🌎 Taxing times for CCUS #254

OBBB blows tailwinds through CCUS, but takeoff stalls

Happy Monday!

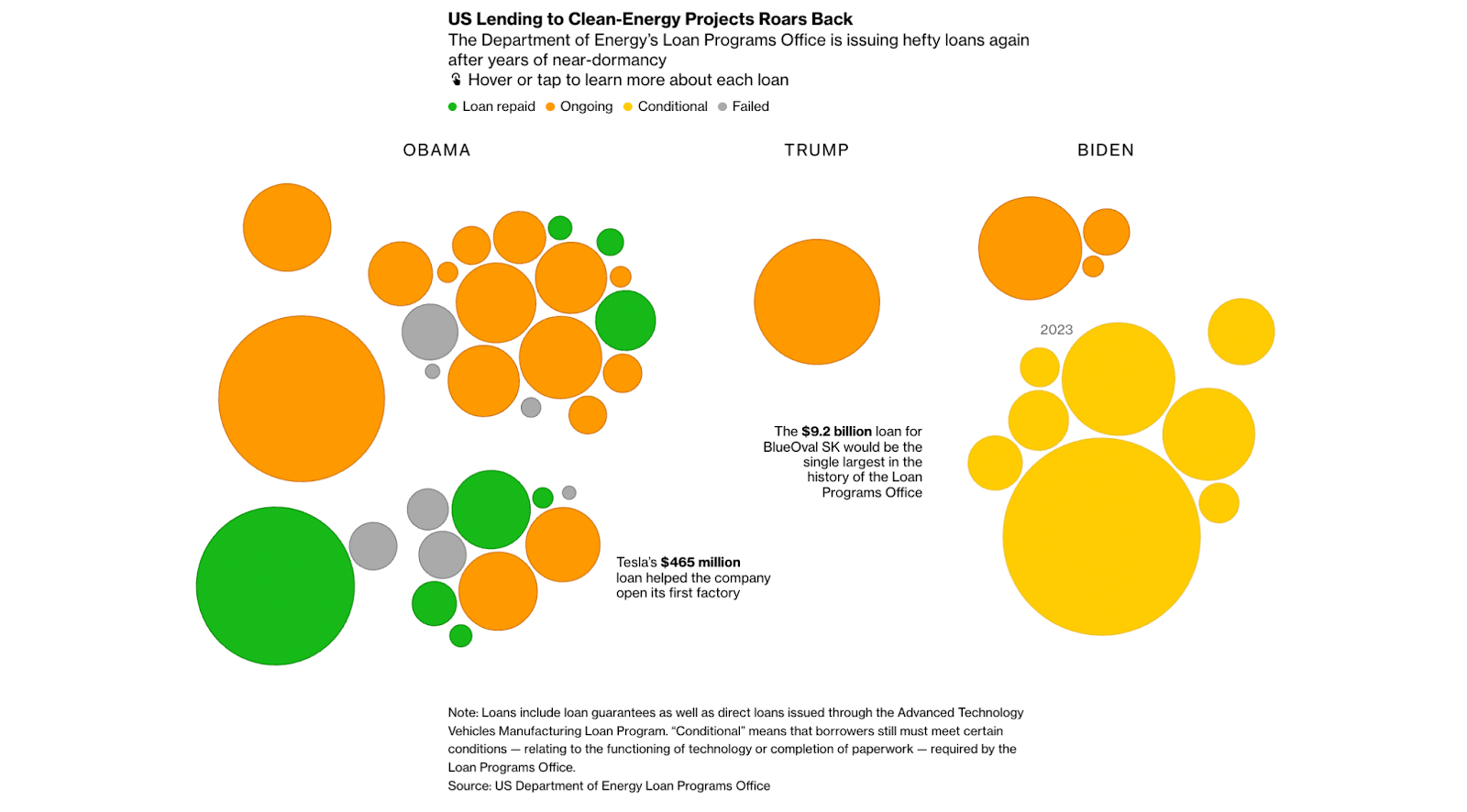

In the ongoing push to boost American battery production, the US Department of Energy plans to loan Ford and SK On the largest sum in the history of the Loan Programs Office (LPO). It’s the latest in a series of loans for battery projects as the US looks to loosen China’s grip on the supply chain.

Elsewhere in the news, lab-grown meat clears regulatory hurdles for the first time in the US. Rivian hops on the Tesla charger trend, and the EU considers reconsidering GMO rules.

In deals this week, home electrification collects $470M. AI-powered mineral discovery lands $195M and cultivated meat raises $40M.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter at [email protected].

💼 Find or share roles on our job board here.

The DOE announced the biggest loan in the LPO’s 15-year history last week with the aim of bolstering domestic battery production.

The conditional commitment of $9.2B for Ford and South Korean battery maker SK On’s joint venture (JV) is the sixth loan for battery supply chain projects through the Advanced Technology Vehicles Manufacturing program (the same LPO program that provided a loan to Tesla) and the largest federal backing for a US automaker since the 2009 financial crisis.

🔋 Battery background

💰 Sweetening the deal

Since then, the IRA’s tax credits, including a production tax credit (PTC) of $45 per kilowatt for batteries, have changed the equation. Ford estimates IRA tax benefits could total more than $7B for the company and its battery partners.

But automakers are also scrambling to meet domestic content requirements to maximize those credits—both for themselves and to qualify their EVs for consumer tax breaks.

These incentives are driving a wave of US onshoring, to the tune of ~$75B so far. Batteries in particular are gaining momentum, with the North American pipeline for lithium-ion battery production capacity forecasted to outpace all of Europe post-IRA.

👀 Keep looking upstream

The Ford news comes after the LPO gave a $2.5B loan to GM and LG’s Ultium Cells in late 2022.

But chipping away at China’s dominance in the battery industry will take more than growing US production capacity.

China controls at least ⅔ of global lithium refining capacity, produces ~60% of the world’s natural graphite, and some 98% of the final processed materials that go into making battery anodes, according to Benchmark Mineral Intelligence.

With EV demand projected to skyrocket in coming years, automakers are anticipating shortages of lithium and graphite. The LPO awarded a $102M loan to a graphite project in Louisiana last year and announced conditional loans of $2B for Redwood Materials and $375M for Li-Cycle to support lithium recycling in February of this year.

⚡ 1Komma5°, a Hamburg, Germany-based residential electrification products & services provider, raised $470M in Series B funding from G2 Venture Partners.

⚒️ KoBold Metals, a Berkeley, CA-based developer of AI tools for EV metals discovery, raised $195M in Series C funding from T. Rowe Price, Andreessen Horowitz, and Breakthrough Energy Ventures.

🥩 Omeat, a Los Angeles, CA-based producer of cultured meat from fungi, raised $40M in Series A funding from S2G Ventures, Google Ventures, Bold Capital Partners, Tyson Ventures, Rethink Food, Trailhead Capital, and Cavallo Ventures.

🌾 Guardian Agriculture, a Boston, MA-based aerial crop protection company, raised $20M in Series A funding from Fall Line Capital.

☀️ Yellow, a Cape Town, South Africa-based pay-as-you-go (PAYG) solar energy provider, raised $14M in Series B funding from EEP Africa.

🌱 GreenPlaces, a Raleigh, NC-based corporate sustainability and emissions accounting platform, raised $13M in Series A funding from Redpoint Ventures, Felicis Ventures, Tishman Speyer Ventures, and Bull City Venture Partners.

🌱 Supercritical, a London, UK-based carbon removal marketplace, raised $13M in Series A funding from Lightspeed Venture Partners, RTP Global, Greencode Ventures, and MMC Ventures.

⚡ Focused Energy, an Austin, TX-based laser nuclear fusion developer, raised $11M in Series A funding from Prime Movers Lab and VCP Capital.

⚡ TreaTech, a Lausanne, Switzerland-based provider of hydrothermal gasification technology to convert waste streams into products, raised $10M in Series A funding from CMA CGM, ENGIE New Ventures, European Innovation Council, Holdigaz, Montrose, and Sipchem.

💧 Hyfé, a Chicago, IL-based company converting wastewater to biomanufacturing feedstocks, raised $9M in Seed funding from Alumni Ventures, Overwater Ventures, Refactor Capital, Supply Change Capital, Synthesis Capital, The Engine, and XFactor Ventures.

♻️ CleanHub, a Berlin, Germany-based waste management infrastructure provider, raised $7M in Seed funding from 468 Capital, Daniel Bartus, Integra Partners, Lakestar, Silence VC, and Übermorgen Ventures.

👕 Carbonwave, a Boston, MA-based startup developing advanced biomaterials from seaweed, raised $6M from Pegasus Capital Advisors and Global Fund for Coral Reefs.

☔ WindBorne Systems, a Stanford, CA-based provider of smart weather balloons, raised $6M in Seed funding from Footwork, Harvest Ventures, Humba Ventures, Khosla Ventures, Pear VC, and Ubiquity Ventures.

⚡ Crux, a New York, NY-based IRA tax credits marketplace, raised $4M in Seed Extension funding from Ardent Venture Partners, QED Investors, Lowercarbon Capital, New System Ventures, and Overture VC.

🌳 Rhizocore Technologies, an Edinburgh, United Kingdom-based producer of mycorrhizal fungi pellets for reforestation, raised $4M in Seed funding from Collaborative Fund, Grok Ventures, and ReGen Ventures.

🌱 Squake, a Berlin, Germany-based startup providing carbon calculations for travel & logistics, raised $4M in Seed funding from BackBone Ventures, Lufthansa, Neosfer, Rivus Capital, Schenker Ventures, and Simon Capital.

♻️ Kubik, a Nairobi, Kenya-based developer of low-carbon building materials from plastic waste, raised $3M in Seed funding from Andav Capital, BESTSELLER Foundation, GIIG Africa Fund, Kazana Fund, Plug and Play, Princeton Alumni Angels, Renaissance Partners, Satgana, Savannah Fund, and Unruly Capital.

🌱 Highwood Emissions Management, a Calgary, Canada-based emissions management software and services provider, raised $3M in Seed funding from Energy Capital Ventures and Veritec Ventures.

🥩 Adamo Foods, a London, UK-based company developing whole-cut meat alternatives, raised $2M in Pre-Seed funding from SFC Capital.

💨 1MT Nation, a Tallinn, Estonia-based developer of nature-based carbon removal projects, raised $1M from Margus Kohava and Warmeston.

🏠 Solar X Works, a Moses Lake, WA-based developer of modular solar-powered refrigeration systems, raised an undisclosed amount from GW Global Partners.

🔋 BlueOval SK, a Stanton, TN-based EV battery manufacturing joint venture with Ford, raised $9.2B in a conditional commitment for loan from the DOE Loan Programs Office.

🔋 Northvolt, a Stockholm, Sweden-based sustainable lithium-ion battery manufacturer, raised $400M in Convertible Notes from Investment Management Corporation of Ontario.

🚗 Octopus Electric Vehicles, a London, UK-based EV financing provider, raised $192M from Pollen Street Capital.

🏠 GridPoint, an Arlington, VA-based provider of energy management systems for commercial buildings, raised a $150M credit facility from HASI.

🧪 Verde Bioresins, a Santa Monica, CA-based bioplastics manufacturer, announced a SPAC merger with TLGY Acquisition Corp.

♻️ JEPLAN, a Tokyo, Japan-based PET chemical recycling provider, announced a SPAC merger with AP Acquisition Corp.

🏠 Optimum Energy, a Seattle, WA-based HVAC optimization software provider, was acquired by Bernhard Capital Partners for an undisclosed amount.

☀️ Oregon Shines, a Portland, OR-based community solar projects developer, was acquired by Arcadia for an undisclosed amount.

Planeteer Capital, a New York, NY-based investment firm, held a first close of its $75M fund that invests in climate tech startups at pre-seed and seed stage.

Avaana Capital, a Mumbai, India-based investment firm, held a first close of its $70M fund that provides capital for climate tech startups.

TDK Ventures, a San Jose, CA-based investment firm, has launched a new $150M fund to invest in European and North American-based energy transition startups.

Share new deals and announcements with us at [email protected]

At climate finance talks in Paris last week, developing nations fought for more funding to tackle climate change, but the summit concluded without a global shipping tax agreement or meaningful commitments from Western nations.

Upside Foods and Eat Just earned the first approval to sell cultivated meat in the US. The two companies received the final greenlight for production from the US Department of Agriculture (USDA) this week, following initial FDA and USDA consumption approvals (more on the cultivated meat regulatory process here).

Con Edison will begin operating New York City’s largest battery system, a 7.5MW Tesla Megapack battery installation, next week—just in time for the summer heat.

Your gas stove is more harmful than you think and can be worse than secondhand smoke. A new Stanford study looking at gas stoves found that when in use, they emit a significant amount of benzene, a chemical known to cause blood-cell cancers.

Rivian is the latest to join the Tesla Supercharger network, following Ford and GM. The company announced that its EVs will have access to the chargers as early as spring 2024 and that it plans to incorporate North American Charging Standard (NACS) in its vehicles beginning in 2025.

The EU may soon revisit the conversation on GMOs, citing the need to grow more climate-resilient crops.

Multnomah county is suing oil and gas companies for causing the deadly heat wave in the Pacific Northwest in 2021, seeking damages and money for future ‘weatherproofing’. While climate litigation is on the rise, this case is one of the first seeking damages related to a specific weather event.

3M settled for $10.3B in a lawsuit claiming it polluted the water in towns across the US with ‘forever chemicals,’ AKA PFAS. The company did not admit to wrongdoing.

The UN adopted a new high-seas treaty in the first legally-binding global agreement to protect biodiversity in international waters. This comes a few months after the initial agreement in March.

The NRC authorized the first US plant to produce HALEU, a critical ingredient for many advanced nuclear reactors and SMRs. Approval for the Ohio facility is a key step in the commercial production of HALEU in the US.

The EPA announced final rules for renewable fuel standards in the US from 2023 to 2025. The agency ultimately lowered requirements proposed in December for the amount of renewable fuels US refiners will have to blend with gas and diesel.

The Senate budget committee put a spotlight on the oil industry’s spending to spread misinformation last week, examining whether it has delayed climate action.

Four non-transmission solutions to amp up the grid's energy game. Call it a power play.

To quell the emigration exodus of companies, Germany set aside 4B Euros for energy subsidies to offset skyrocketing electricity prices.

Why do heat waves keep crashing higher and higher?

Climate takes center stage at the Cannes Film Festival.

Excellent visuals in a new Rewiring America report on the pace needed to deploy efficient electric machines into every home in America.

A new IEA and IFC report suggests that emerging market clean energy investment must more than 3x to match rising energy demand, from $770B to $2.8T per year.

Annual SVB climate tech report says investment activity and valuations remains steady in the sector.

Did rising temperatures from climate change give Hunter Wellington the boot into bankruptcy?

HotHog, the app that shields pigs from heat. Obviously.

What are venture studios and how can they help innovate climate?

🗓️ London Climate Action Week: The annual event brings together climate professionals and communities to harness global climate action and takes place from June 24 to July 2nd

🗓️ Greenfin: Join Greenbiz’s sustainable finance and investing event from June 26 to 28th in Boston

🗓️ AI for Good Global Summit: Join the United Nations to promote AI to advance health, climate, gender, inclusive prosperity, sustainable infrastructure, and other global development priorities in Geneva on July 6 to 7

💡 Clean Mobile Power Cohort: Apply to Third Derivative’s latest accelerator cohort focused on cost-competitive, zero-emissions mobile power by July 14

Cofounder/CTO @Flip

Principal @Obvious Ventures

Commercial Agronomist - Coastal Northeast @Pivot Bio

Software Engineer (Senior) @Kopperfield

Scientist - Bioprocessing @Macro Oceans

Process Engineering Director @Macro Oceans

Research Associate - Bioprocessing @Macro Oceans

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

OBBB blows tailwinds through CCUS, but takeoff stalls

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook