🌏 The Investors’ Guide to the DOE

How to decode DOE's commercial investments

The 2024 Oracle results, what you think will happen this year

In the distant memory of four weeks ago, we shared 10 predictions for 2024 with comments from 15 experts. We asked you to gaze into a climate crystal ball with us and say yes or no to how our 2024 predictions might play out and you answered the call. Later this year we’ll discover who the true climate oracle is, but until then we thought we’d take a closer look at what you think this year will bring.

What's going to be the hot topic in 2024? Your hot trends alerts ranged from cutting edge tech to market behavior shifts. These were the seven that got top votes (aka 4+ mentions).

Nuclear

Policy

Geothermal

Hydrogen

Grid

AI & Climate

Adaptation

Honorable mentions: Critical minerals, biomining, biodiversity, nature tech, precision fermentation, and synbio. And just for fun…the silliest: Tiny cars!

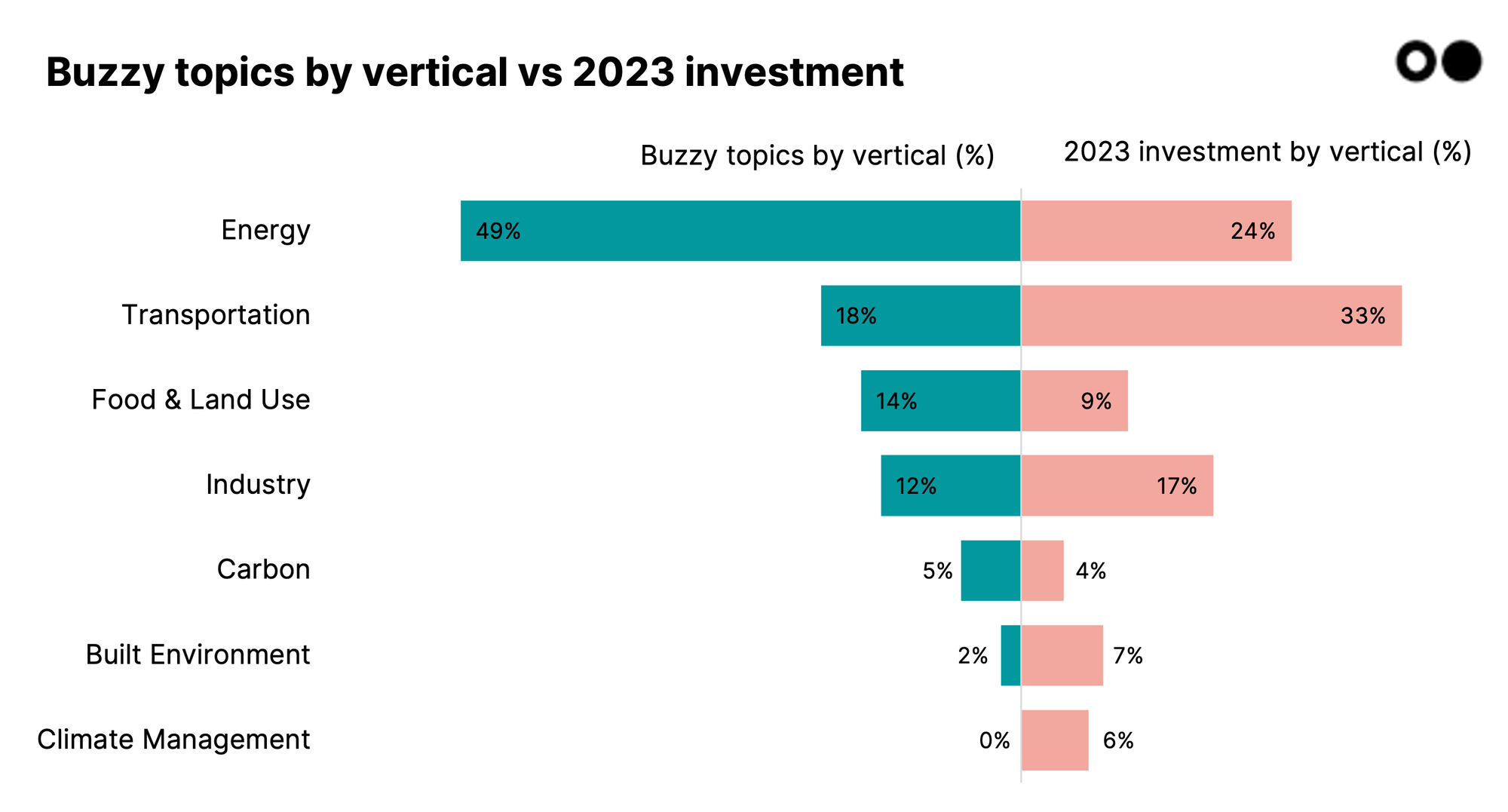

And because we’re data nerds, we categorized your responses by climate vertical and compared it to 2023 investment to see where the wind is blowing in 2024. While Transportation funding continued to reign supreme last year, the topic du jour this year points to Energy, with multiple mentions of baseload and flexible clean energy solutions like nuclear, geothermal, hydrogen, and long-duration energy storage.

For more information on last year’s investment trends see our 2023 climate tech investment trends report.

Where is 2024 headed? Your insights revealed several themes that might shape the coming year.

In 2022 total funding was $40B, in 2023 (as of end-November) the total is $28B.

Yes (89%). There’s a tall tower of agreement that investment in climate tech will increase in 2024, with 30% justifying their vote with a belief that interest rates would fall, while others cited policy changes and increasing public concern as investment drivers.

No (11%). Those who voted No tended to diverge in their view on where interest rates were going, with a few also citing political instability and funding flowing to AI as reasons to be pessimistic.

Yes (54%). The Yeses thought this was a long awaited adjustment – valuations are too high and there’s no more runway – and the interest rate bears thought rates staying higher would be decisive.

No. (46%). Real rates bulls argued lower rates would save the day, boosting valuations. A few felt climate exceptionalism, driven by the existential requirement, would keep valuations up.

2 out of the 3 most active acquirers in climate tech since 2021 were O&G companies.

Yes (51%). You may have been nearly evenly split on the question, but you generally agreed on one thing in your comments: O&G will act in their own interest. Where you differed was whether O&G acquisitions of climate tech would lead to revenue diversification beyond their core or enable them to continue burning fossils.

No (49%). The other half mostly argued that climate tech ran against their business model and with high O&G prices they’d double down on their core business.

We list the top ten climate tech acquirers on slide 30 of our public 2023 climate tech investment trends report.

Yes (61%). The debate came down to what a Trump presidency would mean for the IRA. Many of you felt it wouldn't last long. Others felt the law would change regardless of the winner; Trump ditching and Biden going further.

No (39%). The largest group of comments was from those who felt Trump might win, but would be prevented from repealing too much of the IRA due to benefits flowing to red states.

The S&P Global Clean Energy Index tracks the market value of 100 clean energy companies from around the world. The fund rose rapidly in 2020, from a little over $750 to topping out at over $2,000 in January 2021. In 2023, it declined to its current position under $900.

Yes (58%). Rates returned as the decisive factor. Those of you who thought they’d be falling voted yes, believing lower rates would boost equity markets and reduce the cost of capital needed for green infrastructure projects.

No (42%). The Nos thought higher rates and political uncertainty would keep capital costs high.

2023 saw investigations highlighting issues with carbon offsetting projects that weren’t delivering what they’d promised. The VCM has been estimated at ~$2B in 2023.

Yes (41%). “The emperor has no clothes” was the driving argument for the Yeses. On the other hand, a few voted yes because they believed the VCM would return to growth, but it would take more than a year.

No (59%). VCM is dead, long live VCM. Those voting No generally agreed that 2023 had been a rough year for VCM with a lot of issues exposed, but they felt this would drive a flight to quality and in turn help a new better quality market grow. More skeptical responders argued that buyers don’t care about quality and are too attached to marketing boosts to stop buying.

The expectation for DAC costs today is $600-$1,000 a tonne, but has been reported to be able to get to $150 a tonne by 2050.

Yes (37%). There was lukewarm confidence, with equal numbers of respondents believing the technology is ready and those expecting an announcement but doubting whether it’d be real.

No (63%). In an unexpected twist, those who voted "No" generally showed more belief in DAC, with a majority thinking the technology isn't ready yet but might be in a year or two, while others doubted its future viability. Same question, same time next year?

In 2022, 14% of all new cars sold were electric, up from 9% in 2021 and less than 5% in 2020.

Yes (44%). New electric car buyers aren't looking in their rearview mirror. Better charging infrastructure, policy incentives, and user experience are all reasons to believe 2024 is the year of EVs.

No (56%). A few comments highlighted supply chain crunches, areas with insufficient charging infrastructure, and prices as reasons to be bearish, but the vast majority of the Nos were debating the ETA, not the direction. Four of you even got specific and said No to 25% but yes to 20%.

In 2023 interest in the geologic hydrogen extraction rose, with US DOE providing $20M in funding and startups like Koloma raising venture capital. Geologic hydrogen has been accidentally discovered before, with a site powering a town in Mali today, but will 2024 see an intentional project launch and successfully demonstrate that it can be commercially viable?

Yes (46%). More startups and sites that seem ready to go including France, Mali, Utah, and the Mid-Continent rift all getting shout-outs. But not all Yeses were positive, several thought it possible but irrelevant – the resource is too rare to be meaningful.

No (54%). The Nos were nearly unanimous; it’s just too early. Construction takes time and as one person commented, the Utah project isn't slated until 2027-28.

eSAFs or ‘electrofuels’ are synthetic fuels derived from renewable energy.

Yes (55%). Yeses were split into two camps: didn't this already happen (it certainly did for bio-SAFs, see our deep dive on the various kinds of SAF here) and the more skeptical view that it might happen, but only as a publicity stunt, with a small plane making a small trip.

No (45%). Are we there yet? Those who said No generally didn't think so, arguing that e-SAFs are still too expensive and need to address outstanding regulatory and safety issues.

We’ll be back at the end of the year to see how the predictions did and look into 2025. For those who didn't get a chance to take the survey, shoot us your hot takes at [email protected].

How to decode DOE's commercial investments

Poor performance this half as investment falls to 2020 levels, but some strong plays.

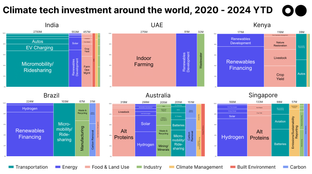

Mapping the topography of climate investment hotspots