🌎 The SMR shake-up #284

Small reactors, big power rankings

Happy Monday!

If you (like us) generally glaze over at the words “tax code guidance” and “public interest stakeholder input”, IRA’s pot of green gold might be enough to make you wake up. Around three-quarters of the Inflation Reduction Act’s climate investments run through the tax code - and the IRS wants to hear from you about how to allocate those billions. We’re awake 👀

In fundings this week, $450m for iron-air batteries, $124m for climate-resilient seeds, and $120m for Indian solar manufacturing.

In the news this week, OPEC slows oil production during Europe’s time of need, the US opens its first cobalt mine in decades, and Rivian recalls the fleet due to a loose bolt. Oops!

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter here.

💼 Find or share roles on our job board here.

The IRA “definitively changes the narrative from risk mitigation to opportunity capture.” Most of that opportunity lies in a field of $270B shiny new tax incentives that could lower climate technology costs by 40% on average. This means that about three-quarters of the Inflation Reduction Act’s climate investments are run through the tax code with the Treasury and IRS setting the rules.

The prize: potentially $800b (!) up from the oft-cited $369b if the tax credits prove to be as popular in practice as Credit Suisse estimates.

A new report from @CreditSuisse says the #InflationReductionAct is an even bigger deal for the U.S. economy than Congress (or CBO) thinks, and is likely to spur explosive growth in American clean energy industries. @robinsonmeyer has the details https://t.co/Ilg0VQFRAW pic.twitter.com/fw7du7yLXA

— JesseJenkins (@JesseJenkins) October 5, 2022

But this isn’t a done deal. The Treasury is on a tight timeline to set the rules for how these credits get doled out. Last week, the Treasury issued 6 notices seeking public stakeholder input before Nov 4th:

⚡ Energy Generation Incentives

🏠 Incentives for Homes/Buildings

🚗 Consumer Vehicle Credits

🏭 Manufacturing Credits

🪄 Credit Enhancements

💸 Credit Monetization

The prize is huge, but the devil is in the details. Tax code interpretations are complex, and the more details the less popular the uptake of the incentives

Clarity matters. Definitions and implementation matter and skew the outcome. IRS guidance will need to provide clarity around key issues including wage and apprentice requirements, credit stackability, and domestic manufacturing requirements.

Waiting for the signal. The IRA is set to be a big boon for clean manufacturing and energy but all those who seek to benefit - from equipment manufacturers, carmakers to energy investors - are still waiting on the sidelines. Corporates are hesitant to commit to new projects without a clear signal.

Lifecycle sets eligibility. As the IRA transitions to a tech-neutral tax credits approach in 2025, lifecycle emissions analysis will take center spotlight. For hydrogen and fuels, credit eligibility and rate will depend on emissions from cradle to gate. Whichever emissions measurement framework gets set could make or break which technologies stand eligible.

💨 LanzaTech, a Skokie, IL-based carbon recycling company, raised $500m in funding from Brookfield Renewable.

☀️ Form Energy, a Somerville, MA-based developer of wind and solar batteries raised $450m in Series E funding from TPG Rise Climate, Canada Pension Plan Investment Board, VamosVentures, The Engine, Temasek Holdings, Prelude Ventures, NGP Energy Technology Partners, Energy Impact Partners, Coatue, Capricorn Investment Group, Breakthrough Energy Ventures, ArcelorMittal, and GIC.

🌱 Inari, a Cambridge, MA-based company developing sustainable, resilient seeds for agriculture, raised $124m in Series E funding from Sage Hill Capital, Pictet Private Equity Investors, NGS Super, Hanwha Impact Partners, Flagship Pioneering, and Canada Pension Plan Investment Board.

☀️ Waaree, a India-based solar PV modules manufacturer, raised $120m in funding.

🏭 ElectraSteel, a Boulder, CO-based company sustainably manufacturing iron raised $85m in funding from Breakthrough Energy Ventures, Valor Equity Partners, Temasek Holdings, S2G Ventures, Lowercarbon Capital, Capricorn Investment Group, BHP Ventures, Baruch Future Ventures, and Amazon.

🚗 Euler Motors, a India-based EV developer, raised $60m in Series C funding from GIC Singapore, Moglix, QRG Investments and Holdings, Blume Ventures, Athera Venture Partners, and ADB Ventures.

🥩 Gourmey, a France-based alternative meats startup specializing in lab-grown foie gras, raised $47m in Series A funding from Earlybird VC, Keen Venture Partners, Omnes Capital, Discovery, Thia Ventures, Heartcore Capital, Point Nine Capital, Air Street Capital, Partech, and Beyond Investing.

📮 The Rounds, a Philadelphia, PA-based, zero-waste delivery service, raised $38m in Series A funding from First Round Capital and Construct Capital.

🚗 Loop, an El Segundo, CA-based EV charging station company, raised $40m in Series A funding from Fifth Wall, Agility Ventures, and B. Riley Financial.

⚡ LineVision, a Somerville, MA-based company providing energy grid monitoring and analytics technology, raised $33m in Series C funding from S2G Ventures, Climate Innovation Capital, Zoma Capital, UP Partners, National Grid Partners, Microsoft Climate Innovation Fund, Marubeni, and Clean Energy Ventures.

🌿 Wicked Kitchen, a Minneapolis, MN-based plant-based meals company raised $20m in funding from Ahimsa VC, NRPT, and actor Woody Harrelson.

🛒 EcoCart, a San Francisco, CA-based company developing sustainable infrastructure for e-commerce, raised $14.5m in Series A funding from Fifth Wall Climate, Capital One Ventures, SVB Capital, SuperAngel.Fund, Base10 Partners, and Ryder Ventures.

🚗 Good Car Company, an Australia-based EV bulk buying service, raised $11m from Boundless.

🗑️ Trash Warrior, a San Francisco, CA-based waste management company raised $8m in Pre-Series A funding from AltaIr Capital, Amino Capital, Operator Partners, Vermilion Ventures, Hyphen Capital, Primavera Capital, Sand Hill Angels, Lombard Street Ventures, and 500 Startups.

🔋 Anthro Energy, a Palo Alto, CA-based battery creation company, raised $7.2m in Seed funding from Union Square Ventures, Energy Revolution Ventures, Ultratech Capital Partners, Voyager Ventures, Nor’Easter Ventures, and Stanford University.

⚡ Greenenergy, a Costa-Rica based company developing financial solutions for energy management and efficiency for businesses, raised $5m in funding from Deetken Impact Sustainable Energy.

🚗 Halo.Car, a Las Vegas, NV-based EV-share startup, raised $5m in Seed funding from At One Ventures, T-Mobile Ventures, Earthshot Ventures and Boost VC.

🌊 Ocean Aero, a San Diego, CA-based manufacturer of autonomous underwater and surface vehicles, raised $4m in Series D funding from S2G Ventures.

🌾 Falca, an India-based platform providing farming solutions, raised $3m in Pre-Series A funding from Inflection Point Ventures, Mumbai Angels, and LetsVenture.

⚡ Molten Industries, a Stanford, CA-based methane pyrolysis company, raised $2.5m in Seed funding from USV, Fifty Years, J4 Ventures, Moai Capital, and UVC Partners (dive deeper in our profile here).

🥩 TissenBio Farms, a South Korea-based alternative meats company utilizing 3D bioprinting, raised $1.6m in Pre-Series A funding from Envisioning Partners, FuturePlay, Mirae Holdings, and Stonebridge Ventures.

🌎 Raise Green, a Somerville, MA-based impact investing platform, raised $1.2m in Seed funding from TechStars.

⛓️ Reneum Institute, a Singapore-based blockchain platform funding climate solutions, raised $4.1m in Pre-Seed funding from Ajeej Capital.

♻️ Rentle, a Finland-based ecommerce company developing circular-economy software, raised $3.7m in Seed funding from Tera Ventures, Anthemis Group, The Fund, Mission One Capital, and Maki.VC.

🌾 Farmerline, a Ghana-based company utilizing AI to provide information and resources for farmers, raised $1.5m in Seed funding from Oikocredit International, Acumen Resilient Agriculture Fund, Greater Impact Foundation, and FMO.

🥩 Innomy, a Spain-based alternative protein company, raised $1.3m in Pre-Series A funding from Corporación Cervino, Zubi Capital, Eatable Adventures, the National Center for Technology and Food Safety, and Rockstart.

🔋 Cadenza Innovation, a Wilton, CT-based lithium-ion battery developer, raised funding from Turtle & Hughes Inc.

Activate Capital raised $500m for its second fund, aimed to invest in various sectors across climate change, including energy, transportation, cybersecurity, and others.

Energy Capital Ventures raised $61m for its first fund, focusing on investing in the ESG integration and digital transformation of the natural gas industry.

Convective Capital raised $35m for its first fund, aimed to invest in wildfire solutions.

Complete Solaria, an Oakland, CA-based solar manufacturing and distribution company is going public at an implied $888m value through a merger with Freedom Acquisition I Corp.

RoadRunner Recycling, a Pittsburgh, PA-based waste management company acquired Compology, a San Francisco, CA-based company developing waste and recycling smart tech.

Beyond setting the rules for the IRA, the Treasury also announced a $1B loan agreement for the Climate Investment Fund – a trust to scale low carbon technologies (particularly those replacing coal) in developing countries. Programs to be financed could include projects to install new renewable energy, retire and repurpose older coal plants, and support communities affected by energy transition.

Adding pressure to the ongoing EU energy crisis: After OPEC Plus announced it will reduce its production quota by two million barrels a day in a bid to lift oil prices (and allying with Russia), President Biden says the US is eyeing ‘alternatives’ to OPEC Oil.

EV charging may qualify for biofuel credits under EPA’s new draft plan, as long as it uses some form of renewable power. The measure is part of a proposal to set biofuel-blending requirements for gasoline and diesel ahead of a planned mid-November release.

In the aftermath of Hurricane Fiona that hit Puerto Rico last month, Biden pledged $60m in funding to help coastal areas become more storm-resilient through “strengthening flood walls, creating a new flood warning system and other projects”.

South Africa submitted a $8.5b climate finance investment plan to accelerate the country's transition to renewable energy. Seen as a harbinger of climate transition investment appetite leading up to COP27, the deal is currently held up in negotiations with donor countries - the US, UK, France, Germany and the EU.

The US opened its first cobalt mine in 30 years as EV battery needs grow. Based in Idaho, the project will be led by Australia-based Jervois Global Ltd.

Munich Re announced that it will no longer invest in or insure new oil and gas projects starting April 2023 – this includes the planning, financing, construction and operation of oil and gas fields, midstream infrastructure related to oil, and oil fired power plants.

Rivian is recalling nearly all its vehicles (~13,000) due to a potential problem that could cause drivers to lose steering control.

A positive feedback loop we’re excited about! The climate economy is about to techify according to our friend at The Atlantic, Robinson Myers. The IRA’s estimated $370 could be closer to $800+ in climate investment if Americans take advantage of the bill’s uncapped tax benefits.

A “silver tsunami” of retiring tradesmen leaves the US facing a shortage of electricians and electric daydreams on backorder.

It’s as easy as ABC to solve climate in artist Nicole Kelner’s latest watercolor.

Michael Liebreich’s latest on the Ukraine war’s “energy trilemma” of security, affordability, and sustainability that might just accelerate Europe’s clean energy adoption for the same reasons it once relied on oil.

Permit Problems? Read here to learn how permits work.

NASA is joining the critical mineral hunt. The space agency is using its airpower to help, mounting infrared technology to a small plane to monitor where minerals might be hiding in the Southwest.

“How to Recycle a 14-Story Office Tower”. The NYTimes reports on Amsterdam’s growing community of circularity practitioners.

Three directors of EV co Faraday Future have resigned due to death threats.

Manhattan’s EV-charging sites now outnumber its gasoline stations more than 10 to 1.

🗓️ A Global Look at Energy Reliability, Independence & the Environment: Register for this in-person and virtual event hosted by Axios on Oct 11 for a discussion about energy security, reliability, and independence amidst the shift to cleaner sources.

🗓️ Tough Tech Talent Fair: Register for The Engine’s Talent Fair on Oct 14 taking place in Cambridge, MA. This fair aims to connect students, postdocs, and industry professionals with Tough Tech companies looking to grow.

🗓️ SOSV Climate Tech Summit: Register for this free and virtual summit taking place on Oct 25-26. You can also learn more about the two day event by taking a look at their website and agenda. (Not yet on the agenda are breakout sessions that will be led by DCVC, Khosla, BEV, SOSV, MCJ and many more!)

💡 SOSV Matchup: SOSV is also running an invitation-only, virtual Matchup for climate VCs and founders on the Brella platform. Founders can apply using the link, while VCs can reach out to [email protected].

💡 Grist 50 Nomination Form: Do you know an emerging climate leader? Someone whose work deserves to be celebrated, and whose story deserves to be told? Nominate them by Nov 1 for the Grist 50, an annual list that recognizes the next generation of innovators forging our climate future. Our very own Sophie was a Grist Fixer this year!

Partner @Azolla Ventures

Investment Analyst @Azolla Ventures

Expert Network Strategy & Operations Manager @OnePointFive

Senior Strategy Analyst @Rumin8

Marketplace Operations Contract @Watershed

Chemical/Environmental Engineer @Yale Carbon Containment Lab

Head of Customer Experience @SINAI Technologies

Engineering Manager, Product @SINAI Technologies

Legal Counsel @Earthshot Labs

Internship @Wisk

Head of Government Affairs @Antora Energy

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Small reactors, big power rankings

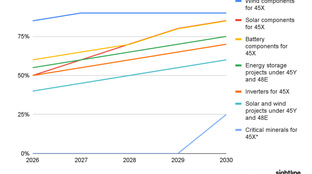

Stricter foreign sourcing rules reshape clean energy tax credit eligibility

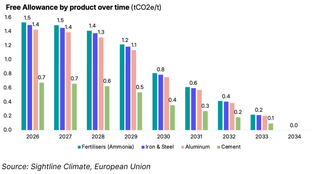

We did the EU carbon math