🌎 Fervo and General Fusion open the exit window #280

A tale of two public debuts

Pencils down, papers collected.

Back in January, you sent us your predictions for what 2025 would bring for climate tech. Now that the year is (almost) in the books, we’ve finally worked our way through the grading pile — and the results are in.

Most questions split opinion, but for scoring we went with the majority view, measuring your calls against what the year actually delivered. Consider this your Climate Tech 2025 Report Card.

Final score: 71% correct. Not too bad. You didn’t ace the test, but you definitely studied, and it was a better grade than last year, when you got 60%.

Read on to see how your predictions stacked up. We used expert sources to verify, and some of the data to back up the numbers comes from our 2025 Climate Tech Investment Trends report, coming next month, so you’re getting a sneak peek.

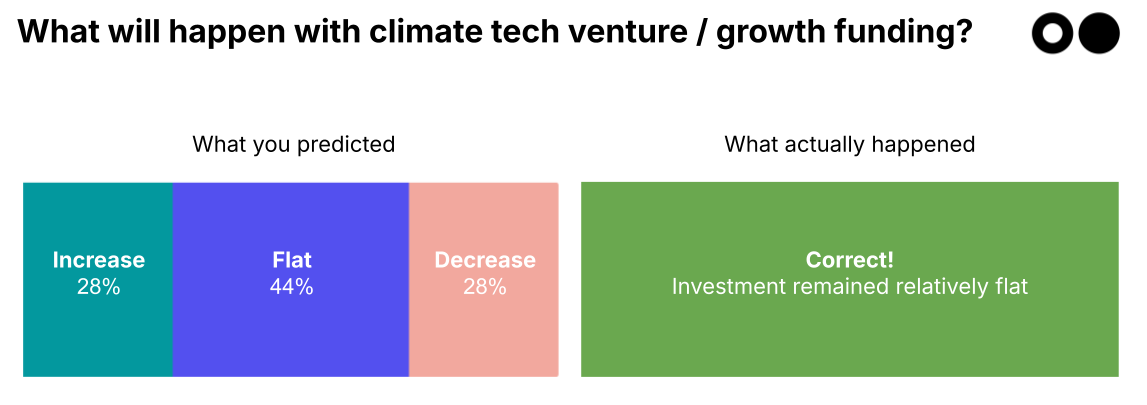

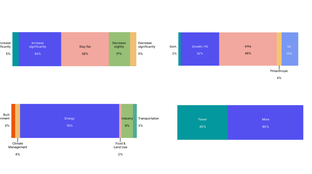

Prediction: Opinion was divided; 28% foresaw a clean rebound after the messy 2023–2024 reset, 28% expected a slow grind, lower than before, but the largest group — 44% — believed we’d settle into a new, structurally lower “normal” for climate tech VC and growth

Outcome: ✅ Correct. Without giving too much away from our year-end report, which we’re releasing in January, total VC and growth funding ticked up by less than 10%. That modest increase leaves the sector relatively flat overall, confirming the “new normal” thesis rather than a sharp rebound.

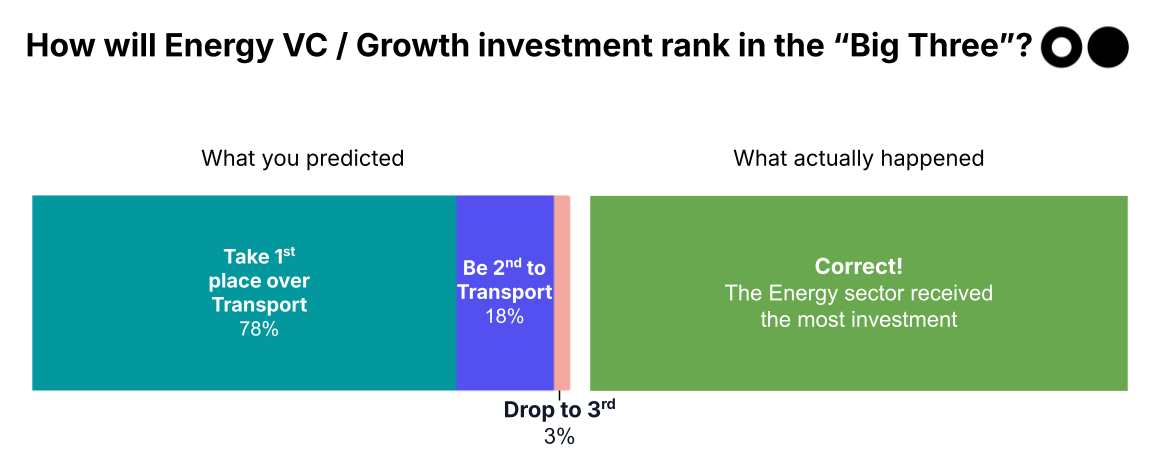

The “Big Three” verticals — Transport, Energy, and Food & Land Use — consistently account for ~80% of all climate tech investment.

Prediction: An overwhelming 78% of you said Energy would take first place.

Outcome: ✅ Correct. Energy led the pack, as utilities, corporates, and investors look to unlock new capacity and generation as power demand rises. Unsurprising — but our year-end report will show which subsectors did best, including a few surprises.

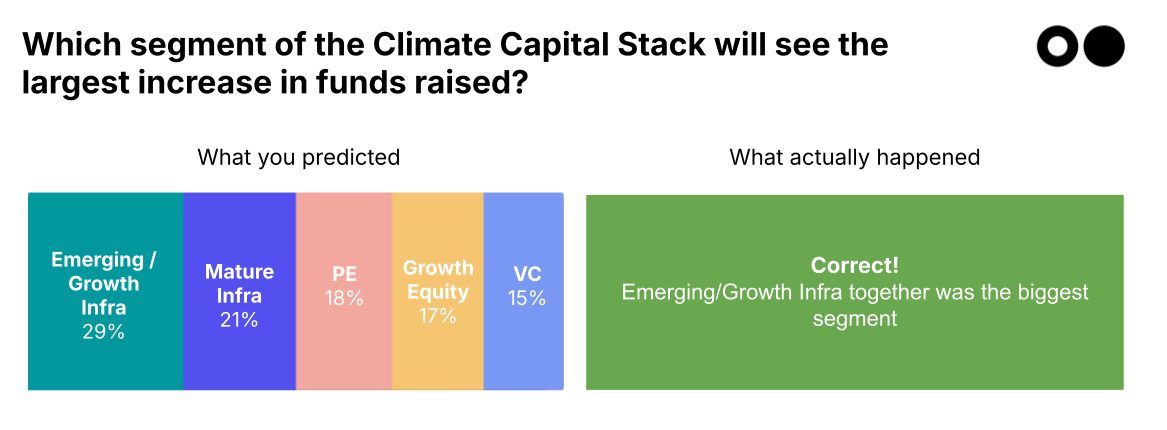

As the climate capital stack matures, expectations have shifted toward later-stage capital. In 2024, investable climate dry powder reached $86bn, with Infrastructure funds accounting for nearly 60% of new climate AUM.

Prediction: Responses were fairly even, but 29% of you picked Emerging & Growth Infrastructure, reflecting the shift toward more mature capital and hopes of filling the “missing middle.”

Outcome: ✅ Correct. Emerging and Growth Infrastructure together became the largest segment of funds raised in 2025.

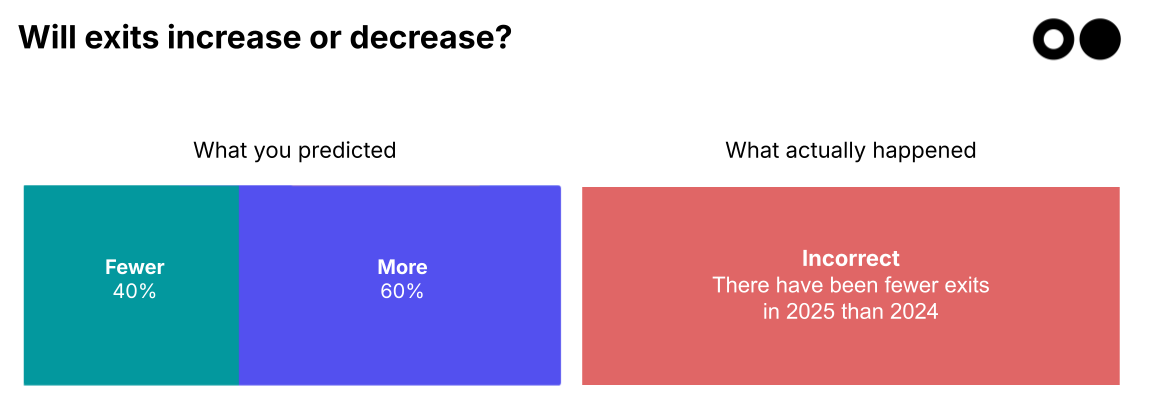

In 2024, exits surged 136%, driven overwhelmingly by acquisitions (92% of all exits), confirming a strong buyer’s market dominated by tuck-ins.

Prediction: 60% of you guessed exits would increase again.

Outcome: ❌ Incorrect. We’ve tracked that this year, exits actually declined slightly year over year. But only by a handful. To be fair, we didn’t offer “remain flat” as an option — so yes, this one was a bit of a trick question.

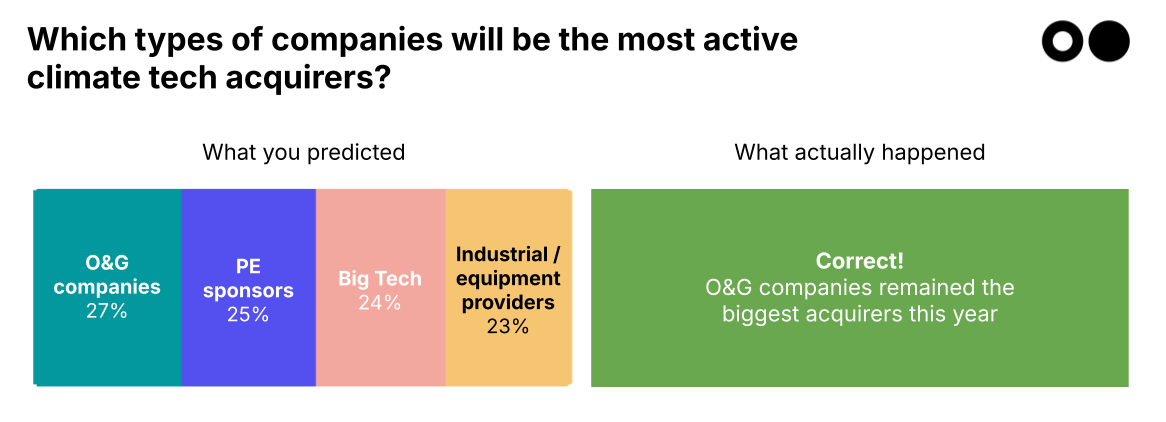

As of last year, since 2021, 2 of the 3 most active acquirers in climate tech have been oil & gas companies. In 2024, that dropped to 3 of the top 5.

Prediction: Oil & gas was the top pick, though opinions were split across other corporates.

Outcome: ✅ Correct. O&G companies remained the most active acquirers — though it was tight this year. Our end-of-year report will break down who led the pack and where acquisitions clustered.

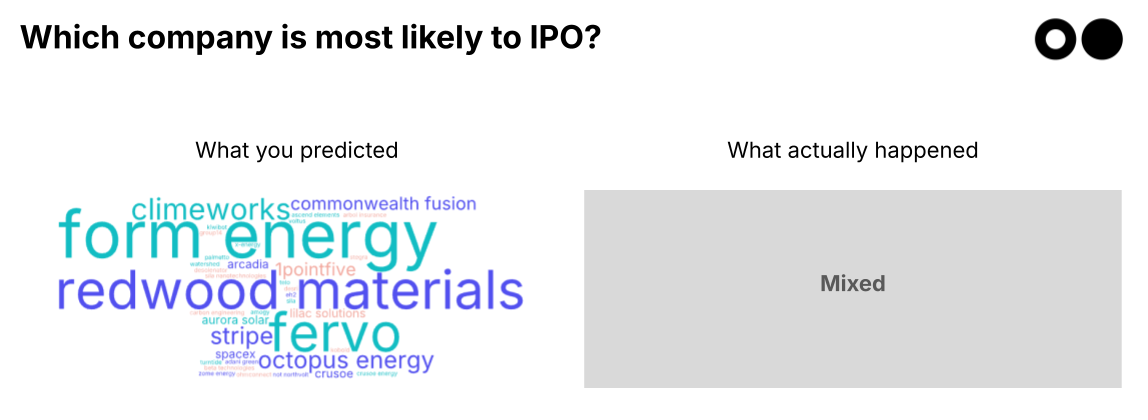

IPOs ticked up slightly in recent years (6 in 2024 vs. 5 in 2023), though still well below 2020–2021 levels. Two of the largest recent IPOs came out of India.

Predictions: Your top guesses were Form Energy, Climeworks, Redwood Materials, and Fervo.

Outcome: 🤷 Mixed. None of the top picks IPO’d — but credit where it’s due: One of you guessed Beta Technologies, which did IPO last month. Several of you guessed SpaceX (not climate tech per se), which announced plans to IPO in 2026–2027. Others flagged Arcadia (which merged with Perch), so not an IPO, but still an exit.

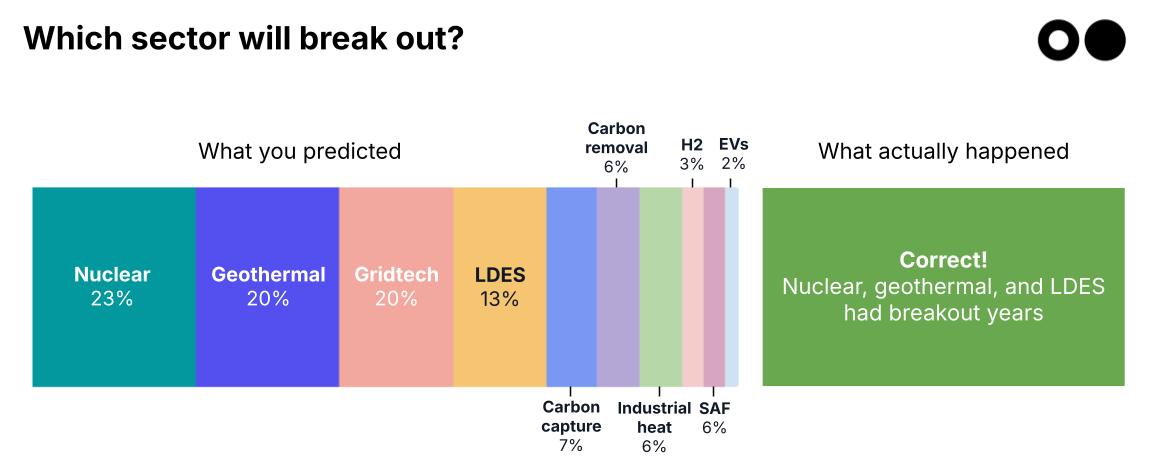

In 2024, several sectors surged: Geothermal nearly tripled to $558m, Nuclear almost doubled to $1.9bn, and Aviation and low-carbon fuels quadrupled. Mega-deals clustered around clean firm power and data centers, with standouts like X-energy and Form Energy.

Predictions: Your top picks for 2025 were nuclear, geothermal, and grid tech. And your reasoning included: Nuclear as reliable clean baseload for intensive AI and data center power demand, geothermal benefiting from drilling innovation and O&G talent crossover, and gridtech gaining momentum from modernization, resilience needs, and bipartisan support.

Outcome: ✅ Correct. Without going into the numbers, which will be out in our 2025 Investment Trends report next month, nuclear had a gangbusters year. geothermal momentum continued, and gridtech has seen substantial investment growth as utilities raced to keep up with demand and reliability pressures. These sectors already emerged as frontrunners in our H1 2025 report.

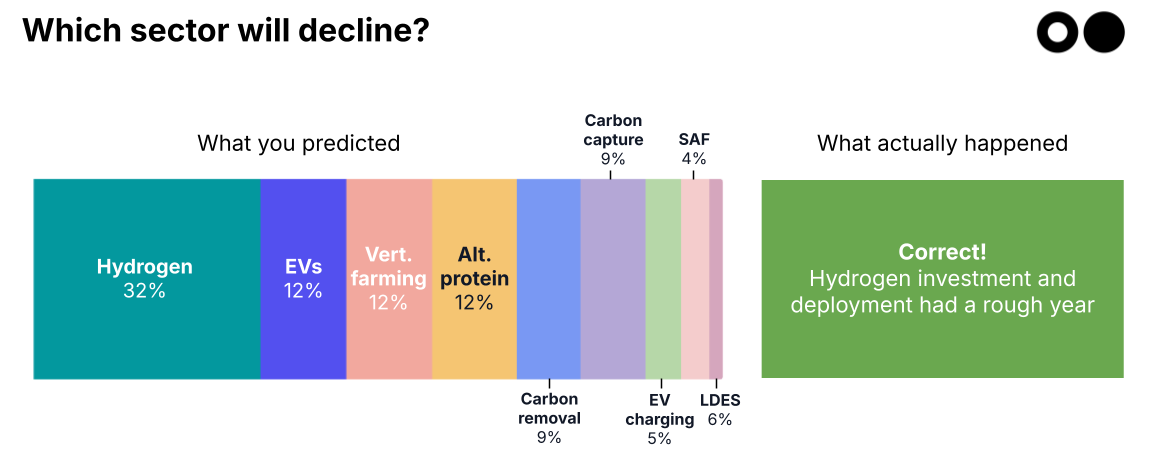

Some sectors were already under pressure in 2024: Batteries (transport) down 79%, Steel down 80%, and Mining & metals down 74%.

Predictions: You foresaw declines in Hydrogen, EVs, Vertical farming, and alternative protein. Your reasoning: heavy reliance on subsidies, unclear economics, high costs, and slow adoption.

Outcome: ✅ Mostly correct. Hydrogen VC funding has fallen 63% YoY, vertical farming and alt protein saw bankruptcies and consolidation, and sure, the EV market stalled in the US (although it stayed strong elsewhere). Subjective, but broadly accurate.

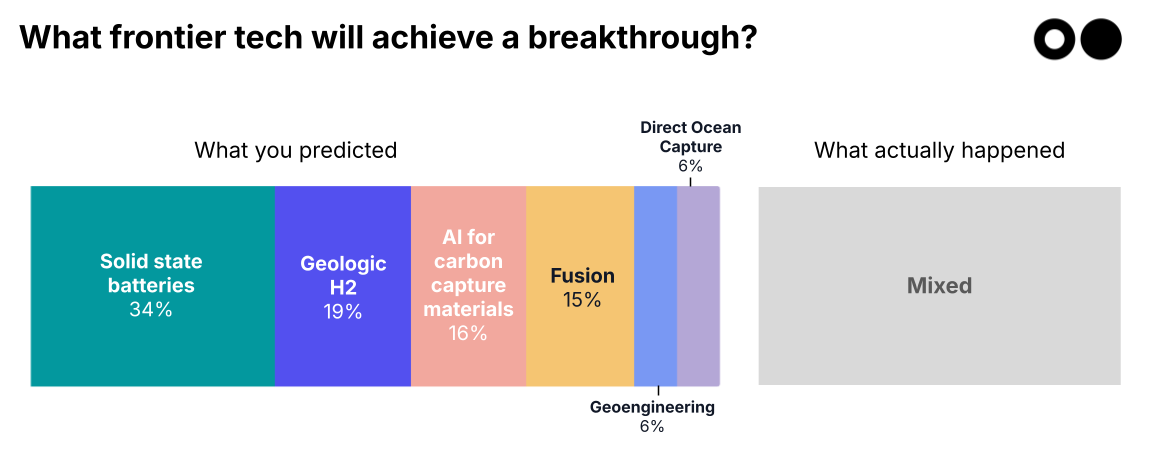

Prediction: From a shortlist, most of you chose solid-state batteries.

Outcome: 🤔 Debatable. Solid-state batteries remain largely in pilot phases (mainly in China). Instead, Direct Ocean Capture showed one of the fastest real-world scale-ups, jumping from 10 to 1,000 with the meaningful efficiency and energy-use improvements that many are waiting for in DAC. We’ll subjectively crown DOC the winner — though honorable mentions go to breakthroughs not on the list (like Zanskar’s AI-driven geothermal modeling).

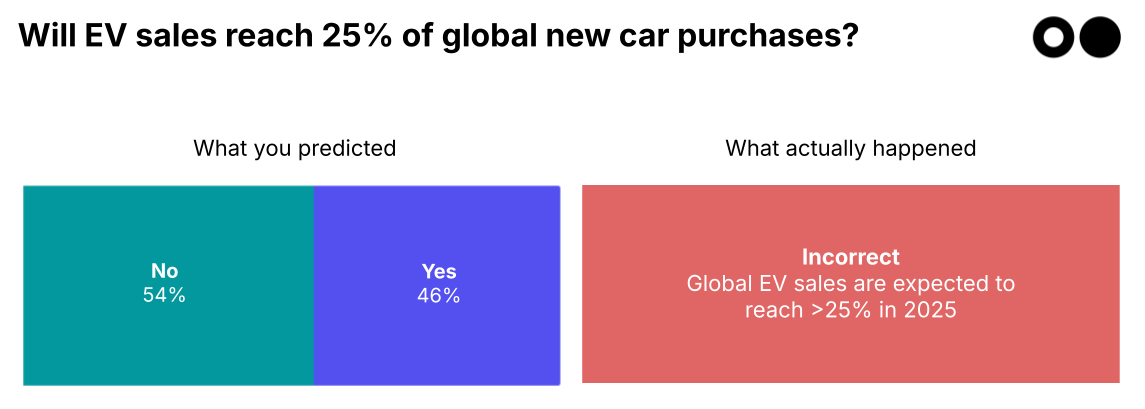

Prediction: It was close, but most of you said no.

Outcome: ❌ Incorrect. Electric car sales in 2025 are expected to exceed 20 million worldwide to represent more than one-quarter of cars sold worldwide, per the IEA.

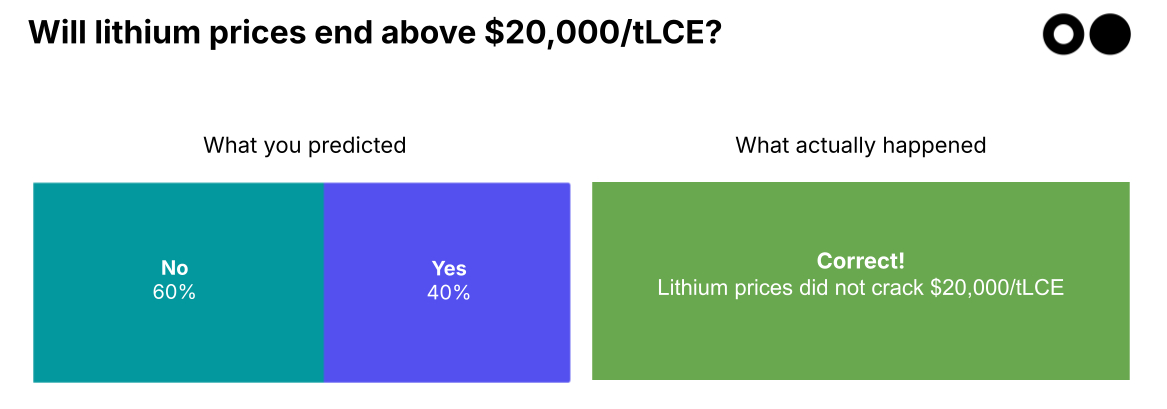

After a record-breaking 2022, lithium prices fell sharply.

Prediction: 60% of you said they wouldn’t reach previous highs.

Outcome: ✅ Correct. Prices hit a high this year of around $13,000/t LCE.

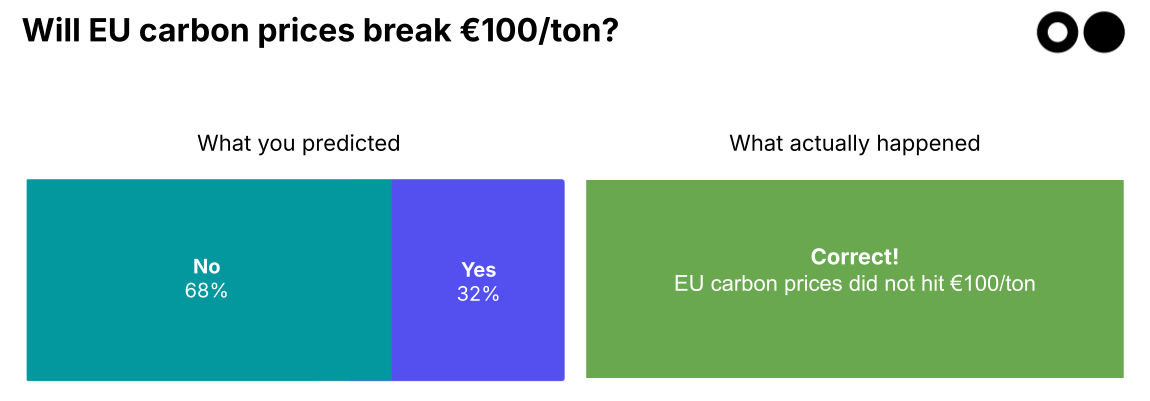

Prediction: 68% of you said no.

Outcome: ✅ Correct. Prices peaked at €84 in January, but slumped in the rest of the year, then hit €84 again this December, never cracking €100.

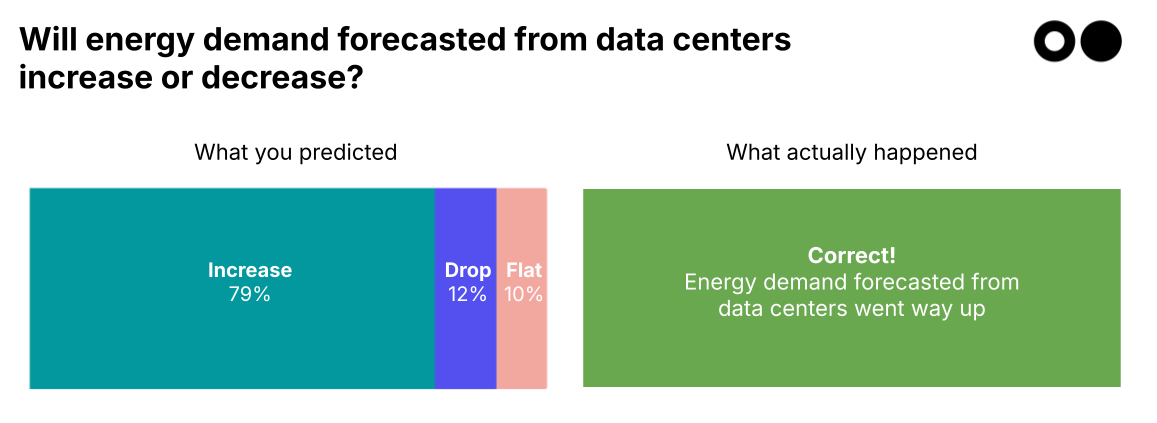

AI and electrification drove a surge in demand. The IEA revised its 2026 forecast to 800 TWh, up from 460 TWh in 2022.

Prediction: Overwhelmingly, you said it would increase.

Outcome: ✅ Correct. In fact, the scale of growth now makes earlier forecasts look almost quaint. According to the latest Grid Strategies report, aggregate US load forecasts have surged to 166 GW of new demand projected by 2030 — a six-fold increase compared to the “flat” load growth outlook that dominated forecasts as recently as 2022.

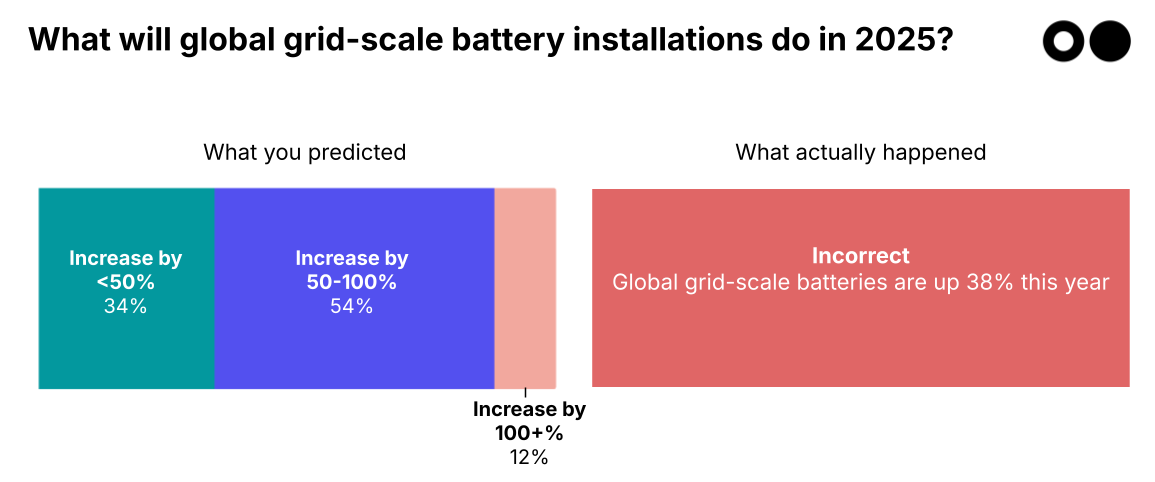

At the end of 2023, 56 GW / 200 GWh installed globally, up from just 3 GW five years earlier.

Prediction: Most of you expected 50–100% growth.

Outcome: ❌ Incorrect. Growth came in at ~38% YoY at the end of November, so there’s still a little wiggle room. That was lower than you expected, though still substantial.

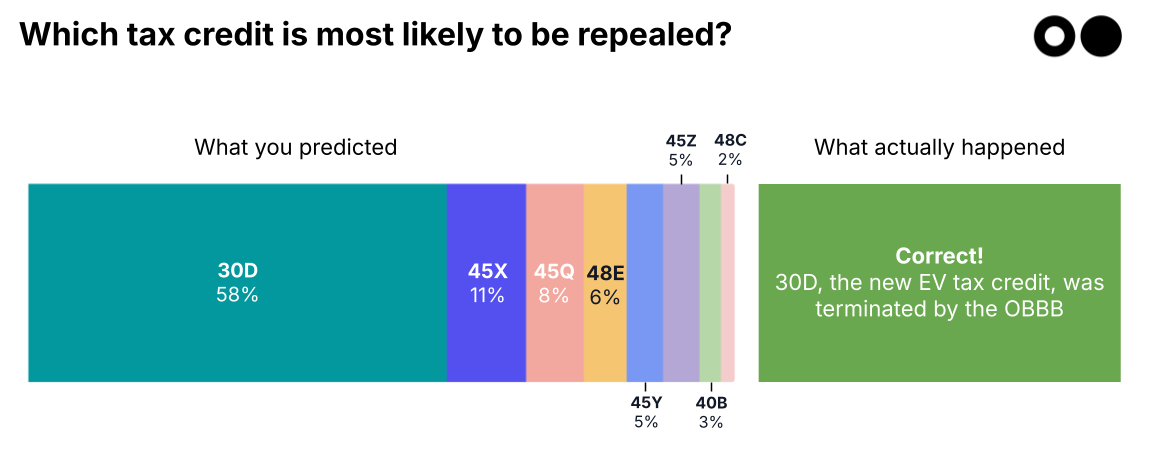

Prediction: Uncertainty lingered around IRA incentives. Most of you picked 30D, the federal Clean Vehicle tax credit, while also pointing to other key IRA incentives — including 45X for advanced clean energy manufacturing, 45Q for carbon capture and storage, 45Y and 48E for clean electricity production and investment, and 48C for domestic clean energy manufacturing facilities.

Outcome: ✅ Mostly correct. The clean vehicle credit was repealed by the OBBB. Meanwhile, other major climate-related tax credits — including credits for advanced manufacturing (45X), carbon capture (45Q), and tech-neutral clean energy production (45Y/48E) — have not been fully repealed, but many now face accelerated phase-outs, tighter eligibility rules, or new construction/deadline requirements rather than outright elimination.

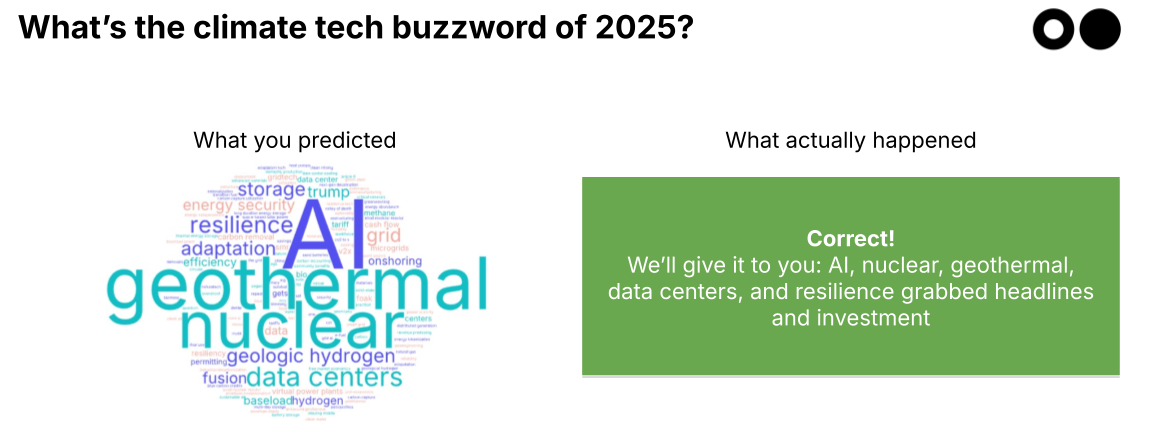

Predictions: Geothermal. Nuclear. AI. Adaptation & resilience. Data centers.

Outcome: ✅ Nailed it. These themes dominated climate tech conversations all year. Geothermal and nuclear broke out as credible solutions for clean, firm power, driven by surging demand from AI and data centers, while AI itself became deeply embedded across the stack — from subsurface modeling to grid optimization and energy management. At the same time, adaptation and resilience moved from the margins to the mainstream, as extreme weather, grid stress, and infrastructure vulnerability turned climate resilience from a “nice to have” into a core investment thesis.

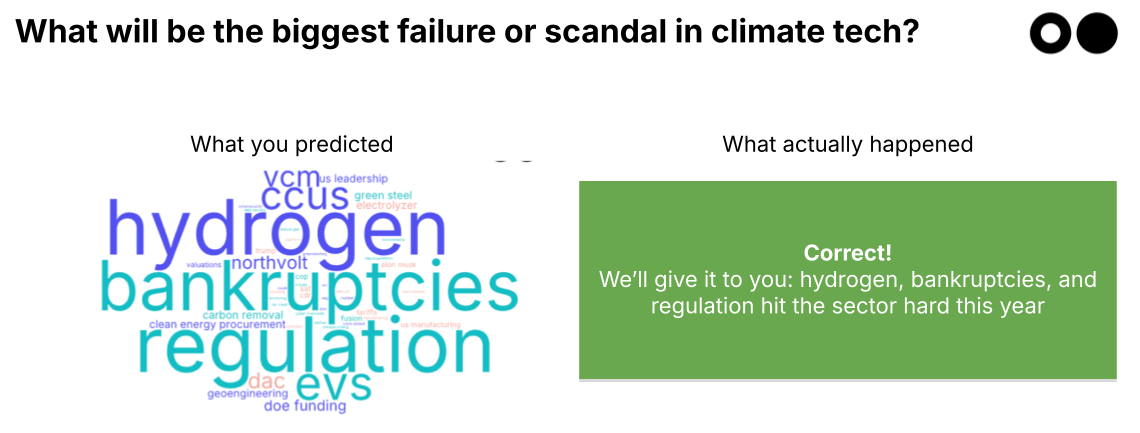

Prediction: Hydrogen bubbles, regulatory pullbacks, and bankruptcies.

Outcome: 😬 Unfortunately correct. The hydrogen hype cooled rapidly as policy support weakened, project economics failed to pencil, and demand lagged expectations — triggering a wave of bankruptcies, project cancellations, and consolidation across the sector.

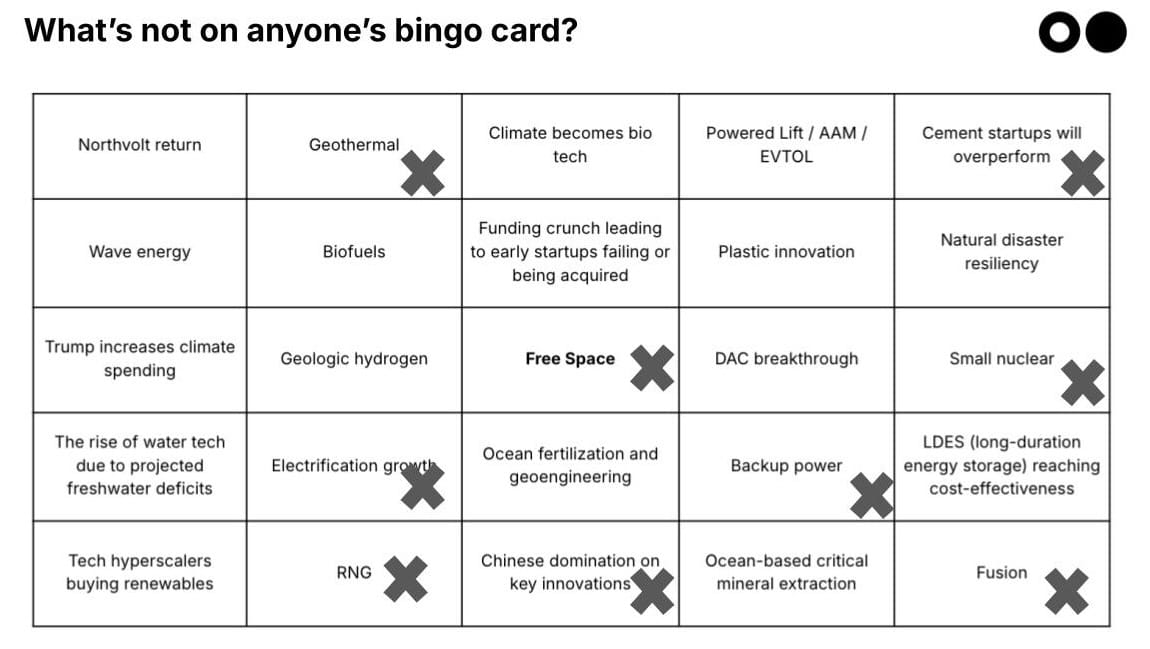

Well, not quite bingo, but definitely not a blank card either! Clearly, geothermal was on people's bingo cards. Sustainable cement hit milestones with Brevik. Small nuclear had some big moments. Electrification has continued, and backup power is increasingly an option for data centers. The RNG market grew this year. China continues to dominate in key climate tech areas, and fusion scored some of the most massive funding rounds we've seen.

It’s been an eventful year, and stay tuned for the results of the 2026 Climate Tech Oracle. Share your predictions for the year ahead in our survey, and you’ll be entered to win a $50 gift card!

Not a subscriber yet?

A tale of two public debuts

US courts roll back Trump-era actions on offshore wind and DOE grant cancellations

We asked, you answered, and experts weighed in on 2026