🌎 A weak $11.3bn start to 2024

Poor performance this half as investment falls to 2020 levels, but some strong plays.

A half year in climate tech, measured across ~250 deals via ~1k firms

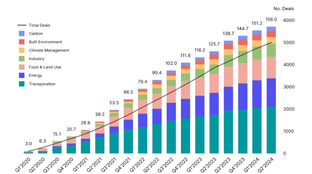

Over the last 18 months, Climate Tech VC has obsessively reported on the explosion of activity in climate tech investing. We’ve tracked ~1,000 unique investors who have collectively participated in funding ~600 venture capital climate tech deals since Q2 2020. Our end of year 2020 Roundup shared some high level takeaways, but the velocity of the past 6 months has 2021 already feeling like an entirely different market.

TL;DR climate is heating up, more traditional investors are participating, and there are more cross-sector opportunities than ever before.

Not a subscriber yet?

💰 In the first half of 2021, climate tech startups raised ~$16b across ~250 venture deals

💼 ~1,000 investment firms joined at least 1 climate tech deal from Q2’20 to Q2’21, with ~50 firms backing 5+ climate tech deals

📈 Compared to just a year before, there were ~50% more climate deals in Q2’21 vs Q2’20

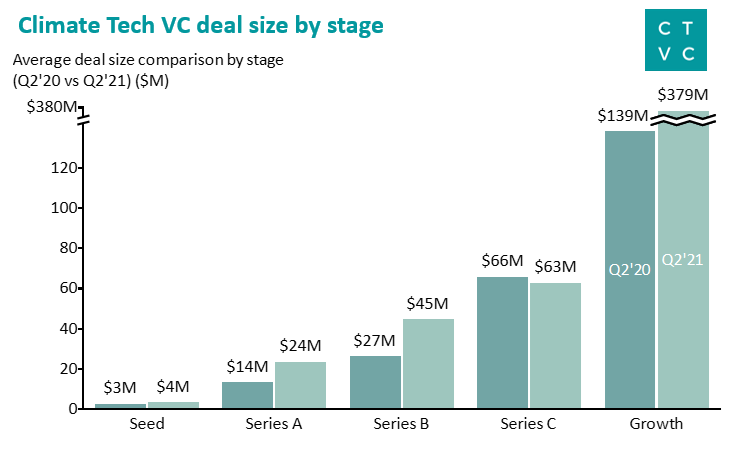

💸 In Q2’21, Series A deals were double the average size of same stage deals from a year before; meanwhile, Growth deals have tripled in size

🚚 Mobility sector deals are the largest on average, and make up ~50% of total H1 2021 funding

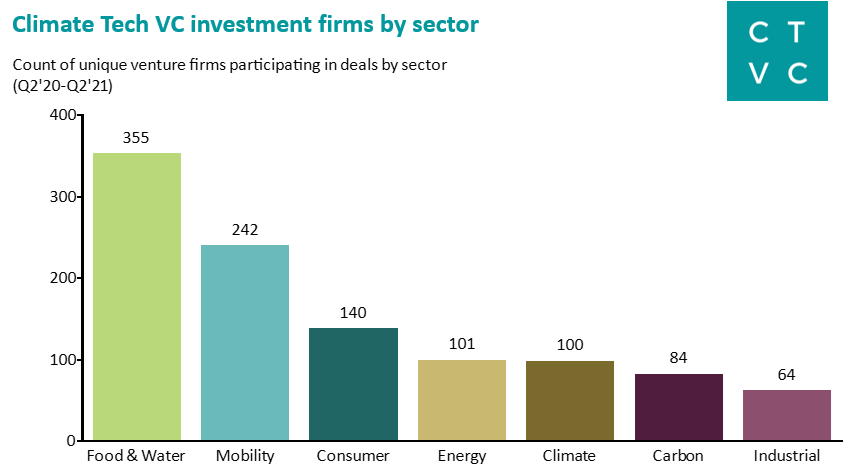

🌱 Food & Water and Mobility attract the greatest diversity of investment firms; over half of climate tech investors are active in these two sectors

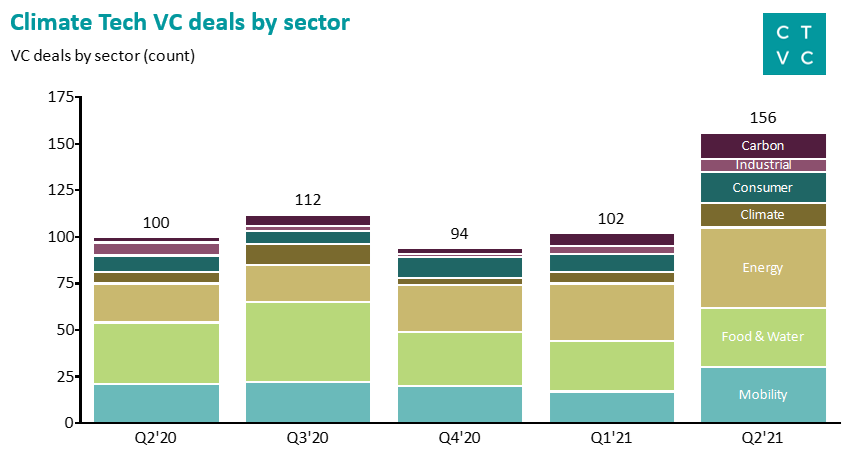

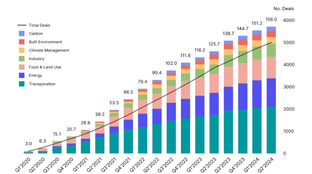

~250 unique climate tech venture deals occurred in the first 2 quarters of 2021. Q2’21 exhibited a ~50% increase in deal activity compared to the prior 12 months, with a considerably greater number of Energy sector deals.

~$16b of climate tech venture capital funding was announced in H1 2021. Relative to the count of deals by sector, Mobility punched above its weight in terms of average deal size. >50% of venture capital funding in H1 2021 was committed exclusively to Mobility deals. Though more nascent climate tech sectors like Climate, Consumer, Industrial, and Carbon have begun to increase in deal count, their smaller deal sizes mean that these nascent sectors remain a small percentage of total climate tech venture funding.

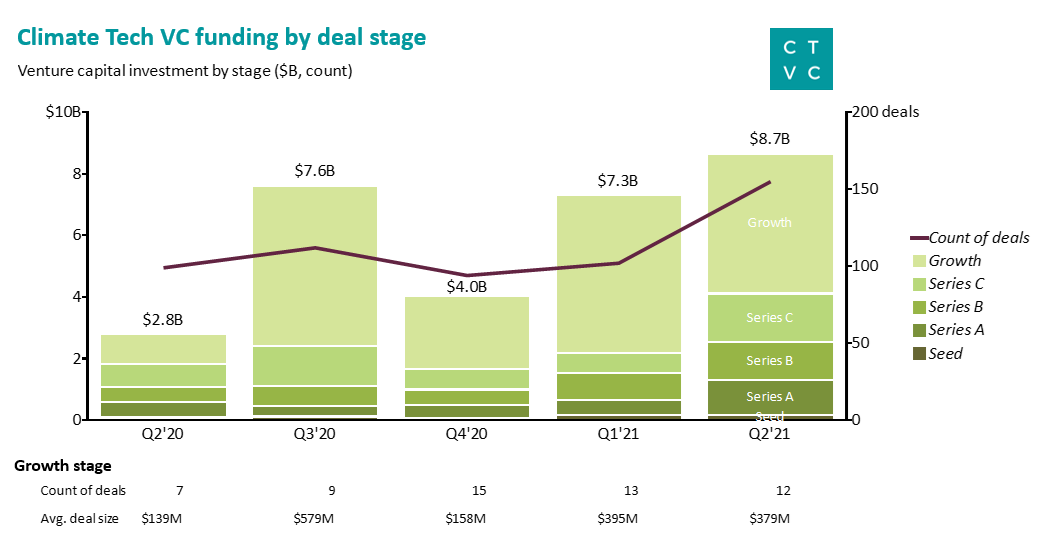

Compared to the 4 prior quarters, in Q2’21 pre-Growth stage deals like Series A, B, and C commanded relatively more climate tech venture funding as both the count and size of pre-Growth deals increased. Overall, Growth deals (expectedly) make up >50% of total climate tech venture capital funding.

Compared to just a year before, the average deal size of every stage of climate tech deals increased (except Series C). Of particular note, Series A deals in Q2’21 are double the average size of same stage deals from a year before. Meanwhile, Growth deals in 2021 are triple the size of Growth deals in 2020 - likely buoyed by vast quantities of institutional ESG capital and SPACs.

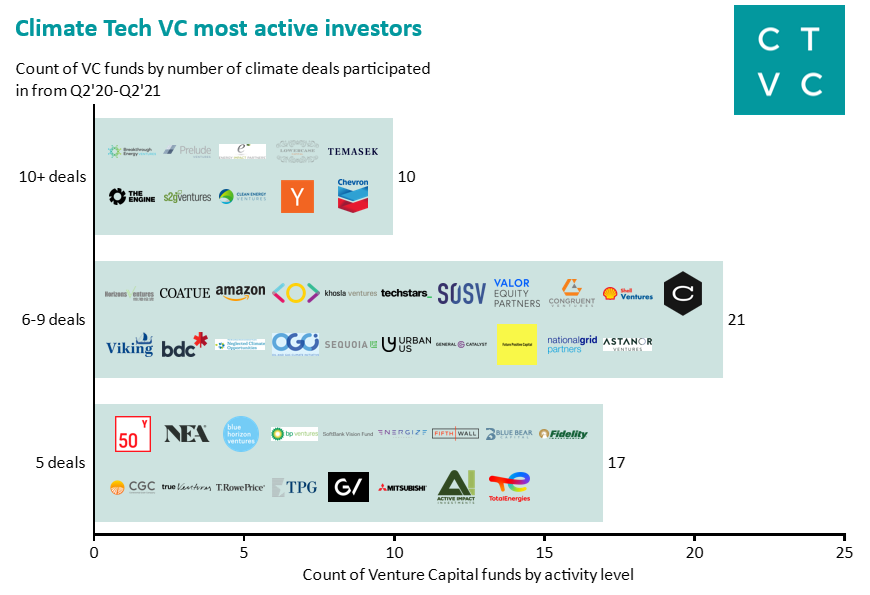

From the last half of 2020 through the first half of 2021, 48 investment firms participated in at least 5 unique climate tech deals each. 10 investment firms busily participated in over 10 deals, with Breakthrough Energy Ventures joining 30 deals - nearly double that of the next most active firm. ~1,000 unique investment firms joined at least 1 climate tech deal from Q2’20 to Q2’21.

Of all of the unique investment firms who participated in climate tech deals from Q2’20 to Q2’21, over half funded deals in Food & Water and Mobility. Given these two sectors’ ubiquity in everyday life, it’s logical that a diversity of traditionally non-climate investors are drawn to these broad appeal categories.

We’re obsessed with this market and are building up our understanding with a deal-by-deal database of where investors and operators play in climate tech. We’ll continue drop digests like this one to inform operators, investors, and those interested in getting into climate tech - so look out for more coming from us. Thoughts, insights, or questions? Send us a note! 📩

Poor performance this half as investment falls to 2020 levels, but some strong plays.

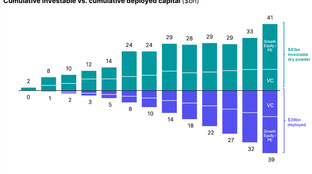

$82bn of new capital for climate tech in the past 6 months

A new interactive Climate Capital Stack Map