🌏 Spinning CO2 into clothes

Scaling “symbiotic manufacturing” with Rubi Laboratories

Last week, the acclaimed co-founder of Apple, Steve Wozniak, unveiled his second company, Efforce [https://www.efforce.io/], with a slick website and much media fanfare. Efforce claims to disrupt the energy efficiency market by using blockchain and “WOZX” tokens to finance energy efficiency projects. The platform encourages the public

Last week, the acclaimed co-founder of Apple, Steve Wozniak, unveiled his second company, Efforce, with a slick website and much media fanfare. Efforce claims to disrupt the energy efficiency market by using blockchain and “WOZX” tokens to finance energy efficiency projects. The platform encourages the public to directly invest in energy efficiency projects – and receive tokens in exchange for energy saved. Think of a blockchain version of the PACE loan model which allows debtholders to pre-fund efficiency projects. What we (and the market experts) are left puzzling is why the WOZX token? Efforce’s emphasis on crypto is reminiscent of 2017-18 ICOs where this token model failed to be adopted (or understood) at necessary scale.

In the rollercoaster of the pandemic and hype of SPACs, the heady rush of ICOs back in 2017-18 seems long forgotten. But if you’ll humor a quick history lesson: what exactly happened to all the blockchain hype? Taking a few years’ step back, blockchain first emerged on the scene in 2008 with Satoshi Nakomoto’s seminal whitepaper on creating the first blockchain-based cryptocurrency, Bitcoin. (It’s important to remember that Bitcoin and blockchain are not synonymous; if blockchain is the flour, Bitcoin is a croissant pastry). At its core, blockchain is simply a distributed record-keeping system that uses cryptography to prevent the falsification of records, therefore ensuring trust without the need for a centralized verifying authority. The excitement around blockchain technology’s potential “led a number of startups down the path of a solution in search of a problem,” notes Matt Brown, VP of Corporate Development at LO3 Energy. Launching an ICO became synonymous with launching an idea to test a blockchain-based use case. Needless to say, the market corrected itself and blockchain applications in climate tech (e.g., creating decentralized digital electricity microgrids) suffered the same fate.

So in light of Wozniak temporarily forcing the blockchain spotlight back on climate tech, we dug into the evolution of the climate blockchain landscape with new and surviving ventures from the 2018 crypto crash and evaluate opportunities for meaningful applications in energy and the carbon market & accounting.

The accelerating deployment of DERs (Distributed Energy Resources) in our electricity grid seems a natural fit for the decentralized features of blockchain. Customers are becoming more active grid participants able to control their own energy production and consumption through solar panels, smart devices, and evolving storage systems like EVs. During the 2017 crypto boom, startups making broad claims about leveraging blockchain to manage increasingly complex electric power systems raised over $300m (75% through ICOs). One promising energy blockchain application is electricity trading, either in the form of Peer-to-Peer transactions where customers can trade surplus rooftop solar power with one another, or using blockchain to enhance the existing wholesale electricity trading market. However, the majority of these startups failed due to the power sector’s conservative and heavily regulated nature disincentivizing unproven and complex technologies like blockchain. Tokens from ICOs also introduced more friction than value and distracted from the core blockchain infrastructure applications. In 2016, LO3 Energy ran blockchain-based marketplace pilots for homeowners to trade electricity. Since then, LO3 has pivoted its business model to a B2B2C enterprise offering for utilities and electricity retailers. The company has been able to outlast many of its energy blockchain startup peers by “focusing on commercial and regulatory realities and working with incumbent suppliers where the economics for community-level DER markets make sense” Matt explains. In these local energy marketplaces, blockchain enables prosumers who own DERs or community assets to provide services to other retail customers. As more DERs come online and participate in programs at multiple levels of energy markets, blockchain ledgers could be useful for securely processing and recording these distributed transactions.

It’s hard to think of a messier market that’s more ripe for blockchain’s unique capabilities than the carbon market. Legacy carbon markets are fundamentally plagued with a double-counting problem. Today, if a buyer in France purchases a carbon credit from a Brazilian forestry developer, both France and Brazil will count the same emissions reduction as their own. In voluntary carbon trading too, brokers can hold and sell credits many times before the carbon is retired, resulting in an inaccurate and inflated market size vs actually offset carbon. Further, the “market” is controlled by a few big colluding developers and brokers who trade off-the-books (case in point: a very high profile carbon trading tax fraud case in the EU that was dubbed the “fraud of the century”.) There’s limited liquidity nor fair market price, despite carbon inherently being a commodity.

Enter the potential for blockchain to eliminate double counting, and enable fair operational carbon markets and accounting. Blockchain can replace paper-based settlements, audits, and reconciliations with immutable, timestamped records of ownership. As the market for large carbon neutral corporate offtakers expands, so will the demand on accurate and efficient reporting of carbon offsets and footprints. One venture laser-focused on this auditable accounting of enterprises’ energy and carbon footprints? ClearTrace connects to smart metering devices and loads energy data into a blockchain ledger to create an auditable trail across the energy supply chain. What Pachama does for trees, ClearTrace does for electrons. If you’ve ever wondered where the electrons charging your EV actually came from, ClearTrace answers that. “ClearTrace is like Carta, but for carbon systems of record. We’re more than a digital climate accounting system. We’re the tool that enables critical infrastructure like electricity, steam, and natural gas to transition from the physical to the digital world” says Founder and Chief Strategy Officer, Evan Caron. Combining such traceability and auditability with a tokenized marketplace, Nori seeks to create a carbon removal economy – starting with agricultural soil carbon. CEO Paul Gambill explains, “The solution is two-fold: 1) put all records of transactions on a public ledger, and 2) separate the removal from the trading, so that carbon is ‘retired’ immediately and the token (which represents 1 future tonne of CO2 removed) can be bid on as a commodity”. In a Nori marketplace, farmers adopt CO2 removal practices which are verified by a third party, then Nori issues blockchain-enforced certificates (Nori Carbon Removal Tonnes or NRTs) which farmers can sell to buyers. The buyer pockets a certified tonne of removed carbon, and the farmer gets paid for the NRT in NORI tokens, which they can then trade in an open market with fluctuating (ideally upwards) prices. The tokens also act as a unique insurance mechanism which Nori can clawback upon finding that carbon hasn’t been kept in the ground.

🧰 Blockchain is a tool in the toolkit, not a silver bullet solution. Fundamentally blockchain enables tracking and auditing of complex systems without bias, and – as with most enablers – is most powerful when not seen or heard. Businesses starting with blockchain as the solution (most tokens, cryptocurrencies, and front-facing blockchain applications) will continue to go the way of the Dodo. Meanwhile, businesses designed to solve a problem (tracking, verifying, auditing where bias and trustworthiness are in question) by thoughtfully wielding blockchain in pursuit of a clear business case and ROI will survive.

✔️ Data providers filling in for blockchain’s missing verification layer. Blockchain does as it’s told. To verify the veracity of the (secure, traceable) information, one needs a middle layer of validation between the raw data and the blockchain ledger. This source of truthing comes from a separate suite of data providers ferrying information from the physical to the digital worlds. IoT data providers can certify the quality of data from their sensors and meters, and AI companies can try to validate based on predictive models.

🤧 On burnt ground from the 2018 boom and bust, blockchain applications face serious hurdles to adoption. Whether right or not, corporates, investors, and much of the public have an allergy to the word “blockchain” and idea writ large. Blockchain is perceived as a clunky solution that introduces new complexities like cybersecurity, regulatory, and compliance risks. Ventures must bury mention of blockchain entirely or until their target is otherwise hooked – increasing the challenge of securing key early company partnerships. There’s also the need for establishing some common protocol in order for end applications to work, much like how the Internet Protocol facilitated the scaling of the internet. And of course, the benefits of the distributed ledger technology manifest only with a multiplayer network.

✊ Never doubt that a small group of highly collaborative, innovative, and mission-driven blockchain fanatics can change the world. Blockchain (not crypto…) attracts just the type of systems thinkers needed to solve the climate crisis. Time will tell if they can change the world.

Curious to learn more about blockchain climate solutions? Check out Yale’s OpenLab with Martin Wainstein (who graciously shared his expert perspective for this feature), Climate Chain Coalition and their 200+ member entities, InterWork Alliance, Climate Warehouse at the World Bank, the Open Climate Collabathon, Hyperledger Climate Action & Accounting Special Action Group, Climate Ledger Initiative, and the Energy Web Foundation.

Curious to work on building blockchain climate solutions? LO3 is hiring a Full Stack Developer, ClearTrace is hiring a Director of Sales, and Nori is hiring a Senior Software Engineer and Head of Product.

Interested in more content like this? Subscribe to our weekly newsletter on Climate Tech below!

Scaling “symbiotic manufacturing” with Rubi Laboratories

How to build trust and collaboration in CDR with Isometric, starting with the science

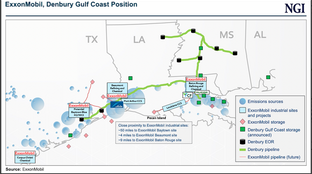

Exxon’s acquisition of Denbury fuels CO2 transport ambitions