🌎 Fervo and General Fusion open the exit window #280

A tale of two public debuts

From tax credit rollbacks to foreign content rules — what’s changing

Happy Monday!

Thanks to the 300+ of you who joined us on Friday for our webinar, "Line of Sight: Growth Sectors in a Low-Subsidy World." ICYMI, shoot us a note at [email protected] to get the replay or find some time to learn more about how you can engage with our team.

"Wait and see" might be over, with the release of the new US House budget proposal — and now we can see the fate of the IRA. We break down the proposed changes and their impacts (some bad, some surprisingly alright).

In deals, $129m for earth observation technology, $60m for ocean data collection and $50m for radioisotope power systems.

In other news, the UK's new grid program funding, the world's first commercial e-methanol plant, and CCS supply chain buildout in Canada.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

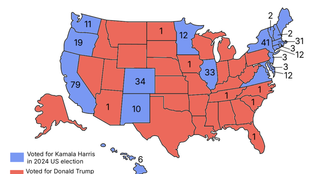

It feels like everyone in the market has been stuck in “wait-and-see” mode for the past year — waiting on the outcome of the US presidential election, seeing what the fate of the Inflation Reduction Act will be. Now, we finally have some answers: Last week, House Republicans released their proposed budget, and after some internal wrangling, it cleared a key committee vote on Sunday and is now on its way to the Senate. While nothing is finalized, the proposals show us what’s on the chopping block and when.

There’s no beating around the bush that it represents a setback, but don’t forget: as we’ve seen before in Cleantech 1.0, sunset dates drive urgency, companies and states find workarounds, and competitive techs stay in the game.

Overall, the budget proposes a 22.6% reduction in non-defense discretionary spending, including steep cuts to clean energy programs and climate research. The proposals eliminate billions in clean energy investments, roll back environmental regulations, and dramatically phase out tax credits for renewable power, electric vehicles, and energy efficiency:

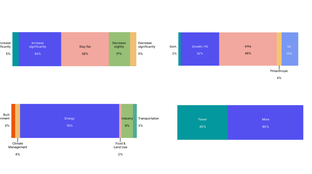

🧾 Big changes to tax credits, the main engine of the IRA

And in the place of clean energy, the budget prioritizes fossil fuel infrastructure and expands oil and gas permitting. Other key changes include:

Still, nothing has passed yet — and it’s far from set in stone. A group of Republican budget hard-liners, who don’t think these proposals go far enough on the debt, reportedly secured a promise to move up the repeal date for certain IRA clean energy tax credits. But that shift may face resistance from more moderate red-state House members, whose districts have benefited from IRA-driven funding and job creation — not to mention from Senators, who still need to approve the final budget. More than 20 House Republicans and 4 Senate Republicans, none on tax-writing committees, have publicly opposed major IRA rollbacks, citing economic benefits and affordability gains from provisions like credit transferability. There are slim margins in both chambers, so we’re stuck in another wait-and-see loop for now.

It’s the small wonky things that will have the big impacts. Tax credit transferability has unlocked crucial capital for emerging climate tech, and its elimination can change the risk calculation for those investing in FOAKs for newer tech.

But the proposed shift from “begin construction” to “placed in service” could derail many projects. Previously, it was a looser definition, and developers could qualify for credits with early-stage work; now, only operational projects by the sunset date will count — a major risk given construction delays and supply chain issues.

Layer on foreign content restrictions, and the uncertainty grows. Projects using components from countries like China may be disqualified even mid-build. Expect a surge of activity as developers rush to qualify — but longer-lead projects like offshore wind, geothermal, and nuclear could miss the window.

By sector, nuclear fission may be hit hardest, with long timelines making tax credits out of reach. Green hydrogen suffers from the early end of 45V, while battery manufacturing holds on via 45X but possibly squeezed by content rules. Carbon capture sees short-term upside via preserved 45Q, but long-term uncertainty looms. Solar and storage survive, but with more hurdles.

This is just a snapshot of Sightline's full breakdown on the federal budget, which is available now for clients on the Sightline platform here. If you’re interested in speaking to Sightline experts on the budget breakdown, you can find time here.

🛰 Xoople, a Madrid, Spain-based Earth observation analytics platform, raised $129m in Growth funding from AXIS Participaciones Empresariales and CDTI.

🛰 Saildrone, an Alameda, CA-based ocean data collection service, raised $60m in Growth funding from Export and Investment Fund of Denmark (EIFO), Academy Securities, BZH Capital, Calm Ventures, Crowley, and other investors.

⚡ Zeno Power, a Seattle, WA-based radioisotope power system developer, raised $50m in Series B funding from Hanaco Venture Capital, 7i Capital, Balerion Space, Beyond Earth Ventures, Jaws Ventures, and other investors.

🚢 Neptune Robotics, a Kowloon Tong, Hong Kong-based robotics-based hull inspector, raised $50m in Growth funding from Sequoia Capital China.

⚡ Hystar, an Oslo, Norway-based PEM electrolyzer developer, raised $36m in Series C funding from AP Ventures, Finindus, Firda, MOL switch, Nippon Steel Trading, and other investors.

🔋 VFlowTech, a Singapore, Singapore-based vanadium redox flow battery developer, raised $21m in Growth funding from Granite Asia, Antares Ventures, EDBI, Entrepreneur First, MOL PLUS, and other investors.

⚡ Realta Fusion, a Madison, Wisconsin-based magnetic mirror fusion energy developer, raised $36m in Series A funding from Future Ventures, Avila VC, GSBackers, Khosla Ventures, Mayfield, and other investors.

☀️ Solestial, a Tempe, Arizona-based solar panel developer, raised $17m in Series A funding from AE Ventures, Airbus Ventures, Crosscut Ventures, General Purpose Venture Capital (GPVC), Industrious Ventures, and other investors.

♻️ Rekosistem, a Jakarta Selatan, Indonesia-based waste management and recycling provider, raised $7m in Series A funding from K3 Ventures, Saratoga Investama Sedaya, AppWorks, Bali Investment Club (BIC), Orvel Ventures, and other investors.

🌳 Veritree, a Vancouver, Canada-based restorative project tracking platform, raised $7m in Series A funding from Pender Ventures, Diagram Ventures, Garage Capital, and Northside Ventures.

🌾 Verdi, a Vancouver, British Columbia-based Modern farm automation platform, raised $7m in Seed funding from SVG Ventures, Ponderosa Ventures, Elemental Impact, GenomeBC, One Small Planet, and other investors.

💨 Riverse, a Paris, France-based carbon measurement, verification and monetization platform, raised $6m in Seed funding from Alven, K Fund, Makesense, Serena Capital, and Speedinvest.

♻️ Bovotica, a Brisbane, Australia-based synbiotic for cattle methane reduction developer, raised $3m in Seed funding.

🏠 Zendo Energy, a London, England-based data centre energy optimisation software, raised $2m in Pre-seed funding from Fly Ventures, Octopus Ventures, and Pact VC.

⚡ Voltra, a San Francisco, CA-based intelligent EV connectivity software developer, raised $2m in Pre-seed funding from Contrary, Hanover Technology Investment Management, and Velocity.

🔋 Eku Energy, a London, England-based global energy storage developer, raised $60m in PF Debt funding from NatWest and Sumitomo Mitsui Banking Corporation.

🥩 Heura Foods, a Barcelona, Spain-based plant-based meat producer, raised $22m in Debt funding from European Investment Bank (EIB).

🏭 Foodiq, a Järvenpää, Finland-based food processing equipment manufacturer, raised $11m in Corporate Strategic funding.

🏭 Calefa, a Hollola, Finland-based waste heat technology provider, raised $8m in PE Expansion funding from Evli Private Capital.

🌱 Greenbids, a Paris, France-based digital advertising carbon emissions tracking platform, was acquired by Perion.

⚡ CPower, a Baltimore, MD-based energy management platform, was acquired by NRG Energy.

🌱 nZero, a Reno, NV-based carbon emissions management platform, was acquired by Asuene.

Actis, a London, England-based investment firm, closed its second Actis Long Life Infrastructure Fund (ALLIF2) with $1.7bn to invest in brownfield infrastructure across growth markets in Asia, Latin America, CEE, the Middle East, and Africa, focusing on long-term, contracted assets in sectors like renewables, power transmission, and digital infrastructure.

Aligned Climate Capital, a New York, NY-based investment firm, closed its sixth distributed solar fund, Aligned Solar Partners 6 LP (ASP6), securing commitments that exceeded the $200m target.

Carbon Equity, an Amsterdam, Netherlands-based investment firm, closed its third fund, Climate Tech Portfolio Fund III, with $120m (€107m) to invest in at least 150 climate innovations through 7 to 10 PE and VC funds across Europe and the US.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate.

The UK launched Great British Energy, a publicly owned company with $11bn (£8.3bn) in funding to accelerate clean energy deployment, starting with a $400m (£300m) boost to domestic offshore wind supply chains. GBE’s broad remit includes potential investment in emerging areas like LDES, BECCS, SAF, and low-carbon cement, making a new key instrument in driving net-zero infrastructure and catalyzing private investment.

The world’s first commercial-scale e-methanol plant opened in Kasso, Denmark, producing 42,000 tons annually for customers including Maersk, Lego, and Novo Nordisk. The launch marks a milestone for green fuels in heavy transport and industrial decarbonization, with ambitions to continue to scale and achieve price parity within the decade.

Svante has opened the world’s first commercial gigafactory for carbon capture and removal filters in British Columbia, producing enough to capture up to 10 million tons of CO2 annually. The facility uses solid sorbent filters with MOFs and marks a major cost and scale breakthrough for industrial CCS, long seen as too expensive. With customers like Chevron, Lafarge, and Climeworks, this signals a pivotal moment for scaling carbon management across both point-source and direct air capture markets.

Steelmaker Cleveland-Cliffs has scrapped its $100m plan to build a transformer plant in West Virginia after poor Q1 earnings and will stick to its core auto steel business. The project now becomes a missed opportunity to address 2+ year lead times for critical grid equipment, and may delay capacity build-out needed for electrification.

Carbfix has secured Europe’s first permit for onshore geological CO2 storage under the EU CCS Directive, enabling up to 3.2 million tons of CO2 to be permanently mineralized in basalt rock at its Hellisheiði site in Iceland. The facility already hosts emissions from ON Power’s geothermal plant and Climeworks’ DAC systems, and now gains clearance for full-scale operations. This breakthrough anchors Iceland as a leader in commercial mineral storage and supports EU goals to scale injection capacity to 50 Mt/year by 2030.

Talen Energy is shifting away from colocated power deals with data centers after FERC rejected its plan to supply Amazon's data center directly from its Susquehanna nuclear plant. Regulatory concerns over grid reliability and public rate impacts from behind-the-meter models prompted the pivot, meaning that other innovative tariff designs or models could be strategies for data centers relying on firm, zero-carbon power.

Farmers sue Trump admin over deleting climate data and win.

The illegal wind turbine side hustle: stealing copper cables.

Xi rewired China’s future into a geopolitical flex of electricity, according to Financial Times.

Norway’s Brevik plant hits 1,000 tons of CO2 captured!

All-of-the-above approach to powering data centers has reached LDES, with XL Batteries to deploy its FOAK at a Wyoming data center by 2028.

Real House-reefs of Miami: Coral City Camera live streams the marine drama of an urban reef.

📅 State of Climate Tech 2025: Market Sentiment vs. Fundamentals: Join us on Thursday, May 22, 2025, at 10 AM ET for this online event by Carbon Equity. An opportunity to engage with leading climate tech experts and discuss the latest trends shaping the sector’s investment outlook.

📅 Open Climate: FOAKing Real Talk: Join Skander and Marco from Climate Drift on May 22 at 10:00 AM PT / 7:00 PM CET for a live session with four FOAK insiders—Deanna Zhang, Rushad Nanavatty, Nik Baumann, and Tim Woodcock.

📅 Turning First-of-a-Kind (FOAK) into a Funded, Functional Reality: Join us on Wednesday, May 28 at 1 PM ET / 10:00 AM PT via Zoom (registration required, subject to approval). A tactical deep dive into deploying FOAK climate solutions, from development to financing. Featuring insights from Jennifer Holmgren (LanzaTech), Hannah Friedman (Mark1), and moderator Dimitry Gershenson (Enduring Planet).

📅 Carbon Unbound 2025: Accelerating Gigaton-Scale Carbon Dioxide Removal: Join us May 20–21 in New York for the premier East Coast summit on carbon dioxide removal. Connect with 400+ senior leaders from business, investment, and policy to explore cutting-edge CDR tech, regulatory trends, and strategic funding opportunities.

Analyst @Hitachi Ventures

Research Associate @Molecule Ventures

Executive Director @Arête Glacier Initiative

Business Operations Coordinator @SiTration

Energy Advisor @EnergySage

Senior Associate – Investments and Partnership @ Maersk

Investment Associate @Climate Tech Partners

Development & Grants Associate @Canary Media

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

A tale of two public debuts

US courts roll back Trump-era actions on offshore wind and DOE grant cancellations

We asked, you answered, and experts weighed in on 2026