🌎 Taxing times for CCUS #254

OBBB blows tailwinds through CCUS, but takeoff stalls

A string of SAF project cancellations indicates a bumpy runway to scale

Happy Monday, and Olympics opening weekend!

Our eyes are on another race — the sprint to scale Sustainable Aviation Fuels (SAFs), which has had a bumpy start after a recent spate of project cancellations.

In news, a proposed US energy permitting reform bill; the EPA’s $4.3bn in grants for emissions-reducing projects; and a decline in value in voluntary carbon markets.

In deals, $183m for plastics recycling; $133m for electric autonomous tractors; and $73m for electric propulsion systems for aviation.

Plus, it’s almost that most magical time of the year: New York Climate Week! We know it can be overwhelming to navigate so we’re putting together this public CTVC NYCW events tracker in the spirit of helping climate tech founders, funders, and supporters find one another and make the most of the week! Send any NYCW activities and events relevant to the climate tech community to us here. And keep your eyes peeled later this week for the big schedule reveal! 👀

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

This summer, headwinds are hitting the sustainable aviation fuel (SAF) sector after a string of project cancellations, spanning several types of SAF technology and both startups and incumbents alike.

What happened?

Why now?

SAFs have taken flight in the past few years as airlines have set decarbonization targets and governments passed legislation around biofuels. Governments, including France, Norway, Sweden, and the UK, enacted SAF blending targets between 2019-2022, while the US’ 2022 Inflation Reduction Act offered strong SAF tax credits.

SAF offtake agreements, investment decisions, and MOUs followed: deals increased tenfold in 2021-22, compared to 2020, per S&P. However, that dropped back down about 50% in 2023, as new questions emerged.

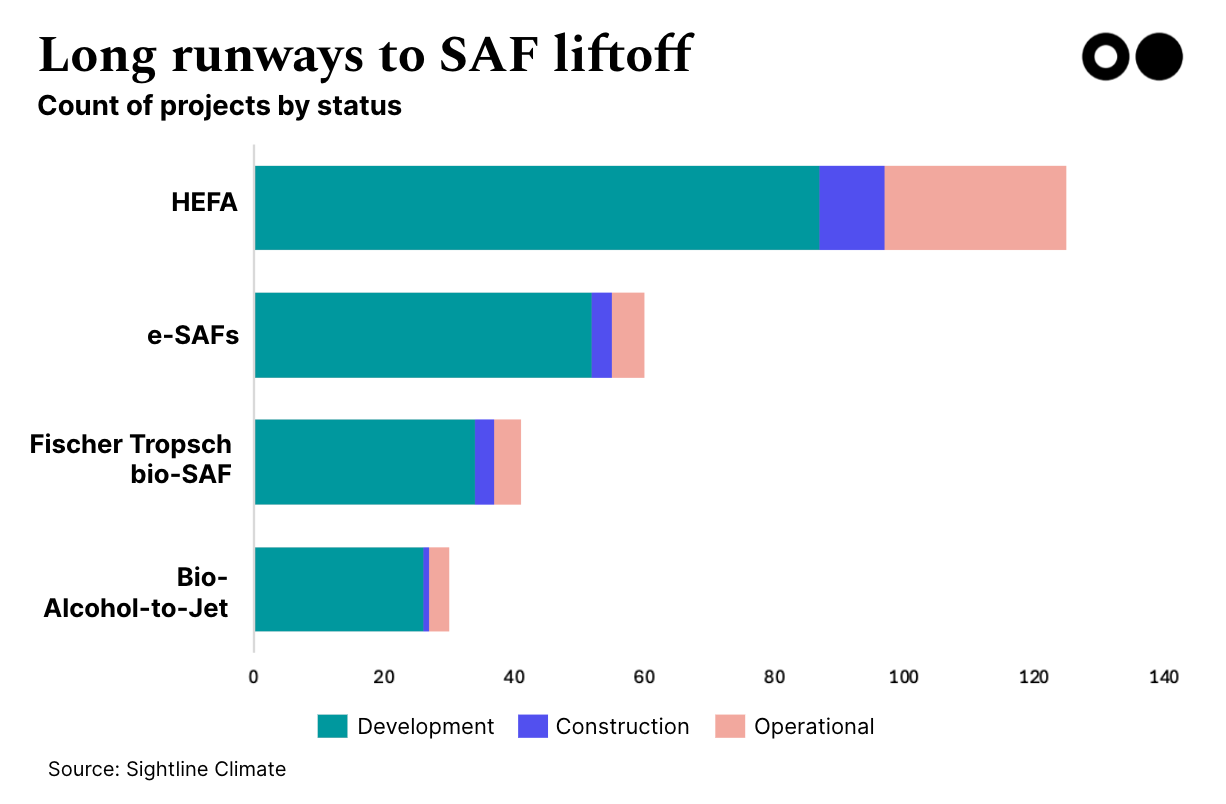

In the above chart from Sightline Climate, showing SAF project count by status, no one clear winner has emerged yet, despite HEFA's early start. Out of the dozens of technologies and players (you can read our overview of the sector here), all face their own scaling sticking points, and one overarching challenge — meeting the large demand from airlines for fuel at the right price point. They still come at a premium compared to conventional jet fuel, largely due to feedstock costs (both of the feedstock itself and coordinating sourcing it). HEFA plants, for instance, need used cooking oil — logistically difficult to get because of how distributed it is. E-SAFs are great from an environmental perspective, but rely on captured carbon and low-carbon hydrogen, two early-stage and expensive inputs.

Today, many key players have raised the hundreds of millions of dollars necessary to build SAF-producing facilities. But a valley of death has opened up while scaling. And a slowdown in SAF projects implies a longer flightpath to our final destination — aviation decarbonization.

Key takeaways

🌾 Monarch, a Livermore, CA-based electric autonomous tractors manufacturer, raised $133m in Series C funding from Astanor Ventures, HH-CTBC Partnership, At One Ventures, Het Welvaartsfonds, and PMV.

✈️ H55, a Sion District, Switzerland-based electric propulsion systems for aviation developer, raised $73m in Series C funding from Investissement Québec.

🔋 NanoGraf, a Chicago, IL-based silicone-based anode material for batteries platform, raised $65m in Series B funding from Volta Energy Technologies, Arosa Capital, Emerald, Evergreen Climate Innovations, and TechNexus Venture Collaborative.

🔋 Addionics, a London, UK-based 3d li-ion batteries developer, raised $39m in Series B funding from Deep Insight, GM Ventures, and Scania Growth Capital.

☀️ EneCoat, a Kyoto, Japan-based perovskite solar cells developer, raised $34m in Series C funding from Kyoto University Innovation Capital, Mitsubishi HC Capital, SPARX Asset Management, and Woven Capital.

🌾 InnerPlant, a Davis, CA-based genetically-engineered living sensor plants developer, raised $30m in Series B funding from Coutts Agro, Systemiq Capital, Deere & Company, and Bison Ventures.

🌾 Micropep, a Ramonville-Saint-Agne, France-based sustainable pesticide developer, raised $29m in Series B from Zebra Impact Investors, BPI Green Tech Investments, Fall Line Capital, FMC Ventures, Sofinnova Partners, and other investors.

🏭 Quatt, an Amsterdam, Netherlands-based hybrid heat pumps developer, raised $25m in Growth funding from Blue Earth Capital, Impact Equity Fund, and Seaya.

⚡ Cowboy Clean Fuels, a Denver, CO-based RNG developer, raised $13m in Series B funding from Machan Capital Investments.

☔ First Street, a New York, NY-based physical climate risk data provider, raised $21m in Series A funding from Innovation Endeavours, SE Ventures, and Nuveen Real Estate.

⚡ Splight, a San Francisco-CA based AI-based grid operations software platform, raised $12m in Seed funding from noa, EDP Ventures, Elewit, Draper Cygnus, Draper B1, and other investors.

🛰 Star Catcher, a Jacksonville, FL-based power network for satellites developer, raised $12m in Seed funding from B Capital Group, Initialized Capital, and Rogue VC.

⚡ Paces, a Brooklyn, NY-based GIS platform for renewable energy project development, raised $11m in Series A funding from Navitas Capital, Suffolk Technologies, MCJ Collective, Resolute Ventures, Soma Capital, and other investors.

💨 CarbonBlue, a Haifa, Israel-based water-based CO2 removal service provider, raised $10m in Seed funding from FreshFund, Ibex Investors, ENGIE New Ventures, and Secret Chord Ventures.

🥩 NoPalm Ingredients, a Wageningen, Netherlands-based fermented oils and fats manufacturer, raised $5m in Seed funding from Rubio Impact Ventures, Fairtree Elevant Ventures, Netherlands Enterprise Agency, OostNL, and Willow Capital Investments.

🌾 Agrobiomics, a Copenhagen, Denmark-based biostimulants for crop health platform, raised $4m in Seed funding from NOON Ventures.

🌱 FuturePlus, a London, England-based sustainability and ESG platform, raised $4m in Seed funding from Sustainability Group.

📦 Sparxell, a Cambridge, UK-based biodegradable pigment manufacturer, raised $3m in Seed funding from Circular Innovation Fund, Cycle Capital, Demeter, Earth.vc, and SNØCAP VC.

🧪 IRG Erie, an Erie, PA-based plastics recycling developer, received a $183m conditional commitment for a loan guarantee from the US DOE Loan Programs Office.

⚡ SHINE Technologies, a Janesville, WI-based nuclear fusion developer, raised $32m in Grant funding from the US Department of Energy’s National Nuclear Security Administration.

✈️ ZeroAvia, a Hollister, CA-based hydrogen plane developer, raised $14m in Grant funding from Aerospace Technology Institute.

♻️ Eureka Recycling, a Minneapolis, Minnesota-based waste prevention and recycler, raised $10m in Project finance funding from Closed Loop Partners, American Beverage, and The Recycling Partnership.

🏭 ecop, a Vienna, Austria-based high-tech heat pump manufacturer, raised $7m in Grant and Equity funding from the European Innovation Council.

⚡ Kyoto Fusioneering, a Tokyo, Japan-based nuclear fusion equipment provider, raised $7m from In-Q-Tel, Marubeni, and Nichicon.

⚡ LanzaJet, a Chicago, IL-based sustainable aviation fuel developer, raised an undisclosed amount of Corporate Strategic funding from Airbus.

⚡ Hecate Energy, a Chicago, IL-based renewable power and storage solutions company, was acquired by Repsol for an undisclosed amount.

NGP, a Dallas, TX-based investment firm, announced a $500m commitment towards their clean energy transition strategy.

Sustainable Aviation Fuel Financing Alliance (SAFFA), a coalition led by Airbus, raised $200m to finance SAF production.

Agfunder, a San-Francisco, CA-based investment firm, held a final close on its $102m fourth fund that invests in agritech and food companies.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate

A newly proposed bipartisan permitting reform bill in the US aims to accelerate the leasing and permitting process for energy and transmission projects across wind, oil and gas, and geothermal to ease regulatory hurdles faced by many renewable energy projects. While it is unlikely to pass in the current session, it could form the basis for bipartisan legislation on permitting. Still, critics note that the bill could limit opportunities for community opposition to fossil fuel projects and change offshore oil leasing processes.

Elsewhere in the US government, the EPA announced $4.3bn in grant funding for 25 projects reducing greenhouse gas emissions. As the end of Biden’s term closes in, federal agencies will be racing to push out remaining cash from the Inflation Reduction Act. [Read our Investor's Guide to the DOE here.]

The voluntary carbon market saw a dramatic decline in 2023, with global sales’ value plummeting by 61%, according to Ecosystem Marketplace's new 2024 VCM report. At the same time, the UN has advised against companies using carbon credits to offset their emissions, urging them to invest in reducing their own carbon footprints, a stance that opposes practices by major energy companies like Chevron and tech giants such as Microsoft and Apple.

In a big boost to batteries, California is looking to procure 10.6GW of energy resources, including 1GW of multi-day long-duration energy storage (LDES) and another 1GW of 12+-hour LDES. The regulator aims to help scale novel technologies, and mature technologies such as lithium-ion or pumped hydro energy storage (PHES) will not be eligible.

Data centers in Ireland now consume more electricity than all residential homes put together. Currently, the sector uses 21% of the country’s electricity consumed, and it’s anticipated to grow to 31% in the next three years, amping up pressure on the tech companies with footprints there.

In German hydrogen news, the German government announced plans for a national hydrogen transport network and a new hydrogen import strategy. The country is expected to need 95-120 TWh of green hydrogen per year by 2030 and 360-500 TWh by 2045 to reach its goal of climate neutrality, with imports expected to cover 50-70% of those needs. Additionally, Shell made a final investment decision to build a 100MW renewable hydrogen electrolyzer to supply its German chemical plant.

South Korea is continuing to grow its nuclear capabilities, and recently won a new contract to build a new conventional nuclear plant in the Czech Republic. The country also joined a coalition with the US, UK, Germany, China, and Japan that announced an $866m investment in fusion over the next 10 years to develop more infrastructure.

Plus, fusion startups are booming in China with significant private and public investments, amid reports that China’s public support of fusion is about double that of the US.

Let’s get physical: Google released a new paper on its new neural general circulation model (GCM) that can optimize weather forecasts for climate change.

All gas, no breaks: Blackrock’s Global Infrastructure Fund IV, backed by UAE’s ALTÉRRA fund with a $300m commitment, is backing a natural gas pipeline.

Running out of charge: Richmond, CA-based battery maker Moxio furloughs staff and warns of shutdown.

Powering up: A recent study estimating the energy intensity of AI found that the least efficient image generation models use up to half a smartphone charge per image generation.

There’s a time and space for everything: The military and NASA re-visit nuclear powered spacecraft.

The Rhodium Group published its 2024 annual outlook of US emission reduction projections under current policies through different scenarios.

Weed out classes: Can AI help Bayer and other ag companies identify and develop new herbicides?

Circle of (LI)fe: New RMI report discuses how mineral extractions for batteries can become net-zero and circular by 2040.

The Curiosity rover makes an out-of-this-world discovery of pure sulfur on Mars, the first of its kind.

I guess the apple could turn yellow or green: Where does Harris stand on climate change?

(Con)fusion: Altman-backed Helion Energy’s progress in fusion and lack of published results leave the scientific community skeptical.

Concrete results: Calix is awarded $15mm grant to support the construction of the world’s first zero-emission lime plant in South Australia.

A shadow of a doubt: White House meets with the Plantary Sunshade Foundation to discuss limiting global warming by using a very large parasol.

💡 Twilio.org Climate Tech Prize: Are you using technology to boost climate resilience in frontline communities? Apply now for the Twilio.org Climate Tech Prize! The Twilio.org Impact Fund is investing $1 million in five entrepreneurs or organizations creating climate technology solutions that tackle immediate and long-term challenges, including migration and displacement. Don't miss this opportunity to apply. Deadline to apply: August 14th.

📅 Climate Tech State of Markets: RSVP to attend the Climate Tech State of Markets Presentation and investor panel co-hosted by SVB, Clean Energy Ventures, E8, and the Microsoft Climate Innovation fund during Seattle Tech Week on July 30th.

💡 Small Manufacturer Modernization Grant: Apply to the Small Manufacturer Modernization Grant Program by July 31st to access $50,000 to $250,000 in grants for your advanced technology business.

📅 Summer Happy Hour: Register to join the Boston Climate Tech Summer Happy Hour with Earthshot Ventures, Clean Energy Ventures, and Activate on July 31st for an afternoon of networking over drinks and snacks.

📅 Greentown Labs EnergyBar: RSVP to join the Greentown Labs signature EnergyBar networking event in collaboration with MassMutual Ventures on August 15th to network with entrepreneurs, investors, corporate leaders and others in the climate tech ecosystem.

💡 Building Tech Lab: Apply for the inaugural cohort of the Buildings Tech Lab by September 20th to pilot your growth stage building decarbonization startup with the DOB and improve how it regulates construction and development throughout New York City’s five boroughs.

📅 OutRun CO2 Club: Register to join the ReGen Ventures and Planeteer Capital on September 23rd at the starting line of NY Climate Week 2024 to outrun CO2!

Associate, Energy Systems @Marble

Chief Growth Officer @M-RETS

Sustainable & Impact Investing Strategist @UBS

Principal Sustainability Advisor to the Chief Sustainability Officer @Microsoft

Equity Research Associate - Mobility Tech and Energy @TD Bank

Climate Engagement Director @Harris for President

Mechanical Engineer (Senior/Lead) @Ammobia

Investment Associate - Renewable Energy Infrastructure @Madison Hunt

Investment Associate - London/Cologne/Dublin/Oslo @Energy Impact Partners

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

OBBB blows tailwinds through CCUS, but takeoff stalls

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook