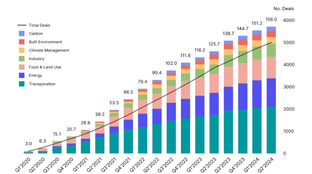

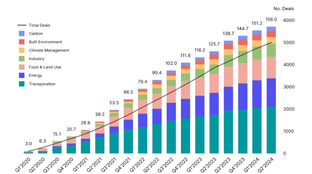

🌎 A weak $11.3bn start to 2024

Poor performance this half as investment falls to 2020 levels, but some strong plays.

A list of and conversation with the leading CVCs investing in climate innovation

Amidst the rise of climate tech venture funders and newly green-reformed PE Goliaths, another actor has quietly been capitalizing climate startups. This week, we shine a light on Corporate Venture Capital funds investing in innovation to decarbonize their respective industries.

First, let’s set the stage for this rapidly-growing asset class - corporate venture capital, or CVC, broadly describes the investment of corporate funds directly in external startup companies. There’s a couple ways this can break down as: 1) individual direct investments off the corporate balance sheet; 2) investing as LPs into independent VC funds; or 3) setting up an independent true fund structure where the corporate sits as the sole LP. For the purposes of our definition, we’ll focus on this last bucket.

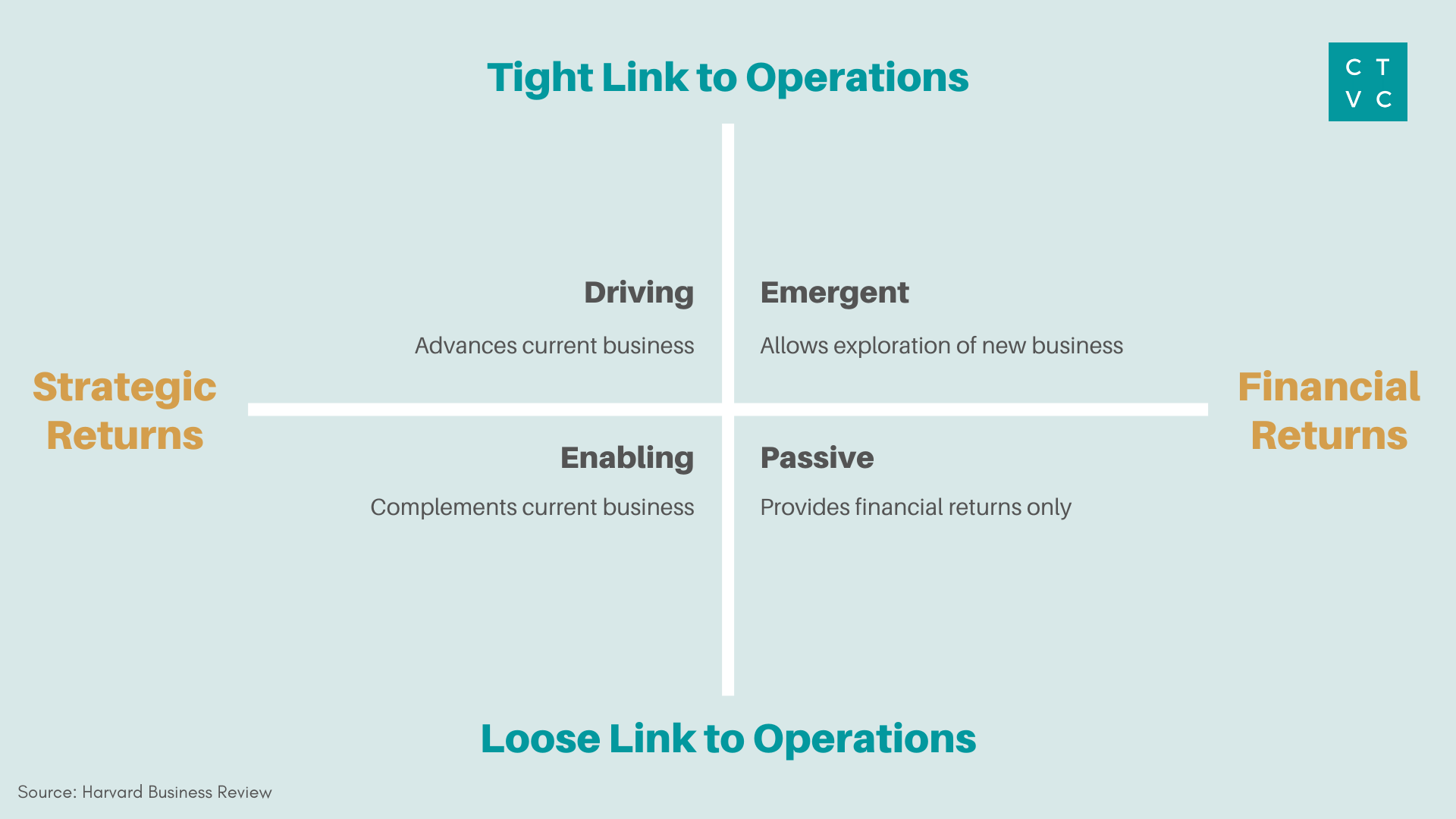

Whereas traditional venture capital funds are purely financially oriented, CVCs’ objectives often bifurcate into prioritizing strategic and financial returns. CVCs vary widely across the returns axis here, with some willing to sacrifice higher direct financial returns for greater strategic value. On the other operations-oriented axis, CVCs have the distinct capability of linking their investing focus to driving their operations forward. Some corporates leverage the venture model to directly strengthen the current state of their business (e.g., an O&G major investing in fracking tech) whereas others use startup investments to acquire “blue sky” innovation in the vision of where their business is headed (e.g., an O&G major investing in carbon capture tech).

In a world of corporate net zero commitments, CVCs have bolstered their mandates to invest in accelerating climate technologies. Last week, VW announced a $355m venture fund for decarbonization of “the unavoidable remaining emissions for which we don’t have any technical or economic solutions.” Corporate participation in venture deals has tended to lean heavier in climate tech vs the overall market - perhaps due to the strategic and patient capital necessary to scale capital-intensive, hardtech solutions as well as the increasing importance of sustainability within corporates’ strategic priorities. As part of CTVC’s deal tracking, corporates have participated in 45% of all climate tech deals over the past 15 months, compared to 25% for the overall US venture market. We are now seeing CVCs in almost every other deal, and that number is only likely to grow from here.

The saying goes that startups are bad at scaling, and corporates are bad at innovating - so the upsurgence in CVCs’ investment into climate startups has us excited for their partnership potential to scale climate innovation.

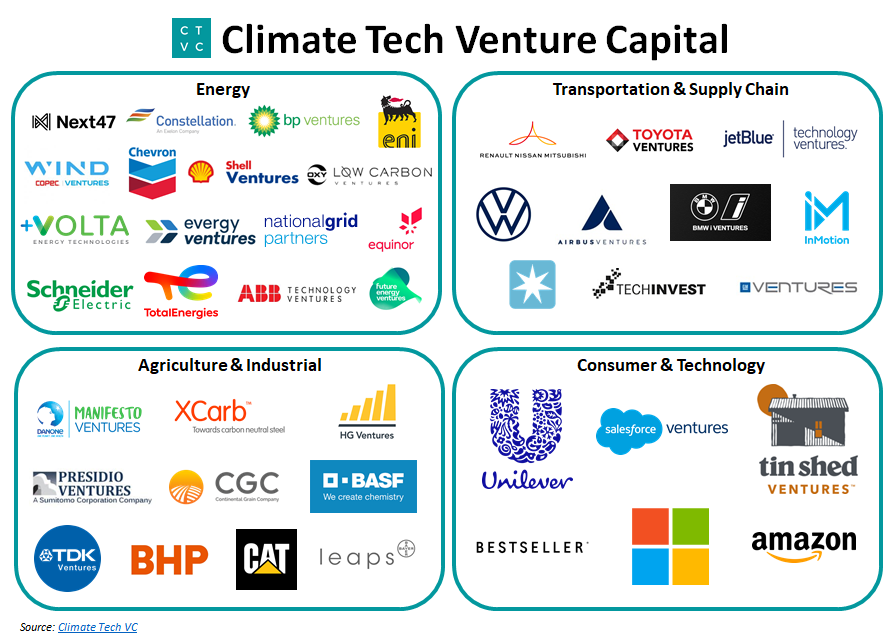

You asked, we delivered. As a much sought-after addendum to our popular running list of Climate Tech VCs, here is the running list of Climate Corporate VCs.

To make the list, CVCs must be an independent venture fund and have several climate deals under their belt. As always, we’ll continue to update this list as the market continues to evolve, and you can submit suggestions to add climate CVCs.

We’ve categorized the primary climate corporate climate funders by the verticals below:

Energy: Oil and gas majors, utilities, energy solutions

Transportation & Supply Chain: Auto OEMs, aerospace and airlines, supply chain & logistics

Minerals, Agricultural & Industrial: Agribusiness, steel, chemical, building materials, construction and mining

Consumer & Technology: Consumer goods, fashion, technology & enterprise software

View CVC fund descriptions, portfolio companies, and filter by industry on the full list.

To better understand this elusive class of venture investors, we reached out to some of the leading funds across these broad sectors: BHP Ventures, Microsoft Climate Innovation Fund, Toyota Ventures, Maersk Growth, Chevron Technology Ventures, and TotalEnergies Ventures.

“We target game-changing technologies and teams to support future growth for BHP. This has three broad limbs: 1) driving innovation underway in our core operations today (electrifying our fleet, low/no-CO2 fuels, and site-electrification); 2) growing our resource base in key commodities (new exploration and extraction technologies); 3) exploring potential growth opportunities for BHP tomorrow (new energies and minerals, low emissions steelmaking, battery recycling, carbon removal, etc). We seek both a robust financial return on the capital we deploy, as well as a ‘strategic return’ for BHP via the unique insights we source, the partnerships we make, and the options we create.” — Mark Frayman, BHP Ventures

“In January 2020, Microsoft made a commitment to become carbon negative by 2030 and to invest $1B through a new Climate Innovation Fund (CIF). The CIF invests in carbon reduction and removal solutions across a range of economic sectors, as well as in technologies to reduce and replenish water consumption and to deliver zero waste solutions by 2030. We prioritize investment opportunities based on these guiding principles: 1) climate impact; 2) underfunded markets; 3) climate equity; and 4) shared alignment with Microsoft’s core business and customers.” — Brandon Middaugh, Microsoft Climate Innovation Fund

“Our mission is to explore what’s next for Toyota by helping early-stage startups bring disruptive technologies and business models to market quickly. Through the Toyota Ventures Climate Fund, a $150m AUM fund announced in June 2021, we invest in startups creating scalable solutions for carbon neutrality including technologies such as renewable energy, hydrogen, carbon capture, and more.” — Jim Adler, Toyota Ventures

“Maersk Growth is an early stage investor with the mission to digitise, democratise and decarbonise the full scope of logistics and supply chain. We are passionate about working with visionary innovators who disrupt the status quo to help us connect and simplify our customers’ supply chains. We are doubling down on sustainability as a core focus area to decarbonise our operations to be carbon neutral by 2050 both on land and at sea with the green fuels of the future. We leverage our global network to source deals and by now our rich portfolio represents startups from 4 continents.” — Shereen Zarkani, Maersk Growth

“Chevron Technology Ventures (CTV) launched in 1999 to identify and integrate technologies which enhance the way Chevron produces and delivers affordable, reliable, and ever-cleaner energy. Through our systematic approach to validation/trial through to scale, we bridge the gap between innovation and our operations. Our CORE Fund, in its sixth iteration with $90 million to invest in startups, focuses on technologies for enhancing existing operations. Our FUTURE Funds have committed $400 million to focus on industrial decarbonization, emerging mobility, energy decentralization and circular carbon economy. CTV also has committed over $100 million to invest as an LP in other funds that address our objectives.” — Barbara Burger, Chevron Technology Ventures

“Our mission is to find, fund and foster global startups which contribute to a low carbon future. We invest in technologies which support TotalEnergies’ ambition to be the most responsible energy major and reach our ambition of carbon-neutrality by 2050. Key investment areas for us are smart energy, new mobility, recycling / circular economy / bio-plastics, carbon markets and decarbonization technologies.” — Ugo Catry, TotalEnergies Ventures

“We work hand-in-glove with our innovation teams to help create value for our companies via BHP’s involvement. For technologies that may have an application in our business today, we can look to run pilots or demonstrations in our operations . For some start-ups, we may look to jointly develop new business opportunities together. For others, we may make introductions to our customers, suppliers and/or regulators. We often also look to purchase products from our start-ups, including purchasing CO2 credits where relevant,to help validate their technologies and catalyse a market.” — Mark Frayman, BHP Ventures

“Microsoft’s Climate Innovation Fund seeks to provide catalytic capital that would otherwise be inaccessible for nascent and first-of-a-kind climate solutions. Where relevant, we can contribute technical expertise, initiate opportunities with Microsoft’s partners or customers, and support our investees’ growth. We can also connect with other Microsoft programs, such as Microsoft for Startups, the Global Social Entrepreneurship Program, and AI for Earth.” — Brandon Middaugh, Microsoft Climate Innovation Fund

“While we believe that financial returns must precede strategic returns, the value of Toyota’s global network can bring significant resources and technical expertise to help startups accelerate their growth against competitors. At Toyota Ventures, we have a dedicated Platform team that focuses on finding ways to support startups as they go to market, from recruiting and customer discovery to business development and marketing.” — Jim Adler, Toyota Ventures

“Corporate venture investing doesn’t always receive glowing reviews but there’s a new generation of CVCs making their dent. Our model is based on an experienced investment team coupled with a portfolio management team who partner with our startups to inject our ‘rocket fuel’ post investment. We leverage Maersk’s relevant resources, or “ABCDE”, including access to our Assets, our strong Brand, our 78,000 global Customers, our rich Data sources from covering 20% of global trade, and our network of 80,000 supply chain Experts. We have the independence, mandate and pace to make investment decisions while leveraging our Maersk colleagues.” — Shereen Zarkani, Maersk Growth

“As an experienced CVC, we understand the problems in the current energy system and have the experience to scale solutions. We’ve built relationships and credibility within Chevron to support longer commercialization times, and established a vast global innovation and co-investor network to identify, invest in and deploy disruptive technologies. We have built organizational capability specifically around engaging, evaluating, piloting & scaling start-up technology, which has enabled us to deploy the majority of the technologies we have invested in.” — Barbara Burger, Chevron Technology Ventures

“We have dedicated BD professionals working to activate our portfolio companies in and out of TotalEnergies, through site co-location, piloting, MOU, JDA, and so forth. Our knowledge, network and assets are expansive: $1B R&D spending per year, active in 130 countries, 10 GW low-carbon electricity production (with the ambition of 35 GW by 2025 and 100GW by 2030), 800 industrial sites, pioneer in CCUS hub projects, and dedicated carbon trading desks).” — Ugo Catry, TotalEnergies Ventures

“While many are attune to the ‘downside risk’ of decarbonisation, few appreciate the ‘upside’ exposure that our business has in sustainably delivering the raw materials needed to decarbonise. For that reason, we are targeting technologies to discover and extract new materials that are both critical to global electrification, as well as huge business opportunities for BHP. Many emerging climate tech businesses are a great fit for CVC, since they naturally complement the capabilities of incumbents like BHP – i.e. an ability to scope, develop, fund and operate large projects, manage complex stakeholder value chains, and market a product. These businesses also often require the long-term, patient capital that a committed CVC can provide.” — Mark Frayman, BHP Ventures

“We look forward to seeing the climate finance sector collectively evolve its approach to measuring, monitoring, and reporting impact. We would also like to see environmental justice and climate equity considerations integrated into every climate investment strategy, with a diverse array of entrepreneurs funded.” — Brandon Middaugh, Microsoft Climate Innovation Fund

“The sector sometimes loses sight of the fundamentals of what it takes to build a successful business. Even though our mandate is to help Toyota accelerate its carbon neutrality goals, we remain laser-focused on investing in companies that have the right team and business model, and can demonstrate true product-market fit. Being ‘financially focused’ has served us well, because startups know that we’re aligned with their success goals.” — Jim Adler, Toyota Ventures

“The 2020s are all about logistics – it’s finally become sexy! The global impact of COVID on supply chains continues to be unprecedented, unexpected, far reaching and very public with major events like the Suez canal blockage. Supply chains have now become ‘board room’ talk, similar to sustainability, hence an area ripe for disruption as can be seen by the recent influx of funding. With the boom in e-commerce and last mile delivery, logistics needs to evolve to adapt to customer needs. While there are plenty of archaic areas to disrupt with technology, the challenge of underlying complex and fragmented physical infrastructure can be underestimated. Integrated logistics will be made possible by new digital platforms, connected physical assets, and unique actionable insights to impact supply chain outcomes.” — Shereen Zarkani, Maersk Growth

“Investors often fall in love with a technology, rather than the problem, and underestimate the time, resources, policy, and partnerships required to scale. There’s a systems approach to solving problems, which requires integration between the current system and new innovation. The energy system is massive and complex - as well as the expectations for energy to be reliable, affordable AND ever-cleaner at the same time.” — Barbara Burger, Chevron Technology Ventures

“Investing in energy and climate is not easy as it requires technical know-how, industrial scaling expertise, and appropriate market/ regulatory drivers.” — Ugo Catry, TotalEnergies Ventures

“Be collaborative, nimble, and commercial - the opportunity set is massive, the rate of change is rapid, and being able to partner with a diverse range of companies, investors and others is key to success. Have a long term horizon, as the heat in climate tech markets may well ease at some point. Who knows? The technology giants of tomorrow could emerge from the climate tech landscape today. CVCs play an important role in this investment landscape, bringing access to global networks and capabilities that climate tech companies (particularly those in deeptech) will need.” — Mark Frayman, BHP Ventures

“CVCs are uniquely positioned to help founders drive growth in the market, by providing both funding and end markets for critical technologies and solutions that must be deployed at scale to reach net zero, even in the midst of changing market conditions. As the market evolves, founders will want to seek out long-term partners with the agility to pivot and adjust to support scalable climate solutions.” — Brandon Middaugh, Microsoft Climate Innovation Fund

“As the climate tech startup landscape constantly changes and gets more competitive, look for a corporate venture team who can match your speed, be founder-first, and treat their portfolio companies like valued customers. CVCs investing in climate tech today should be committed to supporting their startups for years to come and not close up shop when the business cycle ebbs. Make sure that your investor isn’t just a fair-weather tourist, but - like a Toyota car - reliable when the weather turns foul.” — Jim Adler, Toyota Ventures

“CVCs can play a pivotal role in helping founders mature solutions necessary for our climate emergency. By committing early on R&D projects, companies like Maersk can kickstart climate tech initiatives in the broader market by proving demandearly on. We recently invested in Einride, a provider of electric and autonomous freight mobility solutions, and WasteFuel, a developer of biorefineries producing sustainable fuel from waste. Both investments require significant development costs and early corporate demand to scale, and demonstrate how CVCs are an integral part of developing a healthy ecosystem of innovation and collaboration.” — Shereen Zarkani, Maersk Growth

“Having a differentiable core technology or business plan is essential. However, in our experience, the biggest hurdles to commerciality in the climate tech space often are in the scale, partnerships and value chain integration – not core product development. A good CVC investor can provide support in these areas, bringing more to the table than money. We have “skin in the game” in climate tech, and want our startups to be successful and scale their solutions. We have done field trials with a majority of our portfolio companies and many have become suppliers to Chevron.” — Barbara Burger, Chevron Technology Ventures

Poor performance this half as investment falls to 2020 levels, but some strong plays.

$82bn of new capital for climate tech in the past 6 months

A new interactive Climate Capital Stack Map