture startup raised $3m in Seed funding from KdT Ventures and Fondo Alerce Venture Capital. The company harnesses the power of microbes to develop novel seeds that rely less on synthetic nitrogen and outperform traditional crop yields.

📏 Transect, a San Antonio, Tx.-based company focused on environmental risk for energy, infrastructure, and real estate companies, raised $1.5m in Seed funding from Blue Bear Capital, Holt Ventures, and Gary Horn.

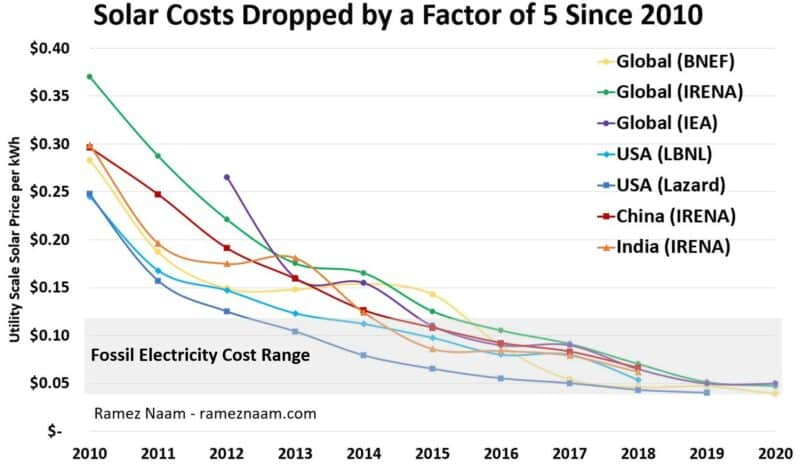

Despite much effort and funding poured into innovative solar technologies over the past two decades, financing mechanisms have been critical to driving down the cost of deployment as much if not more than the technology innovations did themselves.

As carbon capture and sequestration (CCS) technologies mature, the production of carbon offsets will require similar creativity in the arrangement and deployment of capital.

Key renewables financing takeaways:

What’s similar about the carbon offset and solar markets?

Both require outsized complex technologies, scale, and sale of commoditized end products (e.g. electricity, carbon offsets) for which there are myriad cost complexities. Both struggle with deployment, and both reduce the cost of technology on a predictable curve. However, to date, there has been less innovation on how to price the return of carbon offsets partially due to a lack of financial innovation.

What needs to be true for CCS technologies to scale?

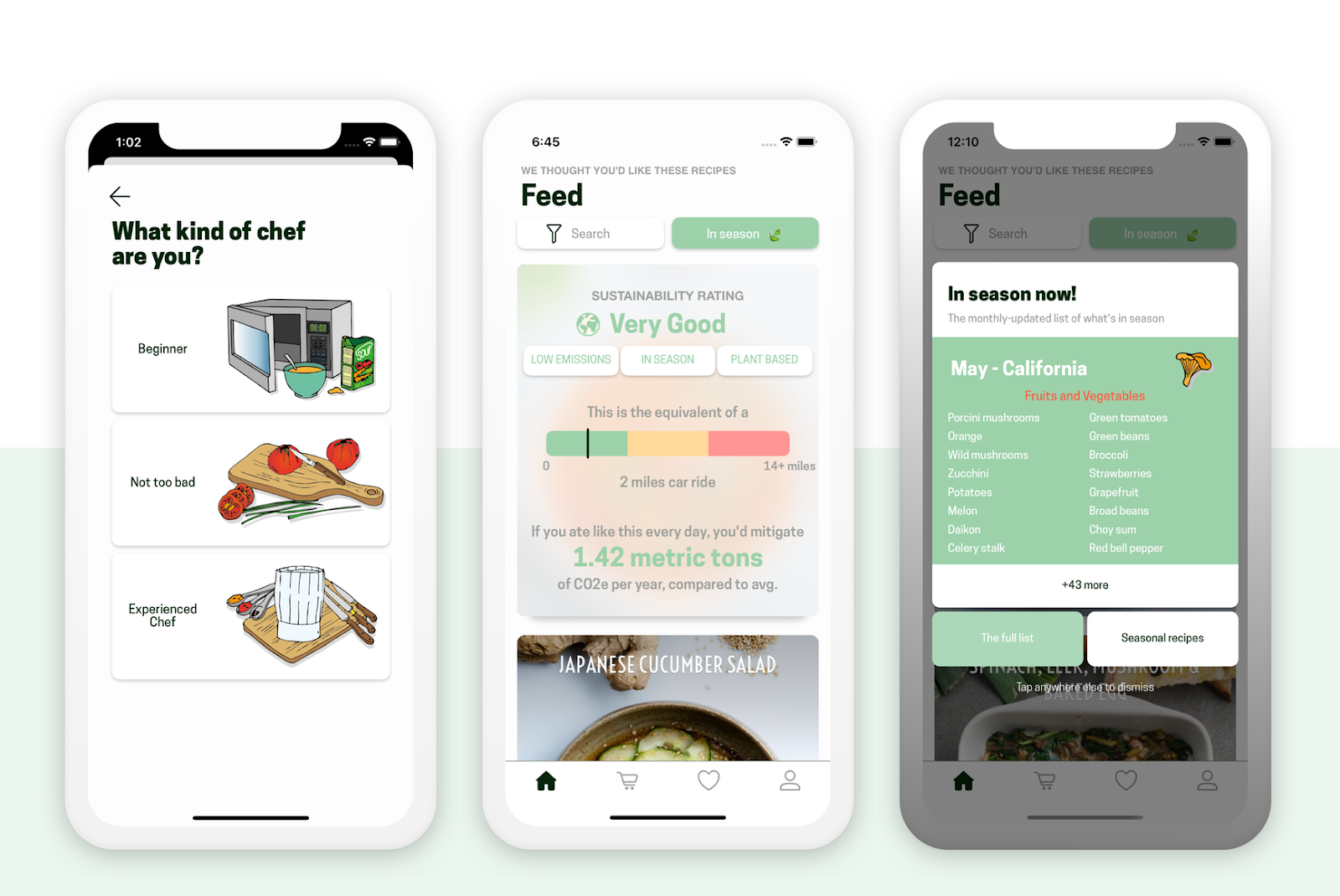

Kuri: Download a new app to help you cook more sustainably, personalized to the seasons near you. Kuri is the first cooking app to calculate the carbon footprint of its recipes. Kuri curates recipes based on your dietary preferences and will soon offer low-carbon personalized meal plans.

Venture Capital Needs A Complete Reset: Read a call to action for the VC industry to step up to a higher purpose, which Gabe Kleinman of Obvious Ventures argues will, in turn, drive higher value. It’s a hat tip to the decarbonized economy, plant-based food, and all things climate tech.

Entrepreneurs Creating Success in Cleantech: Join Women in Cleantech & Sustainability and The Cleantech Open this Thursday at 5pm PT for networking with two female entrepreneurs (Exergy, ChargerHelp) at different stages of their journeys into starting cleantech companies.

Power Trip: Watch the PBS series on how energy "is the underlying force behind water, food, wealth, transportation, cities, and war," based on the book of the same name published last year by Michael Webber.

Air Miners: Laugh and learn at the 5 minute (literal) rap up of the Air Miners conference.

We’ve teamed up with Climate.Careers to highlight the latest jobs in Climate Tech:

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

England's new election ushers in a new test of clean energy and climate tech

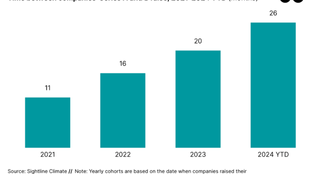

H1'24 funding totaled $11.3 billion, down 20% from H1 2023.