🌎 Taxing times for CCUS #254

OBBB blows tailwinds through CCUS, but takeoff stalls

Happy Monday!

New projects announced in recent weeks could supercharge clean hydrogen growth in the US. Bolstered by IRA incentives, electrolyzer manufacturers are mapping out plans to rapidly expand production, with new facilities that would more than 4x global capacity.

Meanwhile, California passes the world’s first total ban on diesel trucks. A cash crisis puts the brakes on Lordstown Motors’ EV production and El Nino is bringing serious heat.

In deals this week, $70M for two startups developing tools for smarter energy consumption in buildings, $37M for electric ride hailing, and $30M for cleaner combustion engines.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter here.

💼 Find or share roles on our job board here.

The race to scale clean hydrogen is heating up in the US. Over the last two weeks, electrolyzer-makers Ohmium, Electric Hydrogen (EH2), and Nel all announced plans to build new production capacity.

Hydrogen is critical to reaching decarbonization goals, particularly in heavy industry. And electrolyzers are the enabling tech for clean hydrogen, using electricity to split apart the hydrogen and oxygen that make up water molecules.

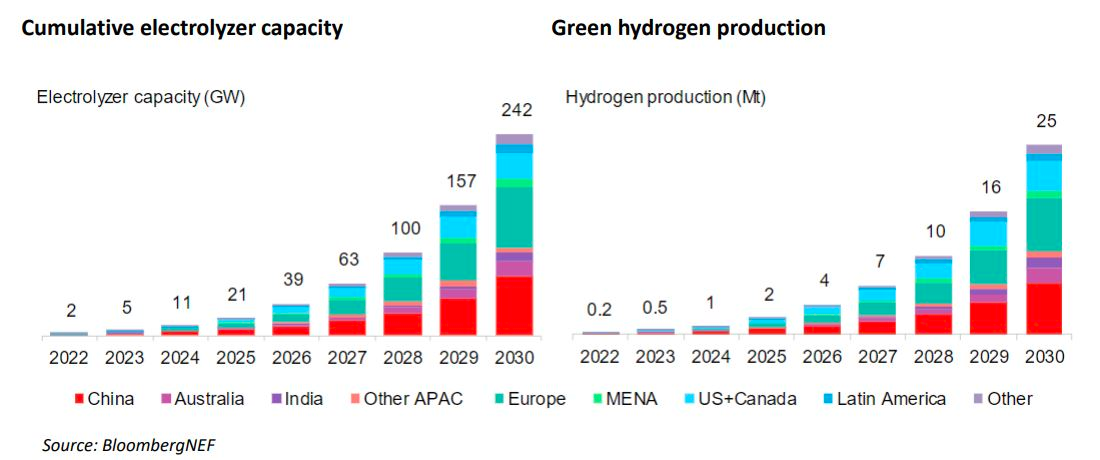

Last year, global installed electrolyzer capacity was ~2GW, up from less than 0.5 GW in 2021. These three projects alone could produce enough electrolyzers to more than 4x current capacity.

These announcements come as DOE determines how to deploy the $8B for clean hydrogen hubs included in the IRA (applications for the regional hubs closed last month) and President Biden commends manufacturers like Cummins that are ramping up production of electrolyzers.

The IRA also includes a clean hydrogen production tax credit (PTC) of up to $3/kg, which could help drive grow US production from < 1M metric tons annually to ~10M tons in 2030.

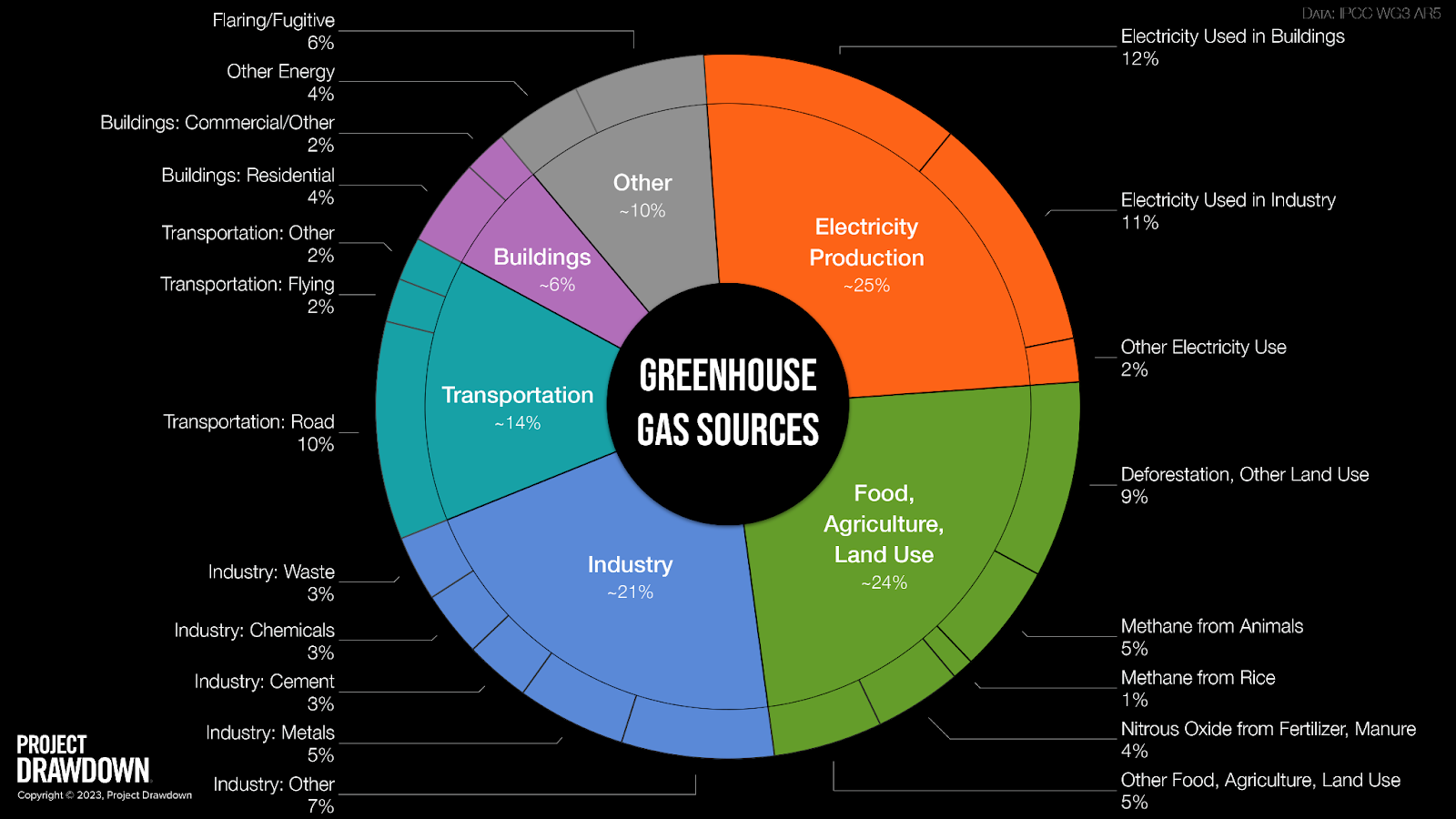

DOE estimates that hydrogen can play a role in decreasing as much as 25% of all energy-related CO2 emissions, but it needs to scale up fast. By 2030, the capacity of electrolyzers installed globally could increase by well over 100x as ~$130B is poured into production.

Right now, China produces most of the world’s electrolyzers and has a cost advantage—Chinese alkaline electrolysis systems cost ~$343 per kilowatt, compared with $1,200 per kilowatt in the US and Europe.

In an attempt to avoid the same pitfalls as the domestic solar industry, which lost market share and pricing power to China, the US is picking up the pace and building out more alkaline electrolyzer manufacturing.

There are still some material questions about how best to scale H2 production and set agreed-upon standards for “clean” hydrogen.

The H2 rainbow—from black and gray to blue and green—is much less useful in determining which types of hydrogen are a net benefit than just calculating the GHG emissions generated from producing it. Qualifying as "clean" means considering lifecycle emissions, including factors like the source and location of the electricity being used. Then there are the transportation and leakage challenges.

But clean hydrogen will play an important role in reaching decarbonization goals, and the US is setting the stage for domestic production.

🏠 Redaptive, a San Francisco, CA-based energy-efficiency-as-a-service provider, raised $50M in Growth funding from Linse Capital.

🛵 BluSmart Mobility, an Ahmedabad, India-based electric ride hailing company, raised $37M in Series A funding and $5M in debt financing from BP Ventures and Survam Partners.

🚗 MayMaan Research, a Hollywood, LA-based clean combustion engines company, raised $30M in Series A funding from WAVE Equity Partners.

🏠 BrainBox AI, a Montréal, Canada-based autonomous building technology company, raised $20M in Series A funding from ABB and Government Of Quebec.

🧱Partanna, a Nassau, Bahamas-based carbon-negative building material startup, raised $12M in Pre-Seed funding from Cherubic Ventures.

🔋 Chemix, a Sunnyvale, CA-based AI-based EV battery development platform, raised $10M in Seed funding from Ibex Investors, Mayfield Fund, and Radical Ventures.

♻️ ecoSPIRITS, a Singapore, Singapore-based low-carbon spirits distribution company, raised $8M in Series A funding from Closed Loop Partners, Pavilion Capital, and Proterra Asia.

☔ Frontline Wildfire Defense, a San Francisco, CA-based wildfire defense company, raised $6M in Seed funding from Echelon.

💸 Green-Got, a Paris, France-based green banking service, raised $5.5M in Seed funding from Pale Blue Dot and Equity crowdfunding through Crowdcube.

🔋 Altris, a Sweden-based sodium-ion battery manufacturer, raised $5M in Bridge funding.

☀️ Navitas Solar, a Surat, India-based solar module manufacturer, raised $5M in Growth funding from Lemon Emerging Ventures and Parishi Diamond Group.

⚡ Kazam, a Mumbai, India-based EV charging management software provider, raised $4M in Series A funding from Avaana Capital, We Founder Circle, Inflection Point Ventures, and Third Derivative.

⚡ ecoplanet, a Munich, Germany-based B2B energy platform, raised $3M in Seed funding from Gerhard Cromme and HV Capital.

⚡ Sniffer Robotics, an Ann Arbor, MI-based developer of methane emission detection drones, raised $2M in Seed funding from Michigan Angel Fund.

💧 Spacedrip, a Tallinn, Estonia-based water treatment systems company, raised $2M in Venture funding from Eigenkapital, Kuldar Väärsi, Taavi Veskimägi, and Vestman Energia.

☀️ Solar Ladder, an Andheri, India-based rooftop solar installation management platform, raised $1M in Seed funding from Aditya Bandi, Axilor Ventures, Deepak Jain, DevCo Partners, Subin Mitra, Titan Capital, and Varun Alagh.

🧪 Insectta, a Bukit Merah, Singapore-based biomaterials from insects developer, raised $1M in Seed funding from Glocalink Singapore, Paragon Capital Management Singapore, Seeds Capital, and Trendlines Group.

⚡ SMPnet, a London, UK-based real-time energy network optimization company, raised $1M in Seed funding from Marathon Venture Capital.

💨 Athian, an Indianapolis, IN-based livestock carbon marketplace, raised an undisclosed amount in Seed funding from DSM Venturing and California Dairies.

🌱 Bend, a New York, NY-based carbon removal corporate spend company, raised an undisclosed amount in Seed funding.

💨 Carbon Capture Scotland, a Crocketford, United Kingdom-based company capturing CO2 produced from organic processes such as whisky fermentation, raised an undisclosed amount in Seed funding from Steyn Group.

🌾 Sentera, a Saint Paul, MN-based agriculture insights company, raised an undisclosed amount in Series C funding from Continental Grain Company and S2G Ventures.

⚡ Avaada, a Mumbai, India-based green hydrogen ammonia producer, raised $1B in funding from Brookfield Renewables.

⚡ Serentica Renewables, a Gurgaon, India-based renewables developer for hard-to-abate industries, raised $250M from KKR.

✈️ Joby Aviation, a Santa Cruz, CA-based electric vertical take-off and landing company, raised $180M from Baillie Gifford.

✈️ Lilium, a Munich, Germany-based electric air taxi company, raised $100M out of a $250M round from Aceville, an affiliate of Tencent.

⚡ Xcel Energy, a Minneapolis, MN-based electric utility, received a $20M grant from Breakthrough Energy for projects using Form Energy’s iron-air battery.

🥩 Above Food, a Regina, Canada-based Vertically-integrated plant-based food solutions, announced a SPAC merger with Bite Acquisition Corp at an implied valuation of $319M.

🔋 Eclipse Energy, a Greenfield, IN-based battery testing and validation services company, was acquired by Blue Whale Materials.

⚡ True Green Capital Management acquired a majority stake in CleanChoice Energy, a Washington, DC-based renewable energy supplier.

Mitsubishi has launched a $1B decarbonization fund, alongside partners MUFG and Pavilion Private Equity to invest in climate tech companies.

Energy Impact Partners has closed $112M for their Elevate Future Fund, which focuses on investing in diverse founders driving the clean energy transition.

The51 Food and AgTech GP, a Canada-based investment firm, raised $30M towards their first fund, which invests in diverse founders across the food and agtech sectors.

The Yield Lab Latam, an Argentina-based investment firm, raised a $20M fund to invest in agtech companies.

Gigascale Capital, a climate investment firm founded by the ex-CTO of Meta investing in early climate hardtech solutions, launched with an undisclosed amount.

Folium Capital, a Burlington, MA-based investment firm, launched a new fund to invest in forest and agriculture assets.

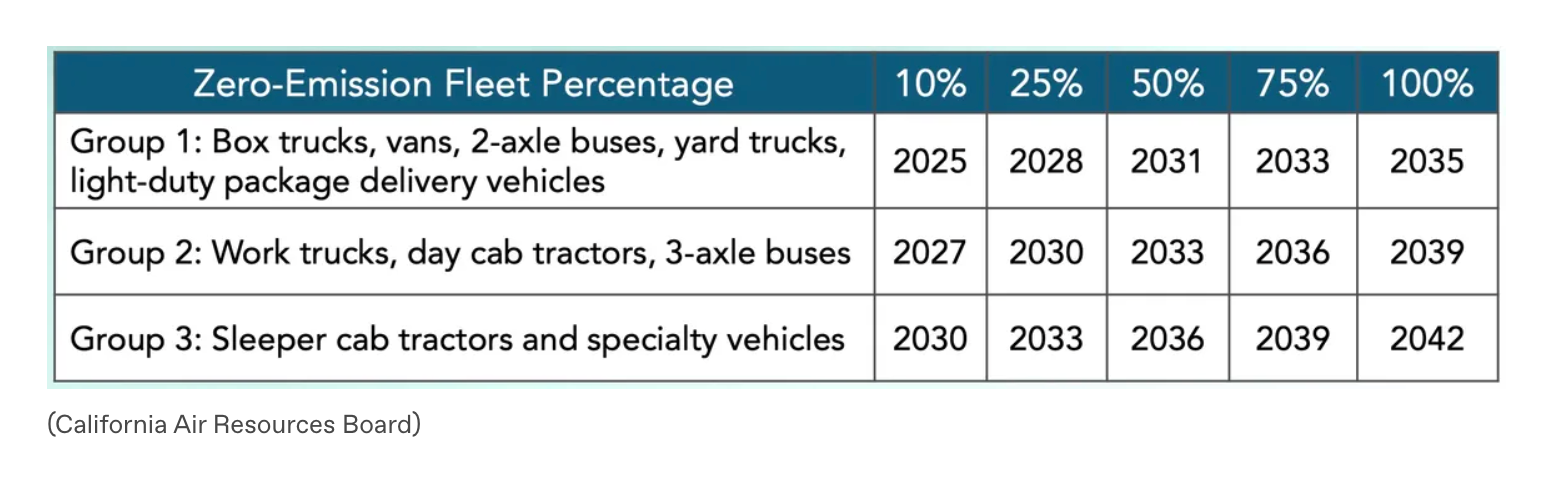

California unanimously approved a ban on the sale of diesel trucks. It’s the first regulation in the world that requires trucks to get rid of internal combustion engines and requires that all fleets be emissions-free by 2042.

Google’s promise to remove ads from Youtube videos and consequently ad revenue for users who deny climate change is under scrutiny after a report this week highlighted the continued proliferation of ads on videos portraying climate change as a hoax or exaggeration.

Global temperatures are expected to reach new records with the predicted onset of El Nino. La Nina, in effect for the past three years, had been providing some cooling relief.

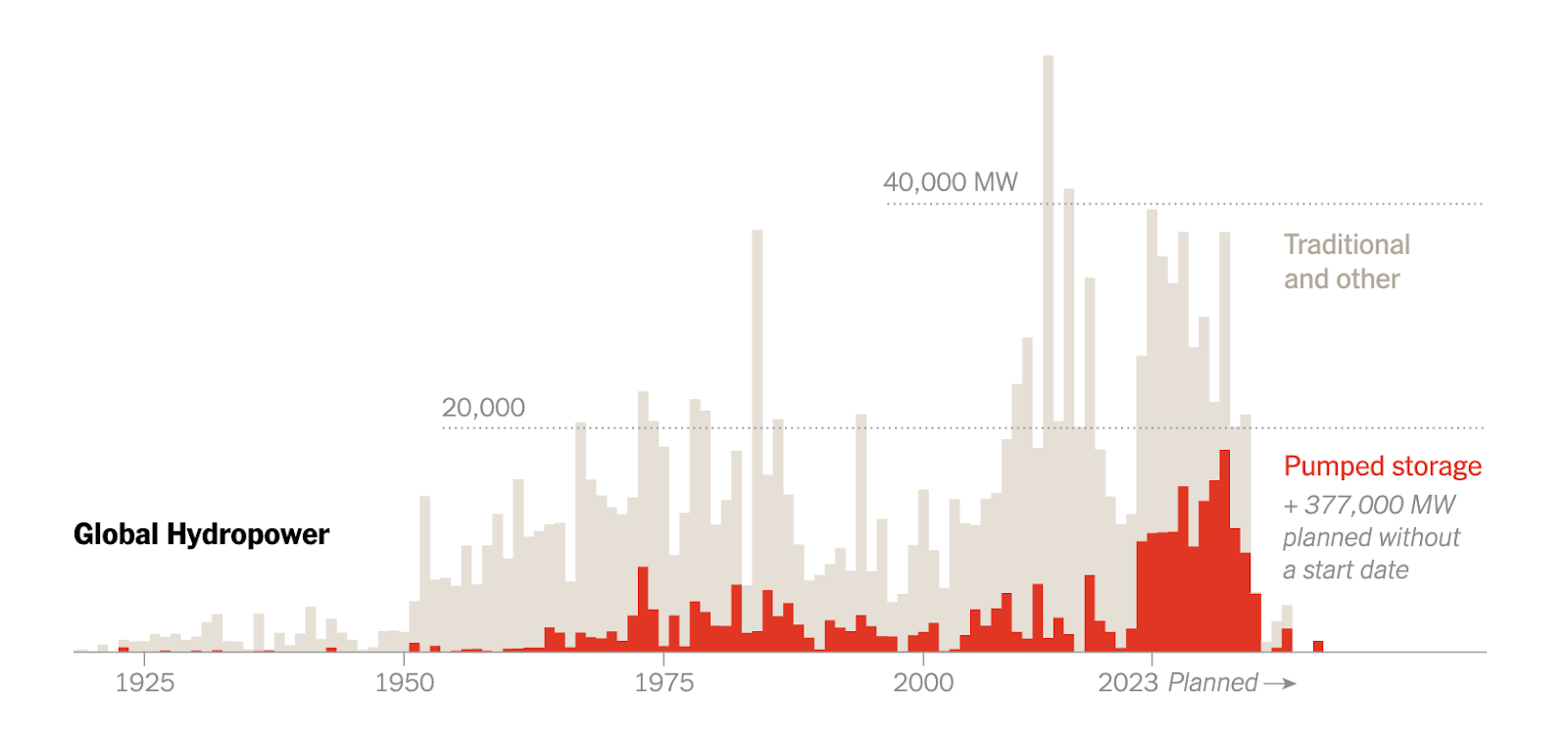

Hydroelectric projects globally are picking up momentum, with a shift toward pumped storage rather than traditional dams.

Lordstown Motors, the Ohio-based electric pickup truck startup, expects to end production of its EV pickup and potentially face bankruptcy if it can't salvage its funding and production deal with manufacturing giant Foxconn.

Westinghouse, a U.S. electric power and manufacturing company, unveiled a new small modular reactor (SMR) at 300 MW capacity that could replace coal plants and power industries like water desalination. Nuclear SMRs are meant to fit new applications and be sited at a wider range of locations than traditional reactors.

In one of the farthest-reaching efforts yet by U.S. Republicans opposed to sustainable investing, Florida governor Ron Desantis signed a bill into law that bars state officials from investing public money to promote environmental, social, and governance goals, and prohibits ESG bond sales.

Meanwhile, the European investment industry is bracing for funds to revert from Article 8 back to 9 following the EU’s recommendation to allow fund managers themselves to define what they mean by sustainable, rather than adhering to EU’s Sustainable Finance Disclosure Regulation (SFDR) classifications.

Schools across Europe are staging climate protests to call for more action on climate with 22 institutions being shut down as part of the proposed month-long campaign.

Chemical plants in China and the U.S. continue to emit N2O (Nitrous Oxide), a pollutant 273 times more potent than CO2. A byproduct of highly durable plastic used in airbags and tires, N2O is not currently regulated by either government.

India removed a key clause from a final draft of its energy policy and plans to stop building new coal-fired power plants, apart from those already in the pipeline.

Mental health awareness month, climate tech founder edition.

Mexico is seeding clouds to make it rain as it battles drought, but scientists warn evidence the practice works is barren.

Diamond List is dripping this year.

Calling all software engineers, a new platform for software jobs at top climate tech cos.

NOAA researchers want to live in an underwater space station.

Climate dads are real and walk among us!

Diamond List is dripping this year.

VPPs vs. peaker plants—DERs are a real contender.

Mapping drawdown: The science and strategies for prioritizing climate solutions.

Don’t say climate? The new Utah education bill could strike “climate change” from the curriculum.

From LCOE to CoC: IRENA’s report breaks down the cost of capital for renewable energy financing, and more.

How climate change will reshape where Americans live.

Battery bonanza: The US and its partners would need 10X of the lithium supply in their countries to meet 2030 demand.

🗓️ Sustainable Investment Forum: Attend the 6th annual Sustainable Investment Forum Europe in Paris on May 9th to learn about effective ESG risk management and greenwashing mitigation.

🗓️ Greentown Labs Buildings Sector Pitch Day: Join Greentown Labs on May 10th for a program featuring discussions, pitches, and networking regarding emission reduction within the buildings sector.

🗓️ Greentown Labs Go Move Showcase: Join Go Move’s final showcase on May 11th to see their Move 2022 cohort present their decarbonization technologies and future plans.

🗓️ Climate Transformation Summit: Virtually join the Climate Transformation Summit from May 11th-12th to attend interactive panels and discussions from experts and leaders within the climate transformation space.

💡 Frontier Climate RFP: Apply to Frontier’s RFP by May 19th to receive pre-purchase agreements for your carbon removal technologies.

💡 Village Capital: Apply by May 25th Village Capital’s accelerator program, Climate Justice for Migrants & Communities of Color, that supports startups that are developing solutions for groups who were disproportionately affected by climate change.

🗓️ Change Now Summit: Attend ChangeNow 2023 from May 25th-27th in Paris to interact with impactful decision makers and leaders in the global climate transformation space. The summit features over 400 speakers and attendees from over 120 countries.

💡 Joules Accelerator Cohort 12: Apply to the 12th Cohort of Joules Accelerator by June 1st to receive support for your climate and energy solutions.

Head of Engineering, DAC Venture (Stealth) @Deep Science Ventures

Associate, New Venture Creation in Climate @Deep Science Ventures

Chief of Staff @Euclid Power

Senior Expert, Environmental & Social Management @Finance in Motion

Senior Investment Manager in Renewables (f/m/d) @Finance in Motion

Senior Associate, Planetary Health @RA Capital Management

Investment Associate @Designer Fund

Chief Commercial Officer @Resonant Link

Director, Innovative Climate Finance @US IDFC

Managing Director, Upstream Climate Pipeline Development @US IDFC

Head of Investment @Rewiring America

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

OBBB blows tailwinds through CCUS, but takeoff stalls

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook