🌏 High-flying fuels

The runway for sustainable aviation fuels

The plug on battery innovation with guest column from Intercalation Station

Batteries are the plug of decarbonizing electrification. Cumulative demand for lithium-ion batteries is slated to swell 1700% by 2030 charged by the pulse of electrification in transportation and grid storage. A wave of manufacturing is sweeping North America and Europe in an attempt to match China’s one-gigafactory-per-week amped up growth rate.

In particular, lithium-ion batteries have welded their marriage with the electric vehicle (EV) industry, as OEMs continue to announce major electrification targets. America’s darling, the Ford F-150 pickup, unveiled its electric version this week to President Biden’s glee: “this sucker’s quick!” Other auto OEMs like BMW are also going through battery innovation FOMO and hedging their bets by simultaneously partnering with Sila Nanotechnologies (silicon) and Solid Power (solid state).

Why all this electrification hype now? Batteries have massively scaled down the cost curve over the last decade, from more than $1,000/ kWh in 2010 to $137/ kWh today. As costs come down, electric vehicles and energy storage systems can go from luxury, small-scale use cases to becoming widely adopted. Now even the DOE believes getting to the eye-watering price target of $60/kWh is feasible. But the jury is still out on how the industry will arrive at this target. Emerging technologies like solid state, lithium metal, sulfur, and silicon will have to compete with the incremental improvements in conventional lithium-ion as it barrels down the learning curve.

Beneath the surface of eco-friendly altruism and lower lifecycle emissions lies a strong undercurrent of economic opportunity: investors have made huge bets on the value of battery and EV companies, contributing a record $8.1b towards the cause in 2020. However, it’s worth noting that battery startups have not had the best of track records so far. While OEMs take up to 5 years to green-light new battery technologies, investors often have to take claims of commerciliazability for “breakthrough materials” at face value. Can you accept a decade-long warranty from a year old startup? This also highlights the lack of independent benchmarking. The spec sheet for a vacuum cleaner battery doesn't exactly map directly onto eVTOL applications. Thankfully, new battery technologies can compete on more dimensions than solar PV, including cost, energy density, fast chargeability, safety, manufacturability, mineral dependency, and recyclability. Many of these metrics directly tradeoff with each other.

Innovations in the Value Chain

With gigafactories playing the economies-of-scale game, where will startups plant their flag?

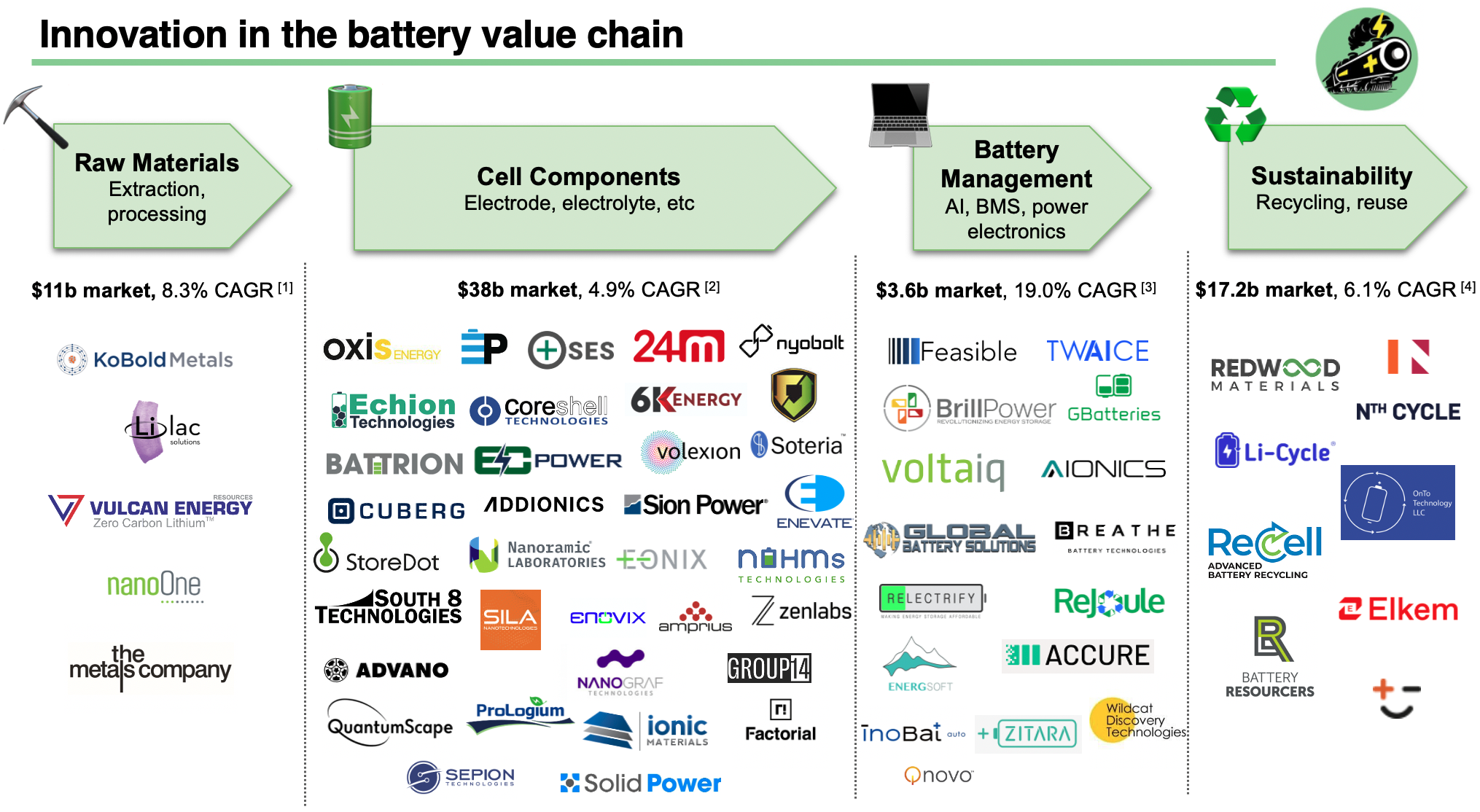

To intuit how startup innovations will intersect with the existing value chain, we’ve covered some stages from mineral to EV pack and back, and share a few innovators to watch out for:

Plenty has been said about the impending battery minerals supply crunch. The ecosystem is highly globalized, think Bolivian evaporation-pond lithium, “artisanal” Congolese cobalt, Indonesian nickel, South African manganese. Even graphite anodes, electrolyte solvents, and polymer separators come from petroleum products. These minerals are converted into intermediates such as lithium hydroxide, nickel sulfate, and other salts, mostly by Chinese manufacturers. Overall this process can take anywhere from days to months.

Upstream innovations include using big data for resource exploration, direct lithium extraction from geothermal brines, microbial biomining of tailings waste, deep sea sourcing of polymetallic rocks, and direct metal to cathode synthesis methods which may help localize cathode materials production.

Innovators: KoBold Metals (smart exploration), Lilac Solutions (direct extraction), NanoOne (metal to cathode), Vulcan Energy (geothermal brines), The Metals Company (deep sea mining)

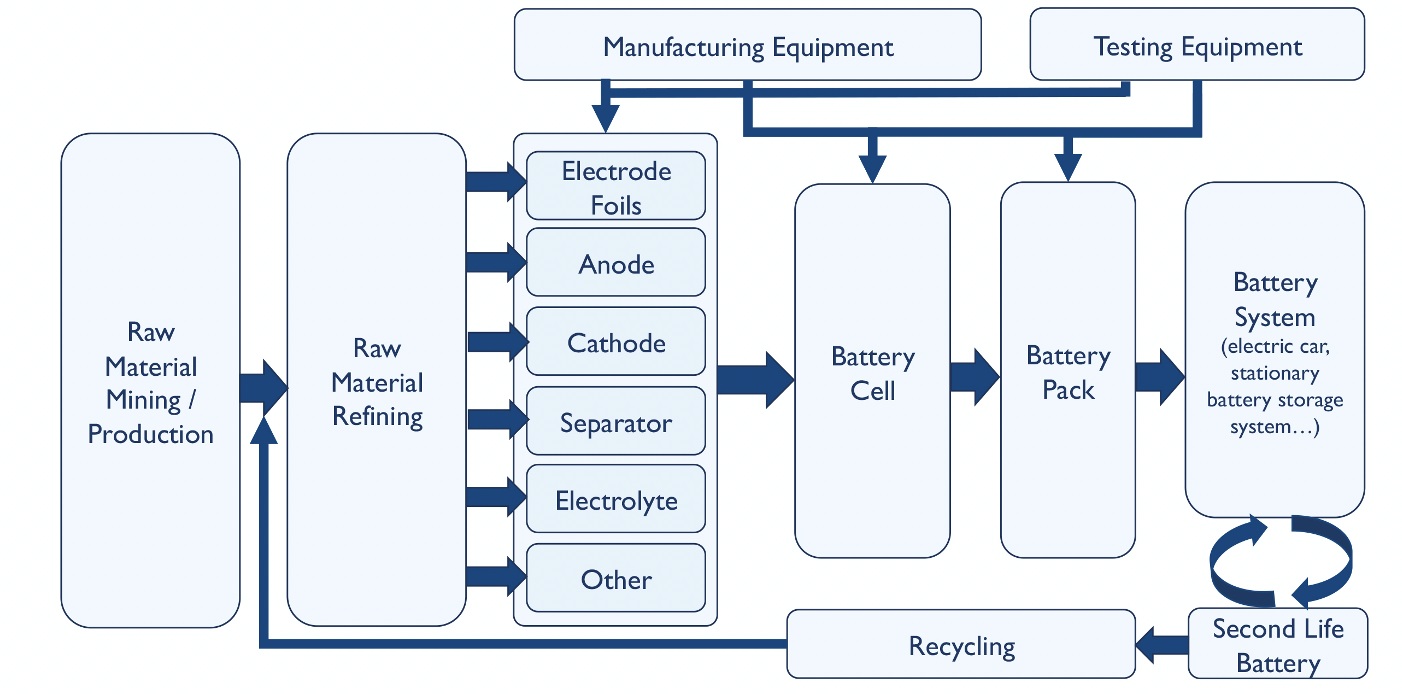

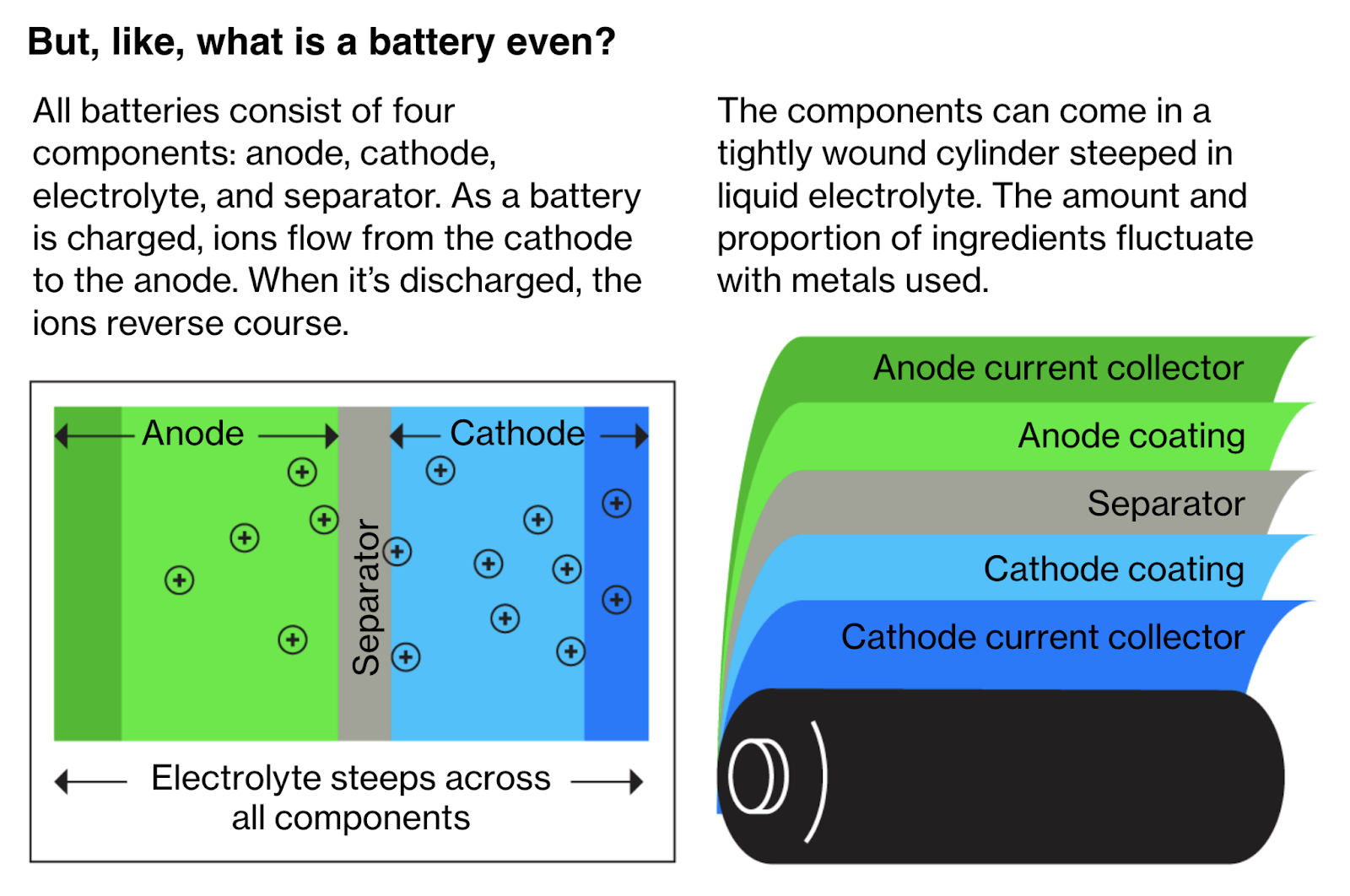

All the components in a battery need to be carefully synthesized with specific production processes. This includes baking and grinding the metal oxide and graphite powders that end up as the cathode and anode active materials which store charge, dissolving salts into solvents to make electrolytes that allow lithium ions to flow, and rolling out copper foils that form current collectors that carry the electrons. Processing at this stage requires one to two weeks to reach battery grade.

Current lithium-ion battery components really haven’t evolved much. Startup innovation on the cell component and design front is also the most crowded. Climate Tech VC has previously covered some notorious solid-state and silicon players that use new chemistries to unlock performance. Likewise, other approaches include 3D current collectors and electrodes, as well as novel (solid or liquid) electrolyte formulations which enable lithium metal anodes. It can be useful to consider how these innovations fall on a spectrum between “platform agnostic” and “paradigm shifting” which bring their own characteristic risks and rewards.

Innovators: Coreshell (protective coatings), EnPower (electrode architectures), Sion Power (Li metal), Echion (niobium), Nyobolt (niobium), Storedot (silicon & germanium), Battrion (aligned graphite), Volexion (graphene coatings), SES (Li-metal), 24M (semi-solid), South 8 (liquified-gas electrolyte), Packaging and Crating Technologies (fireproofing), Addionics (3D current collectors), 6K (plasma synthesis), EC Power (thermal modulation), Oxis (Li-sulfur), Cuberg (Li and ionic liquid), Soteria (metalized polymers) Eonix (electrolyte), Nohms (electrolyte), Nanoramic (electrode processing), ZenLabs (silicon), Sila Nano (silicon), Enovix (silicon), Enevate (silicon), Amprius (silicon), Advano (silicon), NanoGraf (silicon), Group14 (silicon), Quantumscape (solid state), Prologium (solid state), Ionic Materials (solid state), Factorial (solid state), SolidPower (solid state), Sepion (membranes)

Battery manufacturing is dominated by the gigafactory giants the likes of Tesla, LG Chem, CATL, SK Innovation, Panasonic, BYD, and VW. For early stage ventures, this is a no-fly zone due to regulatory, land, capital, and labour requirements at this scale. How is the battery assembled? Active material powders need to be mixed into a slurry, before being spread onto metal foils and dried to complete the electrode. Coated electrodes are then layered or wound up with separator and electrolyte and sealed into a complete cell. This is a continuous process, but the formation + conditioning steps where a battery is slowly charged and discharged can take from one to three weeks to complete. From there, individual cells are combined into modules and packs.

Here it is more common to see disruptors form joint ventures with larger industry players so that startups can bridge the gap between component innovation and mass manufacturing.

Along with the embrace of electrification, companies without battery expertise will need to partner up to craft bespoke battery management systems for their devices and vehicles. This also allows startups with AI tools to work on much larger datasets. Smart telemetry, algorithms, and power electronics can also add value across all stages of the battery supply chain. For example, digital twins and advanced sensors can aid factory process optimization while software and AI methods can speed up R&D and improve data management. Similarly, Big data and other analytics optimize the value provided over a battery's operating lifetime. Battery management and physics-based models enable fast charging with less impact on lifetime and electronic circuitry can squeeze more out of degraded packs, where performance is limited by the weakest individual cell.

Innovators: Feasible (ultrasonic monitoring), Brill Power (battery management), Voltaiq (enterprise software), GBatteries (fast charging algorithm), Global Battery Solutions (smart monitoring), Aionics (AI R&D), Breathe Battery (battery management), Twaice (analytics), Relectrify (power electronics), Rejoule (diagnostics), Energsoft (software analytics), Zitara (fleet management), Wildcat Discovery (high throughput R&D), InoBat (AI cells), Accure (intelligent platform), Qnovo (battery management)

As the massive volumes of batteries eventually reach end of life, companies are also closing the loop on a circular economy. Old cells can be repurposed for second life applications with smart management as covered above. Of course, the valuable materials from spent batteries can also be sustainably recycled. This requires a myriad of processes, from physical disassembly and separation, to pyrometallurgy, where less valuable components are incinerated and metallic compounds are smelted down into alloys, to hydrometallurgy, where liquid leaching is used to extract the materials.

The financial and energetic cost of fighting entropy is tentative, and the market can shift in strange ways (see why prices on used batteries can be even higher than new ones). The emergence of cheaper battery materials like LFP also changes the economic viability.

We’re seeing many partnerships being struck (Redwood x Proterra, and GM x Li-Cycle), to support and scale sustainable business models.

Innovators: Redwood Materials (shred, extract, regenerate), Li-Cycle (shred, extract, regenerate), ReCell (direct regeneration), Onto Technology (shred, extract, regenerate), Nth Cycle (electro-extraction), Battery Resourcers (sustainable cathode), Betteries (2nd life)

As uncertainty in the battery roadmap persists, venture capitalists should look to realign expectations based on lessons from scaling the pharma industry, to avoid playing Russian roulette with promising startups. Many believe consolidation is on the horizon. Right now, this presents a prime opportunity for risk-tolerant investors to try their luck betting on some winning horses.

Key takeaways

Intercalation Station is here for your battery needs. Check out Andrew (@ndrewwang) and Nicholas’ (@nicholasyiu) Chart Library that aggregates key forecasts and metrics. Intercalation was founded to communicate the latest battery news in academia and industry, inform real science against sensationalist stories with expert insight, and ultimately support the environmental movement around climate technologies.

The runway for sustainable aviation fuels

Well-to-wake pathways to cleaner shipping

The cost and complexity challenges of creating drop-in alternative fuels