🌎 The UK digs deep for critical minerals #285

England strikes lithium and comes up with geothermal gold

Interviews with Energize Capital's John Tough and Planeteer's Sophie Purdom on recent fundraises

Happy Monday!

We sat down with two of climate tech’s most recent fundraising standouts — Sophie Purdom of Planeteer and John Tough of Energize Capital — to find out what it really takes to raise a fund today, where the biggest opportunities are emerging, and how AI is reshaping the landscape.

In deals, $406m for EV infra, $343m for energy storage, and $150m for fusion development.

In other news, the EU's on track for its climate targets, Meta's new risky nuclear deal, and more Trump tariffs.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

It’s no secret climate tech has hit a new normal, where investment numbers and round sizes are down. In today’s environment, VC investors are becoming increasingly skeptical of high valuations and averse to capital-heavy solutions, while hungry for those ever-elusive returns. This is creating a new sweet spot: AI-enabled early-stage small teams, delivering software-enabled solutions that won’t need many future rounds.

So what does this mean when it comes to raising funds or rounds right now? We’ve been tracking it all ahead of our H1 investment trends report, out later this month, and wanted to hear directly from two folks who’ve actually closed capital and lived to tell the tale.

First, our very own CTVC co-founder Sophie Purdom, who closed Planeteer Capital Fund I, a $54m first-time fund led solo, with a thematic focus on software, climate, and frontier tech, last week. At the same time, John Tough, managing partner at Energize Capital, a $1.8bn platform, closed its third venture fund with $430m.

While John brings a veteran lens from a multi-fund platform, Sophie’s got the on-the-ground reality of pitching as a first-time solo GP. The upshot? There’s still capital and conviction — if you know where to look.

Sophie: I pitched 400+ organizations over two years. What changed most was LP sentiment — and it swung wildly. We went from “What is climate tech?” to “Climate is too hot, we’re over-allocated.” From “We love first-time funds” to “We only want Fund IV.” From “We like solo GPs” to “We want to see a platform.” And most significantly from “We want impact” to “We want DPI.”

It’s Planeteer’s first fund, so I haven’t known any other market conditions — to put it in context, we did our first close during the SVB collapse. But the message of right-sized, thematic managers who can consistently identify the edge of the market and win allocation into the best companies will always resonate.

John: We launched our fundraise 15–16 months ago with a $350m target, wanting dry powder for what we expected to be a market reset. Since 2021–22, generalist interest has stepped back, rounds are more scrutinized, and “growth at all costs” has faded — and frankly, that’s made the space healthier.

Because this was our third fund, we focused almost exclusively on institutional LPs. 80% of our capital came from institutions — pensions, endowments, sovereign wealth — and they were very thorough. It’s not just about paper returns; they wanted to know if the marks were real.

We’ve also expanded globally. Over half our LP capital now comes from outside the US. Europe’s been much more steady-handed on ESG and impact, and that consistency helped us make the case.

Sophie: We’re deliberately small and nimble. I think the real play is an early-stage $50m–100m vehicle — you can lead, have control, and return the fund without suspending reality on outcomes.

We’re anchored by both an Ivy League endowment and a strategic co-investor. That mix helps — our LP base is diversified across global family offices, foundations, and a few corporates. It sets us up well to support our companies, and for fund II.

John: We saw the growth-stage stack deteriorating, so we increased the fund size to $430m to build in more reserves. Many of our LPs also wanted access to SPVs — so our total deployment capacity is likely double that. In this market, flexibility matters.

Sophie: We’ve made 8 investments so far, leading at pre-seed and seed. We often see two types of companies. First, hardware-enabled software — where data collected through a device powers a dual revenue model, and later, network effects from stacking insurance or financing.

Second, companies built around climate-driven volatility — pricing, risk, underwriting, data infrastructure. These often come from repeat founders re-entering climate with new tools like AI. It’s a wave of “climate fintech,” and we think it’s the next chapter of adaptation.

John: We focus on largely software and some services — capital-light ways to index into big infrastructure trends. With power demand rising for the first time in decades, grid interoperability, resilience, and interconnection are massive themes again. Industries, despite this administration, are still becoming far more decarbonized, and there are a lot of great tools helping them get there.

We’ve leaned more into circular economy and supply chain too. Younger consumers are far more educated about the ecological cost of their footprint. And tech adoption is catching up.

Another area is financial services. Catastrophe risk is rising, which creates a forcing function for adoption. We’re watching how this sector starts to engage on climate innovation.

Sophie: We’re moving from an era of flat energy demand to accelerating growth. Capitalism wants more stuff — and that shows up in compute, HVAC, and beyond. Efficiency alone won’t cut it. We need more electricity, better transmission, and serious drawdown solutions.

At the same time, AI makes it radically easier to build efficient companies. Every portfolio company we’ve backed has reorganized: fewer people, more output. Founders are hands-on builders. That means lower burn and faster inflection.

As a first-money-in investor, that changes everything. These companies don’t need as much capital. They might only raise once or twice. Series A funds will get squeezed unless they shift earlier.

It’s a threefold shift: AI and energy are creating opportunity areas, every company can hypothetically operate more efficiently, and fund structures need to adapt.

John: AI is a tailwind. It’s increasing power demand and accelerating enterprise buying cycles. Companies like Microsoft are acting like energy buyers — and that’s good for innovation.

Even our software companies interact with physical assets. AI makes things like image capture, training, and remote sensing more powerful. We’ll see more happening at the physical-digital edge.

Entrepreneurs are realizing this is a fundamentally different toolset. The customer doesn’t care if it’s AI or not — they just want answers. But the takeaway is: do more with less.

Sophie: The early stage is still robust. We’re seeing great founders come in — though it’s not the dominant narrative. The middle of the market is shakier. Many mid-performers won’t raise a series B. There’ll be rollups, write-offs, and consolidation, in messy and uninteresting ways. But the top companies are breaking out fast, and nimble early-focused funds will capture that upside.

John: It’s a great time to deploy. When it’s hard to raise, it’s usually the best time to invest. There are LPs still in education mode, but they’ll come around — especially if we show strong returns.

In the past few years, the biggest mistake generalists made was backing extreme tech risk just because of TAM. That never works in climate. The capital intensity is too high.

Now what we need are more wins on the board. That’s what will bring more capital back into the space.

⚡ TAE Technologies, a Foothill Ranch, CA-based field reversed configuration fusion developer, raised $150m in Corporate Strategic funding from Chevron, Google, and NEA.

🌬 Aerones, a Riga, Latvia-based wind turbine maintenance robots manufacturer, raised $62m in Series B funding from Activate Capital Partners, S2G Investments, Blume Equity, Carbon Equity, Change Ventures, and other investors.

💨 Treefera, a London, England-based forest data and carbon credit verification platform, raised $30m in Series B funding from Notion Capital, AlbionVC, Endeit Capital, Triple Point Ventures, and Twin Path Ventures.

🏭 Manex AI, a Rothenberg, Germany-based AI-driven manufacturing optimization platform, raised $9m in Seed funding from BlueYard Capital, Lightspeed Venture Partners, CDTM Venture Fund (Center for Digital Technology & Management), and DI Technology.

📦 Alrik, a Stockholm, Sweden-based construction logistics management software developer, raised $7m from People Ventures and Pi Labs.

🌱 Atmen, an Eching, Germany-based green certification platform, raised $6m in Seed funding from Project A Ventures, Revent, and Vireo Ventures.

💧 Kumulus Water, a Paris, France-based solar-powered clean water producer, raised $4m in Seed funding from Bpifrance, Flat6Labs, Kalys Ventures, PlusVC, and Spadel.

🌾 ClearLeaf, a San Pedro, Costa Rica-based agricultural emissions monitoring and analytics platform, raised $4m in Seed funding from Hawthorne Food Ventures and M7 Holdings.

⚡ Termina, a Melbourne, Australia-based automatic energy account switcher service, raised $2m in Seed funding from EVP, Archangel Ventures, and Skalata Ventures.

🌱 Groundley, a Copenhagen, Denmark-based construction logistics management platform, raised $1m in Seed funding from Export and Investment Fund of Denmark (EIFO).

🏭 REplace, a Tel Aviv, Israel-based AI-powered renewable and data center development platform, raised $2m Seed funding from Gravity Climate, Adam/a, Techstars, and Malbec Ventures.

⚡ Believ, a London, England-based electric vehicle charge point operator, raised $406m in Debt funding from Liberty Global, Zouk Capital, ABN AMRO, MUFG Bank, NatWest, and other investors.

🔋 GIGA Storage, a Santo André, Brazil-based large-scale energy storage developer, raised $343m in PF Debt funding.

⚡ Eavor, a Calgary, Canada-based geothermal energy developer, raised $65m in Growth funding from Canada Growth Fund.

⚡ Charbone Hydrogen, a Brossard, Canada-based green hydrogen producer, raised $50m in PF Debt funding from True Green Capital.

✈️ Eve Air Mobility, a São Paulo, Brazil-based electric aircraft manufacturer, raised $16m in Grant funding from FINEP.

Energize Capital, a Chicago, IL-based investment firm, announced $430m close of its Ventures Fund III, supporting asset-light climate solutions, with an emphasis on companies driving industrial digitization, next-generation infrastructure, and the energy transition.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate.

The EU is on track to reduce its greenhouse gas emissions by 54% by 2030, essentially meeting its legally-binding target of 55% reduction from 1990 levels. So far, it has reduced its emissions by 37%, while its economy has grown 70%. Still, some concerns arise over the rate of decarbonization slowing industrial productivity and making grids less reliable, as shown in Iberian Peninsula blackouts in late April.

Meta struck a 20-year deal to offtake from an Illinois nuclear plant owned by Constellation Energy. Rival Big Tech companies – including Google, Amazon, and Microsoft – have recently made similar nuclear deals to meet the prospective increase in energy demand, largely driven by AI. However, grid and ratepayer concerns persist, a similar plan from Amazon was blocked by US energy regulators last year..

Trump doubled steel and aluminium tariffs from 25% to 50%, in another attempt to force US businesses to buy from American suppliers. The move, effective June 4th, risks job losses domestically as well as in key supplier nations like Canada, and raises costs for American manufacturers. Though the UK secured an exemption maintaining its 25% tariff, other European producers warn that the hike will devastate exports to the US.

South Korea, one of only five countries that export GenIII+ nuclear reactors, recently elected nuclear-opposed president Lee Jae-myung, which could threaten South Korea’s competitiveness in the global nuclear export market. With French and US industries facing expensive delays and lacking strong domestic markets, China and Russia stand to gain the most. South Korea recently won a $18.7bn Czech contract to build two reactors, a decision challenged in court by France’s EDF alleging illegal state subsidies.

Andritz has opened a 1GW electrolyzer factory in Germany, making progress towards Germany’s plans for a nationwide hydrogen pipeline network. Using technology from Norwegian partner HydrogenPro, the first 100MW of machines will go to Salzgitter’s green steel project and another 100MW to a hydrogen project in Rostock.

Cleveland-Cliffs is backing away from its $1.3bn plan to convert its Ohio steel plant to run on clean hydrogen, citing a lack of hydrogen supply. The project received $500m in US government funding in 2024, but CEO Lourenco Goncalves now says the plan is unworkable without sufficient hydrogen and is in talks with the Trump administration to redesign the project around cheaper fossil fuels. The shift comes as proposed federal legislation threatens to eliminate hydrogen tax credits after 2025, putting many green hydrogen projects at risk.

First too little, now too late? NuScale’s small modular reactor design got NRC approval.

Waymo’s electric robotaxis accelerate past Lyft (in San Francisco’s rideshare market).

Credit where it’s due: Crux released a report on lending dynamics in US energy.

Solar surges and battery demand take charge in CAISO market dynamics.

Fusion spending doubles as suppliers warm up, but uncertainty puts a chill on scaling.

A $40bn green jolt for data centers, to keep AI from short-circuiting UK climate goals.

Invested in investment? Clean energy clears fossil fuels in the IEA 2025 report.

Fossil fuel spending is down, for the first time since the pandemic!

Cowabunga! Penguins dive off an iceberg in a photo from the Comedy Wildlife Awards.

📅 Capital in Concert: Unlocking Impact Across Asset Classes: On June 10, 2025, join us in New York for an evening exploring how capital can be orchestrated in service of the future, discussing philanthropic tools, values-aligned public equity strategies, and catalytic private investments.

📅 Female Founders & Funders Gathering: Join us on June 13, 2025 along with 150+ women building and backing climate solutions for an afternoon of connection and momentum during London Climate Action Week.

📅 CUR8’s Carbon Removal Summit at London Climate Action Week: Join us from 1pm for a half-day event bringing together senior leaders in business, finance, policy, and science to explore how carbon removals can drive business value in today’s changing political and economic landscape. Hear insights from sustainability leaders at Google, HSBC, Standard Chartered, Mercedes F1, Visa, Klarna, and more.

📅 VERGE at Trellis Impact 25: Join us October 28-30, 2025 in San Jose for three events at the intersection of climate and technology. Connect with 5,000+ professionals and 500+ speakers advancing decarbonization strategies and climate tech. Register by June 13 to save $500+ and use our partner code TI25SL for 10% off.

CTO/VP Engineering @Ezra Climate

Principle Engineer @Ezra Climate

Primary Engineer @Hitachi Energy

Senior Account Executive @Ecovadis

Technical Writer @Redwood Materials

IoT Systems Engineer @GlacierGrid

Manager, Operations and Compliance @Coalition for Green Capital

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

England strikes lithium and comes up with geothermal gold

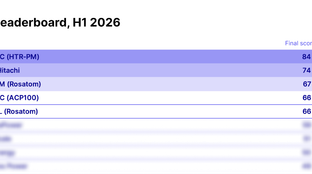

Small reactors, big power rankings

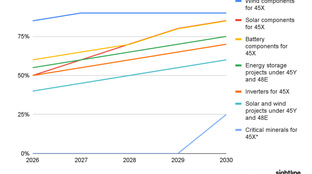

Stricter foreign sourcing rules reshape clean energy tax credit eligibility