🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

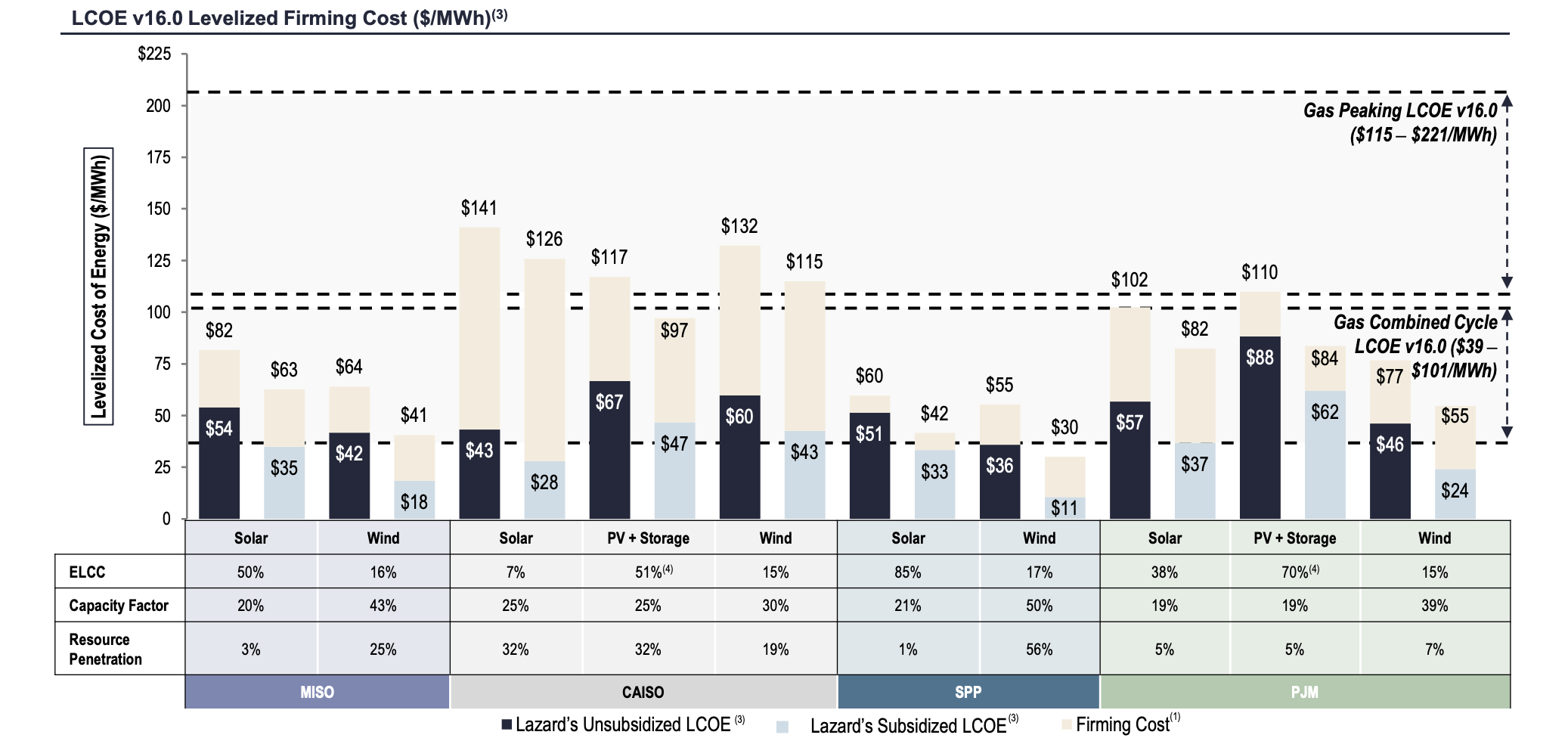

Lazard’s LCOE drop finds solar and wind cost-competitive with fossil fuel, even with the price of firming intermittency

Happy Monday-After-Earth-Day!

Pumping more wind and solar electrons into the grid also necessitates investing in tech to smooth out those intermittent peaks and valleys. While these costs are typically left out of renewable energy price comparisons, a new report runs the proper storage capital calculations and (drumroll…) still finds wind and solar cost competitive with coal and gas power plants.

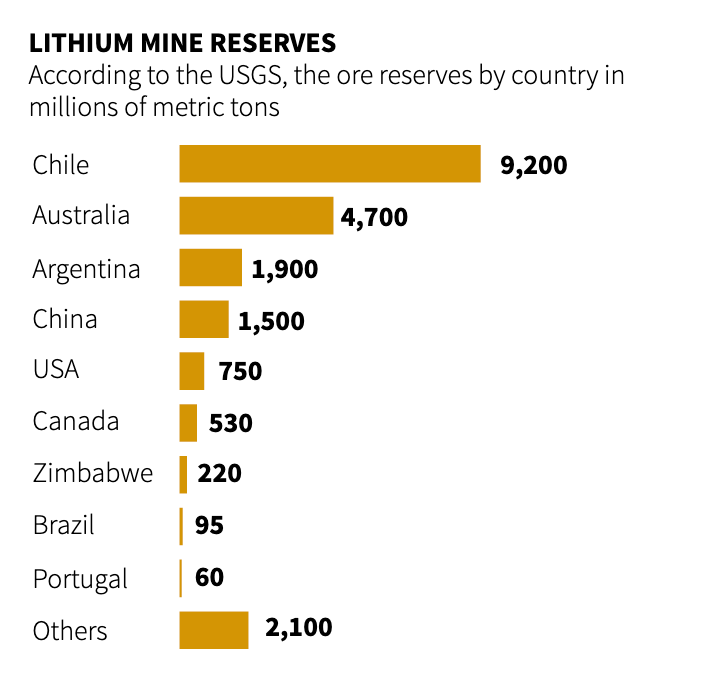

Meanwhile, American automakers jockey to qualify for IRA’s EV tax credit, but only 10 models have received IRS approval so far. CATL announced a battery with enough energy density to potentially power flights. And Chile nationalizes its lithium industry.

In deals this week, $175M for insect-based protein, $30M for crop management, and a $10M O&G investment into geothermal.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter here.

💼 Find or share roles on our job board here.

Lazard’s 2023 LCOE report dropped earlier this month, and we were all 👀.

Levelized cost of energy (LCOE) is a commonly used metric for analyzing the cost of different types of electricity generation, calculated by dividing the total cost of building and operating electricity generating technologies over the lifetime of a project by the total amount of electricity produced.

The annual Lazard assessment provides a detailed comparison of wind, solar, nuclear, coal, and natural gas in the US, as well as the LCOE of hydrogen and energy storage, helpfully taking new IRA carrots and potential carbon tax sticks into consideration.

This year, the LCOE report also includes the cost of “firming intermittency”—the price of energy storage or backup power generation to bolster periods of lower renewable electricity generation—and still finds wind and solar cost-competitive with traditional fossil-fuel generators.

😲 For the first time in the history of the report, the cost of solar and wind increased—a result of more expensive capital and higher construction costs. But with IRA tax credits, some wind and solar projects effectively have a $0/MWh LCOE price.

🔋 For CAISO, the grid operator in California, the analysis found that installing more battery storage capacity is needed to save on costs as well as improve reliability.

🤓 This report accounts for the cost of “firming intermittency,” which helps provide a more realistic picture of the cost of renewable energy resources.

Renewables like wind and solar have been as cheap or cheaper than fossil-fuel power plants for several years now, but this is the first time that Lazard has addressed a frequent sticking point: firming costs.

The price of wind and solar energy has decreased dramatically, but installing renewables to replace traditional GHG-emitting power generation isn’t a 1:1 swap. Because wind and solar are intermittent energy sources, they have lower capacity factors.

This means that reaching an emissions-free power grid will require not just an equivalent amount of renewable energy, but more than the existing nameplate capacity in order to account for the variable nature of wind and solar.

The amount of wind, solar, and battery projects waiting to connect to the grid today is greater than the entire existing capacity of the US power grid. While the interconnection backlog is unlikely to ease in the near-term, the economic upside for renewable energy should only continue to improve as lithium-ion batteries and other energy storage tech also become more affordable.

🐄 Ynsect, an Amiens, France-based insect-based protein producer, raised $175M in Series D funding.

🌾 CropX, a Netanya, Israel-based agronomic farm management system, raised $30M in Series C funding from Aliaxis Group, Edaphon, Finistere Ventures, NTT Finance, OurCrowd, and other investors.

⚡ Sunvigo, a Cologne, Germany-based solar as a service provider, raised $13M in Series B and $8M in debt funding from Future Energy Ventures, Triodos Investment Management, High-Tech Grunderfonds, Übermorgen Ventures, Eneco Ventures, Deutsche Kreditbank, and Sparta Capital.

💨 Ebb Carbon, a San Carlos, CA-based reverse electrochemical ocean deacidification, raised $20M in Series A funding from Prelude Ventures, Evok Innovations, Congruent Ventures, Incite, and Grantham Environmental Trust.

🔋 E-magy, a Broek Op Langedijk, Netherlands-based developer of nano-porous silicon anode technology, raised $16M in Series A funding from Invest-NL, Norsk Hydro ASA, PDENH, Rubio Impact Ventures, and SHIFT Invest.

🌱 nZero, a Reno, NV-based carbon emissions management platform, raised $16M in Series A funding from Fifth Wall and Piedmont Capital Investments.

⚒️ Novalith Technologies, a Sydney, Australia-based producer of low-carbon lithium for batteries, raised $15M in Series A funding from CEFC, Investible, Grantham Environmental Trust, Lowercarbon Capital, and TDK Ventures.

🏠 Enter, a Berlin, Germany-based home energy assessment platform, raised $15M in Series A funding from Foundamental, Coatue, Partech, Target Global, and A/O PropTech.

💨 Abatable, a London, UK-based carbon offsetting procurement platform, raised $14M in Series A funding from Azora.

🍄 EniferBio, an Espoo, Finland-based company developing fungal protein, raised $12M in Series A funding from Aqua-Spark, Tesi, Valio, Voima Ventures, and Nordic Footech VC.

⚡ Fervo Energy, a Houston, TX-based geothermal project developer, raised $10M in strategic investment from Devon Energy Corporation.

⚡ ChargeLab, a Toronto, Canada-based developer of EV charging operating software, raised $10M in Series A funding and $5M in venture debt from Eaton Electrical and Silver Comet Energy Partners.

🌳 Flash Forest, a Toronto, Canada-based aerial reforestation platform, raised $9M in Series A funding from OurCrowd and TELUS Pollinator Fund.

🌳 TreesPlease Games, a London, UK-based gaming platform for planting trees, raised $8M in Seed funding from Lakestar, David Helgason, and other angel investors.

🚗 Kate, a Cerizay, France-based developer of electric micro-cars, raised $8M in Seed funding from angel investors.

⚡ Evergrow, a San Francisco, CA-based clean energy projects platform, raised $7M in additional Seed funding from First Round Capital, XYZ Venture Capital, Congruent Ventures, and Garuda Ventures.

🏠 Sero, a Cardiff, United Kingdom-based provider of home energy optimization services, raised $7M in Seed funding from Hodge and Legal & General Capital.

⚡ Aalo Atomics, a Toronto, Canada-based company commercializing small nuclear fission reactors, raised $6M in Seed funding from Fifty Years, Valor Equity Partners, and other investors. ⚡ Plexigrid, a Stockholm, Sweden-based AI energy consumption software platform, raised $5M in Seed funding from Polar Structure, TheVentureCity, and Vargas Holdings.

🍎 Vivid Machines, a Toronto, Canada-based computer vision monitoring platform for fruit crops, raised $4M in Seed funding from BDC Capital, Standup Ventures, Algoma Orchards, Tall Grass Ventures, Entrepreneur First, BoxOne Ventures, Conexus Venture Capital, The W Fund, Cornell, Freycinet Ventures, N49P, and MaRS Investment Accelerator Fund.

🍄 Nosh, a Berlin, Germany-based company making alternative protein from fungi biomass, raised $4M in Seed funding from Earlybird Venture Capital, Grey Silo Ventures, and Good Seed Ventures.

💨 Specifx Data, a San Francisco, CA-based HVAC data software startup, raised $3.5M in Seed funding from Powerhouse Ventures, Better Ventures, Blackhorn Ventures, SaaS Ventures and Soma Capital.

🐄 Tepbac, a Ho Chi Minh City, Vietnam-based IoT-enabled hardware and data system for shrimp farmers, raised $2M in Seed funding from AgFunder, Aqua Spark, and Son Tech Investment.

🔋 Nanoramic Laboratories, a Boston, MA-based electrode technology platform for battery development, raised an undisclosed amount of funding from GM Ventures.

⚡ Sunnova, a Houston, TX-based residential and commercial solar installer, received a $3B conditional commitment loan guarantee from the US Department of Energy LPO.

⚡ X-Elio, a Madrid, Spain-based solar energy EPC, raised $113M from BBVA and Santander CIB.

💧 Noventa Energy Partners, a Toronto, Canada-based developer of wastewater heating and cooling projects, raised $75M in loan financing from Canada Infrastructure Bank.

☀️ Flisom, a Zürich, Switzerland-based producer of PV thin film solar cells, was acquired by Ascent Solar Technologies.

☀️ Sunergy Renewables, a Florida, FL-based residential solar and storage installer, announced a SPAC merger with ESGEN Acquisition Corp at an implied valuation of $475M.

💧 Air Water Ventures, an Abu Dhabi-based company that extracts water from air, announced a SPAC merger with Athena Technology Acquisition Corp at an implied valuation of $300M.

💨 Ecosphere+, a London, UK-based nature-based carbon credits provider, was acquired by Abatable.

Amundi, a Paris, France-based asset manager, launched a $1B net zero real estate strategy.

NTR and Legal & General raised a $427M L&G NTR Clean Power (Europe) Fund to invest in clean power infrastructure assets across wind, solar and energy storage.

Congruent Ventures, a San Francisco, CA-based climate tech venture firm, raised a $300M Continuity Fund bringing the total amount of assets managed to $700M.

BDC, a Montréal, Canada-based financing and advisory firm, raised a $111M Sustainability Tech Venture Fund to invest in Canadian climate technologies companies.

American automakers that manufacture EVs domestically and source parts from the US or its allies will benefit most from the Inflation Reduction Act's EV tax credits going into effect this week. So far only 10 cars have been approved by the IRS to receive the $7,500 credit but that number is expected to grow in the next few years. Included in that list is Tesla which recently cut its prices in order to qualify.

China’s CATL, the world’s largest EV battery maker, unveiled a new condensed battery that has the proper safety requirements and energy density to one day power aviation.

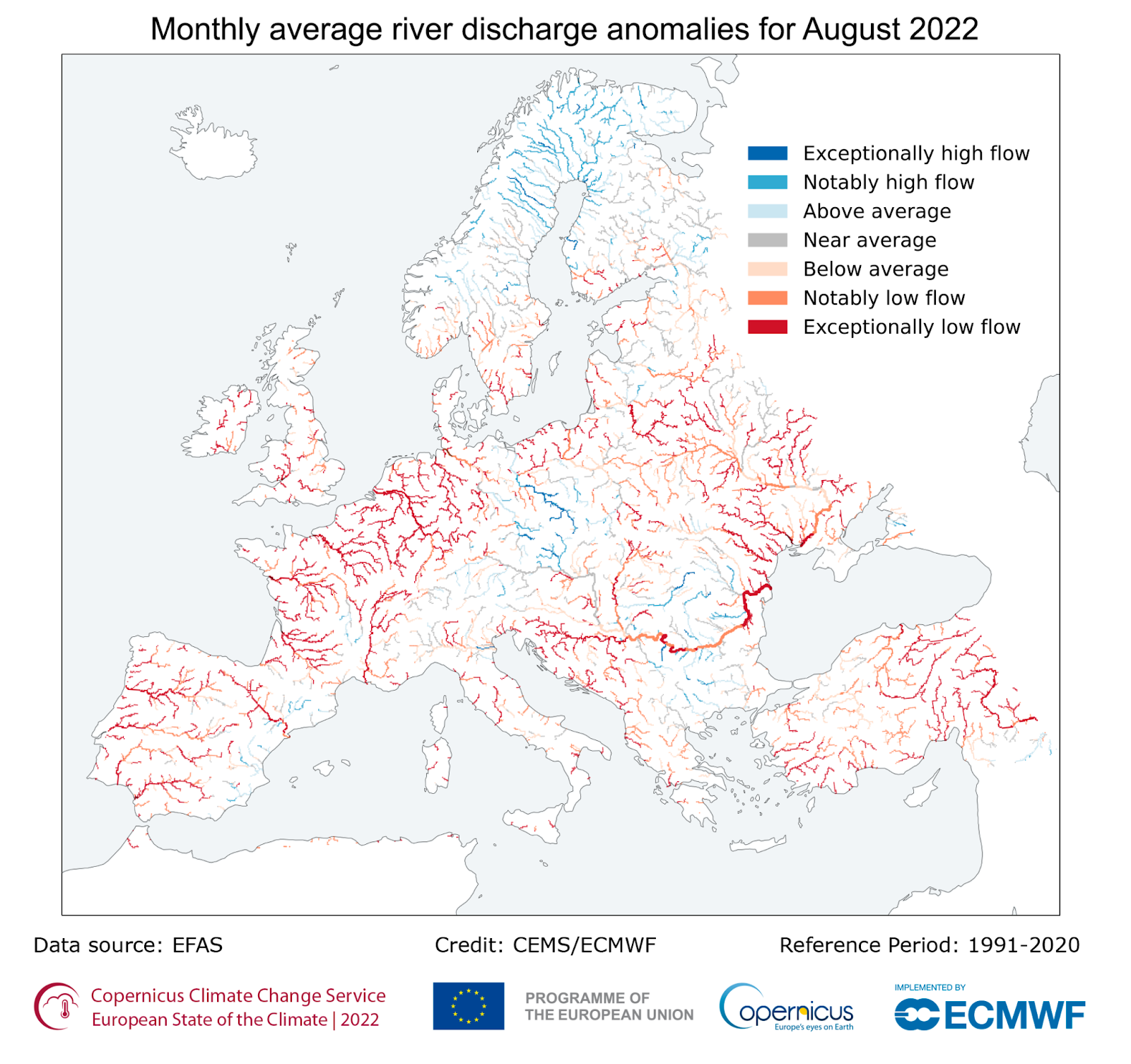

Asia is experiencing record breaking extreme heat this week with Thailand and Laos reporting the highest temperature readings ever recorded. In India, over a dozen people died after a heat wave struck during an outdoor political event. Extreme heat was also the topic of discussion in Europe as a new European State of the Climate Report for 2022 emphasized the grave impacts of extreme heat that have already and will continue to devastate European society, water resources, and livelihoods.

A federal court overturned the first natural-gas ban in the US indicating legal challenges ahead for similar bans in place across the country.

Top financial officials are pushing for the World Bank to broaden its approach from simply being a poverty-fighting institution to one that addresses climate challenges. However, the debate continues to divide officials as questions around who will fund the overhaul go unanswered.

After an 18-year permitting process, a major transmission line connecting an onshore wind farm from Wyoming to to other western states just got approved (but still isn’t under construction), highlighting the challenges with transmission line permitting. Across the country, a Maine jury also approved a major transmission line that will bring power from Hydro-Quebec to the New England grid, a cornerstone of MA’s climate plan.

Chile plans to nationalize its vast lithium industry creating a state firm that will control the world's largest lithium reserves.

G7 ministers set new targets for renewable energy deployment by collectively agreeing to increase offshore wind capacity by 150 gigawatts and solar capacity to more than 1 terawatt by 2030. They were unable to, however, agree on the phase-out of coal.

Back to the future of nuclear fusion, comic-book style.

BloombergNEF calls out 12 climate startup 2023 Pioneer Awardees across green hydrogen, sustainable metals, and decarbonizing food including Nth Cycle, Sublime Systems, Travertine, and H2Pro.

Does climate change make you sick to your stomach? Could be because climate-related turbulence is on the rise.

👏 Stop 👏 giving 👏 airlines 👏 money for their carbon offsets.

An update on salty batteries from our friends at Intercalation Station.

Arctic ice melting is melting life as we know it.

World’s first climate resilient nation? It may not be who you think.

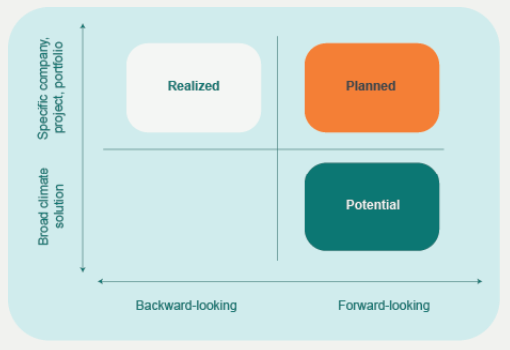

Project Frame is out with a banger of a white paper on screening investments on GHG impacts.

Electrify Everything: Watt's Up with the Shockingly Green Energy Overhaul?

From planting trees to upgrading sewers, New York local governments to spend $737M in response to climate related hazards.

Spring Fever hits the EPA.

A cool path to better health outcomes: why we need to invest in cold chains. Will flash droughts dry up our planet? This study seeks answers.

💡 776 Fellowship: Apply to the 776 Fellowship Program by Apr 24th and receive a $100,000 grant and various resources to develop your climate solutions.

🗓️ Elemental Excelerator: Join Elemental Excelerator Interactive on Apr 24th-26th, to participate in decarbonization talks with investors and innovators in the space.

🗓️ Impact Investing World Forum: Join Impact Investing Conference on May 4th-5th in London to learn about the state and future of impact investing. Keynote speakers include IFC, European Commission, Blackrock, and UBS.

🗓️ Hack Summit: Register for Hack Summit, a 2 day event hosting entrepreneurs, leaders, and investors in food and climate tech on May 11th-12th.

🗓️ Advanced Energy United: Register to attend Advanced Energy United on May 18th and hear from industry and political leaders about the government policy and trends regarding advanced energy markets.

Last chance to toss your hat in the ring for CTVC’s Data Engineer and Data Analyst open call!

Founder, Solving Inland Urban Water Scarcity @ Deep Science Ventures

Head of Software Engineering @ Thalo Labs

Senior Business Development Lead @ Thalo Labs

Senior Software Engineer @ Zero Homes

Head of Capital Markets @ Sealed

Head of People Operations @ Mill

Head of Carbon Strategy @ Terraformation

Strategy Associate @ Brilliant Planet

Senior Investment Manager in Renewables (f/m/d) @ Finance in Motion

Senior Expert - Environmental & Social Management @ Finance in Motion

Account Executive @ Glacier

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project