🌎 H1 2025 Climate Tech Investment: Capital stacking up for energy security & resilience

Get Sightline’s signature H1’25 investment trends report inside

A founder’s guide to winning non-dilutive funding with Elemental Excelerator

It’s been a whole year since the Inflation Reduction Act passed, and the extreme weather this summer has underscored that the stakes for our planet have never been higher. Innovative climate solutions are entering the spotlight, but deploying those key technologies requires resources. We’ve covered the climate capital stack—from the flow of VC dollars to the challenges of accessing commercial debt. One crucial and coveted slice of that stack is the non-dilutive capital that doesn’t have to be paid back: grants.

While the upside is obvious, navigating funding applications can be confusing. That's why we’ve tapped Elemental Excelerator’s expertise and experience to unravel the complexities of accessing non-dilutive government funding (in the US). Elemental Excelerator is a nonprofit focused on scaling climate technologies and has stewarded more than $160M in government and philanthropic funding to support companies working across heavy-emitting sectors. We’ll walk you through the essential steps to prep your climate tech startup for the competitive government grant process.

Though the IRA has gotten much of the attention, the US federal government has passed—count ‘em!—three climate policy packages since 2021.

🦴 BIL “the backbone”: The Infrastructure Investment and Jobs Act (IIJA), aka Bipartisan Infrastructure Law (BIL), was signed into law in November 2021, and is the "backbone," providing much of the infrastructure these technologies need to scale at speed.

🧠 CHIPS “the brains”: The Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act was signed into law in August 2022, and is the "brains," steering billions into cutting-edge research and development needed to accelerate innovation across the economy, including in climate.

🚂 IRA “the engine”: The Inflation Reduction Act (IRA), which provides billions in grants and tax credits to support carbon mitigation, was signed in August 2022. It's the "engine," due to demand-pull measures that provide the security for these technologies to reach market maturity.

Grants are awarded by a range of sources, from entities at the state and city level to federal agencies. Government grants tend to be larger than philanthropic grants and can provide credibility and validation to the companies that win them. They can also support new partnerships between startups, the public sector, and community leaders and organizations. The catch? They often have detailed (sometimes onerous) reporting requirements and can come with restrictions on how the money can be used (e.g., Buy America Build America or prevailing wage rules).

For those who haven’t navigated the government grants process before, here’s a quick cheat sheet of essential federal funding lingo.

Government funding opportunities typically follow similar timelines that allow both the applicants and the granting agencies to ask questions along the way. The information gathered during this process shapes the requirements laid out by the government for successful applications.

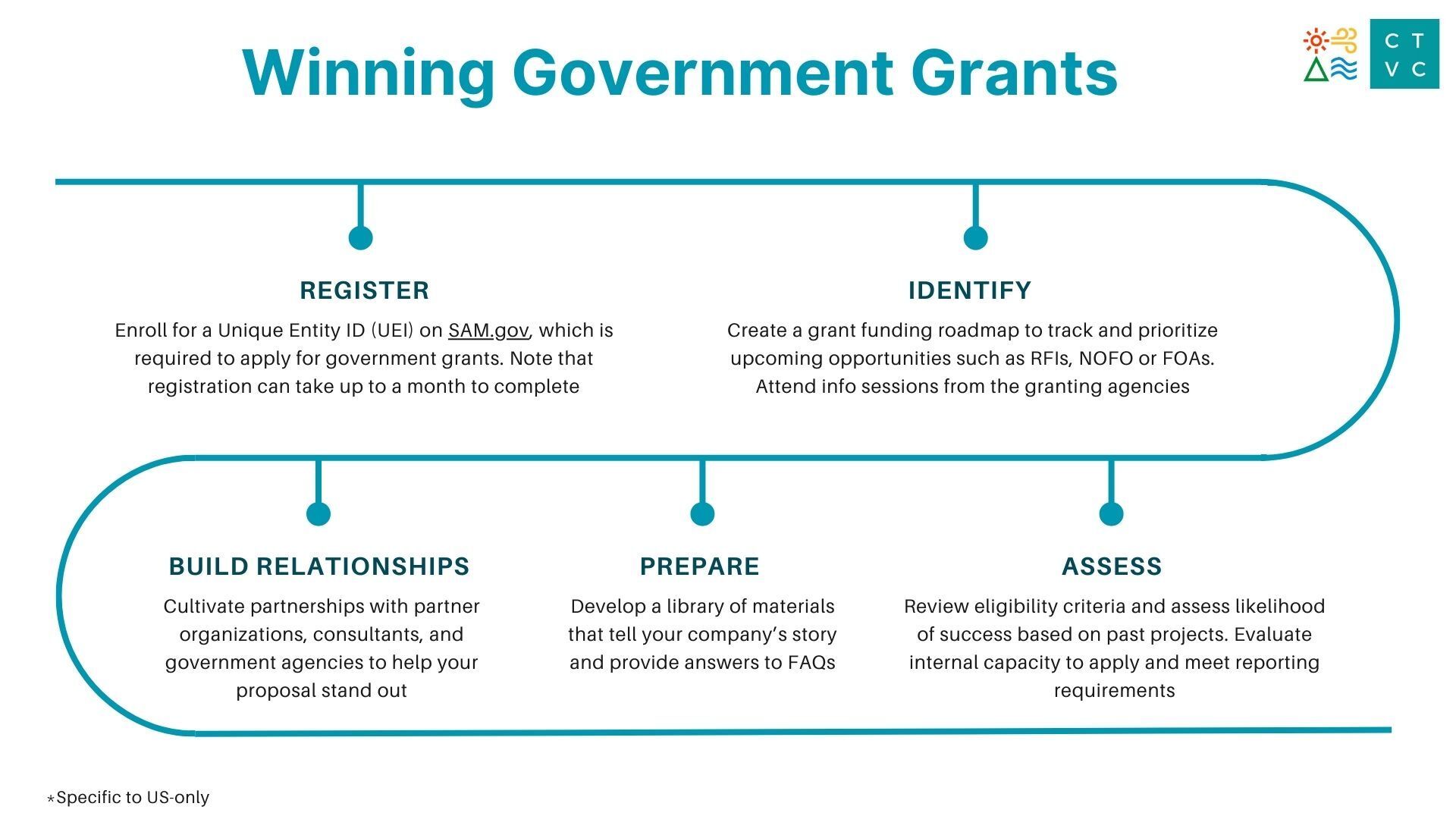

While there’s a historic amount of government funding becoming available for climate tech, that doesn’t mean every opportunity is right for your company. It’s important to triple check eligibility requirements and then narrow down grant options to those most aligned with your organization—otherwise you could waste valuable time and resources chasing federal dollars that are unlikely to materialize.

Review eligibility criteria: Climate tech companies should ensure the project they’re looking to fund fits within the agency’s list of eligible projects. If it is unclear from the funding announcement, companies should reach out to the agency contact (emails will be listed on the funding announcement). Next, they should ensure they can apply as a prime grantee or partner with a group that is eligible to be the prime applicant. Finally, they should ensure they have the right partners in place to meet or exceed teaming arrangements and J40 priorities to make their application competitive. For example, many DOE grants require “letters of commitment” from community-based nonprofit organizations. Developing partnerships to secure such a letter can take many months.

Assess the likelihood of success: Companies should assess their likelihood of success before investing time and resources to develop a grant application. Companies should start by familiarizing themselves with past projects that were funded under the grant program, and assess how their program compares with past project types, geographies and teams. Companies have reported that success rates seem to be helped when (i) they have a preexisting relationship with the granting agency, so they understand the agency’s priorities and (ii) they have provided feedback through RFI processes to help inform the funding announcement.

Assess internal capacity: Before applying, companies should carefully consider their capacity to develop a grant application and meet reporting requirements, should they win. Developing a narrative proposal and supplemental materials can take several weeks, which may distract from other urgent priorities. Companies should ensure they have someone on staff to project manage the proposal and people to contribute to writing the narrative, formulating the budget, collecting letters of commitment and developing logic models or other supplemental materials. Outside consultants can be helpful, but they will be most helpful if the company has an established relationship in advance of the application process and internal capacity to help manage and support those consultants to develop materials.

To maximize your chances of success, your team should begin preparing to respond to government grant opportunities long before a funding opportunity is announced. For example, the IRA identified priorities for a variety of new funding programs, but these were debated and iterated upon for months before funding announcements were released. Companies who responded to RFIs and developed relationships with the agency, implementation partners, and other key stakeholders in the intervening months may have helped shape specifics—and built partnerships to make their proposals stand out.

Create a grant funding roadmap to prioritize opportunities

Build relationships with partner organizations

Build relationships with consultants who can provide swing capacity

Build relationships with government agencies

While it can be tempting to structure your narrative to match your pitch deck, remember that a government audience differs greatly from a VC. The scoring rubric is followed closely, so it is important to answer the questions directly to receive full points. Your best bet is to use the suggested headings verbatim and, in your answer, to repeat the terminology used in the question description. Be sure to save time for reviewers to check your answers against the scoring rubric.

Letters of commitment

Many grant applications require letters of commitment from partner organizations. These letters express the organization’s commitment to supporting the proposed program, and outline their role in ensuring its success. The best letters include examples of how the organizations have partnered together previously. Letters of commitment take time to secure, and companies should begin forming these relationships well before a grant funding program opens.

Companies should also request letters from federal elected officials representing the district where a project occurs. A warm introduction to a staffer is the best route, but absent that, you can request a meeting on the elected’s website to brief their team on your project and request a letter.

Resources to support proposal development

The Qualifying Advanced Energy Project Credit (48C) [IRS+ DOE; ongoing program] Originally launched in 2009, 48C was expanded with a $10B investment under the Inflation Reduction Act. The Advanced Energy Project Credit provides a tax credit of up to 30% for investments in advanced energy projects. The latest round of applications closed in August 2023, but companies can look out for future opportunities and find more information, HERE.

ARPA-I [DOT; expected launch in 2023] Authorized by IIJA and sitting within the DOT, ARPA-I will fund the development of innovative technologies, systems and capabilities to transform America’s physical and digital infrastructure. It’s expected ARPA-I will operate similarly to ARPA-E, periodically releasing FOAs that climate tech companies can apply to. For more information, check the ARPA-I website.

Clean Energy Infrastructure Funding [DOE; grants ongoing] With more than $97B in investments through the Bipartisan Infrastructure Law and the Inflation Reduction Act, the DOE Clean Energy Infrastructure program is focused on the rapid commercialization, demonstration and deployment of clean energy technologies. Explore open FOAs HERE and subscribe to the newsletter HERE.

Climate Resilience Accelerator [NOAA] This new $60M IRA-supported funding opportunity seeks to fund accelerator groups that will, in turn, provide grants to businesses navigating commercialization pathways for ocean-based climate resilience solutions to help communities build resilience to climate challenges. The goal is to support the development of innovative early to mid-stage businesses with training, resources, mentorship, and seed funding, with the ultimate aim of bringing products to market. Explore more HERE, and view the FOA HERE.

Consumer Electronics Battery Recycling, Reprocessing, and Battery Collection Funding. [DOE, annual] DOE’s $125M funding opportunity is part of the $7B authorized by the Bipartisan Infrastructure Law to grow and secure America’s battery supply chain. Eligible projects include the technologies that improve the economics of recycling consumer electronics batteries, and those that support and incentivize collection. Climate tech companies can be the prime applicant, but multi-disciplinary teams are encouraged. For more information, go HERE.

Energy Efficiency and Renewable Energy (EERE) Grants [DOE; grants ongoing] The EERE program releases FOAs covering transportation, energy, water and buildings. Project selections are competitive and merit-based, with funding criteria based on potential energy, environmental and economic benefits. Explore open FOAs and subscribe to the newsletter HERE.

SBIR Grants EPA (annual program; expected to re-open Q2 2024) As part of the Small Business Innovation Research (SBIR) program, the U.S. Environmental Protection Agency releases annual requests for proposals from small businesses to develop environmental technologies in topic areas identified as priorities. Check in on the latest program priorities (HERE) and subscribe to the newsletter (HERE) to be alerted when new funding opportunities go live.

SBIR Grants DOE (annual; applications for FY24 due Oct. 10, 2023) The Department of Energy’s SBIR Program releases FOAs for areas of interest to the DOE. The DOE’s SBIR has three phases: Phase I explores feasibility, providing awards up to $250,000. Phase II awards up to $1,600,000 over 2 years. And phase III may award non-competitive, follow-on grants or contracts for products or processes. Explore current priorities (HERE) and subscribe to the newsletter HERE.

Vehicle Technology Office (VTO) Program-Wide FOA (annual; expected to re-open Q2 2024) The VTO FOA provides funding to advance research, development, demonstration and deployment in several areas critical to achieving net-zero greenhouse gas emissions by 2050. Focus areas are updated annually and cover reduction of weight and cost of batteries, reduction in life cycle emissions of advanced lightweight materials, reduced costs and advanced technologies for both on- and off-road vehicle charging and infrastructure, innovative public transit solutions, and training to increase deployment of these technologies among diverse communities. For more information, go HERE.

Greenhouse Gas Reduction Fund (GGRF) [EPA] The GGRF is a $27B dollar fund that prioritizes funding projects in historically underserved communities through three program areas:

The GGRF applications are currently open, with SfA applications due in late September, and CCIA and NCIF applications due in October. Climate tech companies interested in this funding should first ensure they are developing meaningful partnerships with community benefit nonprofit organizations to co-create projects. Next, companies should keep an eye on who wins the funding and establish relationships with those groups. It is expected that subgrants and financing will begin to be distributed in late Spring or early Summer 2024.

This summary acts as a starting point, but other trackers and databases are keeping tabs on the details of different funding opportunities. Find more info on tax credits, J40, and grant programs below.

Special thanks to Avra van der Zee (COO), Christina Angelides (Managing Director of the Policy Lab), Theresa Garner (Managing Director of Communications & Creative), and Melinda Hanson (Policy Lab Entrepreneur in Residence) at Elemental Excelerator, a nonprofit investor in climate technology with deep community impact.

Found this guide helpful? Check out much more from Elemental’s Policy Lab including toolkits and building blocks for equity- and community-centered project implementation, such as the Mayor’s Toolkit for Local Climate Action. And look out for more from CTVC shortly on cracking other tranches of the Climate Capital Stack.

Get Sightline’s signature H1’25 investment trends report inside

Survey results: what’s working, what’s stalled, and what’s missing

A sneak preview from Sightline’s exclusive client-only webinar