🌏 Big moment for small nuclear #219

Amazon’s paying prime for next decade SMR delivery

Happy Monday!

It was bound to happen. The backlash is here after a certifiable flood of loosely defined “ESG capital” swamped the equities market throughout the pandemic, with acronym-soup “sustainable investing” initiatives galore to boot. Vanguard has peaced from GFANZ, and GOP state attorney generals are at war against BlackRock’s “climate agenda”. Adhering to our promise to you to write about what it says on the label, we propose some Climate Tech VC implications from the ESG public market turmoil.

In funding, $200m for Swedish autonomous EV freight, another $200m for Seattle hydrogen mine haul trucks, and $150m for Canadian vertical farms. Plus USV closes $200m (the number of the day, apparently) for their second climate fund, and Ecosia raises $53m for its’ World Fund.

In the news, France bans short haul domestic flights, Winter Olympic selection is delayed because winter is harder to come by, and Lithium-ion battery pack prices rise for the first time ever.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter here.

💼 Find or share roles on our job board here.

The ESG backlash may be making its mark. Vanguard, the world's second largest asset management firm and manager of 6/10 of the largest mutual funds, has withdrawn from the global Net Zero Asset Managers initiative. GFANZ was intended to spur institutional sources of capital to commit to net zero principles - and invest accordingly. 290+ asset managers worth $66T in AUM remain signatories, though Vanguard’s abrupt departure may be a bellwether of a shifting ESG climate.

BlackRock, the largest asset manager besides Vanguard, is simultaneously facing criticism for its famous stance on “climate risk as investment risk”. In August, 19 GOP state attorney generals pushed back against BlackRock's "climate agenda." Last week, Florida pulled $2b in state Treasury funds from BlackRock, citing the company's ESG efforts as a "social-engineering project." Activists, on the other hand, are accusing BlackRock of not being proactive enough on climate issues, with activist investor Bluebell Capital calling out the company's "ESG hypocrisy" and pressuring CEO Larry Fink to step down.

The GOP culture wars are hardly entirely causal, though the effect holds that capital deployment in sustainable funds is waning off its 2021 peak. A record $1.6b flowed out of sustainable funds in Q2 driven by the triple whammy of inflation, a recession, and the global energy crisis. Despite still outgrowing the overall market, ESG capital is not immune to broader macro market forces.

Although we likely won’t see the impact of ESG backlash on private markets any time soon, beware the trickle down effects to climate tech:

🚀 Less rocket fuel earmarked for climate. If the ESG investment movement loses momentum, so does the coffer of institutional capital dedicated to financing private climate tech - both in direct investments and indirect ESG mandates to fund early-stage climate tech investors. A shrinking pool of public ESG capital could make growth-stage funding more difficult for private climate cos to make the leap over CT1.0’s Valleys of Death.

⚠️ Later-stage companies slow their race to go public. 2021 was the year of the SPAC, a handful of good ol’ climate tech IPOs to mark (Rivian, Fluence, Allbirds, etc), and peak ESG fund flows during a heady market. Meanwhile, public market activity in 2022 has all but stuttered to a standstill, save a few leftover climate SPACs stumbling over the finish line from last year. ESG backlash is at the back of a laundry list of reasons for the public market slowdown, currently topped by the pending recession and rising interest rates. However, if “ESG” starts to carry controversy, the institutional demand pull for climate tech assets and the green premium it carries may be at risk.

🚚 Einride, a Sweden-based electric autonomous freight mobility company, raised $500m in funding ($200m equity and $300m debt) from AMF, EQT Ventures, Northzone, Polar Structure, Norrsken VC, and Temasek.

🌾 Sound Agriculture, an Emeryville, CA-based company developing climate resilient crops, raised $75m in Series D funding from BMO Impact Investment Fund, Chan Zuckerberg Initiative, FootPrint Coalition, Leaps by Bayer, Syngenta Group Ventures, S2G Ventures, Fall Line Capital, Cavallo Ventures and Northpond Ventures.

🔋 Customcells, a Germany-based lithium-ion battery developer, raised $63m in Series A funding from World Fund, Abacon Capital, Vsquared Ventures, and Porsche.

⛓️ GoBolt, a Canada-based sustainable supply chain network developer, raised $55m in Series C funding from Yaletown Venture Partners, Export Development Canada, BDC Capital, Northleaf Capital Partners, Whitecap Venture Partners, MIG Group, BMO Capital Partners, and Ingka Investments.

🔋 ZincFive, a Tualatin, OR-based company providing nickel-zinc battery energy solutions, raised $54m in Series D funding from Helios Climate Ventures, Standard Investments, Senator Investment Group, OGCI Climate Investments, and Japan Energy Fund.

⛏️ MineSense Technologies, a Canada-based data analytics platform reducing mining resource intensity, raised $42m in Series E funding from J.P. Morgan Sustainable Growth Equity.

🌾 Naïo Technologies, a France-based agricultural robotics company, raised $33m in Series B funding from Mirova, Pymwyic, M Capital Partners, Demeter Partners, Coderna, Capagro, Bpifrance, and ARIS Occitanie.

💧 Cerafiltec, a Germany-based provider of ceramic water filtration membranes, raised $32m in growth funding from Circularity Capital and Stellar Impact.

⚡ Reach, a Redwood City, CA-based company developing wireless energy networks, raised $30m in Series B funding from DCVC, Y Combinator, Transform VC, and Collaborative Fund.

💨 LongPath Technologies, a Boulder, CO-based company providing methane emission detection and quantification tech, raised $22m in Series A funding from White Deer Energy, Williams, ProFrac Services, and Buff Gold Ventures.

🛵 Onomotion, a Germany-based e-bike manufacturer, raised $22m ($6m equity and $16m debt) in Series A funding from Proeza Ventures, the European Innovation Council, and Zu Na Mi.

🚀 Dawn Aerospace, a New Zealand-based manufacturer of sustainable space transportation, raised $20m in Series A funding from Icehouse Ventures, Movac, and GDI.

♻️ CheckSammy, a Dallas, TX-based company providing waste removal and recycling services, raised $15m in funding from Zero Infinity Partners, FirePower Capital, and PaceZero Capital Partners.

🐑 Black Sheep Foods, a San Francisco, CA-based alternative meat company, raised $12m in Series A funding from Unovis Asset Management, KBW Ventures, Bessemer Venture Partners, and AgFunder.

⚡ Ostrom, a Germany-born smart energy management platform, raised $10m in Series A funding from Union Square Ventures and Adjacent.

💨 RepAir, an Israel-based providing CO2 capture solutions, raised $10m in Series A funding from Extantia Capital, Zero Carbon Capital, Shell Ventures, Equinor Ventures, Counteract, and Consensus Business Group.

🐠 WildType, a San Francisco, CA-based company producing cell-culture salmon, raised $8m in funding from SK Holdings.

♻️ Urban Machine, a Oakland, CA-based company salvaging reclaimed wood, raised $6m in Seed funding from Union Labs Ventures, Lowercarbon Capital, GV, and Catapult Ventures.

⚡ Gorilla, a Belgium-based energy data management platform, raised $6m in Series A funding from PMV, Beringea, and VLAIO.

🐝 3Bee, a Italy-based company providing data analytics for pollinators, raised $5m in Series A funding from Ag Funder, Anya Capital, and ESA.

👕 Stony Creek Colors, a Springfield, TN-based company providing bio-based garment dyes, raised $5m in Series B funding from Lewis & Clark Agrifood and Levi Strauss & Co.

🌳 MORFO, a France-based company developing drones to repopulate forests, raised $4m in Seed funding from Demeter, RAISE Ventures, AFI Ventures, and TeamPact Ventures.

🚗 Vidyut, an India-based EV financing company, raised $4m in Seed funding from Force Ventures and Veda VC.

💨 Varaha, an India-based carbon credits platform, raised $4m in Seed funding from Orios Venture Partners, Omnivore, RTP Global, and Better Capital.

⚡ Novatron, a Sweden-based company developing commercial nuclear fusion reactors, raised $4m in Seed funding from KTH Royal Institute of Technology and EIT InnoEnergy.

🌳 Gaia AI, a Somerville, MA-based company providing data analytic tools for forestry management, raised $3m in Pre-seed funding from The E14 Fund, Ubiquity Ventures, Space Capital, SOSV, MIT, HAX, Harvard, and Greentown Labs.

💨 Rize, a France-based carbon credit financing company, raised $3m in Pre-seed funding from Anthemis, Mirova, and BBVA.

🌎 Sustain.Life, a New York, NY-based ESG software platform, raised $3m in Seed funding from Global Cleantech Capital and Kompas.

💨 Accacia, an India-based decarbonization platform, raised $2.5m in Seed funding from B Capital Group, Accel, Rainmatter Capital, Loyal VC, Good Capital, and Blume Ventures.

⚡ Gridless, a Ghana-based company utilizing bitcoin mining to facilitate renewable energy grid solutions, raised $2m in Seed funding from StillMark and Jack Dorsey’s Block.

🍯 MeliBio, a Oakland, CA-based company developing honey without bees, raised $2m in funding from Collaborative Fund, Siddhi Capital, and Greenebaum Family Foundation.

🌍 Verna, a UK-based software company providing sustainable land management solutions, raised $1m in funding from Vanneck EIS and Octopus Ventures.

🥩 Yeasty, a France-based alternative protein company, raised $1m in Seed funding from Asterion Ventures, Sharpstone Capital, Satgana, and Cameleon Invest.

💨 Grain Ecosystem, a Quincy, MA-based company streamlining carbon offset projects, raised funding from SE Ventures.

👕 OceanSafe, a Switzerland-based company developing circular, biodegradable textiles, raised Seed funding from Rütters GmbH and AG.

🚚 First Mode, a Seattle, WA-based company developing a hybrid hydrogen-powered mine haul truck, raised $200m in funding from Anglo American.

🌾 GoodLeaf Farms, a Canada-based vertical farming company, raised $150m in funding from McCain Food and Power Sustainable Lios.

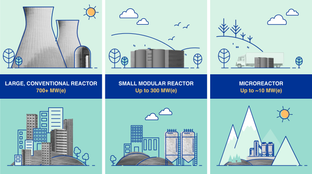

X-Energy, a Rockville, MD-based developer of small modular nuclear reactors, is going public at an implied $2b pre-money equity value via SPAC Ares Acquisition Corp.

PSA South Hills Landfill Gas, a South Park Township, PA-based company producing transportation fuel from landfill biogas, was acquired by Green Rock Energy Partners.

VinFast, a Vietnam-based EV manufacturer, is going public and will trade on Nasdaq.

Union Square Ventures raised $200m for its second climate tech fund.

Jenson Funding Partners has raised $63m for its Aurora I Fund, aimed to invest in companies focused on net-zero transition solutions.

World Fund raised $53m from the European Investment Fund to invest in climate tech startups.

France will ban short haul domestic flights less than 2.5 hours long, a measure which will be reassessed by the EU Commission in three years. The ban comes off the back of a pause started in 2020 when the French government granted Air France COVID relief in exchange for canceling some domestic flight routes to encourage train usage.

Congressional leaders opted against using a bill authorizing military spending to finish a deal between Democrats and Sen. Joe Manchin (D-W.Va). His proposed reform efforts would have included approval for the Mountain Valley pipeline, a controversial natural gas project in his state.

The International Olympic Committee is delaying selection of the 2030 Winter Olympics host due to climate change. To ensure snow and below zero degrees temperatures for snow competition venues, ongoing discussions include introducing new competition formats and rotating the Olympic Winter Games between a pool of hosts.

Lithium-ion battery pack prices are rising for the first time to an average of $151/kWh. Rising raw material and soaring inflation have led to the first ever increase in prices since BNEF began tracking the market in 2010.

Switzerland-based mining giant Glencore will close 12 of its 36 coal mines over the next 12 years to meet its emissions targets by 2035. The move comes as major miners including Rio Tinto and BHP pull away from carbon-emitting fossil fuels in favor of minerals necessary in the low-carbon energy transition, such as nickel, copper, lithium and cobalt.

The Biden administration announced 5 winners for the California offshore wind auction, amounting to $757m in winning bids that will potentially power over 1.5m homes. Copenhagen Infrastructure Partners plans to build its first floating offshore wind farm with one of these permits.

In January 2023, new wage and apprenticeship criteria will kick in for companies seeking popular federal tax incentives for renewable energy projects. Clean power plants claiming the full 30% tax credit must pay laborers at or above the local prevailing wage, as determined by the U.S. Department of Labor.

The House committee will be releasing a trove of documents accusing oil companies of greenwashing with “no real plans to clean up [their] act and are barreling ahead with plans to pump more dirty fuels for decades to come.”

A new bill proposed by Sen. Edward Markey (D-Mass.) would require crypto miners to disclose their GHG emissions for operations that consume more than 5 MW. New York State already banned non proof-of-work bitcoin mining operations that run on carbon-based power sources.

Canada’s government issued guidelines to ensure the country ends new support for the international unabated fossil fuel energy sector by the end of 2022. The guidelines will end new direct public financing for international fossil fuel investments departments, while guiding representatives in their voting on boards of multilateral development banks.

Slumping sausages and supply chain challenges at Beyond.

Would you compost your underwear?

The new remote work climate migrants are moving to southern Europe for warmer weather - and to avoid skyrocketing energy bills.

Jeremy Grantham talks climate VC with economist Tyler Cowen.

Atomico’s annual State of European Tech report shows a spike in funding for “Purpose” (any UN SDG), “Planet Positive” (subset of SDGs), and “Climate tech” (SDG 13).

At Microsoft’s annual meeting on Tuesday, shareholders will hold a landmark vote on whether to support an analysis of the climate risk posed by the company’s 401(k) retirement options.

Like a moth to a flame. A University of Vermont study finds that, over the past decade, Americans are moving into harm's way: the drought- and wildfire-prone West.

More resources on grants, credits, and partnerships for the climate capital stack from The Climate Startup Playbook by Third Sphere.

Get lost in the (sub)stacks with this deep dive from John Sanchez on functionally stable carbon storage.

WSJ coverage on green hydrogen startups sprinting towards the DOE’s $1/kg target.

The TLDR from Rhodium on SAFs: to scale from 4.5m gallons of SAF produced annually to 60 billion gallons of aviation fuel used annually, we need to shore up supply-side, invest beyond pilot projects, and price beyond IRA tax incentives.

Phantom load sucks 5-10% of your electricity bill just to keep your coffee makers, TV, and washing machine on standby.

The new face of fashion house Chloe? Nuclear fusion. Think dead stars, tokamak runways, and the fuschia shades produced in fusion reactions.

🗓️ DEP Engineering Career Fair: Join on Dec 14 to learn about engineering, construction, and design roles to work on water quality, wastewater treatment process, and green infrastructure at the NY Department of Environmental Protection.

💡2022 Mosaic Movement Infrastructure RFP: Local and national “movement infrastructure” projects should apply by Dec 16 to this $75m fundraising effort aimed at helping to implement the Democrats’ sweeping climate law.

💡 Newlab's Founder Fellowship: Underrepresented climate and urban tech founders in NYC should apply by Dec 16 for free one-year access to Newlab's co-working and prototyping space in Brooklyn, plus mentorship and curated programming.

🗓️ 2nd Annual Sustainable Holiday Market: Shop local and low-waste vendors, mingle, learn and enjoy local food and beverages on Dec 18 from 3-8pm.

💡 Google Startups Climate Accelerator: Apply by Jan 19 to Google’s 10-week digital accelerator program for high potential Seed to Series A tech startups based in North America.

Analyst / Associate @Zero Infinity Partners

Head of Content & Communications @Overlap Holdings

Summer Associate @Piva Capital

Climate Tech Research Analyst @ClimateTech VC

Director of Structured Finance and Tax Equity @Fervo Energy

Head of Research and Science @Contrarian Ventures

Director of Business Development @Cloverly

Climate Strategy Director @Lego

Chief of Staff - Operations @Climeworks

Construction Project Management Co-op/Intern (Summer 2023) @Form Energy

Senior Software Engineer (Fullstack, Remote) @Haven Energy

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Amazon’s paying prime for next decade SMR delivery

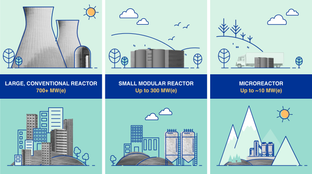

New UK scheme aims to boost energy storage’s bottom line

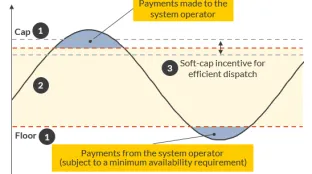

A new leak at ADM’s Illinois CCS site raises concerns about oversight and the sector’s success