🌏 Who are the Climate Tech Investors?

A new interactive Climate Capital Stack Map

Powerhouse Ventures’ 10x journey through cleantech to climate tech

Emily Kirsch and her team have shaped Powerhouse Ventures to sit at the intersection of big clients, big energy, and the software they’ll need to bend the cost curve for climate. With a new $70m fund that’s 10x the size of Fund I, Powerhouse has tracked the trendlines from early cleantech investing to focusing on creating space for climate tech across varying parts of the climate and innovation stack.

What’s the origin story of Powerhouse? And what’s the story behind the name?

Well, the name is an easy one - I just like it!

As for our origin story, when I was an undergrad, I met Van Jones who is now a political commentator on CNN. He had started an organization focused on environmental justice and criminal justice reform and I ended up working with him for five years on local climate policy and state ballot initiatives. Van and Prince (yes, the music icon) were friends who did a bunch of secret philanthropic work all over the country, including helping a startup called Mosaic get going in Oakland. Through Prince, I helped Mosaic launch an Oakland pilot, and just loved it. I realized that every startup needs capital and customers, but the Bay Area had no supporting clean energy ecosystem. So in 2013, we launched Powerhouse to be that clean energy innovation hub and provide startups with capital and customer connections by bringing together entrepreneurs, corporations, and investors.

How does Powerhouse Ventures fit into the ecosystem and evolution of Powerhouse the company?

Powerhouse started as an incubator and accelerator for early-stage companies and we had 50,000 sq ft of space in downtown Oakland with over 100 entrepreneurs and dozens of startups. We hosted great happy hours and parties, and held hackathons where companies like OhmConnect got their start. We loved it - the community was amazing and we had a real meaningful impact.

As we grew, we needed a model that could scale nationally or even globally. A physical incubator or cohort based accelerator is inherently limited in scale and cohort size, so a few years ago we pivoted to what Powerhouse is today - a climate tech innovation consulting firm. Our energy, utility, and tech clients come to us and say, “We want to decarbonize and evolve our business working with entrepreneurs. We’re trusting you to bring us startups that we may want to partner with, invest in, or acquire.”

Powerhouse Ventures came about four years ago. We built a proprietary database of thousands of climate companies with sector breakdowns, and identified a funding gap for early-stage software-focused climate tech startups. At the time there were just a couple of new climate venture fund entrants - so we launched Powerhouse Ventures to take advantage of the opportunity to invest in seed-stage software-focused climate tech companies

What’s Powerhouse Ventures’ climate investment thesis?

We invest in digital solutions to drive decarbonization across 3 categories:

1) Finance and Deployment

2) Asset Management and Optimization

3) Market Access and Participation

We focus on the energy and mobility space because those two sectors represent the technology and infrastructure backbone of a carbon free economy, and constitute over two-thirds of greenhouse gas emissions in the US.

We don’t take technology risk. We do back teams that are enabling proven technology to get to global and ubiquitous scale as quickly as possible.

How do investments you’ve made so far fit into this framework?

In Finance and Deployment, we invested in a company called Terabase that spun out of SunPower. When we invested, the six co-founders had a vision to bring the price of utility scale solar below $0.01/ kWh. Now, they’re 90 people running an interconnected digital ecosystem of software and automation to build the largest solar projects in the world. Terabase’s recent project in Qatar is selling electricity for 1.4¢/ kWh.

In Asset Management and Optimization, we invested in a company called Raptor Maps. When we invested, they were a team of three building software to digitize and monitor solar assets. Now, they’re 37 people and have become the system of record for the solar industry with 50 GW of assets under management, operating in 42 countries with customers like NextEra and Engie.

Finally, in Market Access and Participation, we invested in a company called Leap. They were a four person team when we invested, with a novel approach of connecting distributed energy resources to demand response markets. Now, they are the leading energy market access provider. With 75 people on the team and customers like Nest and Sunrun, they enabled the delivery of 6 GWh of energy to the grid in 2021.

Over the course of Powerhouse Ventures’ Fund I, we invested in 26 portfolio companies, pretty evenly split between those three primary investment areas.

Powerhouse emphasizes connecting startups and corporates. What corporates do you work with and what’s a case study of a “Powerhouse connection”?

Powerhouse and Powerhouse Ventures have this unique relationship: two separate entities that work closely together and share the same infrastructure. The whole value proposition is that the structure and network between Powerhouse and Powerhouse Ventures uniquely position the fund to source, diligence, and support early stage climate tech startups.

Powerhouse’s proprietary startup database serves as the source of deal flow for many of Powerhouse Ventures’ portfolio companies. Our network of startups, corporates, and investors in climate tech, that we’ve been building since our founding in 2013, is one of the industry’s most extensive. Portfolio companies benefit from our introductions to potential customers and investors.

At Powerhouse, our clients look at what we're investing in at Powerhouse Ventures and then often co-invest with us in initial or future startup rounds. For example, Schneider Electric Ventures has followed our investments in Energetic Insurance and Station A. More importantly, we play an enabling role in corporates becoming customers of our portfolio companies. Just about every big name in the industry is a customer of at least one of our portfolio companies.

Lastly, we have a strong brand. Where other funds try to be hard to reach, we take the opposite approach. We have tens of thousands of social media followers and over a million Watt It Takes podcast downloads. We want the biggest, broadest reach possible, because we’ve proven that’s what enables exceptional dealflow.

Powerhouse is infamous for its Watt It Takes podcast. How does the intersection between climate x media impact the innovation ecosystem?

Climate tech media - from Watt It Takes to Canary Media to CTVC - is playing a crucial role in showing people that they can apply their skills to the climate crisis, no matter what industry they're coming from. We have the ability to collectively make a difference, and sharing stories helps everyone understand the interconnectivity of solutions for a climate positive future. During Cleantech 1.0, we were pretty limited in thinking about just the electricity or utility industry and the rise or failure of individual technologies. Today, climate is everything. On Watt It Takes, the stories are as much about the person as they are about the tech they’ve built. This isn’t about just saving the planet and the environment - if we get this right, we're saving ourselves.

Talk to us about the money behind the money. Who are Powerhouse Ventures’ LPs?

Fundraising can be a slog, so it’s appealing to try and raise from 2 or 3 endowments, pension funds, or sovereign wealth funds that can write big checks and be done. When we set out to raise, we wanted our LPs to reflect the industries that we invest in so that our capital could add as much strategic value to the startups that we back as possible. Powerhouse Ventures invests in digital solutions driving decarbonization in energy, utilities, mobility, financial services, and tech. Our investors represent some of the world's largest corporations in each of these sectors, including TotalEnergies Ventures, Constellation Technology Ventures, Energy Impact Partners, American Electric Power, Toyota Ventures, Credit Suisse, and the Microsoft Climate Innovation Fund.

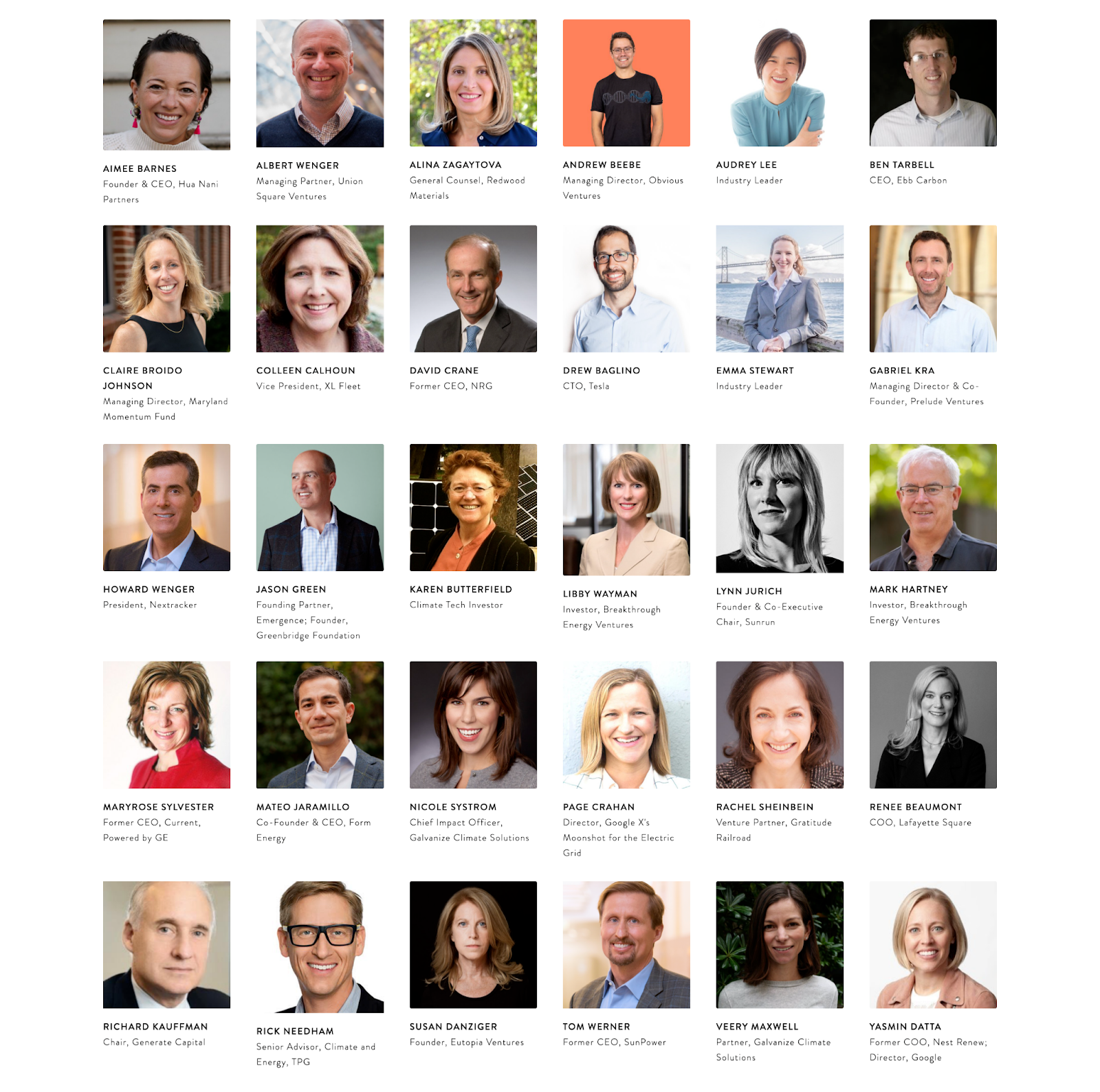

The other unique thing that we did relative to other climate funds was to expand the representation of individual industry leaders as investors who added so much value to Powerhouse Ventures Fund I. They brought us deal flow, helped with diligence, and supported our portfolio companies once we invested. The majority of Fund II’s industry-specific individual LPs are women - which, as you know, is not easy to do in this industry. As we ascend in our careers, as women, we are not as frequently asked to join boards, join as advisors, or become investors, despite the fact that we're equally qualified to do so. As a women-led, and for now, an all-women team, we’re an anomaly in the climate tech space. Just to mention a few names of the individual LPs who are at our table - Lynn Jurich, the founder and Co-Executive Chair of Sunrun; Page Crahan, who leads Google X’s Moonshots for the electric grid; and Maryrose Sylvester, the former CEO of Current powered by GE. It’s a dream team of investors with the combination of the individual LPs and corporate LPs that collectively generate an unprecedented amount of strategic value.

The person who makes all of this real is my colleague, Marie Thompson. I get a lot of credit for being the founder and face of the fund, but I like to describe Marie as the true force behind the fund because without her none of these yeses would turn into money in the bank.

“How can I help” has become somewhat of a VC trope. What’s Powerhouses’ value add?

Last week we wrote an article on the lessons learned from our first fund as a first time solo GP. We wrote about how venture capital is inherently transactional, but our relationships with founders don't have to be. Our first fund was just $7M so we were never in a position to lead - our average check was $150,000 - and we rarely took board seats unless we were invited to do so. But we took it upon ourselves to act like lead investors in terms of our value add because we knew that's what would get us into future rounds, even if our pro rata was smaller than we wanted. Startups came to us with acquisition offers before going to their own board, and reported on our data requests even when we didn’t have information rights.

We don’t try to cover everything in climate tech like water, waste, food & ag because being industry-specific experts allows us to stick with what we know and to be the best fund in our space. Because we’re so specific, we’re able to connect our portfolio company founders to just about anyone. Making introductions feels really good! Our strong brand is not only good for us from a dealflow standpoint, but we leverage the brand in service of our portfolio companies - we write a post on LinkedIn about all of our companies, help get them speaking engagements, and talk about them when we’re meeting with industry influencers.

Lastly, we put people first. We know that ultimately this is about trust and relationships. Not every venture fund operates that way, and it’s something that our team does really well.

Your team is composed entirely of women and a majority of Fund II’s individual LPs are women. How’re you putting your pro-DE&I values into practice?

When I started Powerhouse in 2013, Nancy Pfund at DBL was one of the first (and only) investors in our space that I saw who was a woman and I was grateful to have her as an example. My hope is that Powerhouse Ventures can be that for the others in climate tech investing where there are still only a handful of woman-led teams. McKinsey and others have shown in study after study that diverse executive leadership teams outperform. Venture investors have fiduciary responsibilities - not accounting for diversity means you’re not doing your job.

Given the readily available data on the importance of diversity within companies as it relates to performance, we made a commitment that a minimum of 25% of our investments will go to startups with underrepresented founders. In our industry, underrepresented means women and black, Latine, and indigenous people. We also track LGBTQ+ founders as well, given their lack of representation. In our first fund, we fell two points short of that 25% goal – ending the portfolio with 23% underrepresented founders. I think we have done a good job of expanding our network and building processes to mitigate bias throughout our own investment process, but the fact that we fell short of our goals means in our next fund we will dedicate more time, more resources, and more intentionality to building our network and refining our processes to account for internal bias. Accounting for internal bias means every underrepresented founder gets a second look. If our first reaction is to pass, then we're going to take a second look and, if we do pass, we will provide extensive and actionable feedback. It's not helpful to just say no. It is helpful to say, here are the things that we didn't hear, here are the milestones that would make us want to look again, and that lets us keep the door open.

For other investors, I think the first step is to put a DE&I goal in place. If you don't have a target, then you don't have anything to work towards. Today, many funds aren't even tracking demographic data of their executive teams. We did this in Fund I when we had very limited resources given the small size of the fund. Firms with greater resources have no excuse not to be doing this.

How do you think about climate impact reporting for your fund?

In Fund I, we asked each portfolio company to come up with an impact metric that is specific to them. And the reason we did that is because we care about actual outcomes. Potential GHG outcomes are obviously important, but we also want to quantify and report on metrics that have already been achieved. Each quarter, we asked our portfolio companies to give us an update on that impact metric. These metrics look really different by company. For Overstory, which monitors the risk and impact of vegetation on powerlines, their impact metric is acres monitored (1.62B). For SparkMeter, which offers low-cost smart meters for rural microgrids and urban central grid utilities, their metric is people who have reliable electricity as result of their services (400K).

Similar to Powerhouse Ventures, we found that a number of our peers also chose to track their impact with a focus on near term, startup-specific outcomes rather than trying to quantify the potential GHG emission reductions. This is because it's really hard to calculate GHG impact accurately despite some awesome tools in this space, and because GHG impact doesn't include half of the equation – resiliency and adaptation. Bets in the resiliency and adaptation space do not have GHG emission reduction potential, but they're critical, especially in a human-first mindset like ours.

Given the additional resources that we'll have in Fund II, we will incorporate the Impact Management Project framework during our due diligence process so that we are looking at a more holistic set of criteria when it comes to portfolio impact. In addition, we're also revamping our impact reporting process to work with founders on company specific impact metrics while tying those metrics to the UN Sustainable Development Goals, which we didn't do in Fund I. And, when possible, we will also tie those impact metrics to the Impact Reporting and Investment Standards (IRIS+). Finally, we're going to continue to work with portfolio companies to track and help them achieve diverse executive teams. Tracking those demographics is an important role that we can play in signaling to our portfolio companies that this is important to us and something that we expect them to do.

Are LPs demanding explicit impact metrics?

Microsoft’s Climate Innovation Fund is one of our anchor corporate LPs. Early on they offered resources and motivation to support us in designing a reporting approach - in addition to what we were already aiming to do. They provided an outline for what to do, we then did 6 months of benchmarking research on our own, and came back to our strategic LP base with our impact reporting draft.

Congrats! Powerhouse Ventures announced the close of your $70M second fund - 10x the size of Fund I. What comes next?

Thank you! As we launch Fund II, we realize that we’re at this second turning point in climate tech. Where the first turning point was the dramatic cost reduction in hardware that led to solar costs falling 85% and wind 49% over the last decade, these technologies have been proven and there’s a consensus that we can achieve 90% or even 100% decarbonization of our electricity sector globally within the next couple of decades. The question now is about deployment. And so this second turning point is about converting all of these trillions worth of net zero commitments from investors, governments, and corporations into action and implementation of actual assets on the ground.

That’s why Powerhouse Ventures focuses on our three categories of 1) financing, deployment 2) asset management, optimization and 3) market access and participation. They represent the levers that get proven tech to scale globally, quickly. In our second fund, we're going to write bigger checks and lead rounds to create more opportunities for pre-seed and seed stage entrepreneurs to get their start.

The funnest part of all is taking a bet on people who then build teams and get their tech to scale faster than any of us could have imagined. In terms of this 10x precedent, I'm not sure if Fund III will be another order of magnitude bigger, but one can dream!

If 10xing is your jam, Powerhouse Ventures is hiring an Associate or Senior Associate to join the investment team. Likewise, Powerhouse (the company) is growing and looking for a Head of Business Development and Marketing Manager.

A new interactive Climate Capital Stack Map

Financing around first- or early-of-a-kind project risk

‘Government-enabled, private sector-led’ in action in Washington, DC