🌎 Inside Cloverleaf Infrastructure’s power play #206

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

First economy-wide emissions-reduction bill by Senate, paves climate investment path

Happy Monday! In what feels oddly like progress, the Senate passes the IRA and - as our breakdown last week shows - it’s poised to ramp up climate tech investment meaningfully across sectors.

In deals this week, mostly smaller fundings for hydrogen-electric planes, solar energy plant installation digitization, and satellite analytics for infrastructure networks. In funds and acquisitions, Ginkgo Bioworks acquires a rival synthetic biology player for $300m, and BorgWarner acquires a charging infrastructure startup for $185m.

In the news this week, former NRG CEO David Crane (interviewed here) is nominated for Under Secretary for Infrastructure, Britain’s national energy provider bought energy for 50x the price during its’ most recent heat wave, and Germany revived 21 coal plants (net +4% GHG emissions) to bolster stable grid power.

Thanks for reading!

Not a subscriber yet?

After three decades of inaction, on Sunday the Senate approved the Inflation Reduction Act’s $369b investment in climate change in what Senate Majority Leader Chuck Schumer of New York declared will “endure as one of the defining legislative feats of the 21st century.”

VP Kamala Harris broke the 50-50 deadlocked vote to make history with the first economy-wide emissions-reduction bill adopted by the Senate, and certainly the country’s largest investment in climate change ever. The IRA must now receive nearly every Congressional Democratic vote in order to pass.

We’ve been glued to #ClimateTwitter this weekend first refreshing for journalists’ live coverage of the Senate voting action, then for gleeful digital celebration as we all celebrated and reminisced.

ITS DONE!! THE INFLATION REDUCTION ACT HAS PASSED the nigh-impossible hurdle of the US Senate.

— JesseJenkins (@JesseJenkins) August 7, 2022

This literally changes everything!

What an historic moment. What a reversal of fortunes. Back from the brink of failure just 3 weeks ago. SO GRATEFUL for all who made this happen 🙏 https://t.co/QnydbygqyM

(+ Jesse’s breakdown of the IRA’s impact)

The IRA invests 6x more in climate action than all US legislation from 1998-2008, and 4x more than the 2009 Recovery Act's climate provisions. To call it historic would be an understatement.

— Trevor Dolan 🌲 (@tclarkdolan) August 7, 2022

After covering climate leg efforts for a decade+, I wanted watch Senate passage in person. It will be @brianschatz, still choking back tears as he left the floor, that will stick with me. "Now I can look my kids in the eye and say we're really doing something about climate."

— Lisa Friedman (@LFFriedman) August 7, 2022

The Inflation Reduction Act that this Senate Democratic Majority has passed will endure as one of the defining legislative feats of the 21st century:

— Chuck Schumer (@SenSchumer) August 7, 2022

It reduces inflation, lowers costs, creates millions of good-paying jobs, and is the boldest climate package in U.S. history.

It took 19 hours. Or maybe 2 years. Or maybe 3 decades, depending on how you count it. But the US Senate has now passed a major climate bill.

— Dr. Leah Stokes (@leahstokes) August 7, 2022

It was a compromise. We need to stand with frontline communities against the fossil fuel industry.

But in this moment, I'm celebrating.

This national coordination makes everything cheaper, faster, greater. Make sure to check out our breakdown of the IRA’s spending by climate vertical and what the Act means for your favorite flavor of climate innovation.

☀️ Terabase Energy, a Berkeley, CA-based company digitizing solar energy plant installation and management, raised $44m in Series B financing from Breakthrough Energy Ventures, Prelude Ventures, and SJF Ventures.

✈️ ZeroAvia, a Hollister, CA-based hydrogen-electric plane developer, raised $30m in Series B funding from NEOM, International Airlines Group, Barclays Sustainable and Impact Banking, and AENU.

⚡ Hysata, an Australia-based hydrogen electrolyzer developer, raised $29m in Series A funding from Virescent Ventures, Vestas Ventures, Kiko Ventures, IP Group Australia, Hostplus, and Bluescope Steel.

🛰️ LiveEO, a Germany-based satellite analytics platform that monitors infrastructure networks, raised $19.5m from MMC Ventures, the European Commission, Investitionsbank Berlin, DvH Ventures, Helen Ventures, Matterwave Ventures, Motu Ventures, Segenia Capital and Hannover Digital Investments.

🚗 Leap24, a Netherlands-based provider of charging stations for EV vehicles, raised $15m from Meewind.

🛰 QLM Technology, a UK-based company providing greenhouse gas monitoring through quantum-enabled technology, raised $12m in Series A funding from Schlumberger, Green Angel Syndicate, Enterprise100 Syndicate, Development Bank of Wales, Newable Ventures, and Quantum Exponential.

🛵 River, an India-based electric two-wheeler vehicle developer, raised $11m in Series A funding from Low Carbon Capital, and Toyota Ventures.

⚡ Aurora Hydrogen, a Canada-based company providing emission-free hydrogen production, raised $10m in Series A funding from Energy Innovation Capital led, Williams, Shell Ventures, Chevron Technology Ventures and the George Kaiser Family Foundation.

⚡ Node.energy, a Germany-based energy management platform, raised $7m from BitStone Capital, High-Tech Grunderfonds, Helen Ventures, BonVenture, and 10x Founders.

🔋 Li Industries, Blacksburg, VA-based lithium-ion battery recycling company, raised $7m in Series A funding from Khosla Ventures, Xerox Ventures and Shell Ventures.

♻️ Smarter Sorting, an Austin, TX-based product intelligence platform, raised $7m in funding from Regeneration.VC.

☂️ Raincoat, a Puerto Rico-based startup developing climate insurance solutions, raised $4.5m in Seed Funding from Anthemis Group, SoftBank Opportunity Fund, Popular, Divergent Capital Partners, Consorcio, and 305 Ventures.

⚡ Beacon Power Services, a Nigeria-based energy management software and analytics provider, raised $2.7m in seed funding from Seedstars Africa Ventures.

🌾 Concert Bio, a UK-based company optimizing microbial ecosystems for hydroponic systems, raised $1.7m in Pre-seed funding from The Venture Collective, TET Ventures, Possible Ventures, Ponderosa Ventures, Nucleus Capital, and Day One Ventures.

🚗 Exponent Energy, a India-based EV charging company, raised funding from the Pawan Munjal Family Trust.

☀️ Lightyear, a Netherlands-based solar electric car company developing an automotive platform, raised funding in a corporate round from Koenigsegg Automobile.

[Last week we misreported on EnergyX’s fundraise. The lithium startup has secured a commitment from The Global Emerging Markets Group to invest $450m contingent on the company going public, after which EnergyX can draw down on the equity facility in return for common stock.]

Antarctica Capital, a NY-based private equity firm, acquired a controlling stake of Descartes Labs, a Santa Fe, NM-based provider of geospatial intelligence.

Ginkgo Bioworks, a Boston, MA-based developer of biological engineering products, has acquired Zymergen, a Emergyville, CA-based synthetic biology rival, for $300m.

BorgWarner, a Auburn Hills, MA-based mobility solution provider, is acquiring Rhombus Energy, a San Diego, CA-based EV charging infrastructure startup for $185m.

The White House announced that former NRG CEO David Crane will be nominated as undersecretary for infrastructure at the Energy Department. (See our interview with David from back in early 2020 when he was sponsoring a climate SPAC.)

Analysts and financiers are casting doubt on the feasibility of the Biden administration's proposal to cap the price of Russian oil.

To avoid blackouts during July's heatwave, Britain’s national grid bought electricity at 50 times the usual price.

To bolster their stable sources of grid power, Germany has revived 21 coal plants to restart or run past planned closing dates for the next two winters - to be run on imported coal from Australia and South Africa, where coal burning is now limited. Experts estimate the GHG boost to have a 4%+ national emission increase.

The DOE unveiled the Solar and Wind Grid Services and Reliability Demonstration funding opportunity, which will award $26m to projects with up to 100% solar, wind, or battery storage power systems.

Midwest states IL, IN, MI, and WI are partnering to build a network of EV chargers along the 1,100 miles of drivable shoreline around Lake Michigan dubbed the Lake Michigan EV Circuit Tour.

The White House Council on Environmental Quality (CEQ) is seeking public feedback on an environmental justice scorecard to assess federal agencies’ progress to advance EJ.

The McKinney Fire has earned the hapless title as California’s largest wildfire of 2022, burning through more than 56,000 acres of Northern California's Klamath National Forest.

Our kind of Forbes 30 Under 30 list… the Bloomberg New Economy Catalyst list of 28 innovators who are creating more equitable, inclusive, and sustainable outcomes.

We’ve said it once, and now HBR is saying it (persuasively) again: ESG is not impact.

Another HBR take, but this time on investing in climate adaptation.

Some crazy stats on this $2b, 14 year-old pumped storage hydropower plant which holds more water than 6,500 Olympic-sized swimming pools in 17km of subterranean tunnels that were excavated through the Alps. The Nant de Drance now provides the same energy storage capacity as 400,000 electric car batteries.

Albedo! An LA neighborhood reflects back the deadly heat with pavement coating to lower air temperatures.

Spanish Premier Pedro Sanchez has ditched the tie in a bid for climate fashion.

Meanwhile, German cities may need to turn off the lights on this year’s Oktoberfest and Christmas market celebrations given Russia’s throttling of the gas supplies to Europe.

Charm spills the bio-oil on detailed carbon accounting and MRV in a bid for open-sourcing CDR transparency. Meanwhile, South Pole and WWF team up on a guide to bankability for nature-based solutions.

A must read piece on the end of snow in the Western US.

Study finds that almost all of California's 100-year forest carbon offset buffer pool has been destroyed in wildfires.

🗓️ Hard-to-abate sectors: RSVP for Piva Capital’s Aug 18th panel and networking event in San Francisco gathering operators focused on hard-to-abate sectors like leaders from Pyka (electric aviation), Verne (H2 trucking), and ClearFlame (biofuel trucking).

🗓️ The Drop: Join the waitlist by Aug 12, for the Sept 21 European conference designed to bring climate minds together. Join founders, investors, and climate solutionists in Sweden for a day of talks, panels and decentralized ripples. Organized by our friends at Pale Blue Dot, 2150, and many a previous CTVC profile guest.

Founder @Deep Science Ventures

Senior Investment Professional @Princeville Capital

Director of Business Development @Shifted Energy

Fundraising and Development Manager @International Biochar Initiative

Junior Materials Specialist @Carbon Engineering

Full Stack Software Engineer @HST

Senior Backend Engineer @Cervest

Reliability Engineering Internship @Span

Research Technician @Travertine

Manager, Global Supply Chain @Electric Hydrogen

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

England's new election ushers in a new test of clean energy and climate tech

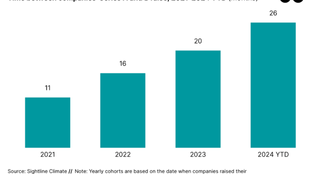

H1'24 funding totaled $11.3 billion, down 20% from H1 2023.