Rhodium: Taking stock of Paris targets

Late breaking ‘Inflation Reduction Act’ changes odds for the better w/ Rhodium’s Ben King

Out in front on carbon removal, Nan Ransohoff sets a new tier for climate leadership with Frontier

Gradually, then suddenly. Carbon dioxide removal (CDR) has been a fringe group for years, often incorrectly lambasted for distracting the global us (who can apparently only do one thing at a time, and then, not even well) from flattening the curve of global emissions. Meanwhile, the IPCC sounded the scientific bullhorn that CDR is “required” to keep us below catastrophic climate tipping points. In WGIII, CCS mitigation options were highlighted in an expensive and terrifying shade of blood red.

Then suddenly… Climeworks raises $650m, the largest venture round ever for carbon removal. Stripe, Alphabet, Meta, Shopify, and McKinsey team up to launch Frontier and catalyze the carbon removals market with nearly $1b of advanced commitments. And Lowercarbon Capital pulls the wraps off a $350m new CDR-exclusive venture fund.

Making Nan Ransohoff (deservedly, by all counts) the literal cover woman of carbon removal. See: Fast Company. Up until this week, the world has collectively coughed up cash to buy just 10,000 tonnes of permanent carbon removals - ever. Nan and her Frontier team intend to scale the market to at least six gigatons (6,000,000,000 metric tons) by 2050, and there’s no time to lose.

How did Stripe Climate start?

At Stripe, our journey into climate started in 2019 with a $1M commitment to buy early-stage permanent carbon removal. The science is clear: in addition to radical emissions reductions, we also need to remove huge amounts of carbon already in the atmosphere and ocean. While some solutions already exist, like afforestation and soil carbon sequestration, it’s clear that these approaches alone won’t scale to the size of the problem. There’s a huge gap. The intention of our initial $1M corporate commitment was to help fill that gap by buying permanent carbon removal that had the potential to be low cost and high volume in the future – even if those solutions are early and expensive today. The strong positive reaction from the carbon removal community, to us, how much the field had been starving for customers. Moreover, many Stripe users reached out saying they had been wanting to do something in climate for a while but hadn’t because it was hard to figure out what to do. They asked if they sent us money could we figure out what to do with it.

These responses collectively formed the genesis of Stripe Climate, which makes it easy for any Stripe business to direct a fraction of revenue toward carbon removal, which we (Stripe) then aggregate and use to buy even more carbon removal down the cost curve.

What's the founding story of Frontier Climate and who’s behind it?

To date, roughly ~$30 million total has been spent buying permanent carbon removal. Globally, that’s roughly 10,000 tonnes of permanent carbon removal delivered to date. Meanwhile, we need to scale removals to 5 to 10 billion tonnes per year by 2050. If we assume that removal will cost $10 to $100/ton, that’s $100 billion to $1 trillion needed every single year buying carbon removal.

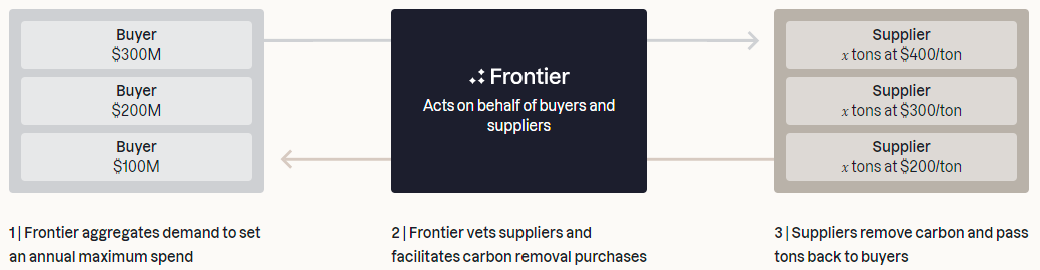

Last summer, we got our team together to discuss one question: how do we get carbon removal on its best possible trajectory as fast as possible? We came up with a bunch of ideas, killed most of them. But one of the ideas that stuck was an Advanced Market Commitment (AMC). An AMC sends a strong demand signal of a viable market for a product - even before it exists. AMCs worked for vaccines, and we thought it might accelerate carbon removal. We cold emailed economists Susan Athey, Chris Snyder, and Rachel Glennerster who had helped develop the concept for vaccines. Together we promptly started a working group to shape the crux of what Frontier would turn out to be. We knew that the demand signal needed to be much louder than just coming from Stripe, so we went looking for other like-minded companies. Today the Frontier AMC includes Alphabet, Meta, Shopify, McKinsey, and Stripe with a combined commitment to spend $925M over the next nine years purchasing carbon removal.

How is the Frontier advanced commitment different from existing Stripe carbon removal purchases?

Most importantly, the commitment is at a much bigger scale. Our original $1M was nowhere near enough. The Frontier approach is conceptually similar with a couple of key differences:

(1) Who funds it. The Stripe Climate carbon removal offering has been limited to Stripe users. With this new structure, more companies can participate at scale.

(2) How we purchase. Stripe Climate has focused on relatively small scale pre-purchases, which means paying upfront before companies remove carbon. For early-stage companies who need the capital early, this works well. But, if they do not deliver the tonnes of removal, we have no recourse because we’ve already given them the funds. Now with Frontier, we’ve added a new concept borrowed from the energy sector - offtake agreements, which allow buyers to purchase a product at a certain price and at a certain volume if a supplier can deliver it. Suppliers benefit from the agreement because they can take the guarantee of a buyer to the bank to help them receive project financing. By pulling in new forms of capital, carbon removal companies can scale faster. Buyers benefit from the agreement because they only pay for the carbon removal once the carbon has actually been removed. If the company does not deliver, the buyer does not pay – de-risking this for buyers.

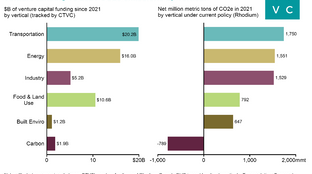

What’s missing in the climate capital stack for carbon removal? Does VC have a role?

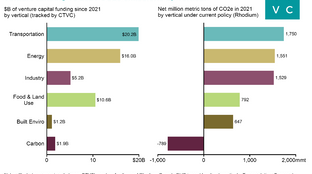

Venture capital has historically been challenged by climate’s high capex, R&D/tech risk, and long timelines. I’m particularly excited to see creative venture models that are really built uniquely for this field. At the end of the day, climate is an atoms problem (bits are important, but they’re ultimately in service of moving atoms). We need VC firms structured with longer time horizons and patient capital. Breakthrough Energy Ventures is a good example.

How can carbon removal scale past a voluntary market paid for by high margin tech companies?

The private sector and voluntary markets can get us to first base, but we are going to need policy to get us to fourth. By 2050, we need this market to get to 5-10 gigatons per year at $10 to $100 a tonne. That's ~$100B to $1 trillion a year. For reference, global GDP is roughly $100 trillion a year. We need global policy to reach that scale. The private sector can help make sure that carbon removal technologies exist when those policy mechanisms are in place, but we’re ultimately buying time to enact policy at scale.

How do the existing compliance carbon offsets markets fit in?

The volume of permanent carbon removal today is miniscule. We're talking about ~10,000 tonnes purchased in total with the average price in the hundreds of dollars. The liquidity nor the price are meaningful in the compliance markets right now. The solutions that exist today on traditional offset markets won’t by themselves solve climate change. We need to create new supply, not just compete over the supply that exists. But the reality is, when new supply gets started, it’s expensive. When Tesla started, the Roadster was expensive. As they learned and scaled, costs came down over time.

What’s the business case for Stripe’s carbon purchases?

We're not investing in any of these companies, we are literally the customers. Our purchases are a bit of a hybrid between philanthropy and an attempt to meet our own net zero commitments.

At the end of the day Stripe is in the business of economic growth. If you take the long view, which we do as an infrastructure company, climate change is perhaps the biggest threat to economic growth. We’re doing our best to take advantage of where we are in the ecosystem to make a dent in solving it. Stripe takes a really long term view, which I suppose can be a bit atypical.

What’s the definitional difference between removals and offsets? Will there be a bifurcation in the market to pay up for permanence?

“Offset” is a loaded word these days. People use it interchangeably to mean everything from carbon removal to avoidance and emissions reduction. But the environment only really cares about two things - GHG in, GHG out.

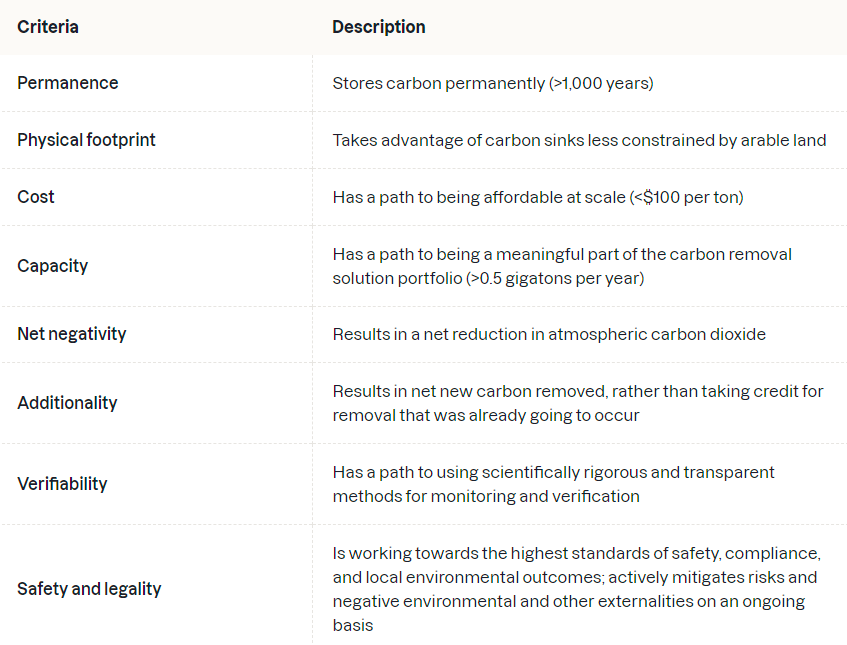

When we talk about carbon removal, we’re specifically looking for permanent 1,000 years or more sequestration that takes advantage of carbon sinks not constrained by arable land. We can only plant so many trees before we run out of space. We're also looking at solutions that have the potential to be sub-$100 and remove more than half a gigaton a year.

Ideally we would be able to isolate characteristics like permanence, and price those differently - rather than just treating a tonne as a tonne. But if we want pricing by the many different dimensions of carbon removal to happen, somebody has to drive that effort forward.

How should corporates think about the tradeoff of purchasing fewer, expensive tonnes of carbon removal vs cheaper, available offsets to claim net zero?

There’s been a lot of fuzziness around how to get to net zero. We have to measure, reduce as much as possible, and deal with the rest - but there's been a lot of hand waving around what to do with the “deal with the rest” piece. I would love to see companies spending as much as they can on helping increase the base supply, rather than just competing over the supply that already exists.

In practice, there are ways to do this that aren’t that complicated. One option is to calculate the emissions that you can’t internally reduce, charge yourself at some social cost of carbon anywhere between $50 to $200 a tonne, then put that money into a pot to buy carbon removal. But you shouldn’t obsess over the number of tonnes that you're getting because most of that supply doesn’t exist today.

A really helpful frame for us has been divorcing the year of spend from the year of return. If more companies can liberate themselves from netting out tonnes in the same year, more capital could be spent on advancing new solutions. I’d love to see corporate climate leaders genuinely ask themselves what action they can take to maximize the marginal climate value of their dollars - rather than meeting some goal that was voluntary in the first place.

How does “buying inefficiently” for volume vs price help to catalyze a market?

Technologies tend to be expensive at the start and get cheaper as they scale. Solar panels, DNA sequencing, cellphones, and Teslas all got significantly cheaper over time. The same is true of carbon removal - we’re right at the beginning of a very similar trajectory. Without early customers willing to pay a premium per tonne at first, these technologies don’t have a path to get cheaper. The idea of Frontier is to identify technology paths with the possibility to reach $100/ tonne in the future, and buy from them now to accelerate that cost curve down.

What areas of carbon removal technologies do you expect more activity in moving forward?

We’re starting to see some really interesting ideas at the intersection of nature and technology. One of the things that's great about nature’s carbon removal capability is that it does the capture part for free. Thanks photosynthesis! It also self-replicates for free, whereas hardware obviously does not. On the flip side, pure nature-based solutions are challenged by typically being impermanent and taking up a lot of arable land.

Running Tide and Charm Industrial are examples at this intersection of nature and tech. Charm uses waste biomass from plants that already did the carbon capture and aren’t competing for arable resources. They pyrolyze it and inject the carbon permanently underground.

There’s lots of potential for creative engineering efforts to harness the best of nature while mitigating some of its downsides, like through synthetic biology. There's been this false bifurcation between “nature vs tech”. We need some better names!

How do you approach the challenge of measurement and verification in the carbon removal market?

Measurement and verification is a major gap for the carbon removal field right now. Measuring a tonne of sunken kelp is very different from measuring a tonne of bio-oil injected underground. We need to come up with a scalable and robust way to do carbon removal measurement and verification across a very diverse set of technologies, while avoiding the lessons learned from MRV in the traditional offset market.

There's a lot of first principles thinking and executional work needed to operationalize this. Likewise, the approach can’t live within an organization like Frontier that’s an active participant in the market - it has to be independent. We’re happy to be the first pilot customer to get this started, and would love to talk with anybody working on innovative ideas for measurement and verification of carbon removal.

It’s been the biggest week of positive announcements in the history of carbon removals. Feeling energized for drawdowns? Frontier wants to hear from (1) corporates who want to write big checks for carbon removals (2) entrepreneurs who want to start or have already started carbon removing companies and (3) folks thinking about measurement and verification for carbon removals.

Late breaking ‘Inflation Reduction Act’ changes odds for the better w/ Rhodium’s Ben King

John Doerr and Ryan Panchadsaram's new book on OKRs to get to Net Zero

David Crane, best known as the former CEO of NRG Energy ousted in 2015 after years of trying to transition NRG into clean energy, has raised a high profile $230M Climate SPAC