🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

Happy Monday!

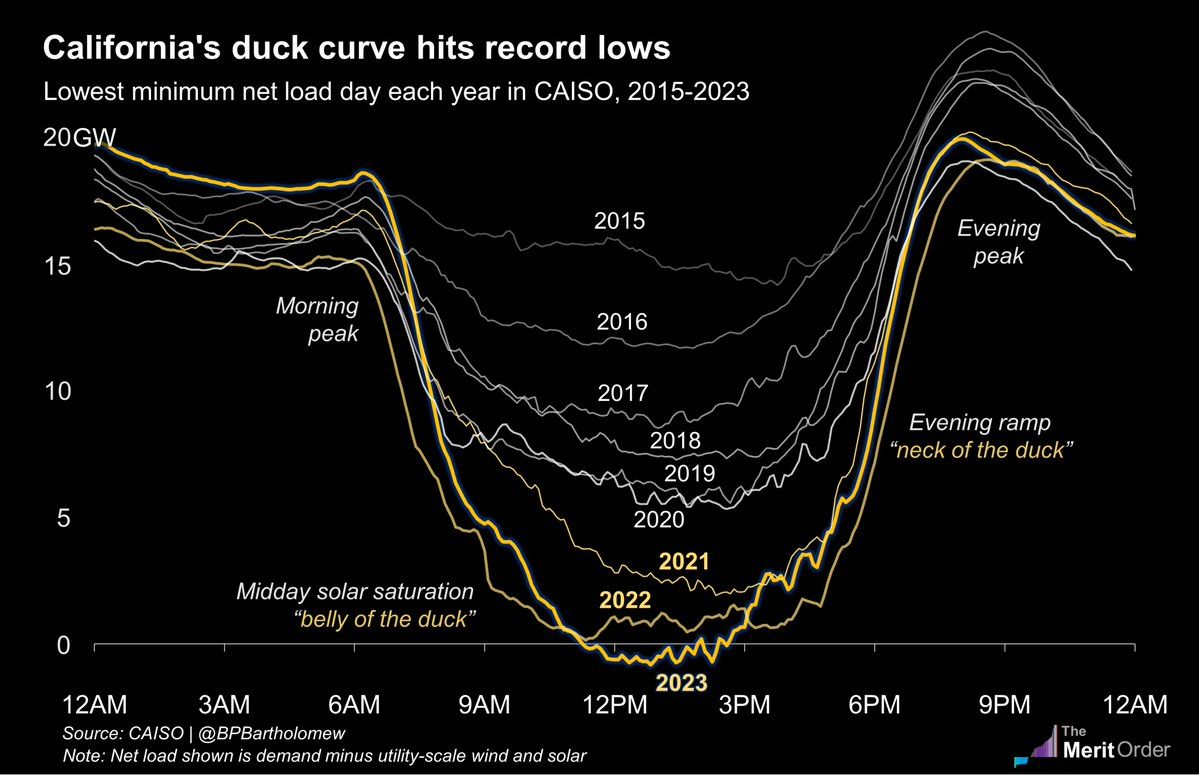

Spring in California now means the daily solar supply/demand “duck” curve is making some funky moves. The amount of renewable energy actually outstripped total electricity demand earlier this month, according to CAISO. While more wind and solar generation is a win overall, it poses some intermittent reliability challenges until grid and storage tech can help ease the steep on and off ramps.

Elsewhere in the news, the EU adopted new laws to help reach its 2030 climate goals. Canada is offering its own IRA-style tax credits for renewable energy development. And some of the world’s largest VC funds joined forces to build more sustainable firms and portfolio companies.

In deals this week, $250M for green hydrogen, $96M for Span’s home electrification tech, and $40M each for compact fusion reactors and portable nuclear.

And once again, we forgot to mention last week that we got a shoutout in the NYT: Do you even decarbonize, bro?

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter here.

💼 Find or share roles on our job board here.

California’s “duck curve” is morphing into a new shape as more and more renewable energy powers the grid. The famous chart, which shows the need to decrease other electricity generation as the sun comes out in the morning and rapidly ramp up non-intermittent sources as the sun sets just before hours of peak energy demand in the evening, is now dipping into net loads (i.e., electricity demand minus utility-scale wind and solar) that are near-zero or even negative in the middle of the day.

This means on certain days, there is actually more renewable energy than CAISO customers can use. Last year on May 8, 2022, California produced enough generation to cover 100% of customer demand for the first time. This spring, we’re seeing greater than 100% renewable energy. Although a surplus of wind or solar might sound good, this “canyon curve” brings some serious challenges for maintaining a balanced grid.

Quick switch: Overproducing energy can also damage the grid. In order to avoid this, operators are faced with a difficult choice: Turn off generation resources that cannot quickly turn back on or turn off clean and cheap renewable energy. The former can lead to reliability issues as solar ramps down and the latter raises the price of electricity, due to the higher marginal costs of thermal generation.

Because demand peaks later in the day when the sun begins to set, grid operators need to ramp up nearly 15 GW of generation in a matter of a couple hours. That’s the equivalent of 7 Diablo Canyon nuclear plants going from 0 to 100% in 3 hours!

The spring season presents unique demand and generation profiles. Mild spring weather coupled with high solar output on sunny days can result in negative net loads, which are unlikely to happen in the summertime when bigger loads like air conditioning drive up electricity demand.

However, the ramp issues in the morning and evening will continue as solar and wind penetration increases. This is one reason CAISO found that adding battery storage actually helped with the LCOE for renewable energy.

Right now, grid balance is maintained by decreasing gas generation output, switching between power imports and exports, and utilizing batteries. Future strategies may rely on inventive technologies, such as time-of-use rates, smarter grid tech, additional types of energy storage, and newer generation technologies like hydrogen.

As this trend continues, there may be rising cases of local reliability issues anywhere with a high solar resources and low transmission access. The duck solar curve is relatively predictable, but in places where wind penetration is high, this ramp problem will be even harder to anticipate.

⚡ Ohmium, an Incline Village, NV-based manufacturer of PEM electrolyzers for green hydrogen, raised $250M in Series C funding from TPG Rise Climate, Hanover Technology Investment Management, Fenice Investment Group, and Energy Transition Ventures.

⚡ Span.io, a San Francisco, CA-based home energy devices company, raised $96M in Series B funding from Wellington Management, Congruent Ventures, Capricorn Investment Group, Qualcomm Ventures, Fifth Wall, Munich Re Ventures, A/O PropTech, and Amazon Alexa Fund.

⚡ Virta, a Helsinki, Finland-based EV charging platform, raised $93M from Future Energy Ventures, Helen Ventures, Jolt Capital, Kotkan energia, Lahti Energia, Tesi, Vantaan Energia, Vertex Growth Fund, Business Finland.

🏗️ TopHat, a London, UK-based low-carbon modular housing company, raised $87M in Growth funding from Persimmon, Aviva, and Goldman Sachs.

🔋 Energy Dome, a Lonate Pozzolo, Italy-based provider of long-duration storage using liquid CO2, raised $44M in Series B funding from Neva SGR, Eni Next, Novum Capital Partners, Japan Energy Fund, Invitalia, Elemental Excelerator, CDP Venture Capital, Barclays Sustainable and Impact Banking, and 360 Capital.

⚡ Avalanche Energy, a Seattle, WA-based compact fusion reactor developer, raised $40M in Series A funding from Lowercarbon Capital, Founders Fund, Toyota Ventures, Congruent Ventures, Climate Capital, Autodesk, Grantham Environmental Trust, MCJ Collective, and Clear Path.

⚡ Radiant, a Los Angeles, CA-based portable nuclear company, raised $40M in Series B funding from Andreessen Horowitz, McKinley Capital, Founders Fund, Draper Associates, Decisive Point, Cantos VC, and Boost VC.

⚡ Xlinks, a Billericay, United Kingdom-based renewable electricity connection infrastructure developer, raised $37M from Octopus Energy and TAQA.

🛵 Luup, a Tokyo, Japan-based e-scooters and e-bikes provider, raised $34M in Series D funding from Spiral Capital, SMBC Venture Capital, ANRI, Mitsubishi UFJ Capital, 31Ventures Global Innovation Fund 2, GMO Internet Group, i-nest capital, Green Coinvest, and Chishima Real Estate.

🏗️ Woodoo, a Paris, France-based augmented wood solutions company, raised $31M in Series A funding from Lowercarbon Capital, One Creation, and Purple Ventures.

♻️ Cyclic Materials, a Kingston, Canada-based advanced metals recycling company, raised $27M in Series A funding from Energy Impact Partners, BMW i Ventures, Bioindustrial Innovation Canada, and Planetary Technologies.

🧪 Polymateria, a London, UK-based biodegradable fugitive plastics company, raised $25M in Series B funding from ABC Impact and Indorama Ventures.

🚚 Optimus Technologies, a Pittsburgh, PA-based EPA-compliant biodiesel conversion systems manufacturer, raised $18M in Series A funding from Mitsui & Co, Urban Redevelopment Authority of Pittsburgh, Richard King Mellon Foundation, Renewable Energy Group, Innovation Works, and Idea Foundry.

🛰️ Hydrosat, a Washington, DC-based geospatial intelligence company, raised $20M in Series A funding and non-dilutive funding combined from Statkraft Ventures, Techstars, Santa Barbara Venture Partners, OTB Ventures, Hemisphere Ventures, Hartee Partners, Freeflow Ventures, Expon Capital, Cultivation Capital, and Blue Bear Capital.

🌱 CarbonChain, a London, UK-based supply chain emissions tracker company, raised $10M in Series A funding from Union Square Ventures and Voyager Ventures.

⚡ Reverion, a Munich, Germany-based provider of biogas power plants, raised $9M in Seed funding from Doral Energy-Tech Ventures, Extantia Capital, Green Generation Fund, LANDWÄRME, and UVC Partners.

🔋 Verlume, an Aberdeen, United Kingdom-based developer of subsea battery storage for offshore energy, raised $9M in Seed funding from Scottish National Investment Bank and Par Equity.

🍎 It's Fresh!, a Burntwood, United Kingdom-based food waste technology company, raised $8M in Series B funding from Zintinus, Business Growth Fund, and Praesidium.

🥩 VFC Foods, a York, United Kingdom-based plant-based protein foods producer, raised $8M in Seed funding from Veg Capital.

🏭 UniSieve, a Zürich, Switzerland-based molecular membrane solutions company, raised $5M in Seed funding from Amadeus APEX Technology Fund, Ciech Ventures, Zürcher Kantonal Bank, and Wingman Ventures.

🧪 HydRegen, an Oxford, United Kingdom-based developer of bio-based catalysts, raised $3M in Seed funding from Clean Growth Fund.

🛵 Selex Motors, a Hanoi, Vietnam-based electric motorcycles producer, raised $3M from ADB Ventures, Sopoong Ventures, Touchstone Partners, and Schneider Electric.

⚡ Swobbee, a Berlin, Germany-based micromobility battery swapping company, raised $2M in Series A funding from SpeedUp Energy Innovation and Clean Future Dividend Fund.

🔋 Octet Scientific, an Ohio, IL-based producer of battery additives, raised $1M in Seed funding from Advanced Manufacturing Fund, JumpStart Ventures, and MAGNET.

⚡ H Cycle, a Mountain View, CA-based low-carbon hydrogen developer, raised an undisclosed amount in Series A funding from Azimuth Capital Management.

🔋 Infyos, a London, UK-based battery supply chain visibility platform, raised an undisclosed amount in Pre-Seed funding from Pale Blue Dot, Nucleus Capital, and Intercalation.

⚡ VinFast, a Vietnam-based EV automaker, raised an additional $2.5B in funding including grants and loans from VinGroup and Chair Pham Nhat Vuong.

🍎 Divert, a Concord, MA-based data-enabled waste diversion company, raised $63M in bonds from the California Public Finance Authority.

🧪 Origin by Ocean, an Espoo, Finland-based algae chemicals platform, raised $8.3M in Seed funding and Debt Financing from Voima Ventures, Lifeline Ventures, Batofin, Security Trading and Business Finland.

✈️ Firefly, a Bristol, United Kingdom-based SAFs from sewage startup, raised $6M from Wizz Air.

⚡ U Power, a Xuhai, China-based EV manufacturer and battery swapping company, has announced a close of its IPO.

Apollo, a NY-based alternative asset management firm, launched Apollo Clean Transition Capital (“Act Capital”) a new $4B investment strategy that focuses on the transition towards clean energy and sustainable industry.

EU countries adopted laws that update the region’s emissions trading system, including new rules for shipping, aviation, and the built environment as well as a social climate fund and a Carbon Border Adjustment Mechanism (CBAM), which aims to keep a fair playing field for goods produced with high climate standards.

Lawmakers in Canada recently agreed to offer a 30% investment tax credit for solar, wind, and energy storage projects, mirroring the IRA and making Canada one of the most lucrative countries for building renewables.

The Senate voted to overturn Biden’s anti-smog rules for heavy duty vehicles. Meanwhile, the House voted to restore paused tariffs on solar panels, though Biden has promised to veto the legislation if it passes the Senate.

A group of more than 20 generalist and climate-focused venture funds formed the Venture Climate Alliance with the shared goal of achieving net zero in their internal firm operations by 2030 and their entire portfolios’ operations by 2050.

GM will cut the popular Chevy Bolt, the most affordable vehicle qualifying for Biden’s tax breaks, from the production line by the end of this year to free up space for electric trucks and other larger electric models.

A recent study finds that the drought in Somalia and the Horn of Africa was made 100 times as likely by climate change. This comes amid continued news of record-setting heat waves and droughts in the US and Europe as well as record-high ocean surface temps.

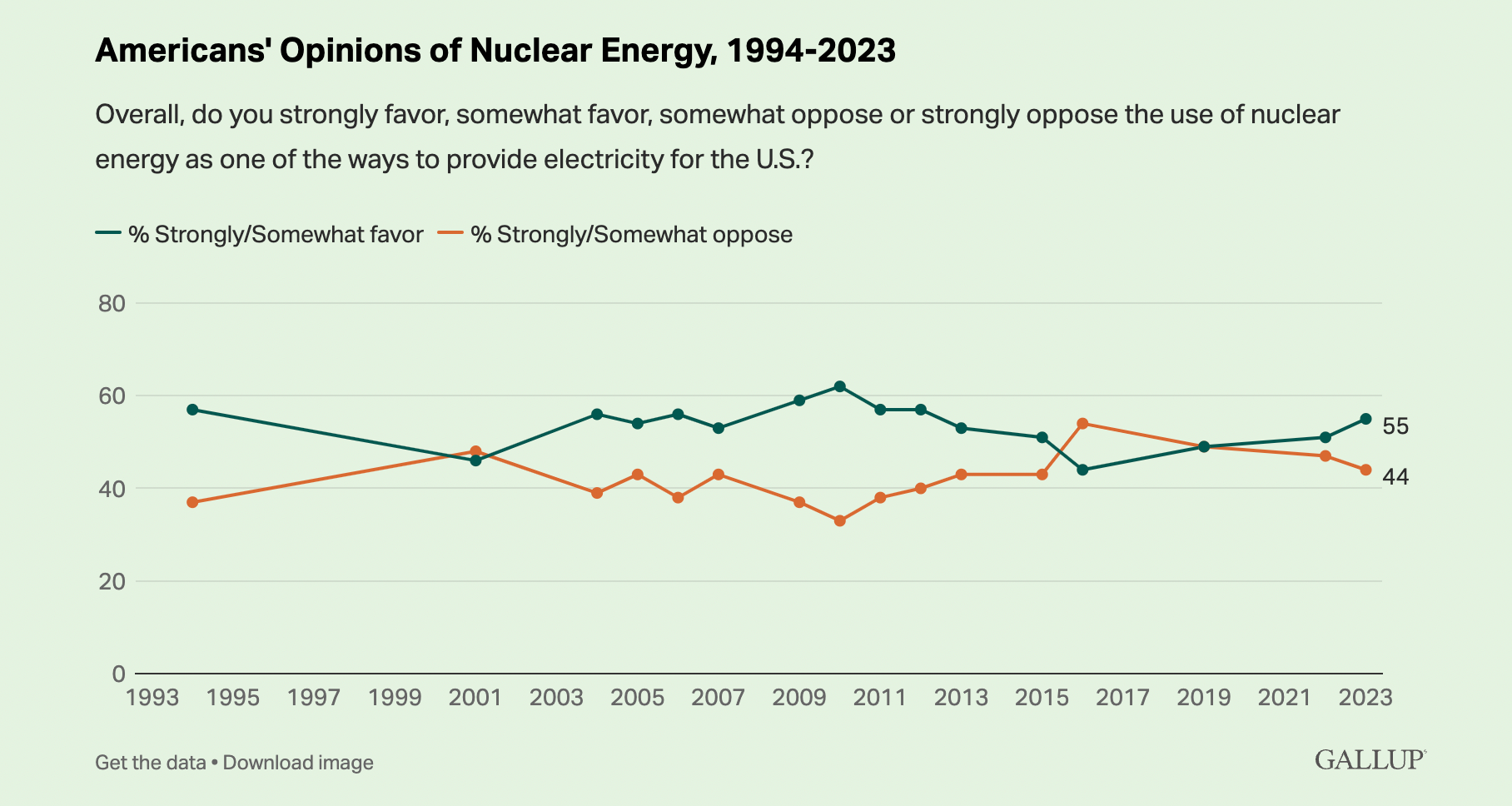

American enthusiasm for nuclear energy is the highest in a decade with 55% in support, according to a new Gallup poll.

Pew Research Center has the latest numbers on American’s views of climate change. With the majority in support of a carbon-neutral US by 2050, incentives for wind and solar, and US involvement in international efforts to limit global warming, your neighbors might agree on more than you expect—though the partisan divide has grown.

EU nations agreed to the world’s largest green fuels mandate to decarbonize air travel.

California is the first state to adopt emission rules for trains, banning locomotive engines more than 23 years old by 2030.

Three in ten voting shareholders dissent as they seek resolutions to push banks, including Wells Fargo, BofA, and Goldman Sachs, to provide climate risk transition plans.

Electrification is in the house. Germany approved a bill banning new oil and gas heating systems starting in 2024. New York City also jumped onto the electric bandwagon banning natural gas, including stoves, in new buildings.

330,000 birds chose an SF layover for their migration earlier last week. Laid over, if you know what I mean.

Tree species are branching out as they grow further north due to climate change.

Are sails the second wind needed to clean up the shipping industry?

With climate change in full bloom, some adults are having allergies for the first time.

XPrize launches a new white hot competition to stop wildfires.

US Electrician counts need a recharge if we want to meet our climate goals. Meanwhile, skilled labor jobs are at risk in a green transition crude awakening.

An EV is now China’s top-selling car - with 440,000 vehicles sold in Q1’23 already.

All EU market-ready CCS projects captured on a map.

Chat IPCC: here to answer all of your climate questions.

🗓️ Climate Transformation Summit: Virtually join this conference on May 11th- 12th bringing together innovations and climate leaders to address the decarbonizations of companies and supply chains.

🗓️ Carbon Unbound: Attend on May 11th - 12th for a summit featuring numerous CEOs and leaders discussing solutions across climate tech, delivering market insights, and networking.

🗓️ SustainabilityCon: Register to join on May 10th-12th and connect with innovators and leaders within the decarbonization space.

Head of Investment @Rewiring America

Investment and Fund Partnerships Principal @Third Derivative

Chief of Staff @Euclid Power

Associate, New Venture Creation in Climate @Deep Science Ventures

Venture Capital MBA Sourcing Intern - Climate @Anthos Capital

Chief Commercial Officer @Resonant Link

Director of Sales & Business Development @Tigo Energy

Entrepreneur in Residence @The Engine

Growth Lead @Lithos Carbon

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond