🌎 The SMR shake-up #284

Small reactors, big power rankings

One Big Beautiful Bill ushers in new (and old) energy agenda

Happy Monday and welcome back from the Fourth of July weekend!

ICYMI, we dropped our H1 2025 funding report last week — and we’re digging into it live in a webinar tomorrow 👀 Join us tomorrow, Tuesday, July 8th, at 11 AM EST as we ride the highs, lows, and dramatic exits of the first half of 2025 and talk through the implications from OBBB in real-time. Sign up here.

Speaking of, last week had more fireworks than just at the barbecues. It also marked the passage of the “One Big Beautiful Bill,” a sweeping package of tax and spending cuts with big implications for climate and clean energy. We’ve got the breakdown below.

In deals, $1bn in utility-scale renewable energy development, $997m for EVs, and $162m for direct air capture technology.

In other news, the EU’s new climate goals, California’s new clean fuel rules, and MethaneSAT goes missing.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

After months of political wrangling, Congress has finally passed the “One Big Beautiful Bill” (OBBB). Pushed over the finish line by Vice President JD Vance’s tie-breaking vote in the Senate, this version — a reconciliation between the House and Senate drafts — spans hundreds of provisions touching taxes, healthcare, immigration, defense, and energy.

The 940-page package delivers Trump’s full domestic agenda in one sweeping stroke: it locks in the 2017 tax cuts and channels hundreds of billions in new funding toward immigration enforcement and defense. To help offset those costs, it slashes spending on Medicaid and clean energy, among other programs — the details of which have been fiercely fought over by House Representatives, Senators, and Trump himself. (Projections still show the legislation would add trillions to the federal deficit over the next decade.)

The devil’s in those details: The OBBB cements rollbacks to key Inflation Reduction Act (IRA) provisions, accelerates the sunset of a range of clean energy tax credits, and pushes fossil fuels. Still, it’s not as bad as it could have been, and there are even some surprising winners, like transferability, clean firm power, and grid.

As we’ve said before — and as Cleantech 1.0 showed — looming sunset dates can spur urgency, while states and companies often find creative workarounds and competitive technologies can still survive.

At the top level, the package resets US energy and climate policy, dismantling much of the IRA’s “more carrots” approach for clean energy and emerging climate technologies while doubling down on fossil fuel and domestic critical mineral production. Specifically, there are several changes to tax credits, the main engine of the IRA’s clean energy push.

Tax credit shifts in the new budget

Beyond these changes, the bill rolls back key federal climate programs and introduces provisions that favor fossil fuel expansion. It changes the DOE LPO’s remit to allow loan guarantees for initiatives that increase capacity, boost output, or provide dispatchable electricity to enhance grid reliability, shifting the program’s focus from solely reducing greenhouse gas emissions to improving overall energy supply.

The bill also allows expanded oil, gas, and coal leasing on federal lands and slashes royalties for coal producers. Billions are allocated to building defense stockpiles of strategic minerals. Additionally, the “foreign entity of concern” rules effectively bar Chinese-linked firms from participating in US clean energy supply chains.

Meanwhile, on the business side, the bill includes measures to spur investment and innovation: It implements 100% immediate expensing for R&D and capital investments, giving companies a major tax break to encourage domestic manufacturing and growth.

In short, this bill takes an “all of the above” approach to domestic energy production. And it’s some of the smaller levers that could have the biggest impacts. For instance, these tighter domestic content rules could still choke parts of the renewables supply chain. Foreign entity restrictions effectively lock out Chinese-linked firms, which supply many critical components for clean energy projects, raising uncertainty for battery and solar deployments already under pressure.

Still, by sector, clean firm power sources like geothermal and nuclear maintain their advantage in a grid hungry for 24/7 power, while biofuels and CCS stand to benefit from preserved incentives. However, hydrogen, EVs, and residential energy efficiency programs get hit hard. Still, grid modernization remains a DOE priority — critical as AI, EVs, and widespread electrification drive power demand ever higher. And pro-business tax breaks in the bill could give clean energy developers some breathing room, but the pivot away from climate-focused support and the introduction of new incentives for fossil fuels raise tough questions about the US path to decarbonization.

💨 Climeworks, a Zürich, Switzerland-based direct air capture technology developer, raised $162m in Growth funding from Partners Group.

🧱 Terra CO2 Technology, a Golden, CO-based supplementary cementitious materials developer, raised $124m in Series B funding from Breakthrough Energy Ventures, Eagle Materials, GenZero, Just Climate, Barclays Climate Ventures, and other investors.

📦 HIVED, a London, England-based all-electric delivery service provider, raised $42m in Series B funding from NordicNinja, Elemental Impact, Future Back Ventures, Marunouchi Innovation Partners, Planet A Ventures,and other investors.

⚡ Dexter Energy, an Amsterdam, Netherlands-based AI-driven energy forecasting platform, raised $27m in Series C funding from Klima, Alantra, ETF Partners, Mirova, Newion, and other investors.

⚡ Steady Energy, an Espoo, Finland-based nuclear residential heating developer, raised $12m in Growth funding from 92 Ventures, Local Tapiola, Move Energy, Tesi, and Valo Ventures.

🏠 Emerald AI, a Washington D.C.-based enables data center power consumption management platform, raised $24m in Seed funding from Radical Ventures, Amplo, CRV, NVentures, and Neotribe Ventures.

⚡ AssetCool, a Sheffield, England-based grid hardware developer, raised $14m in Series A funding from Energy Impact Partners, Extantia, NPIF - Mercia Equity Finance, and Taronga Ventures.

⚡ Tibo Energy, an Eindhoven, Netherlands-based smart grid energy management platform, raised $7m in Seed funding from KOMPAS, Hitachi Ventures, SET Ventures, Speedinvest, and WEPA Ventures.

🌾 Eeki Foods, a Kota, India-based climate-controlled vegetable farm operator, raised $7m in Series A funding from Sixth Sense Ventures.

🛵 Vok Bikes, a Tallinn, Estonia-based heavy-duty electric cargo bike manufacturer, raised $6m in Series A funding from SQM Lithium Ventures, Metaplanet Holdings, SmartCap, Specialist VC, and Sunly.

♻️ Woodchuck, a Grand Rapids, MI-based streamlines wood waste and biomass processing service provider, raised $4m in Seed funding from Alloy Partners, Beckett Industries, CMS Energy, and NorthStar Clean Energy.

🏭 Crosstown H2R, a Stuttgart, Germany-based gas turbine decarbonisation technology developer, raised $3m in Seed funding from 2100 Ventures, Ciri Ventures, Climate Insiders, SDAC Ventures, Swiss Federal Office of Energy (SFOE), and other investors.

🌱 Cosma, a Nice, France-based autonomous benthic monitoring technology developer, raised $3m in Seed funding from Ternel, Wind Capital, 50 Partners, Caisse d’Epargne, and Ifremer.

💨 SDS Separation, a Zwijndrecht, Netherlands-based carbon capture solutions service provider, raised $2m in Series A funding from Invest-NL and Percival Participations.

⚡ Currentt, a Leiden, Netherlands-based smart energy solutions developer, raised $2m in Pre-seed funding.

💧 FieldFactors, a Delft, Netherlands-based water management service provider, raised $2m in Seed funding from Connect the Drops, Amplifica Capital, Ofwat, Tailwind, and Vanzal Limited.

🚗 eMotion Fleet, a Shinjuku-ku, Japan-based fleet electrification services provider, raised $2m in Series A funding from Incubate Fund, Kyushu Open Innovation Fund No.2, Shikoku Electric Power, Shizen Energy, and Shutoken.

🏠 Tarnoc, a Delft, Netherlands-based electric turbine heat pumps manufacturer, raised $1m in Seed funding.

⚡ Clearway Energy Group, a San Francisco, CA-based utility-scale renewable energy developer, raised $1bn in Debt funding from Natixis Corporate & investment Banking,Canadian Imperial Bank of Commerce, KeyBank, MUFG Bank, National Australia Bank,and other investors.

🚗 Rivian, an Irvine, CA-based EV manufacturer, raised $997m in Post-IPO Equity funding from Volkswagen Group.

⚡ Creative Energy, a Vancouver, Canada-based district energy systems developer, raised $50m in PF Debt funding from Canada Infrastructure Bank (CIB).

💨 Catalyxx, a Chesterfield, MO-based bioethanol conversion technology developer, raised $43m in PF Debt funding from European Investment Bank (EIB).

🔋 Eos Energy Enterprises, an Edison, NJ-based battery energy storage developer, raised $23m in Post-IPO Debt funding from US Department of Energy (DOE).

🌾 Agrobiomics, a Copenhagen, Denmark-based biostimulants for crop health developer, raised $9m in Grant funding from European Innovation Council.

🧱 SaltX Technology, a Stockholm, Sweden-based molten salt energy storage developer, raised $5m in Post-IPO Equity funding from Holcim.

🌊 Minesto, a Kriebitzsch, Germany-based tidal and ocean current energy technology developer, raised $3m in Grant funding from Swedish Energy Agency.

⚡ Sparc Hydrogen, a Kent Town, Australia-based photocatalytic hydrogen technology developer, raised $2m in Grant funding from Australia's Economic Accelerator (AEA).

⚡ LBC Tank Terminals, a Rotterdam, Netherlands-based bulk liquid storage provider, was acquired by Mitsui O.S.K. Lines for an undisclosed amount.

✈️ Abundia Global Impact Group, a New York City, NY-based waste into renewable fuels conversion service provider, was acquired by Houston American Energy Corp for an undisclosed amount.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate.

The European Commission proposed a new 2040 climate target to cut net greenhouse gas emissions by 90% from 1990 levels, amending the EU Climate Law to provide certainty for investors and strengthen energy security. Following pressure from member states, the draft includes “flexibilities” such as allowing up to 3% of reductions via international carbon credits and the use of carbon removal technologies and off-EU projects. This softened approach could accelerate clean tech and carbon removal deployment but raises questions about the EU’s reliance on offsets in its energy transition strategy.

California’s updated Low Carbon Fuel Standard regulation went into effect last week, tightening carbon intensity targets for transportation fuels and requiring producers to cut emissions or buy credits from cleaner fuel and electricity suppliers. The changes aim to revive a depressed credit market following a renewable diesel glut since 2021 and redirect public and private investment toward low-carbon fuels and EVs. While the move could accelerate electrification, it also risks political backlash over potential gasoline price increases during the energy transition

In other EV news, Chevron purchased 125,000 lithium-rich acres in Texas and Arkansas, following the footsteps of other oil majors into the lithium market. The acquisition of the acreage, secured from TerraVolta Resources and East Texas Natural Resources, signals a push for critical EV minerals and at least a modest level of confidence in continued EV demand.

The EDF’s $88m methane monitoring satellite has gone offline and is likely irrecoverable. MethaneSAT, launched in March 2024 and funded by the Bezos Earth Fund and New Zealand Space Agency, among others, had been collecting methane emissions data over the past year. The organization said it plans to continue to use the insights and push for more methane monitoring in the future.

Korea Zinc invested $85m into The Metals Company to support its application for a commercial deep-sea mining permit to harvest battery metals from the ocean floor. The deal gives Korea Zinc a 5% stake and options to buy more shares later, and could reduce US dependence on China for many critical minerals, although this exploration is still illegal under UN guidelines.

Germany’s new draft budget slashes hydrogen and industrial decarbonization funding, cutting the national hydrogen strategy’s medium-term budget by a third and industry decarbonization funds from $28.8bn to under $2.4bn. On the other hand, Hyundai unveiled plans for a $6bn hydrogen-integrated steel mill in Louisiana, aiming to launch by 2029 as part of a broader strategy to build a statewide hydrogen ecosystem, reflecting the mixed signals in the sector.

ENGIE powers up MENA’s largest wind farm, a sweeping four months ahead of schedule!

Meanwhile, a power line for midwestern windfarms is facing investigation plus potential delays.

Trash collecting drones are cleaning up Mount Everest litter in record time.

Global oil to peak by 2030 and a focus on critical minerals, among other predictions from the IEA in their big beautiful oil report.

Delhi’s artificial rain washes out deadly smog.

The new green card: Australia is offering a special climate visa to Tuvalu.

The federal website hosting climate reports went dark.

From bust to boom: Lyten recharges Northvolt’s old factory.

💡 Climatebase Fellowship: Climatebase is now accepting applications to Cohort 8 of their flagship program designed to help mission-driven professionals transition into or advance their careers in climate.

💡 2025 Pitch Fest: Realize 2050 and Pacific Gas and Electric Company are launching an open call for novel technologies that tackle some of the toughest challenges facing the California grid. Applications open July 7, with up to $25m in funding to be awarded before year-end.

📅 PNW Climate Week: Join climate professionals in the Pacific Northwest from July 16-25 for a week of climate panels, networking, demos, and more.

Process Engineer @Huminly, Inc.

Project Management Specialist @Hitachi Energy

VP of Engineering @Arbor

Sustainability Analyst @Ecovadis

Scientist I @Sublime Systems

Head of Distribution @Floodbase

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

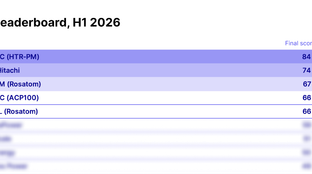

Small reactors, big power rankings

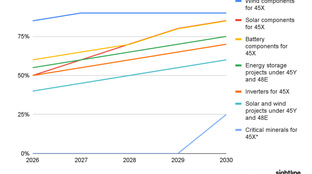

Stricter foreign sourcing rules reshape clean energy tax credit eligibility

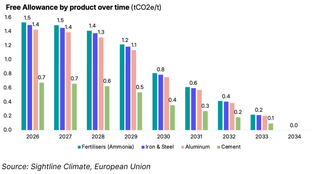

We did the EU carbon math