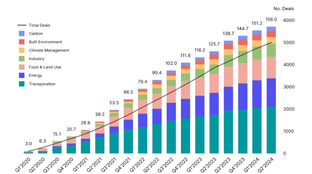

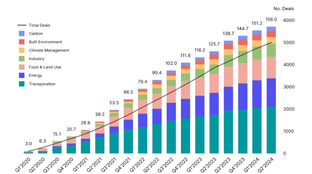

🌎 A weak $11.3bn start to 2024

Poor performance this half as investment falls to 2020 levels, but some strong plays.

👋 Sophie here! A few weeks ago we shared Kim’s news of CTVC’s expansion beyond the inbox into a market intelligence platform for the new climate economy. Today, I’m launching Planeteer Capital, a new venture firm to be founders’ climate-first lead investor. 🚀

You’ve been on this journey with us into climate tech, observing in real time that the capital stack has uniquely evolved into this climate market moment. I believe now’s the right time for a climate-first venture firm to unpack the stack in the service of founders at the earliest stage.

Despite the title of this newsletter, I promise there’s never been a master plan to start a venture capital fund focused on climate tech.

Since we first learned that emojis work well on Substack in early 2020, Kim and I have been powered by an intuition that climate change would ripple through industry as we knew it, making our world stranger, less predictable and in need of more explanation.

When we started the newsletter, we approached this opportunity as climate-first insiders. We’re the climate-first generation who have always known that ours will be a warmer and weirder planet.

Working on this problem has been in service of ourselves, not “for future generations.”

I started in ESG, endeavoring to apply material climate impact via a new public market fund—and then vented my frustrations and learnings about that three-letter acronym’s incapacity to meaningfully drive disruptive change into a book. Startups felt like a foil to ESG, and starting up Kula Bio to bring a new low-cost, low-carbon fertilizer to market certainly brought me closer to molecular-level impact.

As we raised capital for Kula, it was initially hard to find investors interested in clean technologies outside of the energy and transportation sectors. It became clear that Cleantech 1.0 was not the right framing for our company.

Yet, a series of trends began to indicate that the market had shifted in meaningful ways in the span from Solyndra blowing up to Tesla glowing up:

I didn’t have words for it at the time, other than a general sense of market misunderstanding. Later, CTVC became our voice to translate the language of capital into this burgeoning climate economy, which we dubbed Climate Tech.

In a market now served by hundreds of dedicated climate venture capital firms, founders can afford to differentiate potential VC partners by more than just a competitive term sheet.

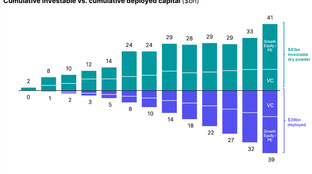

The climate VC market has sped through evolutions of what the broader VC market has had longer to adapt to: solo capitalists, service-rich brands, high velocity crossovers, climate indexes, rolling funds, community funds, and multi-stage platforms. Add to that landscape more climate-specific funding sources like first of a kind facility financing, venture debt, government grants, offtake agreements, first-loss capital, etc. and today’s climate founders have to become sophisticated consumers of capital to win fundraising.

Founders confess, and I felt acutely myself as a founder, that fundraising with an eye for value and long-term preservation of a startup’s vision is opaque for those who only raise a few times over their career. This is even more true for climate innovations with unique Valleys of Death between the R&D, demonstration, and deployment stages.

While the Climate Capital Stack has grown more sophisticated, in both depth and breadth, the current market shakeout shows what we’ve believed all along: not all dollars are created equal, and that commanding your capital stack is one of a company’s most resilient tools for growth.

Whereas the past has been about climate innovation capital at any cost, the next phase of climate deployment will be about scaling down the cost of capital and scaling up productive capacities.

Capital stacking can be a competitive advantage as each layer provides a different cost of capital and type of value addition. VCs and founders can juice outcomes when they:

In reality, founders have limited visibility, data, and time to parse and sequence the layers of the stack. Historically, CTVC has endeavored to lift up the entire market’s access to information about efficient access to capital, via the Running List of Climate VCs, reporting on industry exits, and guides like how to work with the Dept of Energy.

Offline, I have spent a disproportionate amount of my time actively supporting founders navigate this ecosystem. Making introductions quickly moved into making direct investments. Starting with recognizable names like Remora and Heirloom, I began angel investing even earlier with researchers, builders, and climate-curious technologists to help steward their ideas into fledgling climate companies.

I’ve since raised investments significantly larger than my first angel checks, and built a meaningful portfolio that’s 18 companies rich. This has deepened my belief that founders should not have to choose between their lead investors’ specialized preferences on stage or their depth of climate understanding.

Today we're launching Planeteer Capital, our climate-first venture firm right-sized to lead and co-lead Pre-Seed and Seed stage rounds with high conviction and follow-on capital.

We’re joined by limited partners who believe investing in a better world makes financial sense. Planeteer is anchor funded by an Ivy League endowment and Mike Schroepfer, Meta’s former CTO, who joins Planeteer as an Advisor alongside his other climate endeavors. Additionally, we have a diverse group of institutional investors, large family offices, venture funds, and exited entrepreneurs excited about this shared future with founders.

Knowing where the money is flowing and how solutions are being deployed is critical to anticipating which future segments will realize impact. At any time, we’re seeding and testing a few dozen theses with future founders who see the world similarly or who—even better—show us where we get it wrong.

When we meet founders who match our convictions, we invest. Previously, as an angel, conviction that a labor shortage was the core customer pain-point holding back regenerative agriculture adoption led me to invest in Aigen. Belief that the right engineering team could appropriately wield point-source carbon capture to decarbonize commercial buildings led to Thalo Labs. Understanding of the pent-up willingness to pay for emissions monitoring in hard-to-abate industries led to SailPlan.

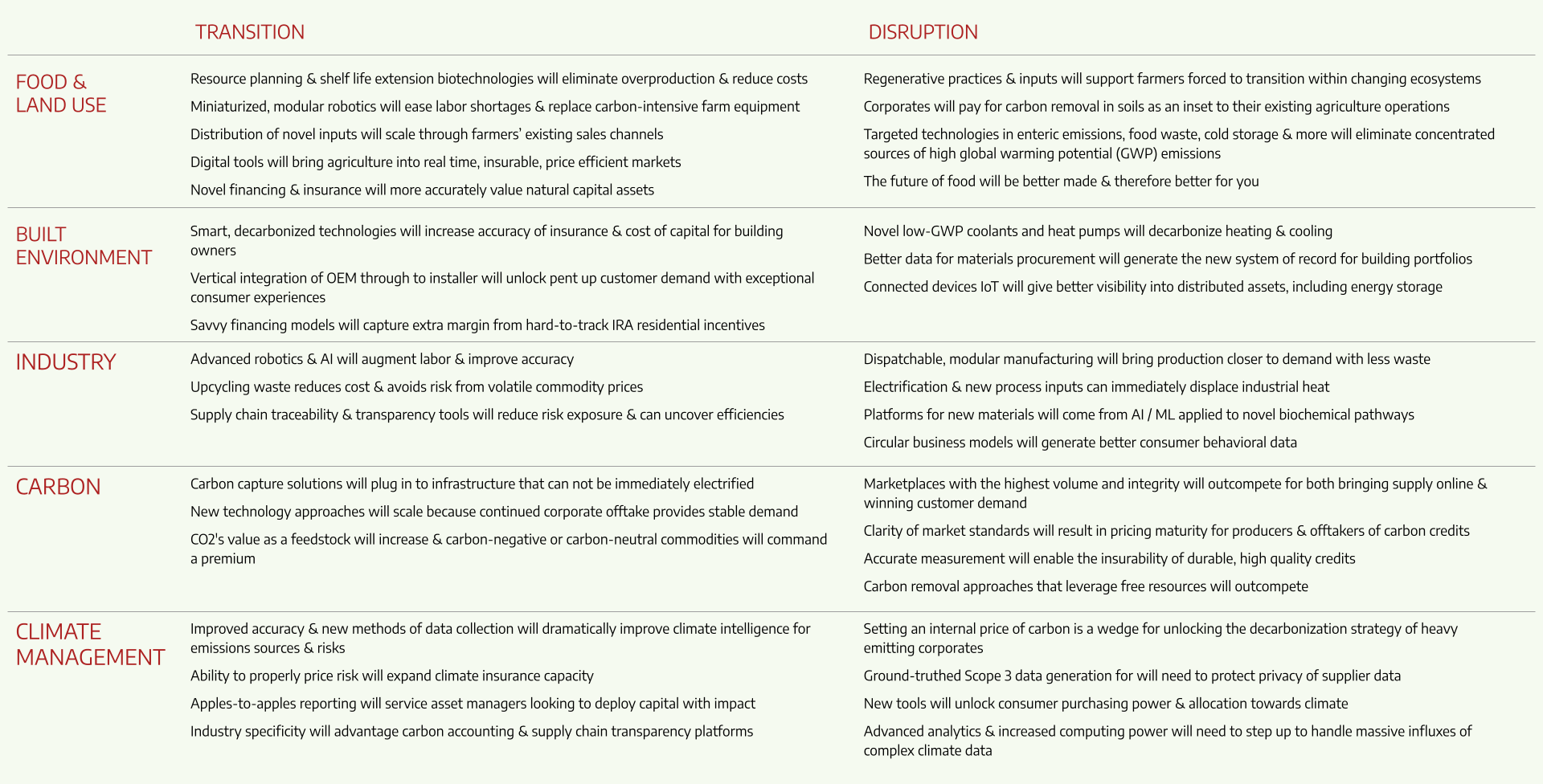

Climate is a persistent driving force that will generate massive physical and market transformations. Broadly, we see opportunity in climate ahead—both in transitioning existing, incumbent businesses and in creating new disruptive markets.

Kim and I share this vision, and are building towards it through parallel, independent paths.

There’s no trust without editorial independence and data integrity. Thus, Planeteer Capital and the CTVC newsletter and market intelligence platform are entirely separate entities—legally and financially, as well as in team and literal name. I run Planeteer (more than 😅) full-time alongside Hannah and a growing team. I’ll continue to contribute to CTVC, with Executive Editor Grace spearheading content—and don’t worry, your free newsletters aren’t going anywhere!

Planeteer is climate-first. We wouldn’t be playing venture with our careers unless we believed that comes with the potential for planetary returns.

We’ve held our first close—in the excitement of a bank run!—and we’re open for business.

Fundamentally, we believe in making the climate ecosystem stronger together, closely collaborating on mobilizing more exceptional people and more money into climate. Planeteer has already started investing, and is looking for more folks to journey with.

If any of this sounds like something you can get behind, drop us a line ([email protected]) with your planet-changing idea for how we can team up!

The power is ours 💪🌍

Disclaimer: This article is not an offer to invest in any securities or fund. Investing in a fund may only be made through a fund offering document to qualified and accredited investors. This article is provided for general information purposes only and may not be copied or redistributed without our prior consent. Past performance is not an indication of future results. We undertake no obligation to update information due to changes caused by subsequent market events or for other reasons. If Godzilla attacks, we're (likely) also not responsible.

Poor performance this half as investment falls to 2020 levels, but some strong plays.

$82bn of new capital for climate tech in the past 6 months

A new interactive Climate Capital Stack Map