🌎 The SMR shake-up #284

Small reactors, big power rankings

Happy Monday!

The AI arms race just hit the grid — and Google is going nuclear to win. We’ve got a deep dive of Google’s new deal with Elementl Power for SMRs, which takes a new approach to developing advanced nuclear.

In deals, $1.1bn for energy storage development, $326m for lithium-ion battery recycling, and $108m for sustainable salmon farming.

In other news, the latest in US-China tariffs, the US’ “skinny” budget proposal, and a possible geologic hydrogen motherlode (happy Mothers’ Day, by the way!).

Sightline also has a few opportunities for you: the last chance to take our investor market sentiment survey — closing this week! Plus, don't miss our webinar this Friday, Line of Sight: Growth Sectors in a Low-Subsidy World, at 11 am ET, with Research Director Julia Attwood.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

Last week, Google announced a new partnership — it’s going nuclear (again). The tech giant signed a strategic agreement with Elementl Power, a nuclear project developer, to co-develop three advanced nuclear power projects. Each one is targeting 600MW of capacity. If completed, that’s 1.8GW of clean, always-on electricity, enough to power millions of homes or a whole lot of AI model training runs.

Elementl, a tech-agnostic nuclear developer founded in 2022, is working to bring more than 10GW of new nuclear online in the US by 2035. This deal with Google marks its first public customer, and its biggest vote of confidence yet.

Under the agreement, Google will provide early-stage capital to pre-position three project sites. That means funding upfront work like permitting, interconnection rights, and site selection — taking on some development risk directly. Then, Google has the option to purchase power from the reactors once online.

This isn’t Google's first nuclear rodeo. The company already has a deal with Kairos Power, an SMR startup, with plans for commercial generation by 2030. But the scale and urgency of this latest agreement signal a new level of commitment — and a clearer line between AI and energy.

Google and other hyperscalers like Microsoft and Amazon are racing to build out massive new data center capacity — each betting that AI will define the next decade of business. That investment is as existential as it is exponential. Google alone plans to spend $75bn this year on infrastructure to train and deploy advanced models.

The AI race isn’t just about better models anymore — it’s about who can lock in power first. Solar and wind are cheap and abundant, but intermittent, so tough for always-on AI workloads. Advanced nuclear like SMRs offer firm, carbon-free energy in compact, factory-built units that can plug-and-play into existing grid sites.

But SMRs have long been stuck in the promise phase. As of mid-2025, none have been built outside of China and Russia. NuScale, once the US frontrunner, saw its flagship project canceled in 2023 after costs ballooned. But momentum is picking up. The sector is getting more creative, with new technologies, new buyers, and now, new development models.

Just last week, the US Nuclear Regulatory Commission began reviewing the Tennessee Valley Authority’s application to build a 300MW GE Vernova Hitachi SMR at the Clinch River site in Oak Ridge, TN, kicking off with public meetings to discuss the permitting process. And across the border, Ontario Power Generation got the green light to begin construction on its grid-scale SMR, also a GE Vernova Hitachi, at its Darlington site, the first SMR to do so in North America.

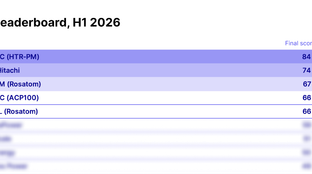

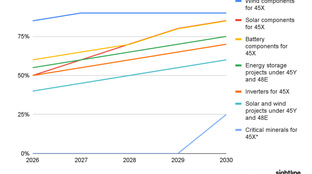

Sightline clients can access our full dataset of SMR projects, as well as deployment charts and tech profiles, on the platform.

Elementl hasn’t picked a specific reactor technology yet but says it will select the most commercially ready option when the time comes. Contenders include different nuclear technology types like:

Based on Elementl’s timeline (site permitting/early development from 2025-26; construction permitting from 2026-28; break ground in 2029, and begin operations 2032-33), they’ll likely opt for a small light-water design. Of the list, GE Vernova Hitachi looks best positioned to meet that schedule.

Overall, three signs of SMR market maturity stand out in this deal:

☀️ mPower Technology, an Albuquerque, NM-based advanced solar technology developer, raised $21m in Series B funding from Razor’s Edge Ventures and Shield Capital.

🚗 Alt Mobility, a New Delhi, India-based EV fleet leasing platform, raised an undisclosed amount in Growth funding from Beyond Capital Ventures, EV2 Ventures, Eurazeo, and Shell Ventures.

💧 Rainmaker, an El Segundo, CA-based atmospheric water generator system, raised $25m in Series A funding from Lowercarbon Capital, 1517 Fund, Long Journey Ventures, and Starship Ventures.

⚒️ Exterra Carbon Solutions, a Montréal, Canada-based mineral carbonation for CO2 storage technology developer, raised $15m in Series A funding from BDC Capital, Clean Energy Ventures, BASF, Government Of Quebec, Investissement Québec, and other investors.

👕 Solena Materials, a London, England-based sustainable textiles developer, raised $7m in Seed funding from Insempra and SynBioVen.

🔋 Rewbi, a San Francisco, CA-based grid battery storage optimising platform, raised $4m in Seed funding from Y combinator, SurgePoint, Aera, General Catalyst, Collab Fund, and other investors.

✈️ WeSky, a Vilnius, Lithuania-based in-seat aviation power systems, raised $1m in Seed funding from Coinvest Capital.

⚡ Aypa Power, an Austin, TX-based utility-scale energy storage developer, raised $1.1bn in Debt funding from Apterra Infrastructure Capital, ING Capital LLC, Nomura, Santander Corporate & Investment Banking (SCIB), Société Générale, and other investors.

🔋 Ascend Elements, a Westborough, MA-based lithium-ion battery recycling service, raised $326m in Grant funding from Poland Ministry of Economic Development and Technology.

🐄 LAXEY, a Vestmannaeyjar, Iceland-based land-based salmon farming producer, raised $108m in PF Debt funding from Arion Bank.

☀️ UrbanVolt, a Dublin, Ireland-based solar energy developer, raised $45m in Debt funding from HSBC.

🐄 LAXEY, a Vestmannaeyjar, Iceland-based land-based salmon farming producer, raised $40m in PF Equity funding.

🚗 Niche Mobility, a Girona, Spain-based digital transmission systems, raised $2m in Corporate Strategic funding from Clave Capital, Copreci, and Mondragon.

✈️ Twelve, a Berkeley, CA-based CO2 to chemical intermediates developer, raised an undisclosed amount in Corporate Strategic funding from United Airlines Ventures.

🚗 Addvolt, a Porto, Portugal-based clean energy solutions provider, was acquired by Carrier for an undisclosed amount.

Bosch Ventures, a Frankfurt, Germany-based investment firm, raised $278m (€250m) for its sixth fund, backing early-stage and scale-up deep-tech startups specializing in artificial intelligence, energy efficiency, automation, climate tech, and quantum computing.

Active Impact Investments, a Vancouver, Canada-based investment firm, announced a final close of $81m (CAD$110m) for its third early-stage climate technology fund, which invests in startups building solutions in circular economies, clean energy, infrastructure, carbon, and sustainable food and water.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate.

In a surprise move, the US and China have agreed to de-escalate their trade war and lower tariffs for 90 days — cutting US tariffs on Chinese goods from 145% to 30% and China's on US goods from 125% to 10%. The move follows intense negotiations and aims to prevent global inflation and job losses. While the deal is temporary, it signals potential stabilization that’s critical to clean tech supply chains, from solar panels to EV components.

President Trump’s fiscal 2026 budget proposal calls for $19.3B in cuts to the DOE, gutting IIJA funds and eliminating support for renewables, carbon removal, and energy efficiency. It also halves EPA funding, kills environmental justice programs, and cuts NOAA climate monitoring, among other things. Though largely symbolic, the proposal sets the tone for a partisan budget battle with Democrats ahead of October’s fiscal year start. These cuts could stall federal support for energy transition efforts, slowing momentum in deployment.

Natural hydrogen explorer Hyterra reported a 96.1% hydrogen concentration in mud gas samples from its first US well, Sue Duroche-3, in Kansas, one of the highest recorded levels of natural hydrogen. The find confirms historic readings nearby, ahead of a second well spud planned for mid-May. If validated, it could accelerate interest in geologic hydrogen as a scalable, low-emissions energy source, an alternative to electrolysis-based hydrogen production.

Warren Buffett has named Greg Abel, veteran head of Berkshire Hathaway Energy, as his successor, underscoring energy's growing role in Berkshire’s strategy. Abel’s track record in utilities, renewables, and grid infrastructure signals a potential pivot from cash-rich consumer and insurance arms to long-term bets on energy assets and energy infrastructure.

Diamondback Energy says US shale output has likely peaked, cutting rigs and production as sub-$60 oil prices make new drilling uneconomical. The pullback is spreading across the sector, with companies like Coterra slashing activity and capital spend, and frack crews dropping industry-wide. With less oil drilling also yielding less associated gas, the slowdown could tighten both oil and natural gas supply, but boost the long-term case for alternatives.

European lawmakers have granted automakers a reprieve until 2027 to meet 2025 CO2 targets, easing billions in potential fines for firms like Volkswagen, Stellantis, and Renault. The move responds to weak EV sales and industry pressure, but casts doubt on the bloc’s 2035 zero-emissions car mandate. It risks slowing momentum in transport electrification just as emissions cuts need to accelerate, and continues the EU’s retreat on climate policy implementation.

In fusion news, two magneto-inertial fusion (MIF) efforts took major hits this month: General Fusion laid off 25% of its team, citing financial strain, while Google’s Project Blixt shut down after finding its frozen-fiber Z-pinch concept couldn’t achieve stable confinement. These setbacks reinforce that while MIF has attracted significant funding, it still faces steep tech risk before commercialization.

DOE liftoff reports may have gone MIA, but the Wayback Machine’s cleared for re-entry.

Prometheus, PureWest, and Frontier are riding into Wyoming with a posse of partners to wrangle carbon and corral the cloud.

At 99, Sir David Attenborough’s still making waves — and this time, he’s diving deep with a new oceans documentary.

From rising seas to rising returns, GIC’s new report charts a course where climate resilience pays dividends.

New climate career resource with 750+ sources just dropped.

The Last of Us? Chernobyl is ready for farming again, while climate change is driving the rise of a killer fungi.

Gregory Bernstein makes the case that in a crisis economy, the fastest maker becomes the market maker.

The colossal squid enters the chat — first-ever live footage of the heaviest invertebrate on the planet is captured by underwater ROV in the south Atlantic Ocean.

📅 Line of Sight: Growth Sectors in a Low-Subsidy World: Join Sightline Climate on May 16, 2025 at 11:00 AM ET for a webinar with Sightline Research Director Julia Attwood to explore which climate sectors and technologies are positioned to thrive amid shrinking subsidies and investor caution. Learn how to evaluate opportunities and regions still supporting early-stage tech.

💡 Decarbon8-US Impact Fund 2025: Apply by June 20th to E8 Angels' philanthropic fund supporting early-stage, capital-light AI and software innovations that deliver meaningful climate impact. Selected startups gain access to funding, mentorship, and greater visibility. Apply here.

📅 LabStart 2025 Fellowship Info Session: Join us on May 22th at 3PM PT for a virtual session. An opportunity to explore LabStart’s fellowship offering up to $100K in funding for first-time founders commercializing breakthrough climate tech—no startup experience required.

📅 Signals & Startups: Strategic Insights for Climate Tech Investors: Join us on Friday, May 16 at 3:00 PM ET via Zoom. The kickoff event in Climate Capital’s new series, this session unpacks key climate investment trends from H1 2025—featuring sector signals, deal dynamics, and global diversification strategies.

Executive Director @Arête Glacier Initiative

Business Operations Coordinator @SiTration

Energy Advisor @EnergySage

Senior Associate – Investments and Partnership @Maersk

Investment Associate @Climate Tech Partners

Product Strategy, Geothermal Delivery @Bedrock Energy

Corporate Development Summer Associate (2025) @Electric Hydrogen

Process Engineer @Form Energy

Firmware Engineering Intern @Mill

Major Gifts Officer, Fellowship Associate @Activate

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

Small reactors, big power rankings

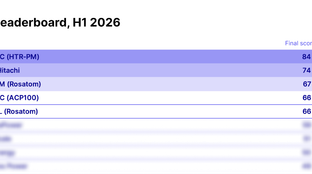

Stricter foreign sourcing rules reshape clean energy tax credit eligibility

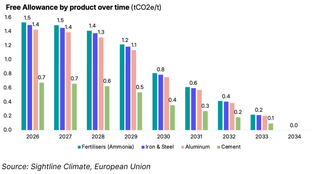

We did the EU carbon math