🌎 H1 2025 Climate Tech Investment: Capital stacking up for energy security & resilience

Get Sightline’s signature H1’25 investment trends report inside

The market may be freezing over, but the world is still warming. There’s never been a better time to be a climate entrepreneur—just see the influx of incentives, spiking spend, technology traction, and a torrent of talent. As the tourist investors retreat to more familiar waters, now’s the time for climate-first investors to lean into the current.

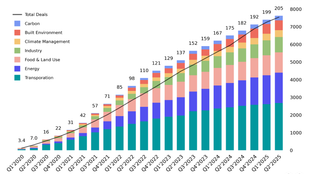

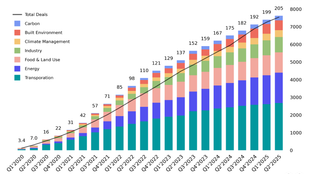

Over the past three and a half years, we’ve obsessively tracked every dollar invested in early stage climate—and who’s behind those checks—to aggregate the most comprehensive and accurate response to our newsletter namesake: “Who are the climate tech VCs?”

In early 2020, it was easy enough to point to the surviving group of clean tech 1.0 veterans and so-called impact investors. Then the party started growing as ESG-earmarked LP capital buoyed existing managers’ balances and new funds erupted from old firms. Tried-and-true deeptech dollars and sector specialist savvy followed. Over the past 18 months, a bevy of new firms led by climate-first managers launched—from proper institutional vehicles, to solo GPs and rolling funds, to those anchored by a single family or foundation or corporate. And just in time, because as the jubilee of the bull market fades alongside the sky-high valuations, it’s time to do the strenuous work that’s rooted in real customer demand, deep value chain understanding, and science, not storytelling.

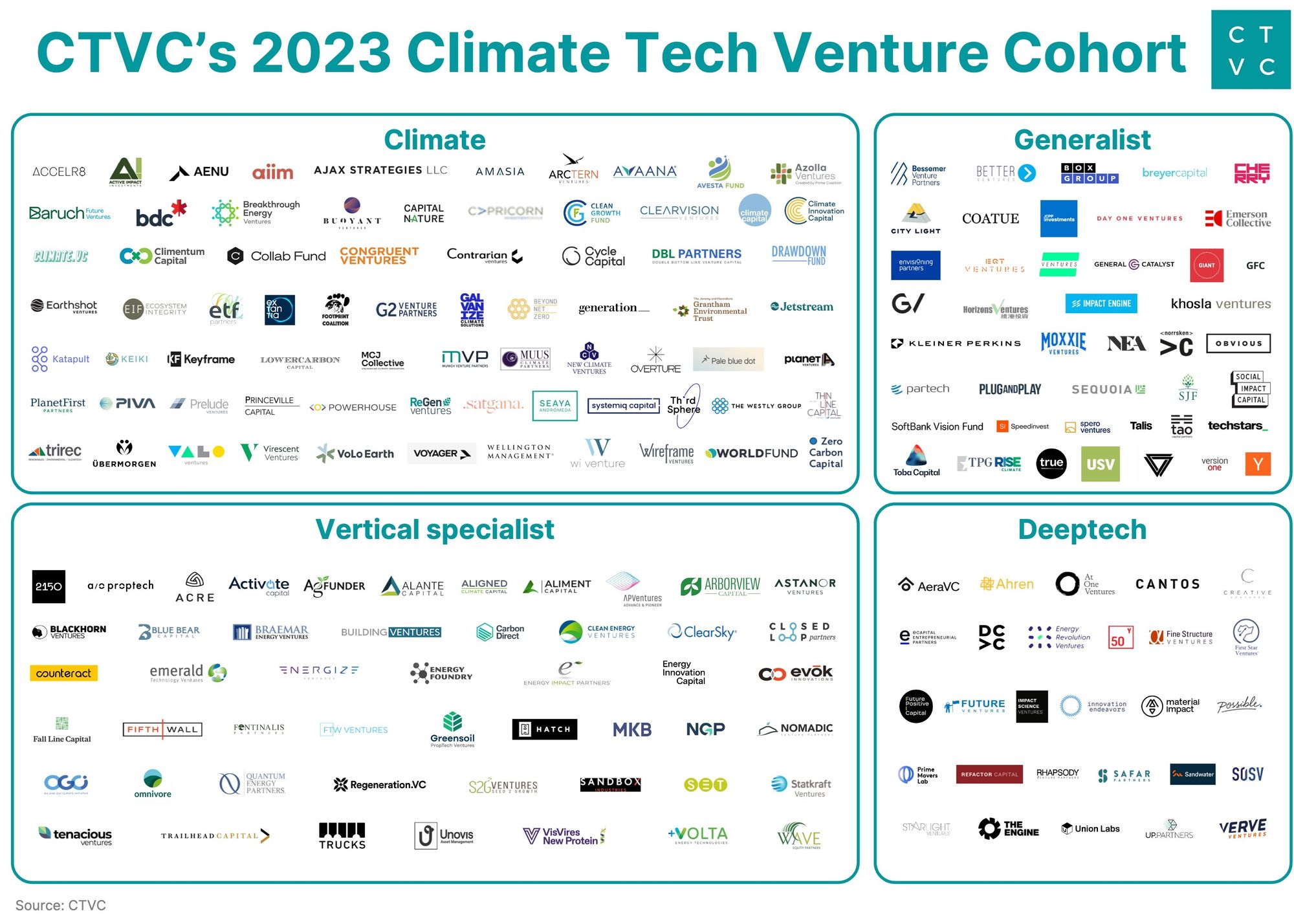

This week, we’re sharing our definitive list of climate tech VCs, updated for 2023. We created this list for the builders, who can filter it to their fancy on our website—by size, geography, and strategy. As climate tech moves from early innovation to the challenges of deployment, we're also broadening our focus to include investors beyond venture and putting out a call for reader input on an expanded climate capital stack list (more on that below).

The list and methodology below are updated for 2023, but the included funds remain the most active supporters of climate tech deals, quantitatively speaking. There is no popularity contest, buying a slot, or marketing manipulation. We’ve spent the time trawling through each VC’s performance so that the founders need not—and can get back to building.

In 2022, more than 4,000 unique investors participated in at least one climate deal, with about half investing in >1 deal. Just a fraction of those—198 VCs—made this list of the core group of firms actively investing in climate tech theses. That number is up from 177 VCs that fit the criteria a year ago.

Based on our deal-tracking database, this list includes VC firms that have invested in climate companies since the end of 2021. With the aim of pointing founders to the investors who can help them build, we weighted climate-specific deals as a proportion of total fund size.

We categorize funds according to four strategies

We reviewed the existing list, submissions from VC firms, investors in our deals data, and new climate funds from our dry powder analysis and included only the VCs actively investing in climate tech in this update.

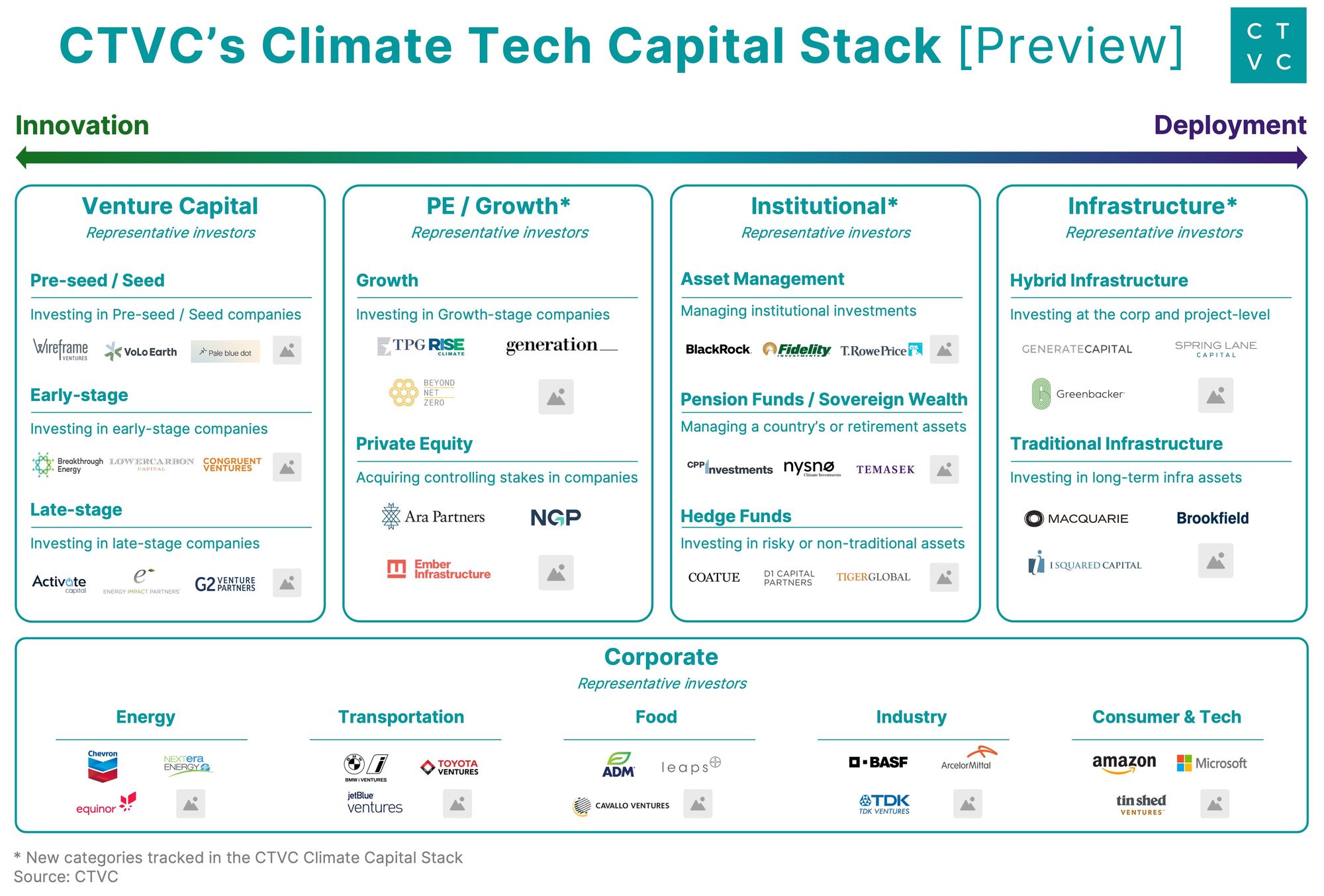

VC may be in our name, but as climate tech zooms out from early VC-backed innovation to the critical growth phases of deployment and scaling, we’re also broadening our focus.

Many founders have found initial traction and are now seeking non-dilutive capital that can help them deploy. But it’s more difficult to secure investments in today’s macroeconomic environment, and climate tech founders facing the challenge of building physical assets and infrastructure need to consider all available sources of funding. It’s precisely this important scale-up capital that can be the hardest to find.

So as the climate tech capital stack itself innovates, so are we. We’re expanding our list to include other types of capital allocators to our catalog of investors.

This isn’t yet a comprehensive climate tech capital stack, just a representative sample of institutional asset classes needed to finance climate tech to scale. The investors named here are a reference point for the types of capital allocators we’re adding to the list.

*denotes new categories tracked in the CTVC Climate Capital Stack

Venture Capital: Investing in early-stage companies

Pre-seed/seed investors: Wireframe, Volo Earth, Pale Blue Dot

Early-stage investors: Congruent Ventures, Breakthrough Energy Ventures, Lowercarbon

Late-stage investors: G2 Venture Partners, Energy Impact Partners, Activate

PE/Growth*: Acquiring controlling stakes in companies and/or investing in growth-stage companies

Growth investors: Beyond Net Zero, TPG Rise Climate, Generation

PE investors: Ara Partners, NGP, Ember Infrastructure

Institutional*: Managing institutional investments for clients

Asset management: Blackrock, Fidelity, T. Rowe Price

Pension funds/Sovereign wealth: Temasek, CPPIB, Nysno

Hedge funds: Coatue, Tiger, D1 Capital Partners

Infrastructure*: Investing in long-term infrastructure assets

Hybrid infra: Generate, Spring Lane, Greenbacker Capital

Traditional infra: Brookfield, Macquarie, I-Squared

Corporate: Venture arm or fund associated with a corporation

Corporate VCs: Chevron Technology Ventures, Nextera, Equinor

If you’re an investor in one of these new categories and want to be included in this list, please submit your info by May 26. We’ll comb through responses in the coming weeks and share an expanded climate capital stack.

In the future, we’ll build this list out further to include crucial parts of the capital stack, particularly the early catalytic side, like accelerators, nonprofits/NGOs, governments (DOE), and catalytic capital.

We’ve endeavored to be comprehensive and transparent in open-sourcing this list as a public good, but—of course—we’re bound to have missed something! Please do share with us if your fund’s profile needs a tweak, we missed a fund altogether (triple check the criteria first 🙏), or you’re allocating climate capital outside the realm of venture.

Other feedback? Musings? Favorite emojis? Reach out, we’d love to hear from you! As our venture namesake brethren like to say… let us know how we can be helpful 😉.

Shoutout to Francesca Gencarella for her help updating this list and creating graphics!

Get Sightline’s signature H1’25 investment trends report inside

Survey results: what’s working, what’s stalled, and what’s missing

A sneak preview from Sightline’s exclusive client-only webinar