🌎 NY Climate Week debrief

Takeaways from five days of hallway and main-stage conversations at NYCW

Reflections, predictions, and thanks from across climate tech

Despite our strong affinity for stacked bar charts and running the numbers every week, the genius animating climate innovation today is the many individuals shaping the world through their work day in, day out.

We collected a breadth of perspectives on this year, next, and the many people and things to be grateful for in-between.

We’re grateful for all our ~20k subscribers, ~10k+ applicants looking for climate hustles through our job board, and everyone who played any part in helping to deploy more than ~$40b into early stage climate tech across almost 600 deals (full recap coming Q1! 👀).

Most of us went into 2021 unsure of what to expect, and what we got was more than unexpected - a groundswell of capital, both human and financial - deciding that maybe focusing on our Earthverse may matter more than the alternative. Policy and infrastructure have begun to shift, technologies have broken out of the lab and more into the mainstream, and SPACmania hurdled us towards (some, maybe) profitable exits.

A few highlights from 22 perspectives on 2022:

Thank you for reading, supporting, and believing that all of this matters - wishing you and yours a happy, healthy (boo omicron!) and prosperous holiday and new year!

“Biodiversity! We will all work on how to measure it and improve it, though it won’t become mainstream in 2022.” — Hampus Jakobsson, Pale Blue Dot

“Molecular farming.” — Dan Fitzgerald, Regen Ventures

“Supply chain embedded carbon.” — Doug Johnson-Poensgen, Circulor

“Infrastructure” — Sean Hunt, Solugen

“DAC and other forms of carbon removal!” — Amy Duffuor, Azolla Ventures (Prime Impact)

“DAC for all sorts of applications and the evolution of positioning carbon dioxide as pollution to carbon dioxide as feedstock. Carbon market arbitrage and a rush on locking up supplies of high-quality offsets and removals for voluntary market buyers. Excitement regarding all things fermentation, particularly from those jaded by the time, cost and complexity of cellular agriculture. Climate risk disclosure regulations and compliance mandates in US financial markets.” — Sierra Peterson, Voyager

“Testing big companies' resolve on deep decarbonization. Press releases at COP26 are easy. Capital commitments and the strategies to enable them are hard.” — Nat Bullard, BNEF

“Climate tech blitzscaling.” — Abe Yokell, Congruent Ventures

“Scale for certain lanes within climate tech (EVs, decarbonized ag, the end of coal in America, etc.)” — Andrew Beebe, Obvious Ventures

“Greenwashing fundraises by fancy private equity firms who realize they can't raise money without the green tint, however faint it may be authentically. Then, greenwashing blowback and the separation of the cream from the crop based on true sustainability bona fides. Big climate tech IPOs. The "energy transition" of dirty energy professionals who have finally realized that they have a grim professional future otherwise.” — Scott Jacobs, Generate Capital

“The great resignation... to work on climate!” Diego Saez Gil, Pachama

“People under 30 starting climate tech companies and outraising any other age group.” — Amy Francetic/ Allison Myers, Buoyant Ventures

“Spelunking. It's time to dig deep, be daring as all get-out, and get uncomfortable. We don't grow when we stay in our well-lit, comfortable bubbles. To deploy climate technology equitably, and at scale, we all need to get closer to the ground where the action is happening and embrace the unknown and the unfamiliar. ” — Dawn Lippert, Elemental Excelerator

“Greater understanding. Many of the tradeoffs and compromises will come into full view and the smartest people of our generation will realize that they villainized people that they should have embraced as partners and lionized people that took them on dead-end pathways.” — Jigar Shah, DOE

“When people realize it will never go back to "normal". The exponential pace of change in our world will be undeniable everywhere. From COVID to folks graduating college. People will realize you don't prepare for things any more, you prepare for change.” — Shuo Yang, Fifty Years

“Acceptance of COVID19 as part of daily life and a market correction driven by rising rates.” — Matt Eggers, Breakthrough Energy Ventures

“Utilities becoming partners to new energy companies.” — Kiran Bhatraju, Arcadia

“Consumers are part of the solution to reversing climate change.” — Dan Fitzgerald, Regen Ventures

“Many large companies will take meaningful action on climate change even without federal regulation.” — Matt Eggers, Breakthrough Energy Ventures

“Even the most capital intensive climate tech companies will have access to capital assuming their fundamentals are solid. This has definitely not been the case over the past 13 years.” — Abe Yokell, Congruent Ventures

“That COP would become a financier-fest. The private sector really showed up.” — Scott Jacobs, Generate Capital

“Investor and public pressure would cause corporations to begin measuring Scope 3 emissions. I also didn’t believe that our global supply chain was so fragile.” — Sean Hunt, Solugen

“The financial losses associated with climate change will be exponentially worse than scientists and economists have predicted and no community will escape unharmed. ” — Amy Francetic/ Allison Myers, Buoyant Ventures

“Higher returns come from upfront abatement investment costs (CAPEX), rather than increasing OPEX for buying carbon credits or removals.” — Maria Fujihari, Sinai

“COVID’s impact will be much more lasting than I thought, on work, travel and life.” — Andrew Beebe, Obvious Ventures

“I thought we might actually have a federal carbon tax in the US and now I recognize that political inertia has yet triumphed again and we'll probably have to live with the infrastructure bill. It's all fine, but the economist in me pines for a universal price signal.” — Sierra Peterson, Voyager

“We can attract significant amounts of capital into the climate space (the good!), but financial markets are not yet aligning actual incentives with decarbonization (the bad…). Big fund managers and investors have to shift for us to continue thriving on this planet (the ugly). The U.S. is capable of making big policy changes (the good), but it’s far harder for us to lead the world than we have in the past (the bad). Real progress relies on localities - cities, states, neighborhoods - taking on entrenched interests to deploy climate solutions and have real-world impact (to avoid the ugly).” — Dawn Lippert, Elemental Excelerator

“Voluntary carbon markets can be a part of a successful business model.” — Shuo Yang, Fifty Years

“Carbon markets are a legitimate lever (but shouldn't be the sole driver) to help us achieve our decarbonization goals.” — Amy Duffuor, Azolla Ventures (Prime Impact)

“Negative emissions and sucking down carbon from the sky will be funded by VC!” — Hampus Jakobsson, Pale Blue Dot

“Mass electrification of road transport is moving much faster at every level from the speed pedelec bike to class 8 trucking.” — Nat Bullard, BNEF

“We can stop deforestation by 2030. I'm super encouraged by COP26 pledges, corporate commitments to funding nature-based solutions, and by progress on capabilities to track forest carbon conservation remotely.” Diego Saez Gil, Pachama

“Banning gas in buildings would be popular. NYC just voted on all-electric heating and cooking in new construction!” — Ryan Panchadsaram, Speed & Scale

“UFOs and regenerative ag. The more farmers I talk with, the more I'm convinced that aliens exist, but that crop circles are fake. Also that there is serious discipline and structure involved in regenerative agriculture as a thoughtful approach to a complex food system.” — Nico Pinkowski, Nitricity

“Spent more time in nature.” — Andrew Beebe, Obvious Ventures

“Focused more on mental health and taking myself out for more walks.” — Maria Fujihari, Sinai

“Traveled more in the summertime and gone to a few more parties in July, when the COVID risk was actually low.” — Sierra Peterson, Voyager

“Prioritized my own mental and physical health sooner.” — Shuo Yang, Fifty Years

“More hugs. The climate community lost a pioneer this week with the passing of Ryan Popple. He will be deeply missed.” — Ryan Panchadsaram, Speed & Scale

“More time reading, less time Zooming.” — Dan Fitzgerald, Regen Ventures

“With a magic wand? Recruited Senator Joe Manchin’s children and grandchildren to Team Climate. Who can resist their grandkids?” — Dawn Lippert, Elemental Excelerator

“Congruent's investment cadence has been the highest in our history. I would have invested even more aggressively in 2021.” — Abe Yokell, Congruent Ventures

“Drop everything (and I mean everything) to pursue the one that got away a little more aggressively.” — Matt Eggers, Breakthrough Energy Ventures

“Listened to my instincts on a deal that broke that wasted a lot of our time.” — Amy Francetic/ Allison Myers, Buoyant Ventures

“Hired people faster!” — Hampus Jakobsson, Pale Blue Dot

“Spent more time educating myself on carbon sequestration and geoengineering.” — Jigar Shah, DOE

“We had a good year, but there were a few deals that didn't go through and if I implemented better stakeholder management strategies they could have.” — Nico Pinkowski, Nitricity

“In general, we value people who raise venture capital, but the people doing the most important work are the ones educating their community on the value of deploying clean technology. These are corporate sustainability managers, community leaders working in justice communities, students trying to get their colleges and universities to decarbonize, and labor leaders helping their members see a future in a new direction. This space is created by people who are largely underpaid and underappreciated that simply want to make their community a better place.” — Jigar Shah, DOE

“Unfortunately frontline communities who can directly speak to the impacts of climate change are woefully underrepresented in the traditional "climate tech space"; their views should be integrated into climate tech startups as they design and deploy their technologies.” — Amy Duffuor, Azolla Ventures (Prime Impact)

“Mayors and community-based organizations. Climate tech cannot be deployed without city and local leaders leaning in, taking political risk, mobilizing their constituencies, and opening trusted pathways of conversation and collaboration. We have to invest in these leaders. They are vastly undervalued and it's slowing climate progress.” — Dawn Lippert, Elemental Excelerator

“State governments are powerful forces of change for climate action, and often on the front lines. Local and state governments pioneer much of the policy that entrepreneurs need to solve climate problems!” — Kathy Hannun, Dandelion Energy

“Ocean technology. Kelp farms are undervalued carbon sinks, and mycelium has a huge potential as an alternative material source.” — Maria Fujihari, Sinai

“AgTech. We have to figure out how to feed billions with less arable land.” — Kiran Bhatraju, Arcadia

“Anyone working in the sequestration space across avoidance, sequestration, and the valorization of carbon. It won’t be possible to hit under 2C without it and the demand and pricing tailwinds are going to accelerate exponentially in the near term.” — Sean Hunt, Solugen

“The extraordinary pre-seed and seed funds and incubators that are germinating so many next gen climate tech companies.” — Andrew Beebe, Obvious Ventures

“The project financers. They’ve consistently deployed around ~$300B for the past few years. It has led to the solar and wind numbers we see today. We need them to do more!” — Ryan Panchadsaram, Speed & Scale

“Product managers.” — Nat Bullard, BNEF

“The entrepreneurs, founders, and executives who have relevant sector experience and have been through hypergrowth will be the scarcest resource in the coming years.” — Abe Yokell, Congruent Ventures

“Gender and ethnically diverse founders and CEOs who are not getting enough funding or traction. Lots of investors say they want to support but few are writing sizable checks” — Amy Francetic/ Allison Myers, Buoyant Ventures

“Electricians. Innovative facilities managers. CFOs who care about and understand climate science and economics. College students. Women and girls in developing countries most affected by climate. Multilateral development banks. Local, small-business entrepreneurs and project developers. Job training programs for climate tech and energy transition work. Government affairs professionals with real climate expertise who can make things happen at a local level. Community organizers.” — Scott Jacobs, Generate Capital

“The vibrant community of young people who are eager to jump in and solve big problems. If we can empower them, we will create a fast moving wave that will ultimately help us solve some of civilization's biggest problems.” — Shuo Yang, Fifty Years

“Chris Sacca… I can't believe no one knows who that guy is yet. He's going to be big!” — Dan Fitzgerald, Regen Ventures 🤣🤣

Takeaways from five days of hallway and main-stage conversations at NYCW

What ~300 exits over 3 years show about funding today's climate tech cohort

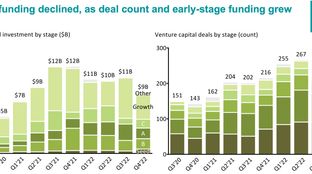

Fewer dollars, more climate innovation in 2022 climate tech market report