🌏 Spinning CO2 into clothes

Scaling “symbiotic manufacturing” with Rubi Laboratories

The underappreciated role of carbon insets in decarbonizing Scope 3 supply chains

It’s always scope 1 somewhere. Even in the gnarliest supply chains, your scope 3 emissions are someone else's scope 1. For the past few months, we’ve been writing and debating with you about two unresolved, mind-bending climate tech hot topics: carbon markets and supply chain decarbonization. At the bullseye of this Scope 3 carbon offset accounting mess are carbon insets.

Whereas most carbon management frameworks today force us towards acknowledging destructive practices and reducing or covering up their malady, insets give us a view towards a constructive reorganization of processes and technologies that manage inputs more than outputs.

Carbon insets are still undergoing their transformation, but we think they have the potential to be the Cinderella of decarbonization - ready to be lifted from obscurity to a point of significance, here goes:

The classic net zero strategy guides that decarbonizing Corporates should 1) mitigate, then 2) offset the rest. A hybrid solution to this, carbon insets look like offsets but sting like mitigation. Insetting refers to the intentional reduction of Scope 3 emissions, the upstream and downstream emissions within a company’s own supply chain. Unlike carbon offsets, inset emissions are directly avoided, reduced, or sequestered within the company's own value chain - not sold as a credit to offset another company’s emissions.

The rub is with Scope 3. (For those who could use it: a quick refresher on Scope 1, 2, 3.) Because Scope 3 represents indirect upstream and downstream emissions, those emissions count across multiple parties’ supply chains.

For example, when Cargill produces sugar which gets mixed into a can of Coca-Cola that’s then delivered onto the shelves at Target, all three players count the carbon intensity of the initial sugar production. So, if Cargill’s carbon insetting program accelerates farmers’ regenerative practices, then Cargill, Coca Cola, and Target can all factor in the same emissions reductions to their net carbon balance without “triple counting”.

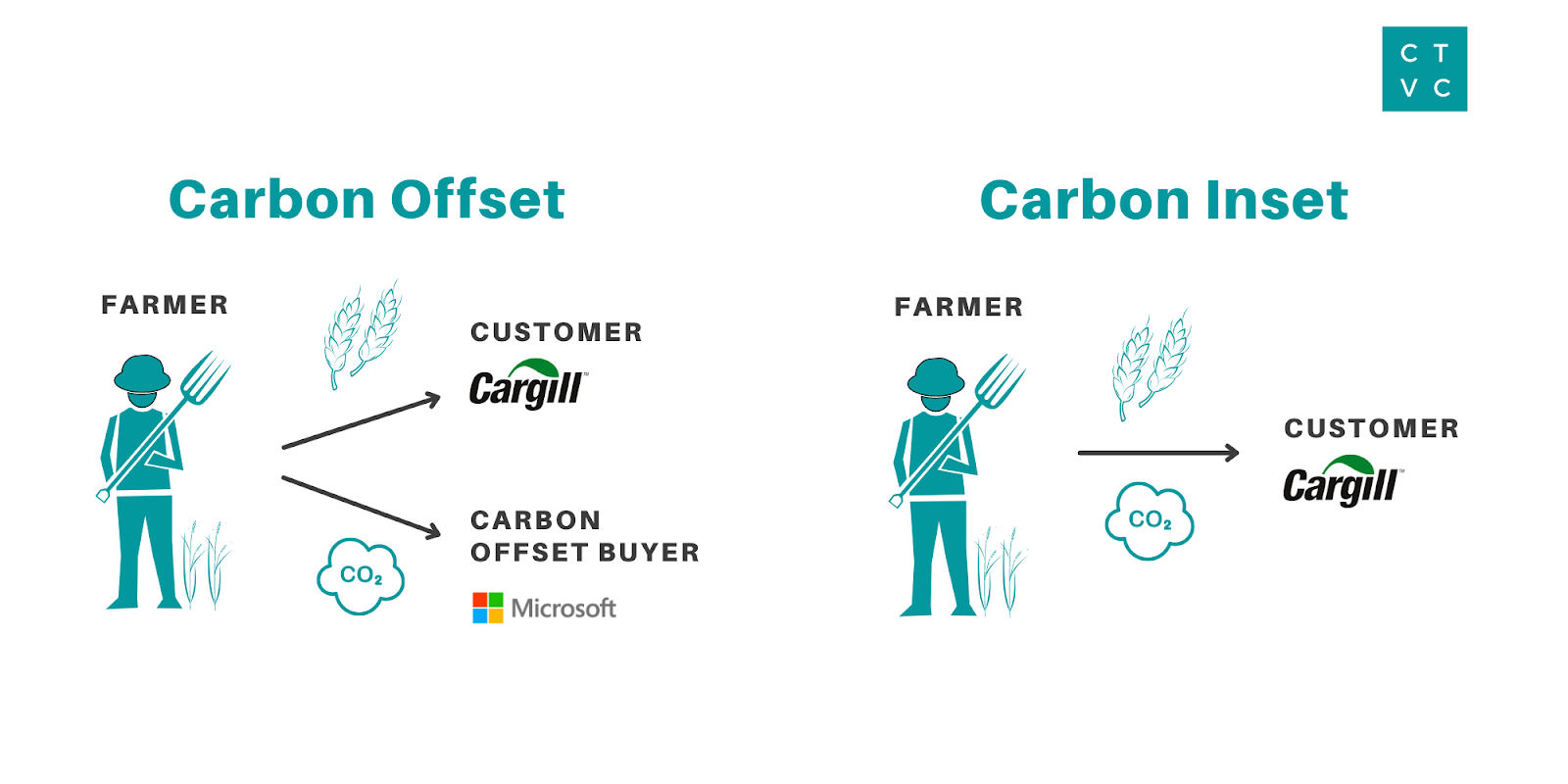

Carbon offsets: emissions reduction (tonnes) generated travels separately from the physical product

Farmers deliver regeneratively grown wheat to one party (Cargill) then deliver the quantified emissions reduction to another party (Microsoft)

Carbon insets: emissions reduction (tonnes) generated travels with the physical product

Farmers deliver regeneratively grown wheat and the quantified emissions reduction to the same party (Cargill)

Compliance credit: A third party regulatory body like the EU ETS sets the compliance standard

Carbon offsets/ removals: A neutral third party like a registry (Verra, CAR, Gold Standard) or ratings agency (Sylvera) set the certification standard

Carbon insets: The multiple parties involved agree on the standard or methodology used

You can’t inset (or offset) what you can’t measure. Corporate emissions accounting all starts in the same place: the carbon balance sheet. The rub with Scope 3 emissions quantification is the lack of traceability and transparency as an asset changes hands, gets physically transformed, and divvied up. Take an ear of corn as an example - it’s a commodity that’s nearly impossible to trace throughout its lifecycle from field to plate as it goes through harvesting, storage, processing, transformation, packaging, distribution, and sale.

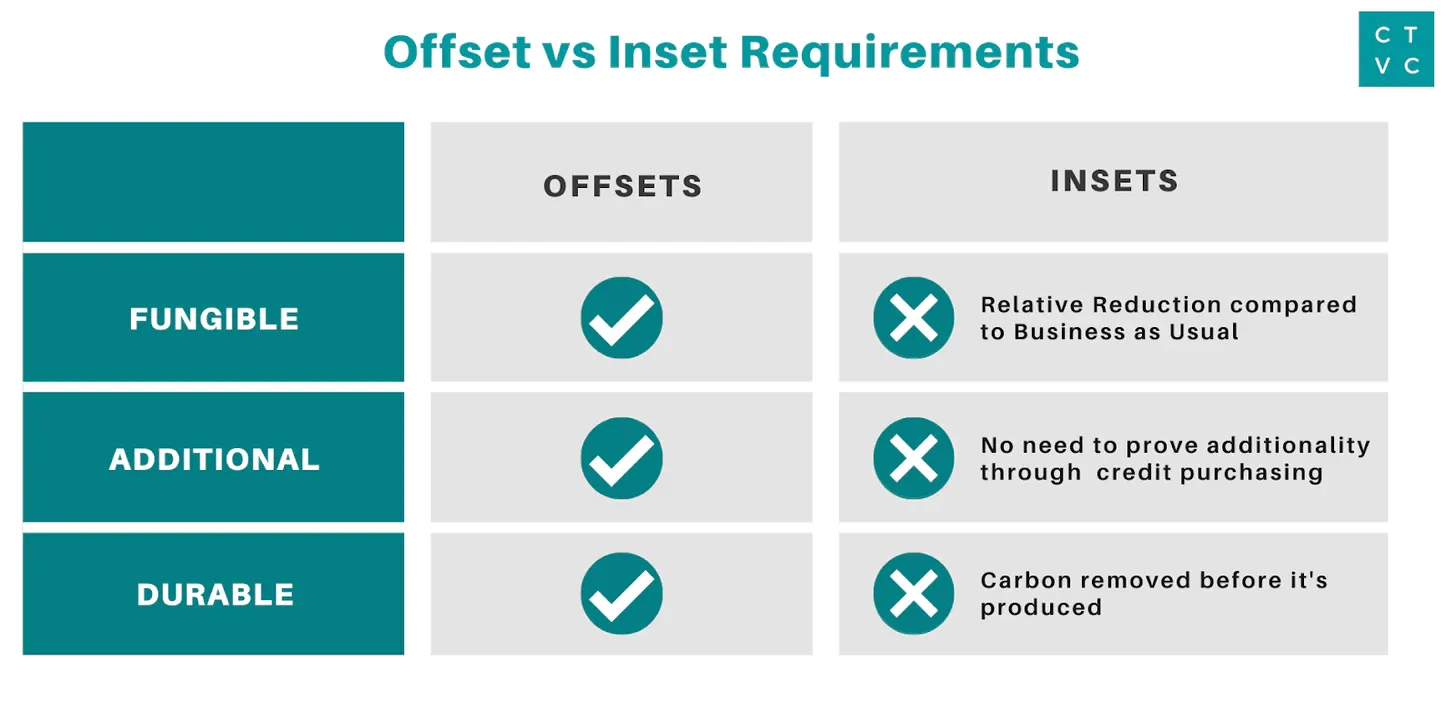

Carbon insets take a clever work-around. Rather than going through the accounting wringer retrospectively to “erase” a corporate’s emissions with another supplier’s offset, insets prevent carbon from being emitted in the first place. Because offsets are a negation of already-emitted GHGs, they must meet rigorous standards of fungibility, additionality, and durability.

Insetting projects do not face the same accounting requirements, in part because they’re not a fungible "credit" like an offset. Insets represent relative emissions reductions, in essence comparing the lifecycle analysis of business-as-usual vs sustainable production. With no external buyers incentivizing insetting projects with credit purchases, there’s less rigor on additionality. Likewise, there’s no need for permanence or leakage because emissions removed through insets never occurred and therefore are inherently permanent and whole.

Regardless of baseline and insetting standards, industries with difficult-to-track embodied emissions, like agriculture, still require technology innovation in Scope 3 MRV (Measurement Reporting Verification) to quantify verifiable reductions.

Though insets are relevant across a breadth of industries, to-date the food & ag supply chains have had the greatest appetite for insets for a number of agriculture-specific conditions:

👩🏼🌾 Low-hanging, low-carbon fruit. Ag practices already exist for decarbonizing food supply chains using nature-based, highly scalable solutions. Relative to new technologies for cleaning up hard-to-abate industries, ag decarbonization is much lower cost. The key is pricing incentives.

💸 Existing financial mechanisms. There are financial systems already in place to incentivize farmers to employ regenerative practices. No new payment systems needed here.

🥧 Big pie. Agricultural soils are arguably the world’s largest carbon sink.

🍴 Consumer-facing. Food is quite literally in our faces. Ag cos are therefore often the first to face the music on consumer sustainability sentiment.

🌱 Sustainability co-benefits. Decarbonizing food supply chains also produce other good stuff like biodiversity, water and air quality, and nutrient-dense food.

As insetting is still nascent, even in ag, there are no centrally defined requirements or standards like in the offsets world. As the lens here matures, insetting discovery, measurement, and qualification will evolve from a secondary criteria to offsets to a primary means of thinking through net carbon impact. What this looks like is an overhaul of the approach of ‘reduce and pay for the bad’ to ‘design processes for good’

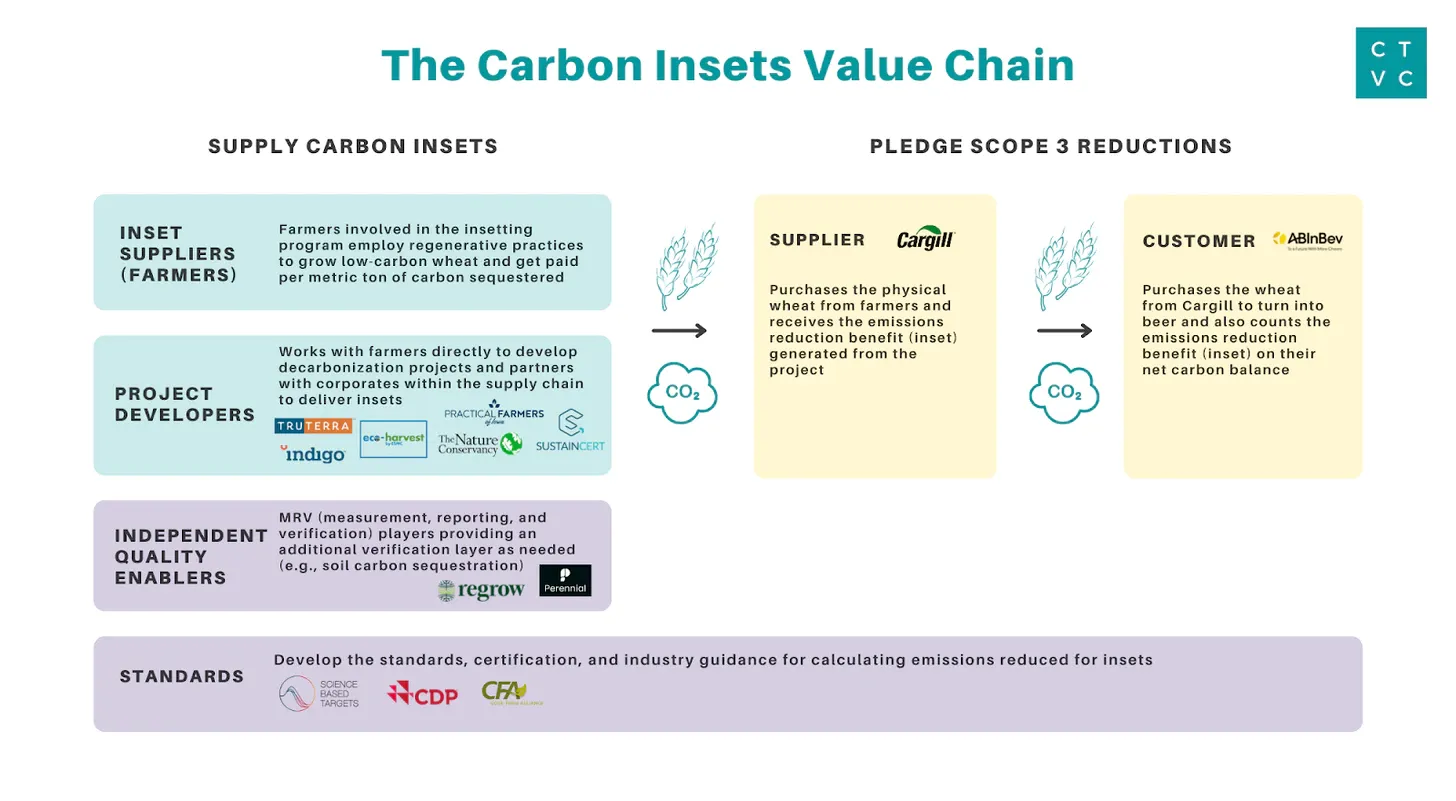

In the Carbon Insets value chain, the emissions reduction is kept within the supply chain, rather than sold to another outside party. Let’s walk through an example: a farmer signs up with Truterra (a project developer) and decides whether to participate in offsetting or insetting.

The key difference for the farmer is the mechanism through which they get compensated, which can vary both price and timing. The distinction between insetting vs offsetting is whether the sustainability claims are attached or detached from the crop.

🧑🌾 Inset Suppliers. Farmers employ regenerative practices to grow crops that reduce and/or sequester GHGs and get paid per metric ton of carbon.

👷🏽 Project Developers. Organizations that work with farmers to implement insetting programs and partner with downstream corporates to deliver emissions reductions (insets) within their supply chains. [Truterra, Indigo Ag, EcoHarvest, Practical Farmers of Iowa, The Nature Conservancy, SustainCERT]

Innovator: Truterra is a 1,900 farmer-strong sustainable project development business of the member-owned cooperative Land O’Lakes. Says Truterra president Jason Weller, “Truterra works with farmers and their trusted advisors to change the way they farm and be rewarded for those changes. That can look a little different for each farm. Some might plant a cover crop between their commercial crops to keep the soil covered and roots in the ground year round to increase how much carbon the soil sequesters, creating a potential carbon offset. Other farmers might park the plow and just plant directly into soil that has not been tilled. Now you’re looking at fewer emissions from the tractor, which could contribute to a potential insetting program. Truterra focuses on helping farmers and their advisors make these changes successfully and also connecting farmers to the companies and organizations who want to support these changes and the positive climate impacts they create. In our first carbon program in 2021, those changes removed nearly 200,000 metric tons of carbon and returned nearly $4 million to those farmers who did the work. That’s a total win-win.”

👨🏼💼 Supplier. Ag retailers and distributors between the farmers and downstream customers. [Bayer, Corteva, Nutrien, Yara, Cargill]

👨👩👧 Customer. Downstream customers that purchase raw commodities like wheat as key inputs in their products. [AB InBev, Nestlé, Campbell, Danone, Unilever]

👮🏾 Standards. Certification bodies that develop best practices for insets.

Innovator: SBTi FLAG project is developing methods and guidance to enable companies within nature-based sectors to set science-based supply chain targets including land-related emissions and removals.

👩🏻💻 MRV. Supplies data to verify carbon outcomes from the pursuit of insetting methodology.

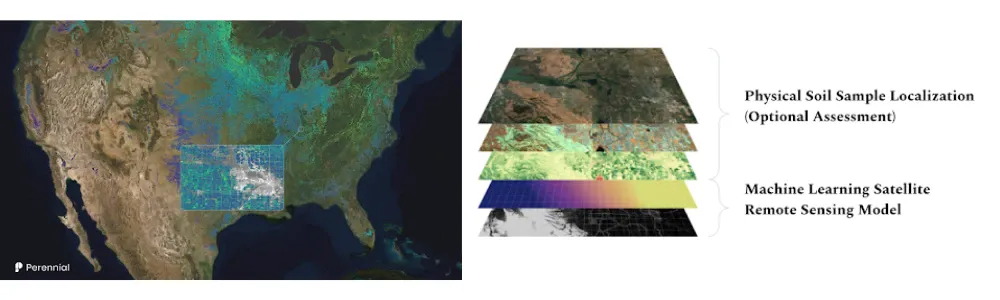

Innovator: Last week, Perennial raised an $18m Series A from a coalition including Temasek, Bloomberg, and Microsoft to measure soil carbon and farmland emissions using satellite-based machine learning models. With this methodology, Perennial produced the first ever 10 meter soil carbon map of the continental United States, unlocking the ability to quantify field-level carbon metrics with few to no physical soil samples. Perennial’s technology allows low- to no-touch emissions monitoring, enabling much easier systems for calculating and applying insets, even deep down the supply chain.

Where to draw the line? The definition of mitigating vs insetting remains blurry. One company’s Scope 1 is another’s Scope 3. So far the line has been drawn as Scope 1 + 2 are to mitigation vs Scope 3 is to insets. This raises headscratchers like: how to categorize switching to a clean electricity source? A building owner who uses that electricity to keep the lights on likely claims mitigation. However, if that clean electricity is used to produce decarbonized cement which is then used in the walls of the same building, the building owner could count the reduced carbon intensity as an inset.

Leveling with double-counting. While it’s valid for multiple owners to account for the inset as the physical good moves down the supply chain, double-counting can run rampant when offsets and insets are created from the same emissions reduction action (e.g., if an offset buyer (Microsoft) and inset customer (Cargill) both claim the same sustainability benefit on their books). Takeaways hold from our longer supply chain feature on traceability and transparency.

Ag today, but everywhere tomorrow. While insetting has primarily been isolated to food & ag supply chains to-date, expect wider adoption - particularly in vertically integrated industries with heavy Scope 3 emissions and clear shared decarbonization incentives (e.g., low-carbon metals for batteries, beneficial to EV OEMs and energy storage cos).

Where’s the referee? Since offsets are internal to a corporate’s supply chain, registries and third party certifiers have been sidelined. Likewise, inset MRV standards and accreditation are, right now, divorced from that of offset MRV compliance - and much more lax. Without the requirement for additionality and temporality considerations, it’s essentially up to the producers and consumers themselves to agree to a methodology, which MRV players then duly provide the component data for.

WTP for practices, not MRV. Going even further, some programs ditch the MRV quantification entirely and are willing to pay for qualitative practices (e.g. cover cropping, no till). While simple to verify, the climate impacts are unknown or estimated.

Shift to fungibility. The next evolution of Scope 3 inset accounting will likely decouple physical assets from their carbon impact, allowing for the tokenization of impact - and more closely resembling offsets. Prime example: Eco-Harvest, an inset credit program which rewards producers for beneficial environmental outcomes from regenerative ag while decoupling the physical commodity from its (negative) emissions. This approach has the potential to rewrite the way farmers are rewarded for their regenerative practices, while simplifying mechanisms for food, fiber, and fuel companies to lower their Scope 3 emissions.

Net Zero is not a zero sum game. Technically, adoption of insetting will decrease demand for offsets. Though realistically, complete supply chain decarbonization is unfeasible today. Expect increased price appreciation of (nature-based) removals intra-supply chains as internal carbon pricing analytics improve and awareness builds around breakeven carbon pricing.

Big shoutout to Laura Klein, Carbon Market Strategy Lead, and Jack Roswell, Co-founder and CEO at Perennial Earth, and Matt Schmitt COO of Eion Carbon for their background and editorial support with this feature.

Scaling “symbiotic manufacturing” with Rubi Laboratories

How to build trust and collaboration in CDR with Isometric, starting with the science

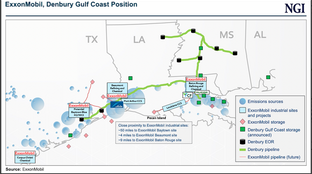

Exxon’s acquisition of Denbury fuels CO2 transport ambitions