🌎 Lithium-ion is the benchmark in new LDES leaderboards #281

With long duration energy procurement surging, new rankings reveal who's pulling ahead

What Europe’s biggest power outage reveals about the grid

Happy Tuesday!

Europe’s biggest-ever blackout flipped the switch on a hard truth: the clean energy transition is only as strong as the grid behind it. Fortunately, there’s no shortage of ways to shore it up, and we've got you covered.

In deals, $755m for renewable energy storage development across two deals, $117m for CO2 capture technology, and $60m for grid-edge software.

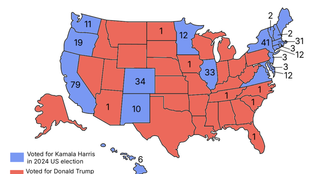

In other news, Trump’s first 100 days, the impact of tariffs to date, and Canada and Australia’s elections.

And don’t miss out — take our investor market sentiment survey here. We’re closing it this week, so share your thoughts, and we’ll publish the results in an upcoming CTVC newsletter.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

Last week, Europe experienced its largest power outage in history when cascading grid failures on the Iberian Peninsula caused a mass blackout, affecting about 55m people for more than 12 hours until power was restored. Blackouts like this one are rare in Europe, but they’re not unprecedented — and increasingly, they are symptoms of a deeper problem: power grid infrastructure needs more investment to ensure a reliable, safe, clean energy transition.

We’re still in the dark about the exact cause of the blackout, and the full picture won’t come into focus for weeks or even months. Here’s what we understand today:

Thankfully, in that time, hydro plants and international links with France and Morocco helped restore supply, while interconnections restarted. While authorities have ruled out a cyberattack, the underlying cause remains under investigation by a new expert panel convened by authorities and grid operators.

The Iberian blackout is a flashing warning light on the dashboard of the energy transition. While Spain and Portugal have raced ahead on renewables — Spain generated a record 56% of its electricity from clean sources in 2024 — the grid they rely on was built for a different era. Centralized fossil fuel plants (which provide sources of inertia) are giving way to distributed wind and solar. Power no longer flows in a straight line from plant to plug. It's a multidirectional, decentralized web.

But the grid hasn’t caught up. Interconnectivity still lags across the Iberian Peninsula, even though the EU has set high targets. That isolation may have magnified the disruption last week. And the grid’s physical backbone — lines, substations, software — remains alarmingly underfunded. Europe is facing a $2tn investment shortfall to modernize its electricity network by 2050.

The Iberian blackout exposed structural gaps in Europe’s grid preparedness — but it also offered a preview of where solutions lie. For instance, there’s no clean energy transition without transmission. That means doubling down on storage, advanced grid technologies, and distributed energy resources that can absorb shocks and bounce back quickly. It also means unlocking regional coordination to expand interconnection. All this can help future-proof both the nuts and bolts, and bits and bytes, behind the grid.

Grid tech

Inertia

Resilience

Want to go further? Request a demo for Sightline Climate, or reach out directly to [email protected] to learn more.

💨 Remora, a Wixom, MI-based CO2 capture technology developer, raised $117m in Series B funding from Valor Equity Partners, Lowercarbon Capital, Union Square Ventures, and Y Combinator.

⚡ Utilidata, a Providence, RI-based grid-edge software platform, raised $60m in Series C funding from Renown Capital Partners, Keyframe Capital Partners, NVIDIA, and Quanta Services.

🚗 indiGO Technologies, a Woburn, MA-based new mobility tech developer, raised $54m in Series B funding from FM Capital, FedEx Corporation, and Foxconn Technology Group.

🔋 Forge Nano, a Thornton, CO-based lithium-ion batteries coating developer, raised $40m in Growth funding from Ascent Hydrogen Fund, RockCreek, Orion Infrastructure Capital, and Top Material.

🛰 Near Space Labs, a Brooklyn, NY-based stratospheric remote sensing platform, raised $20m in Series B funding from Bold Capital Partners, Climate Capital, Crosslink Capital, Draper Associates, Gaingels, and other investors.

🔋 iwell, an Utrecht, Netherlands-based harmonizing clean energy developer, raised $31m in Series A funding from Meridiam, Invest-NL, and Rabobank.

♻️ DePoly, a Sion District, Switzerland-based sustainable PET-to-raw-material recycler, raised $23m in Seed funding from ACE & Company, BASF Venture Capital, Beiersdorf, Founderful, MassMutual Ventures, Syensqo Ventures, and other investors.

👕 eeden, a Münster, Germany-based chemical textile recycling service, raised $20m in Series A funding from Forbion, D11Z, Henkel Ventures, High-Tech Gründerfonds (HTGF), and TechVision Fund (TVF).

♻️ Glacier, a San Francisco, CA-based recycling robotics manufacturer, raised $16m in Series A funding from Ecosystem Integrity Fund, AlleyCorp, Alumni Ventures, Amazon Climate Pledge Fund, Cox Exponential, and other investors.

🐄 Hoofprint Biome, a Raleigh, NC-based methane reduction probiotics developer, raised $15m in Series A funding from SOSV, AgriZeroNZ, Alexandria Venture Investments, Amazon Climate Pledge Fund, Breakthrough Energy Fellows, and other investors.

⚡ Metafin, a Haryana, India-based solar financing platform, raised $10m in Series A funding from Vertex Ventures, AU Small Finance Bank, Northern Arc, Prime Venture Partners, and Varanium Capital Advisors (VCAPL).

👕 Arda Biomaterials, a London, England-based biodegradable materials manufacturer, raised $5m in Seed funding from Oyster Bay Ventures, Clean Growth Fund, Green Angel Ventures, and Kadmos Capital.

⚡ Kofa, an Accra, Ghana-based electric motorcycles and battery swapping service, raised $3m in Seed funding from E3 Capital, Injaro Investments, and Richard Thwaites.

⚡ Recurrent Energy, an Austin, TX-based solar and energy storage developer, raised $415m in Debt funding from Intesa Sanpaolo, Morgan Stanley, Rabobank, and Santander.

⚡ Nexamp, a Boston, MA-based renewable energy assets developer, raised $340m in PF Debt funding from PGIM Private Capital.

⚡ Hy2gen, a Wiesbaden, Germany-based green hydrogen developer, raised $54m in PF Equity funding from Hy24, BenDa, and Technip Energies.

⚡ Adecoagro, a Luxembourg, Luxembourg-based agroindustrial and energy producer, raised PE Buyout funding from Tether.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate.

In his first 100 days, Trump signed 20 executive orders related to environmental policies. Here’s some of the impacts:

President Trump’s sweeping tariffs are already reshaping US trade flows. A 173% tariff rise on Chinese battery imports threatens China’s near-total dominance in the storage sector, creating an opening for South Korean manufacturers to regain ground. At the same time, the Port of Los Angeles reports a one-third drop in scheduled vessel arrivals, while container bookings from China to the US have fallen 45% since last year. These shifts are straining global supply chains, raising consumer prices, and fueling concerns over a potential slowdown in the clean energy transition.

Canada’s recent election put climate action in the spotlight, with newly elected leader Mark Carney pledging to develop clean and low-carbon energy, while his opposition, Conservative leader Pierre Poilievre, aimed to roll back climate policies and expand fossil fuel exports. The outcome of this high-stakes election will play a crucial role in shaping the country’s climate and energy future. Meanwhile, there are sweeping implications of Australia’s federal election, as Labor’s big win over the pro-nuclear Coalition preserves momentum for solar and storage and lays the groundwork for a new AUD$2.3bn ($1.5bn) rebate program for household batteries.

ExxonMobil takes a surprising lead in “low-carbon” spending with plans to invest $30bn in low-emission opportunities by 2030, significantly increasing its 2021 target of $3bn, above Shell and BP. The company’s “low-carbon” investments will focus on reducing emissions from its oil and gas operations, including carbon capture, biofuels, hydrogen, and lithium extraction, aiming to get into emerging energy markets, though success will depend on government support and market demand.

The Metals Company (TMC) has applied for deep-sea mining permits in the Pacific to extract critical minerals, in line with a recent US executive order aimed at securing domestic supplies. However, the order has faced backlash from China over concerns of violating international law. TMC's applications highlight the challenge of balancing mineral sourcing with environmental impacts and raises questions about the international legitimacy of these permits.

Mitsui O.S.K. Lines (MOL) has partnered with Climeworks to remove 13,400 tons of CO₂ by 2030, marking Climeworks’ first deal in the shipping sector. The deal supports MOL’s goal of reaching net-zero emissions by 2050 and includes a potential investment in future Climeworks direct air capture plants. This collaboration signals growing momentum for carbon removal in hard-to-abate sectors.

B100 biodiesel has become the most cost-effective marine fuel in Rotterdam, undercutting all fossil alternatives by up to $97 per metric ton. This price advantage is bolstered by EU compliance incentives like the Dutch HBE rebate, which reached $390 per metric ton last week. This sharp price edge is accelerating the shift toward low-carbon fuels in maritime shipping, and shows well-designed subsidies can drive real demand for sustainable energy solutions.

New report from Clean Investment Monitor shows watt’s been going on with clean energy project supply chains.

The Valley of Death, the Missing Middle — whatever you want to call it, Jeffries has got the numbers behind the names.

Republican states are backing community solar.

Beyond the podcast: Jigar Shah and Jonathan Silver launched a new advisory firm.

Ten charts on Trump’s 100 days.

Taking to the skies: eVTOL company Archer releases a map of planned air taxi routes for NYC with United Airlines.

The world’s biggest 100% electric ship!

Hannah Ritchie on the carbon footprint of using ChatGPT: It’s very small compared to most of the other stuff you do.

Want more energy transition news? Stay in the loop with Semafor Net Zero. Penned by climate correspondent, Tim McDonnell, Semafor Net Zero brings you up to speed on the policies, people, and businesses driving the clean energy economy. Subscribe for free.

📅 Line of Sight: Growth Sectors in a Low-Subsidy World: Join Sightline Climate on May 16, 2025 at 11:00 AM ET for a webinar with Sightline Research Director Julia Attwood to explore which climate sectors and technologies are positioned to thrive amid shrinking subsidies and investor caution. Learn how to evaluate opportunities and regions still supporting early-stage tech.

📅 Securing Carbon Removal Funding in Trump’s America: Join Carbon Unbound on May 7 at 4 PM ET, for a webinar diving into the messy politics of US CDR funding. Learn how to navigate conditional commitments, clawbacks, and legal uncertainty with insights from legal, financial, and climate tech experts. Featuring speakers from Philip Lee LLP, Sightline Climate, and Resilient LLP.

💡 Thriving Communities: Climate Resilience US: Apply by May 9, 2025 for this equity-free accelerator from Village Capital, in partnership with Hewlett Packard Enterprise Foundation and Salesforce. The program supports 10 early-stage startups building climate resilience solutions for low-income U.S. communities, offering investment-readiness training, coaching, expert mentorship, and a chance for post-program funding.

📅 ClimaTech Summit: Join us on May 13–14 in Boston, MA for a two-day summit tackling critical climate issues. Connect with industry leaders and sponsors like Amazon, GE Vernova, and National Grid to help shape a resilient future. Use promo code EMPMINV for CTVC subscribers.

📅 EO Summit 2025: Join us on June 10–11 at Convene 46th St, New York, where Earth observation leaders, users, investors, and public agencies unite to explore EO’s commercial and civilian impact. Featuring tracks on insurance, agriculture, energy, and climate, with attendees from NASA, Amazon, BlackRock, and more. Use invite code EOS25INVITEE to register.

💡 Investor Partnerships: Clean Energy and Climate Technologies: Apply by July 2nd for grant funding from Innovate UK, matched with private investment from selected partners. Designed for late-stage UK-registered climate tech startups across sectors like power, mobility, agtech, and manufacturing. Project funding ranges from £50,000 to £2 million depending on R&D stage.

Senior Account Executive, Growth Marketing Manager @Sightline Climate

Head of Engineering @ReSource Chemical Corp.

Deputy Director of Government Affairs @Carbon Removal Alliance

VP Engineering @Ezra Climate

Full Stack Engineer @Cleanview

Business Operations Coordinator @SiTration

Energy Advisor @Energy Sage

Senior Associate – Investments and Partnership @Maersk

Investment Associate @Climate Tech Partners

Product Strategy, Geothermal Delivery @Bedrock Energy

Corporate Development Summer Associate (2025) @Electric Hydrogen

Process Engineer @Form Energy

Firmware Engineering Intern @Mill

Venture Manager, Strategic Investments and Venture Partnerships @Honda Xcelerator Ventures

Platform & Partnerships Lead @Zero Infinity Partners

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

With long duration energy procurement surging, new rankings reveal who's pulling ahead

A tale of two public debuts

US courts roll back Trump-era actions on offshore wind and DOE grant cancellations