🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

The EPA’s long-awaited proposal would cap coal and gas power plant pollutants, somehow

Happy Monday-after-Mother-Earth Day!

As the EPA springs into new-found action, it released a much-anticipated proposal that would hasten dramatic reductions in the nation’s power sector emissions. Responding to the chorus of opinions from climate action advocates on stage left and utility operator pragmatists on stage right, the EPA thrust a controversial star into the center of the debate: point-source carbon capture. But is CCUS ready (or will it ever be) for the spotlight?

Meanwhile, the energy sector in the EU warns that the bloc’s green hydrogen goals are too ambitious. Nuclear fusion gets its first corporate PPA, and SVB is back to financing community solar.

In deals this week, farming robots reap $52M. Hydrogen production attracts $33M and a carbon removal platform garners $19M.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter here.

💼 Find or share roles on our job board here.

The EPA proposed a new rule on Thursday to regulate the pollutants that billow out of America’s dirtiest power sector smokestacks. The move comes on the heels of last month’s proposals to cut tailpipe emissions, but it’s been decades in the making.

This rule would be the first to limit emissions from the existing 3,400 coal- and gas-fired power plants responsible for ~25% of US greenhouse gas emissions (GHGs).

The EPA’s announcement swivels the spotlight onto point-source carbon capture—removing the CO2 from emissions coal- and gas-fired power plants create when generating electricity before it enters the atmosphere.

The oil and gas industry has touted CCUS as a climate solution for years. Now that the EPA is calling the bluff, major energy sector players claim it’s years away from viability.

omg lololol after years of promising that CCS was a viable climate solution and winning BILLIONS in subsidies via 45Q and the IRA, now that actual EPA standards for power plans are coming down the pipe the fossil fuel guys start to suggest that CCS doesn't presently work. oops! pic.twitter.com/1P5Bc8zg2x

— Dr. Genevieve Guenther (@DoctorVive) May 9, 2023

The other side of this switch-up found many would-be critics of CCUS supporting the EPA’s proposal, which aims to achieve more aggressive emissions reduction targets and avoid judges ruling against the regulation by tying it to carbon capture.

The federal government has already spent billions of dollars to support development and deployment of carbon capture tech—with little to show for it. A single power plant in Canada is the only one in the world currently using CCUS at scale.

So is carbon capture ready for primetime or not?

CCUS is a suite of technologies with varying maturity levels and use cases. There are industrial facilities, like ethanol and natural gas processing plants, that already use carbon capture.

But with such competitive costs for renewable energy, investing in CCUS—and especially retrofitting existing fossil fuel power generation—is often not the most economical application. And the actual reductions to a plant’s net emissions may be much lower (10-20%) than proponents have proclaimed (80-90%).

While the EPA is presenting CCUS as an avenue to reducing coal and gas power plant emissions, the cost may ultimately just drive plant operators to close them earlier. Only ~3% of today’s total coal and gas power generation capacity is likely to actually install carbon capture by 2035, according to Rhodium Group estimates.

The stakes are high—for the planet and the grid. With increasing renewable energy generation comes the challenges of intermittency. With the electrification of transportation and buildings comes additional strain on the grid from new loads. What sort of power generation or energy storage tech will help balance that demand/supply? And what—if anything—will carbon capture have to do with it?

🌾 ecoRobotix, a Yverdon-les-bains, Switzerland-based precision farming solutions company, raised $52M in Series B funding from Aqton SE, Cibus Fund, Verve Ventures, Swisscom Ventures, BASF Venture Capital, Swisscanto Private Equity, 4FO Ventures, Yara Growth Ventures, and Flexstone Partners.

⚡ Modern Hydrogen, a Bothell, WA-based developer of methane pyrolysis hydrogen production systems, raised $33M in Series B funding from NextEra Energy Resources, Miura, National Grid Partners, Gates Frontier, Irongrey, Starlight Ventures, Valo Ventures, and Metaplanet Holdings.

🚚 Hylane, a Cologne, Germany-based hydrogen truck leasing company, raised $27M from The German Federal Ministry for Digital Affairs and Transport.

💨 Cloverly, an Atlanta, GA-based digital infrastructure platform for the voluntary carbon markets, raised $19M in Series A funding from Grotech Ventures, Aquiline Technology Growth, Impact Engine, Mission One Capital, New Climate Ventures, CreativeCo Capital, Tech Square Ventures, SoftBank, Circadian Ventures, Knoll Ventures, SaaS Ventures, and Panoramic Ventures.

♻️ PRYME, a Rotterdam, Netherlands-based circular recycling for plastics company, raised $14M from Infinity Recycling, Invest-NL, and LyondellBasell Industries.

🌾 ChrysaLabs, a Montréal, Canada-based soil quality assessment technology developer, raised $11M in Series A funding from Anges Quebec, AQC Capital, BDC Venture Capital, Ecofuel, Emmertech, Koan Capital, Leaps by Bayer, and TELUS Ventures.

💨 Deep Sky, a Montréal, Canada-based CO2 removal company, raised $10M in Seed funding from Brightspark Ventures and Government Of Quebec.

🥩 Revyve, a Rotkreuz, Switzerland-based producer of sustainable ingredients from food industry byproducts, raised $9M from Cosun and OostNL.

♻️ AMP Robotics, a Denver, CO-based robotics recycling company, raised an additional $8M in Series C funding from Sequoia Capital, Google, Wellington Management, Valor Equity Partners, Tao Capital Partners, Congruent Ventures, Microsoft Climate Innovation Fund, XN, Range Ventures, Sidewalk Infrastructure Partners, and Blue Earth Capital.

🔋 Voltfang, an Aachen, Germany-based company repurposing batteries from cars for energy storage, raised $5M in Seed funding from PropTech1 Ventures, Helen Ventures, Aurum Impact, Eviny, and AENU.

🥩 Fermify, a Gerasdorf Bei Wien, Austria-based animal-free cheese developer, raised $5M in Seed funding from Auxxo and Climentum Capital.

📦 Zyngo EV, a Haryana, India-based sustainable last-mile solutions company, raised $5M in Seed funding from Delta Corp Holdings and LC Nueva Investment Partners.

🌾 EF Polymer, an Okinawa, Japan-based biowaste upcycling company, raised $4M in Series A funding from Beyond Next Ventures, Lifetime Ventures, MTG Ventures, Okinawa Development Finance Corporation, and Universal Materials Incubator.

♻️ Olyns, a Santa Clara, CA-based recycling and retail media solutions company, raised $4M in Series A funding from Vanedge Capital.

🌱 Improvin', a Stockholm, Sweden-based agri-food emissions monitoring company, raised $4M in Seed funding from Pale Blue Dot, Dynamo Ventures, Foodbridge, and PINC.

👕 Werewool, a New York, NY-based protein-based fibers developer, raised $4M in Seed funding from Material Impact Fund and Sofinnova Partners.

⚡ Fuuse, a Lancaster, United Kingdom-based EV charging operating software company, raised $3M in Seed funding from Par Equity.

⚡ RACEnergy, a Hyderabad, India-based battery swapping network, raised $3M in Seed funding from growX ventures, Huddle, and Micelio Fund.

🍄 Mycocycle, an Bolingbrook, IL-based fungi-based remediation solutions company, raised $2.2M in Seed funding from Alumni Ventures, Anthropocene Ventures, Telescopic Ventures, and TELUS.

⚡ Obeo Biogas, a Montréal, Canada-based waste to biogas company, raised $2M in Seed funding from Diagram Ventures.

🥩 MicroHarvest, a Hamburg, Germany-based producer of alternative proteins through fermentation, raised $2M from Simon Capital.

⚡ Watermeln, a Noord-Holland, Netherlands-based producer of mobile hydrogen generators, raised $2M in Seed funding from Accenda and Amsterdam Climate and Energy Fund.

♻️ ICTYOS, a Rhone-Alpes, France-based fashion company using recycled fish skins, raised $2M in Seed funding from JBC2 SAS.

🌳 Mast Reforestation, a Seattle, WA-based wildfire forest restoration company, raised $2M from Carbon Streaming.

🥩 Farmless, an Amsterdam, Netherlands-based startup using fermentation to produce carbon-negative, functional proteins, raised $1M in Pre-Seed funding from HackCapital, Nucleus Capital, Possible Ventures, Revent, Sustainable Food Ventures, Tet Ventures, Voyagers and other angel investors.

🌱 Carbonhound, a Toronto, Canada-based carbon management software for SMEs company, raised $972K in Pre-Seed funding from Verdexus, Archangel, and Highline Beta.

♻️ Interface Polymers, a Loughborough, United Kingdom-based developer of high-performance additives for plastics, raised an undisclosed amount in Seed funding from GC Ventures.

⚡ ev.energy, a London, UK-based EV smart charging platform, raised an undisclosed amount from National Grid Partners.

🔋 CelLink, a San Carlos, CA-based flexible circuits for clean energy company, received a conditional loan commitment for $362M from the US Loan Programs Office.

⚡ Driveco, a Paris, France-based EV charging stations provider, raised $250M from APG Asset Management, Corsica Sole, and Mirova.

⚡Pivot Energy, a Denver, CO-based solar developer, raised a $203M financing facility from Silicon Valley Bank and Foss And Company.

⚡ Project InnerSpace, non-profit geothermal energy organization, received a $165M grant from the US Department of Energy.

⚡ JOLT Energy, a Munich, Germany-based developer of an urban ultra-fast charging network, raised $165M from InfraRed Capital Partners.

✈️ Wingcopter, a Weiterstadt, Germany-based developer of eVTOLs for last-mile delivery, raised $44M from The European Investment Bank.

Redtail Renewables, an Indianapolis, IN-based RNG developer and operator, announced its launch with an undisclosed amount in funding from Inyarek Partners.

Actis, a London, United Kingdom-based sustainable infrastructure investor, has launched Nozomi Energy, a new $500M Japan-focused renewables platform.

Pale Blue Dot, a Sweden-based seed-stage VC firm, closed its second fund with $101M for climate tech-oriented companies.

The U.S. Energy Department’s Loan Program Office is aiming to lend a boosted budget of $400 billion to promising clean energy projects before the 2024 election potentially upends its leadership.

In a first for fusion, Microsoft inked a nuclear fusion PPA with Helion. Helion is looking to produce electricity with the Polaris machine by next year, but still has a lot of steps ahead of getting 50MW online by 2028.

The second-largest European bank, France’s BNP Paribas, announced an end to financing new gasfield projects, though loopholes may still exist to support oil and gas through corporate loans and bond underwriting. BNP joins HSBC and European banks in ending new oil and gas financing, especially after increased pressure from investors earlier this year.

As we warm up to summer, North American Electric Reliability corp warned of the potential for more power outages this year compared to 2022.

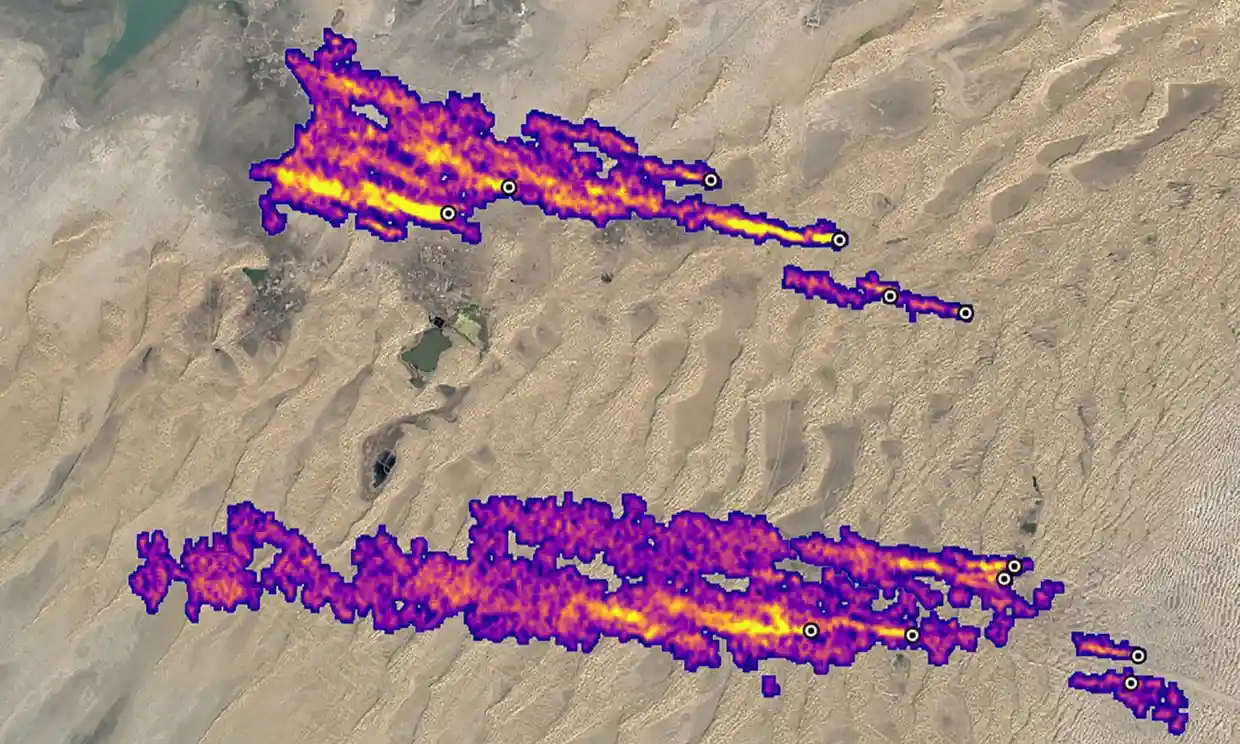

Significant methane leaks in Turkmenistan were recently identified via satellite imagery by environmental intelligence company Kayrros. The methane emissions from these two leaks contributed more global heating in 2022 than all of the UK’s carbon emissions.

Energy executives warned that the EU will likely miss its ambitious 2030 goals for green hydrogen, due to the bloc’s complex regulations. The timeline to 10 million tons of green H2 production and import would need to be supported by speeding up permitting and subsidies.

Two months after insolvency and now a division of First Citizens Bank, Silicon Valley Bank is back with a $203M financing deal for Pivot Energy, a community-solar developer.

X-energy moved closer to a demonstration plant, selecting a location at Dow’s Seadrift site. This is one of a handful of SMR technologies to move forward in siting and X-energy will now look to submit a construction permit application to the US Nuclear Regulatory Commission.

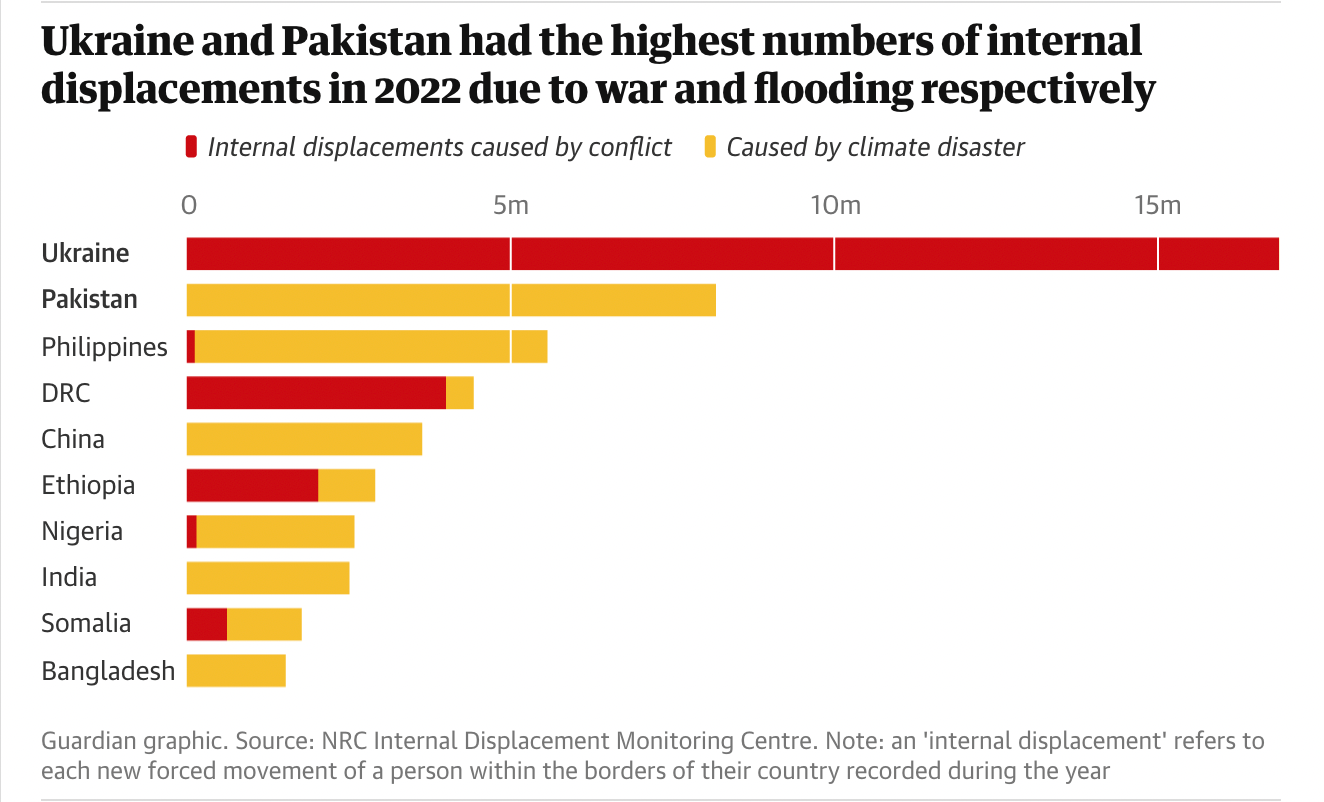

Surging energy prices in Europe due to the war in Ukraine led to an increase in deaths as people were less likely to properly heat their homes. The high cost of heat may have caused more deaths across Europe than covid-19 last winter. Between the Ukraine war and climate impacts, a record number of people were displaced from their homes in 2022. Ukraine saw the greatest movement due to the conflict and historic flooding drove out Pakistanis.

Hawaii is driving forward the future of rate design, a critical lever for the energy transition on an increasingly complex grid. While some states have implemented default time-of-use pricing, Hawaii’s approach is particularly novel. Their price differences are stark—the highest electricity price (peak demand) is 3x as expensive as the least expensive (super off-peak demand).

Warmer seas mean fishy business and more pirates!

Vending machines in Japan want to suck CO2 directly into your pop.

Friend of the Earth and this newsletter, Sidd Shrikanth, unpacks natural capital projects in The Case for Nature.

EVs race to new heights in Norway as the end of ICE sales approaches in 2025. ~80% of car sales last year were electric.

Debt for blue-footed boobies! Largest-ever debt-for-nature swap to switch it up in the Galapagos.

A not-boring NYT piece on insurance makes the case for proper pricing of climate risk ASAP.

We asked for flying cars and the Green New Deal, but got 140 characters and IRA instead.

Climate cos disrupt CNBC’s 2023 Disruptor 50 list.

🗓️ Ion Activation Festival: Join the fest on May 19th to network with energy transition leaders and innovative startups in Houston.

🗓️ Carbon to Value Initiative: Join Greentown Labs’ C2V Initiative showcase on May 24th to hear from industry experts and watch the program finalists’ pitches.

🗓️ Lisbon Energy Summit: Pop over to Portugal on May 30th-June 1st to engage with 200+ speakers and 1000+ delegates on energy and technological innovation.

🗓️ Imperial Climate Investment Challenge: Signup for the largest student-led climate finance pitching competition on June 9th and some post-event networking.

💡 LACI: Apply by June 9th to LACI’s Innovator and Incubation Programs to receive funding and market support for your cleantech startup.

Associate, New Venture Creation in Climate @Deep Science Ventures

Energy Trading Analyst @Equilibrium Energy

Business Development Manager @Isometric

Sr. Project Manager, Infrastructure Projects @Electric Hydrogen

Finance Intern @Meati Foods

Asset Manager @AMP Americas

Venture Capital Associate @Energy Foundry

Director, International Business Development @EnergyHub

Investment Analyst @Revalue Nature

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project