🌎 The UK digs deep for critical minerals #285

England strikes lithium and comes up with geothermal gold

It’s here!

Every year, we ask you to place your bets on what comes next in climate and energy: where capital flows, which companies scale, what technologies actually deploy, and which parts of the ecosystem don’t survive the next cycle. Then we track the tape at the end of the year to see which calls paid out and which ones missed.

This year, nearly 500 of you weighed in on our 2026 Predictions Survey, setting the market odds on the next phase of the energy transition. It’s our crowd-sourced prediction market — no contracts, but lots of conviction.

Below, you’ll find an abbreviated version of the aggregate results, with all the crowd favorites and the long shots, for everything from investment totals and geography to grid assets and climate hazards.

We didn’t stop there. We then stress-tested those bets with a smaller group of investors, operators, and policy insiders. We asked the experts the same questions and got their takes on what the market is getting right, what it’s mispricing, and where consensus could break.

But we couldn't fit it all in this newsletter. This is only the first half — we've got double the predictions in the full post on our website. You can read the rest of the predictions, plus more expert takes and reflections, in the longer post here.

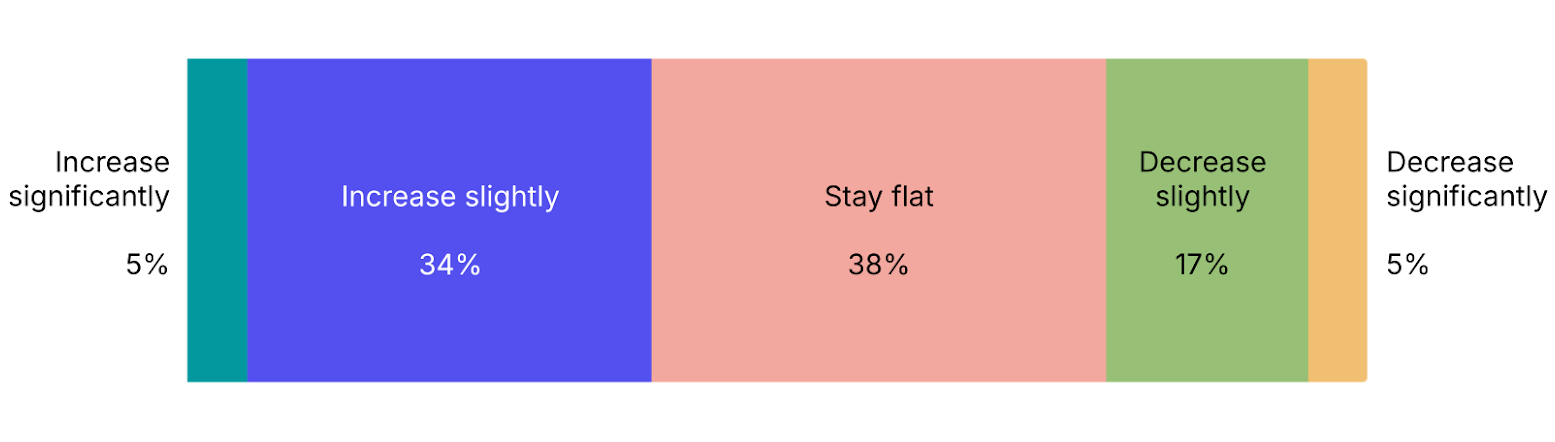

1. Will climate tech venture / growth funding in 2026 …

Results: Most of you expect funding to stay flat or increase slightly. That’s directionally in line with 2025 investment, when climate tech venture and growth was up 8% from 2024, clocking in at $40.5bn for the year.

Expert takes:

“Increase. Soooo much money has been raised globally for climate. That's got to go somewhere.” - Andrew Beebe, Managing Director, Obvious Ventures

“Funding will increase, but concentrate. Capital will continue moving toward companies that have crossed into repeatable deployment and can support layered capital stacks. Growth will favor teams that plan for durability from Series B onward.” - Caie Kelley, Partner, Lowercarbon

“Climate tech venture capital and growth funding in 2026 is likely to strengthen in 2026, in specific areas -- particularly those enabling the rapid deployment of critical energy infrastructure. Platforms leveraging vertical AI that help capital move faster will stand out. In a market defined by rising demand and tight timelines, the companies that attracted funding will be those positioned to execute at speed.” - Alfred Johnson, CEO, Crux

“Venture and growth funding will increase in 2026, benefiting from improving macro conditions despite lingering sector headwinds. This growth will be fueled by the Fed's ongoing rate cuts and more frequent early-stage company exits, both injecting capital back into the sector. After a two-to-three-year period that eliminated companies struggling with funding and commercialization, the surviving firms are poised to thrive and secure large investment rounds in 2026.” - James Frith, Principal, Volta

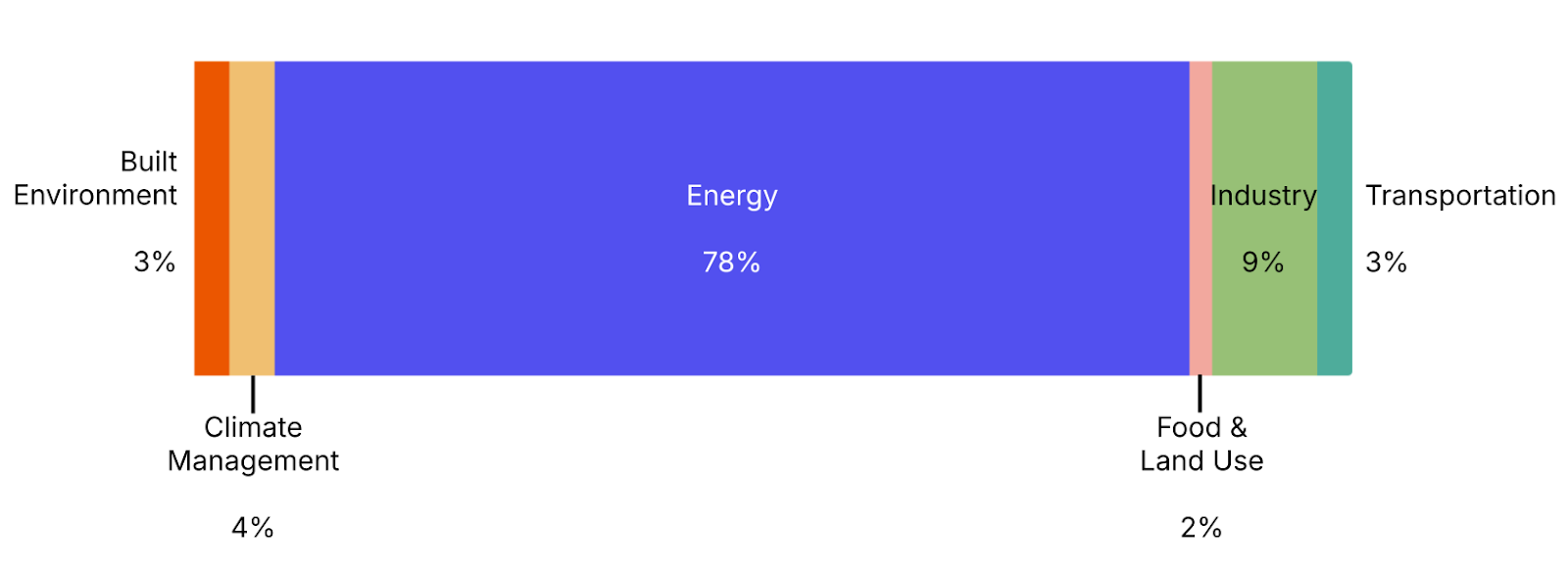

2. Which sector will receive the most investment?

Results: No surprise, Energy captured 78% of responses, an overwhelming consensus. Investment attention continues to consolidate around power generation, storage, and grid infrastructure as power demand rises from AI and electrification.

Expert takes:

“Energy, as the data center energy puzzle will pull forward innovation from demand flexibility and energy storage to geothermal and nuclear.” - Dawn Lippert, Founder & CEO, Elemental Impact

“Energy given the AI story, lots left there.” - Jeff Johnson, General Partner & Head of Energy & Resilience, B Capital

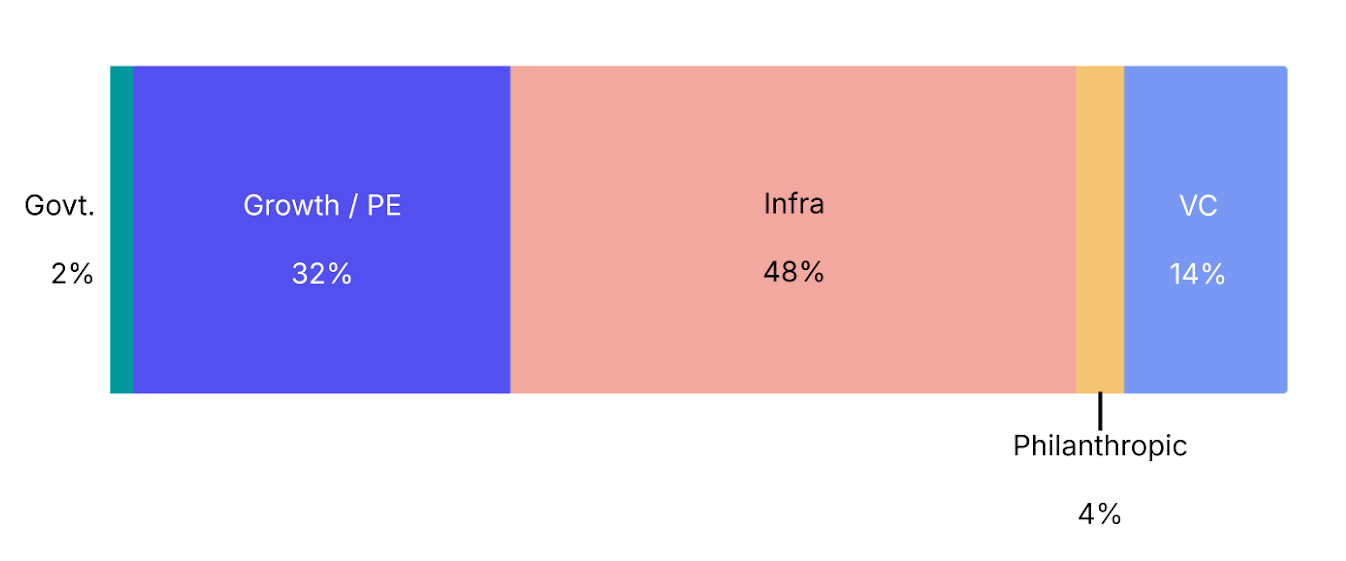

3. Which segment of the Climate Capital Stack will see the biggest growth?

Results: The mature layers of the stack got your vote. Infrastructure leads, followed by Growth and Private Equity. There’s a lot of confidence in the mature renewable-focused private capital.

Expert takes:

“Infrastructure capital. As deep tech companies mature, they increasingly resemble long-lived assets with contracted revenues. That naturally pulls in infrastructure investors, government programs, and hybrid vehicles alongside traditional equity.” - Caie Kelley

“I think philanthropy is ready for a big moment in the sun (the sun here being the climate capital stack). The shakeup of 2025 has shown that 1) innovation and markets have to deliver even more of the climate solutions we need with policy pulling less weight, and 2) the cracks in the capital stack have become even deeper with the government rollbacks, meaning that more good companies and important solutions will fail without intervention. And there are lots of new avenues for philanthropy to be highly catalytic and make a huge impact.” - Dawn Lippert

4. More or fewer exits in 2026?

Results: It’s a hungry market, and you’re betting on more exits ahead, even if the bar stays low. Exits fell 5% in 2025, driven by a dip in acquisitions, which still made up 89% of all exits in today’s buyer’s market.

Expert takes:

“More exits. The market has started opening up and I don’t think Trump will pull off another “tariffs”-like initiative. The pipeline is robust and investors want to see money back.” -Shira Eting, Partner, Vintage Investment Partners

“Far more exits, as the electricity supercycle expands and companies already at scale monetize.” - Jigar Shah, Co-Managing Partner, Multiplier

“More. Blockbuster IPOs like SpaceX and Databricks will open the IPO window wide for late stage companies performing well, and more companies that have exhausted their last bridge round will be picked up by strategic buyers in 2026.” -Dawn Lippert

“I expect we will see a significant increase in exit activity in 2026. This trend is fueled by the improving macroeconomic environment and the continued growth and rising revenue generation of companies that successfully navigated the last two to three years, but be prepared for some high profile failures as well.” - James Frith

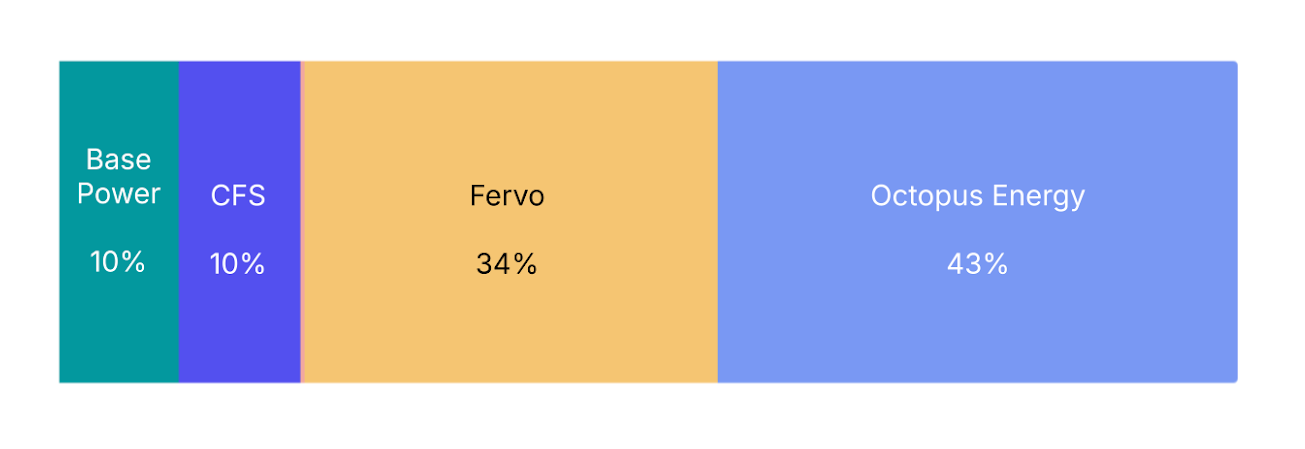

5. Most likely to IPO in 2026?

Results: Lots of bets on Fervo and Octopus Energy (although we did run this survey before Octopus spun out Kraken). Both companies have scale, operating assets, and revenue visibility. And some write-ins? “Radiant.” “Somebody in India.” “Some AI company.” “Nobody.”

Expert takes:

“Holtec, Fervo, over 20 more through SPACs.” - Jigar Shah

6. Biggest new deployment record?

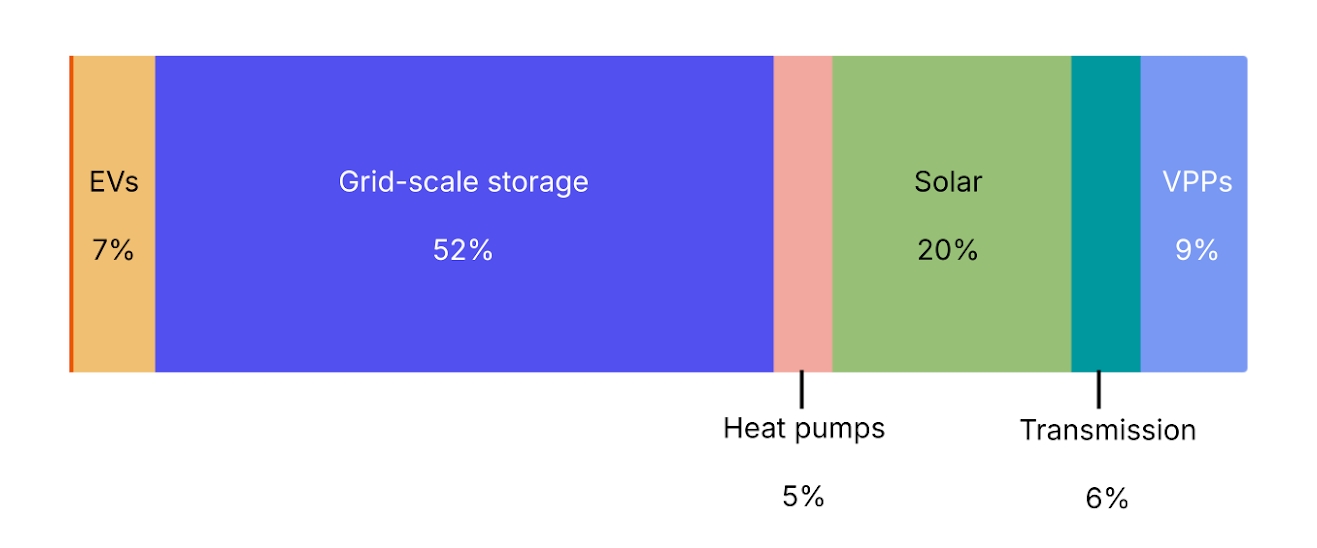

Results: Grid-scale storage took the majority vote. Storage continues to move from a complementary technology to core infrastructure. Deployment expectations reflect bankability, supply chain maturity, and immediate grid need.

Expert takes:

“The newest important trend will be broader deployment of virtual power plants based on larger aggregation of vehicle to grid power. 2026 will be the first year in history where the majority of new EVs sold will provide bi-directional charging and energy transfer. As the revolution in AI and the increased number of data centers increases power demand from the world, utilities, virtual power plants will prove to be the lowest cost most personal solution for utilities.” - Steve Westly, Founder & Managing Partner, The Westly Group

“2025 was a breakout year for energy storage and we expect that to continue in 2026, likely setting new deployment records. Our data shows that in 2025 utility-scale battery installations are projected to reach 18.3 GW (a 78% increase over 2024), making storage the fastest-growing segment of the clean energy market. That growth is being driven by market economics: declining costs, rising power demand, and the need for dispatchable capacity as solar penetration increases. Storage is becoming a core component of grid infrastructure.” - Alfred Johnson

“Small, flexible thermal units such as RICE, aeroderivatives, and small turbines will see a massive increase in deployments over the next 24 months. Relatively inflexible units like fuel cells will also see a surge in deployments. There are four drivers: data centers cannot get online as quickly as they’d like to deploy new chips via utility power alone. Whether these units are operating as a microgrid or bolstering a utility connection as backup or peaking, manufacturing slots for these smaller, more flexible units are largely sold out until late 2028. Second, grid stability can benefit from smaller units. Utilities are deploying smaller units in a variety of jurisdictions, integrated into transmission corridors. So called “Texas-10s” fall within this category. Third, microgrids for oil and gas, as well as processing, continue to deploy these smaller units as they expand drilling to areas beyond the reach of the current grid. Fourth, data centers and other large industrial loads are being challenged in several jurisdictions to display flexibility. One way to do that is to ramp down loads. The other is to install flexible, on-site generation to take load off of utility grids. Note that many of these installations are paired with BESS to achieve reliability and load following capacity.” - Adam Mirick, Senior Energy Advisor, Prometheus Hyperscale

“Solar will have another breakout year. I know it’s probably storage, but despite FEOC requirements. And despite the PTC/ITC construction start or placed-in-service deadline — or because of them! — I bet record PV capacity gets built in 2026 as it trumps other technologies on cost and scalability.” - Mark Taylor, Co-Founder & CPO, Sightline Climate

7. Frontier tech that will break through?

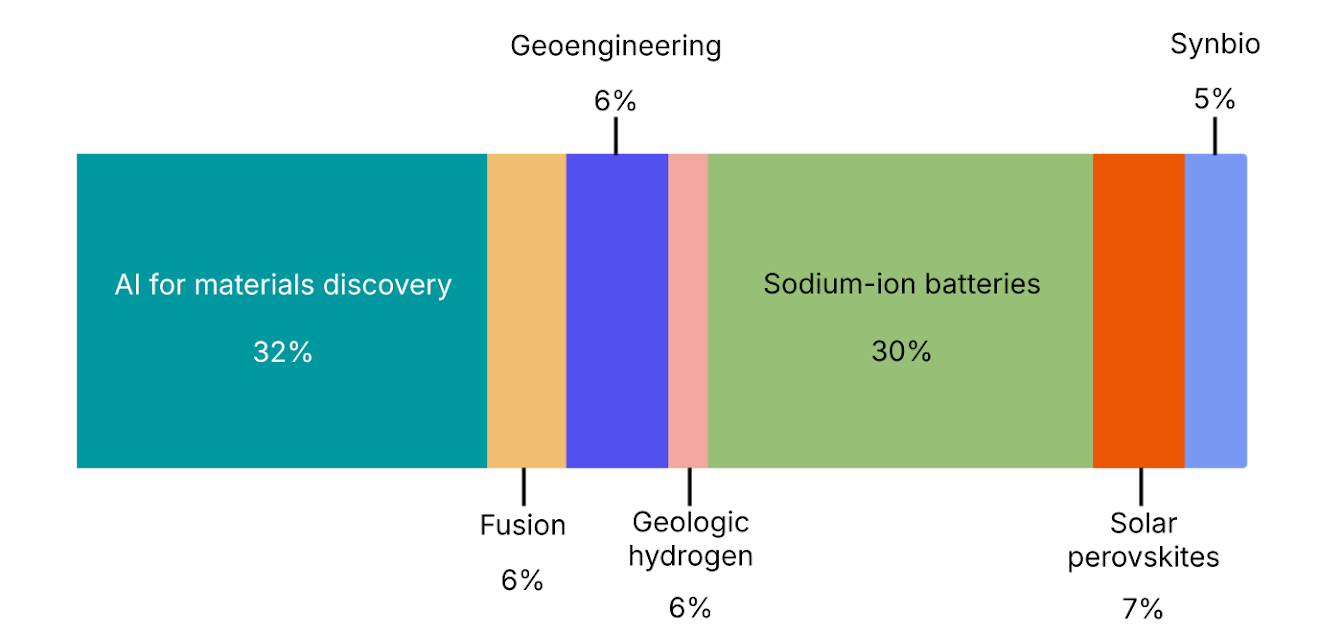

Results: Is this the year for AI for materials discovery or sodium-ion batteries? Respondents expect progress where tools shorten development timelines or reduce cost in existing systems. Some write-ins included: thermal storage, variable compute load, geothermal, AI for critical mineral recovery and grid optimization, and non-lithium-ion, non-sodium-ion storage.

Expert takes:

“AI for material discovery. When in doubt, bet on the models getting better and the resulting innovation. And this is a good thing: secure access to critical materials underpins US innovation, economic strength, and national security.” - Dawn Lippert

“Sodium ion batteries. The capacity exists for this in China already, it’s just not cost-competitive against LFP. LFP cell prices however, have been going up, giving sodium a chance. Solid state batteries, also, driven by continued growth in EVs and growing high-performance needs like drones and EVTOLs.” - Sharon Chen and Roger Zhang, Co-founders, Persimmon Systems

“We will see real progress on sub-50 MW nuclear reactors.” - Jigar Shah

“I believe the most interesting sector in the energy space is long duration energy storage. My view is that the ultimate winner will have minimal mined components, non-toxic solution capable of operating in a wide range of ambient temperatures without thermal runaway risk. People are focused on sodium-ion, solid state silver, and zinc bromide at present. These may win in the near term, but long term, I think we need to achieve materially lower cost than lithium cobalt, and this lilely means non-mined or very common inputs. The use of materials that aren’t hard or costly, in both environmental and human terms, will be a material win.” - Adam Mirick

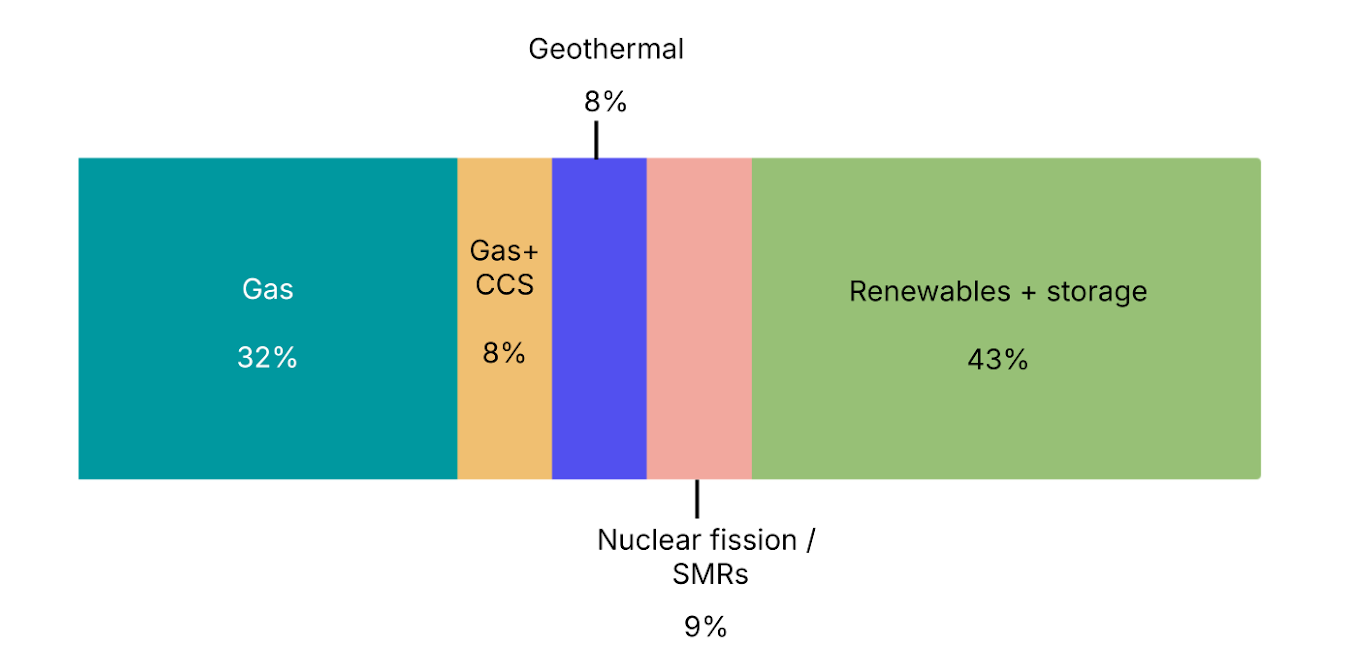

8. Fastest-growing power source for data centers?

Results: Gas remains a significant option, but renewables and storage is still the frontrunner.

Expert takes:

“Solar + BESS + Gas (turbines, recips) micro-grids. Hybrid stack that optimizes for uptime and time-to-power.” - Shanu Mathew, Investor

“I think grid connections WITH very large backup generation or storage systems to cut hours of peak load will be what we'll actually see come online this year. Serve the grid and skip the queue.” - Julia Attwood, Research Director, Sightline Climate

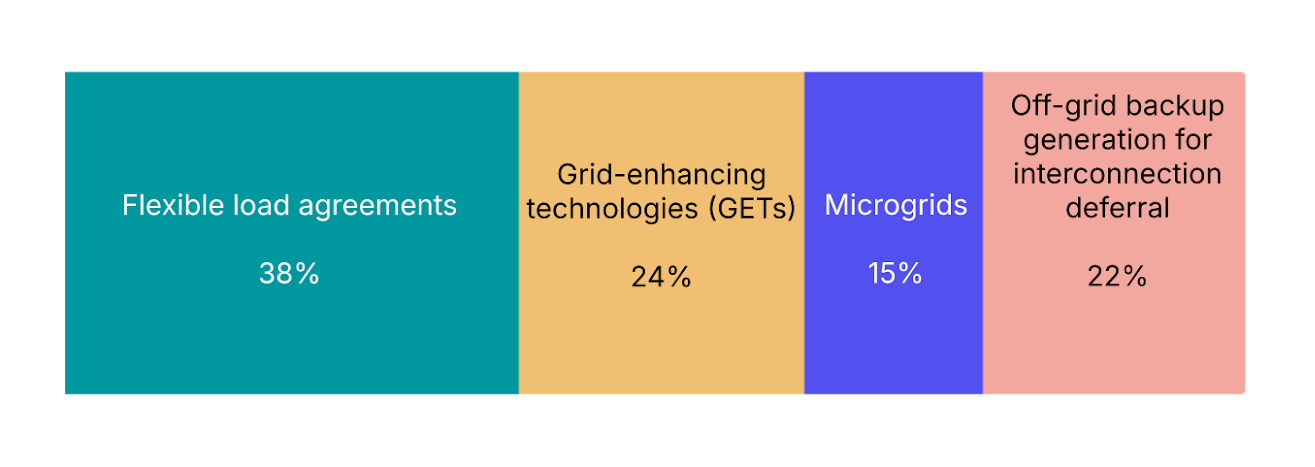

9. Which tech will have the biggest impact on speeding up large-loads?

Results: Flexible load agreements rank highest. This reflects how interconnection delays are being managed in practice, as large customers need to adapt demand profiles for grid constraints.

Expert takes:

“Bring your own capacity/demand flexibility.” - Jigar Shah

“GETs. They're already proven in Europe and ready to be deployed in the US. The cheapest fastest power is what you already have (and aren't using effectively). But the spotlight will probably be stolen by some flashy microgrids.” - Julia Attwood

10. Will flexible load programs become standard for new large-load customers?

Results: The majority of you say yes. Flexibility is becoming a default expectation rather than an exception for new large-load interconnections.

Expert takes:

“Major data centers already have 100% backup capacity for reliability. With Ireland already mulling making this a requirement, lots of the most stressed grids could easily follow. Let's just not have a repeat of the Texas bill…” - Julia Attwood

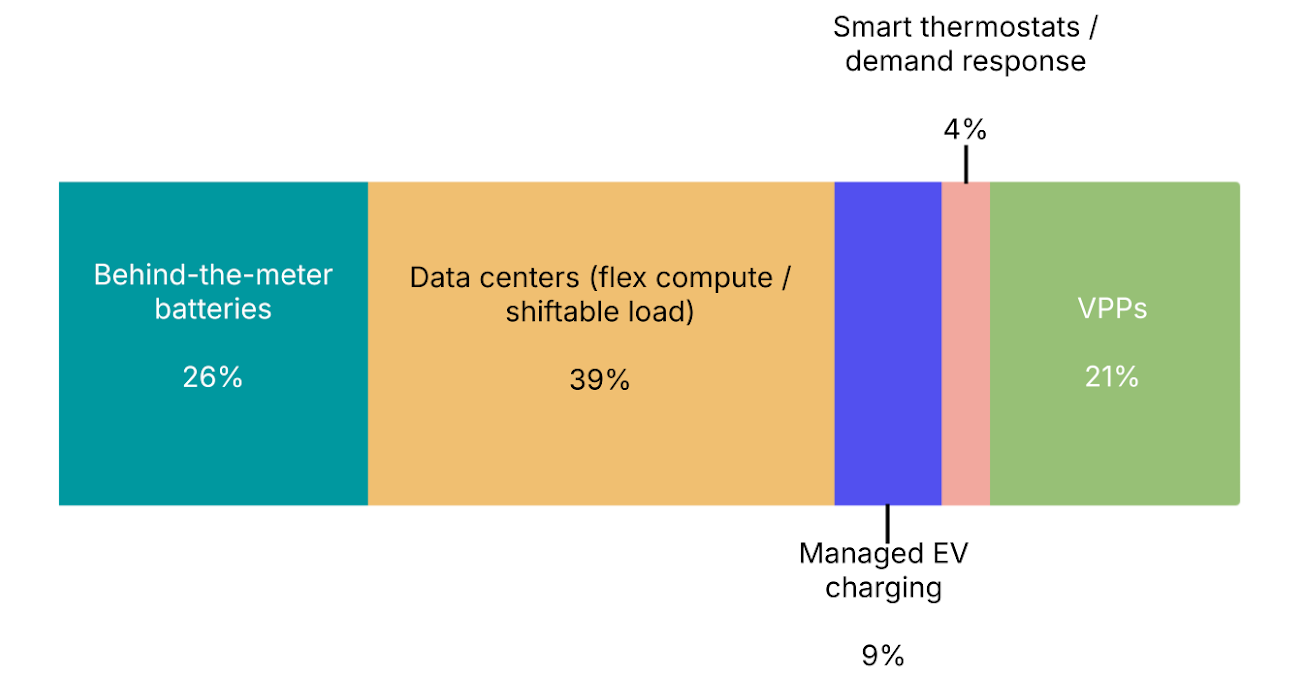

11. Fastest-growing flexible grid asset?

Results: You picked flex compute and shiftable load from data centers. Data centers are increasingly looking to connect to the grid and being good grid citizens is one path forward. Some write-ins included coordinated DERS, energy efficiency, combination, and policy.

Expert takes:

“Virtual power plants. Bonus: in front of the meter large scale batteries.” - Andrew Beebe

“Batteries, followed by Managed EV Charging.” - Jigar Shah

“VPPs – and at least one more state-mandated VPP. Seeing the Virginia Community Energy Act requiring a VPP pilot up to 450MW, others in Maryland, or North Carolina, at least one more state will put a similar law or regulation into place. Legislation introduced in Oregon, California, Illinois, and Massachusetts. It’ll be the year of a lot of things, but VPPs will be one of them.” - Mark Taylor

Thanks for reading! We have the results of 10 more questions, plus expert reflections, in the full post on our website here.

England strikes lithium and comes up with geothermal gold

Small reactors, big power rankings

Stricter foreign sourcing rules reshape clean energy tax credit eligibility