🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

The gathering in Nairobi closed with calls for a global carbon tax and greater climate investment

Happy Monday!

An historic climate summit in Nairobi last week underscored the need for drastic changes in climate finance and clean energy development. Leaders sought to position the continent’s renewables potential and mineral resources as climate investment opportunities and get nations on the same page ahead of COP28.

Meanwhile, an auction in the UK highlights ongoing offshore wind challenges. The Biden administration is canceling drilling leases, and the Texas grid is once again facing emergency conditions.

In deals this week, decarbonized steel secures $1.6B. Battery recycling attracts another big check with a $542M Series D, and food recycling attracts $70M.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter at [email protected].

💼 Find or share roles on our job board here.

Diplomats, investors, and heads of state gathered in Nairobi, Kenya for the first-ever African Climate Summit last week.

Setting the scene: The goal of the event, which drew ~25,000 attendees, was to bring together national leaders to establish a shared position on climate priorities ahead of COP28 in November.

Disproportionate impacts: Home to 1.3 billion people and set to double in population by 2050, Africa is already experiencing some of the most extreme effects of climate change, despite accounting for ~4% of global annual GHG emissions and contributing a minuscule fraction of historic emissions.

The gathering underscored the need for changes to climate finance to avoid leaving the world’s most vulnerable nations unprepared and increasingly on the brink of debt crises as they face a future they did not create.

While African leaders remain somewhat divided on transitioning away from fossil fuels, the inaugural summit ended with a declaration signed by participating nations that included calls for:

Investors made announcements during the event totalling nearly $26B in capital to fund initiatives like solar microgrids, reforestation, and carbon credit purchases, but it’s still unclear how much of that intended money will actually be committed to projects on the continent.

The United Arab Emirates (UAE), host of this year’s UN climate summit, pledged $4.5B toward clean energy investments and $450M for carbon credits.

Much of the interest is in carbon credits, though African projects often draw less than 10% of the price per ton of carbon compared with other regions, and the voluntary carbon market has faced a slew of verification challenges.

Other foreign government and private sector announcements included:

Africa, along with much of the Global South, needs a lot more money in order to develop clean energy infrastructure and adapt to a changing climate. It would take some $277B each year to meet Africa’s 2030 climate goals, according to The Climate Policy Initiative, but annual climate finance to the continent today totals just $30B.

The deficit in climate funding is made worse by rising interest rates, which make it even more expensive for poorer countries to borrow money. The African Union became a permanent member of the G20 at the summit of the world’s 20 largest economies in New Delhi over the weekend, but so far G20 leaders have not made reforms to the World Bank recommended by their own independent expert group this year that could free up hundreds of billions of dollars for low- and middle-income countries to make urgently needed climate investments. Eyes are now on the World Bank/IMF meetings in Morocco in October for further progress.

🏭 H2 Green Steel, a Stockholm, Sweden-based decarbonized steel producer, raised $1.6B from Hy24, Altor, GIC, Just Climate, AMF, and other investors.

🔋 Ascend Elements, a Westborough, MA-based lithium-ion battery materials and recycling platform, raised $542M in Series D funding from Temasek Holdings, Qatar Investment Authority, Decarbonization Partners, Tenaska, Mirae Asset Global Investments, and other investors.

🏭 Boston Metal, a Boston, MA-based sustainable steel developer, raised $262M in Series C funding from Aramco Ventures, Baillie Gifford, Breakthrough, Microsoft’s Climate Innovation Fund, BHP Ventures, and other investors.

🛵 Ola Electric, a Bengaluru, India-based electric scooters provider, raised $140M from Temasek Holdings, Tiger Global Management, SoftBank, Matrix Partners India, Kia Motors, and other investors.

♻️ Mill Industries, a San Bruno, CA-based food recycling technology provider, raised $70M in Series C funding from Prelude Ventures, Lowercarbon, Google Ventures, and Energy Impact Partners.

🥩 Meati, a Boulder, CO-based alternative meat developer, raised $50M in Series C funding from Congruent Ventures and Revolution Growth.

🔋 Polarium, a Stockholm, Sweden-based energy storage system manufacturer, raised $48M from Vargas Holding, AMF and Alecta.

🛰️ GHGSat, a Montreal, Canada-based satellite-based emissions monitoring platform, raised $44M in Series C funding from Fonds de solidarité, BDC Capital, Investissement Québec, Climate Investment, and the Japan Energy Fund.

🌱 Certa, a San Francisco, CA-based procurement platform with ESG management tools, raised $35M in Series B funding from Fin Capital, Vertex Ventures, Tru Arrow Partners, Mantis VC, and GOAT Capital.

🏠 Ambient Photonics, a Mill Valley, CA-based photonics energy harvesting cells developer, raised $30M in Series A funding from Fine Structure Ventures, Helios Climate Ventures, Regeneration.vc, Sustainable Future Ventures, I Squared Capital, and other investors.

🏠 Nuventura, a Berlin, Germany-based developer of sulphur hexafluoride (SF6)-free switchgear technologies, raised $28M in Series A funding from Mirova, FORWARD.one, EIC Fund, IBB Ventures, ADB Ventures, and other investors.

🚢 bound4blue, a Barcelona, Spain-based turnkey wind-assisted sails for maritime transport, raised $24M in Series A funding from GTT Strategic Ventures, European Innovation Council, Shift4Good, Louis Dreyfus Company Ventures, Sustainable Ocean Alliance, and other investors.

💨 Lydian, a Salem, MA-based electrofuels developer, raised $12M in Series A funding from Congruent Ventures, Galvanize Climate Solutions, Grok Ventures, Voyager Ventures, Union Square Ventures, and other investors.

☀️ Okra Solar, a Sydney, Australia-based solar home systems provider for electrifying off-grid households, raised $12M in Series A funding from At One Ventures, Susquehanna Private Equity Investments, King Philanthropies, FMO, and Autodesk Foundation.

🏠 Lumen Energy, a San Francisco, CA-based clean energy platform for commercial buildings, raised $11M in Series A funding from Ajax Strategies, Lowercarbon, Designer Fund, Nuveen, and Bridge Investment Group.

💨 Spiritus, a San Francisco, CA-based direct air capture developer, raised $11M in Seed funding from Khosla Ventures and Page One Ventures.

🚗 e-mobilio, a Munich, Germany-based EV recommendation and buying marketplace, raised $10M in Series A funding from SET Ventures, Übermorgen Ventures, Wi Venture, seed+speed Ventures, Gateway Ventures, and other investors.

🏠 Arbor, an Austin, TX-based home energy solutions and analytics platform, raised $9M in Seed funding from First Round Capital, Obvious Ventures, and Spring Tide.

⚡ Ostrom, a Berlin, Germany-based digital energy solutions provider, raised $8M in Series A funding from SE Ventures, Union Square Ventures, Übermorgen Ventures, J12 Ventures, and Adjacent.

💨 Vaulted Deep, a Houston, TX-based biomass carbon removal and storage developer, raised $8M in Seed funding from Lowercarbon.

💨 Opna, a London, UK-based carbon project financing platform, raised $7M in Seed funding from Atomico, DBT Labs, Pale Blue Dot, MCJ Collective, Angelinvest, and other investors.

♻️ Waste Robotics, a Trois-Rivières, Canada-based autonomous recycling provider, raised $7M from Mirova.

🌳 Kind Designs, a Miami, FL-based company developing 3D printing for seawalls, raised $5M in Seed funding from Florida Opportunity Fund, GOVO Venture Partners, and M4 Investing.

🍎 altM, a Bangalore, India-based biomaterials platform from agricultural residue, raised $4M in Seed funding from Omnivore, Theia Ventures, and Thai Wah Ventures.

⚡ VOOL, a Tallinn, Estonia-based home EV charging provider, raised $3M in Seed funding from Specialist VC and Grant funding from the Estonian Government.

💸 ClimateAligned, a London, UK-based AI-driven sustainable finance platform, raised $2M in Pre-Seed funding from Pale Blue Dot and Frontline Ventures.

🚚 Stack AV, a Pittsburgh, KS-based autonomous trucking developer, launched with $1B in funding from Softbank.

Zenobē, a London, UK-based battery storage developer, was acquired by KKR and Infracapital for an undisclosed amount.

New Funds

Founders Future, a Paris, France-based investment firm, launched a $161M fund to invest in climate and AI startups.

EIT InnoEnergy, a Budapest, Hungary-based investment firm, raised $150M to continue investing in sustainable energy innovation.

China Media Capital, a Shanghai, China-based investment firm, raised $136M for its fund that invests in clean energy sectors.

Blackhorn Ventures, a Denver, CO-based investment firm, raised $100M out of its $200M target fund investing in early-stage companies solving hard-to-decarbonize sectors.

World Fund, a Berlin, Germany-based investment firm, added $55M for its fund that invests in climate tech companies.

Catalyst Fund, a Nairobi, Kenya-based investment firm, held a $8.6M first close of its $40M fund that will invest in African climate startups.

Share new deals and announcements with us at [email protected]

The Biden administration is canceling drilling leases in the Arctic National Wildlife refuge and protecting 10 million acres of Alaskan wilderness from oil drilling.

In its third round of carbon dioxide removal purchases, Frontier facilitated $7M in CDR purchasing from 12 startups. In one of the largest CDR deals to date, Microsoft made a $200M purchase from Heirloom Carbon in order for the company to meet its climate goals.

Toyota, among other Japanese automakers, is falling behind the electric push as EVs begin to take center-stage. Sales in China were down 15% YoY and are a shrinking segment of US car sales. Maybe Toyota is banking on recently announced plans for an EV with 900 miles of range by 2025 to put them back on the EV map.

Just after the wildfire ravaged through the country, Greece, Turkey, and Bulgaria suffered from extreme rains. Last month’s wildfires in Greece were the largest ever recorded in Europe and this rain was also an outlier.

Climate law tailwinds saw the US battery boom continue last week with a few major investments announced within the same 24 hours: Daimler Truck, Cumminsm and Paccar revealed a JV to invest $2-3B in cell production, while Blackrock and others backed Ascend Element with half a billion and Our Next Energy gained support from Oman’s wealth fund.

This summer was the hottest one recorded yet for the northern hemisphere since records began in 1940. Almost the entire world population was exposed to global warming at some point between June and September.

Texas pushed emergency operations on Wednesday evening for the first time since the winter freeze in Feb 2021. This time, the arctic freeze was replaced by scorching heat across Texas, made worse by stranded wind energy.

Following another exit by a key executive, Fortescue Metals (an Australian mining company) founder Andrew Forrest claimed the departures may be due to the strong push to hit real zero emissions by 2030.

Poland, one of the EU’s most coal-dependent nations, plans to establish its first Ministry of Energy Transition to manage the transition of the mining sector and the broader economy.

Findings from the first global stocktake show that while progress has been made, implementation must accelerate to meet Paris Climate Agreement goals.

Offshore wind is going through some hurdles. The UK energy auction secured zero offshore wind farms, almost ensuring a miss of the nation’s clean energy targets. In the US, Orsted announced a need for further government funding to invest in their offshore wind projects due to creeping inflation increasing project costs.

Why annual clean-energy matching =/= hourly matching.

You’ve heard of glaciers melting, but what about glaciers mating?

Tennis matches aren’t as quiet as they used to be. Climate activists interrupted play between Coco Gauff and Karolina Muchova at the US Open Semifinal.

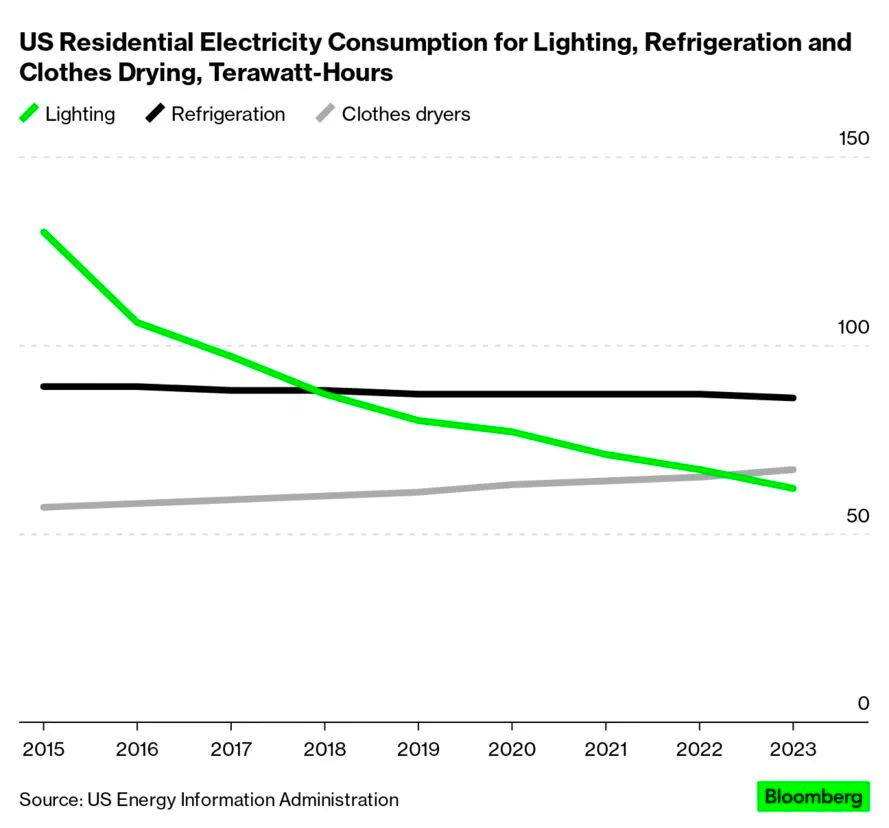

For the first time, keeping the lights on is using less energy than refrigeration in the US.

Being pregnant during sweltering summers is obviously uncomfortable, but hot weather also increases severe health complications, according to a new study.

Grid storage gets the NIMBY treatment.

A new material shows promise harvesting CO2 and water from the air using very little energy.

🗓️ Harvard Innovation Labs: Register to join Harvard Innovation Labs’ virtual classes starting Sept 8th regarding creating successful climate ventures.

🗓️ Out in Climate: Register to join Out in Climate’s Boston meetup on Sept 12th to meet other LGBTQ+ individuals in the sustainability space.

🗓️ The Edge: Infrastructure: Register to virtually join Keep Cool’s event on Sept 12th to discuss the future of infrastructure, ranging from deployment to monitoring.

🗓️ MaRS Discovery District: Virtually join MaRS Discovery District on Sept 20th as they announce their six carbon dioxide removal companies in their newest startup accelerator.

💡 Designer Fund Partnership: Apply by Sept 22nd to the Design Fund Partnership to receive investments and support from experts for your early stage startup.

Founder in Residence - Zero Emission Shipping, Founder - Industrial-scale Heat Pumps (Engineer), Founder - Decarbonizing Industrial Heat (Engineer), Associate - New Venture Creation in Climate @Deep Science Ventures

Product Manager - API Platform @Octopus Energy

Investment Associate @Scale Microgrids

Sustainability Manager @Statkraft

Director of Innovation, Senior Investment Manager @Elemental Excelerator

Community Solar Associate @Sunwealth Power

Senior Product Engineer - R&D @Crusoe

Senior Associate, Investment Analytics @Cypress Creek Renewables

Energy Business Analyst @Honda

Climate and Sustainability Leader @Arup

Investment Director (Venture Capital) @Robert Bosch Venture Capital

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond