🌎 NY Climate Week debrief

Takeaways from five days of hallway and main-stage conversations at NYCW

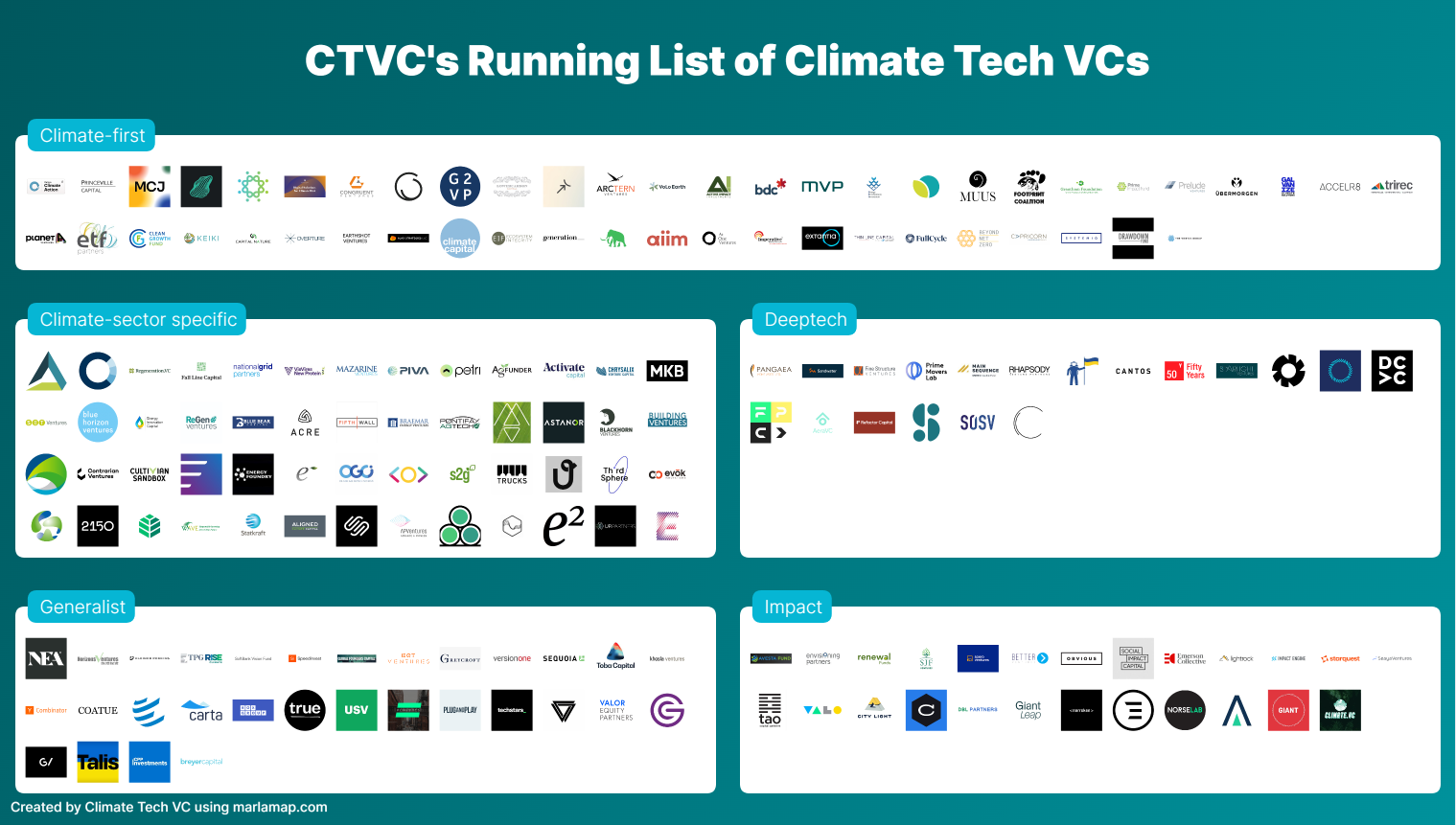

An updated list of 177 climate tech venture capitalists

Where there’s great economic transformation, there’s venture capitalists. Where there’s great economic and planetary transformation, there’s climate tech venture capitalists.

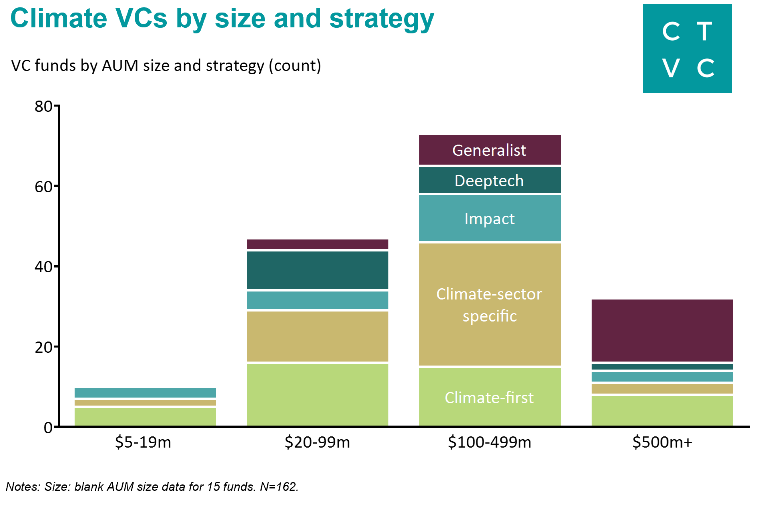

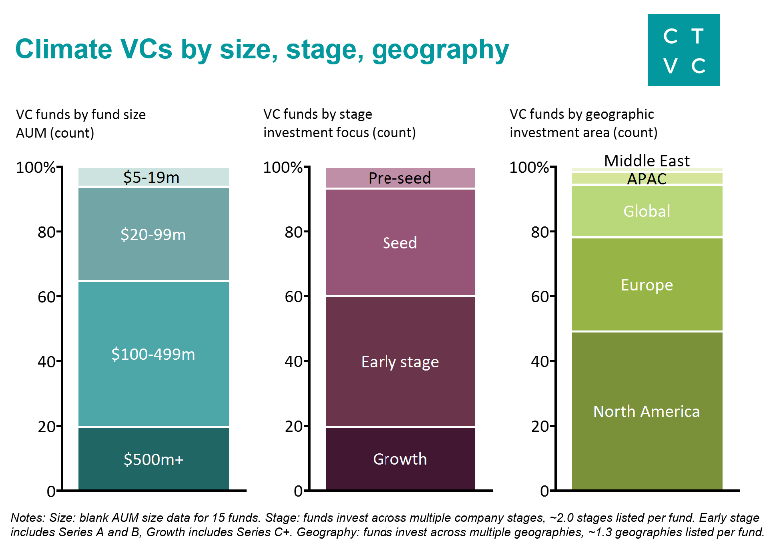

The past few years have borne three types of emerging climate tech VCs. First, the survivors - those that persevered through Cleantech 1.0, and carried with them the lessons and burdens of the past. The second type rose with the rising tide of ESG-thirsty LP capital channeled into existing VC firms that responsively spun up climate funds to validate the emerging green hypothesis. In the third type, most prevalent today, we’re experiencing a renaissance of new, climate-first venture GPs. These new funds come in all shapes, strategies, geographies, and sizes - fit to the breadth of climate founders, technologies, and LPs. We’ve updated the running list of Climate Tech VCs on our website here, complete with brand new filtering capabilities by geography, fund size, and stage.

We now count 177 climate VCs actively investing in climate tech theses. In the past two years, the CTVC Climate Capital List has more than doubled. We created this list first and foremost for climate tech founders, or those aspiring to be. Their core work is creating solutions for climate, chasing capital is secondary. The amount of capital pouring in is testament to the opportunity inherent in solving hard climate challenges.

We built this list bottoms-up based on our deal-by-deal data tracking of VC firms that invested in climate companies over the past 2 years, with a weighting of climate-specific deals as a proportion of the fund size. We categorize funds according to 5 strategies:

Compiled 2,500+ unique funds that invested in climate tech companies tracked in our deals database, and/or submitted through community recommendations

Must have participated in >1 climate deal within past 6 months

Meet minimum threshold of climate companies as a % of overall portfolio, approximate by fund category:

Climate-first: 75%

Climate-vertical specific: 75%

Impact: 25%

Deeptech: 25%

Generalist: 10%

Included only institutional venture capital structures (e.g. excluded Private Equity, Family Offices, Foundations, Venture Debt, Project Finance, etc.)

Excluded microfunds with AUM <$5m

Excluded corporate VCs (latest CVC update here)

We’ll continue to update this list (add new players and ones that we missed, remove those who deprioritize climate, and expand to further segments and asset classes) as the market continues to evolve. Throughout, we’ll aim for this to be the most comprehensive, highest quality resource for founders. In the meantime, cue the pitchforks for any errors or omissions 😅. Our inbox is always open, as is the new fund submission form.

Takeaways from five days of hallway and main-stage conversations at NYCW

What ~300 exits over 3 years show about funding today's climate tech cohort

Fewer dollars, more climate innovation in 2022 climate tech market report